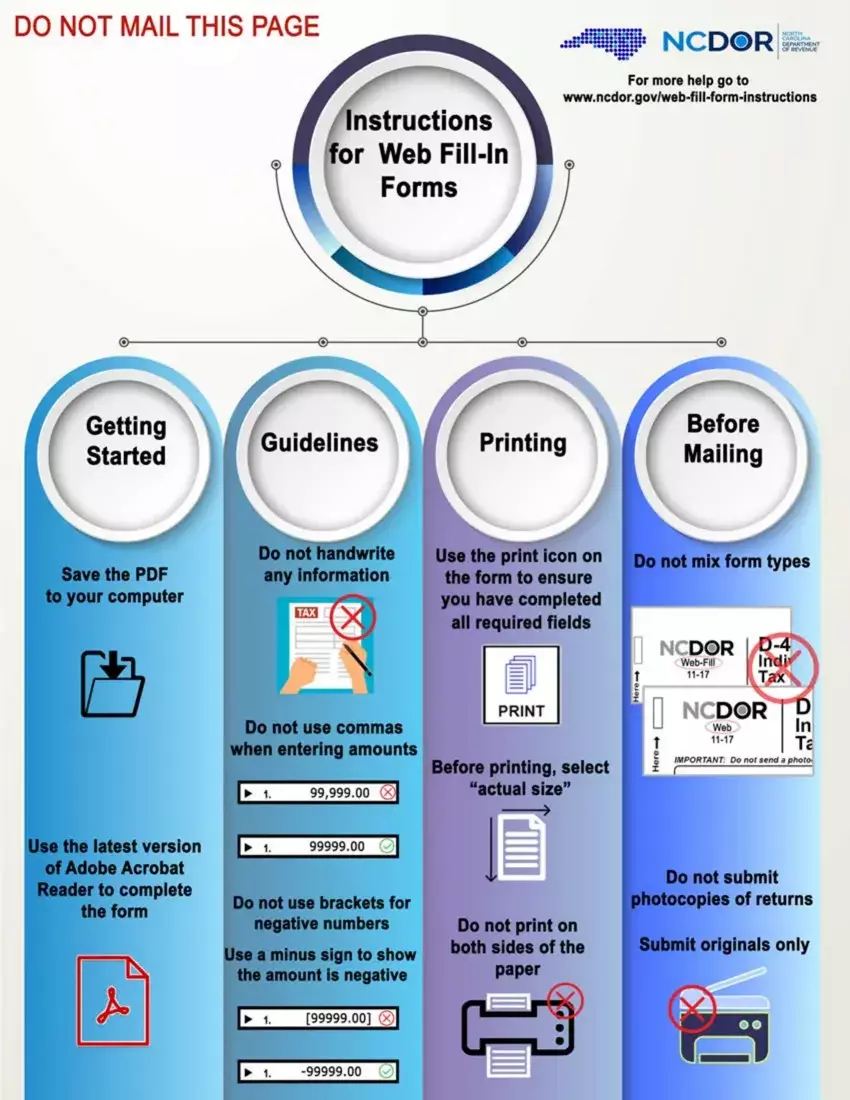

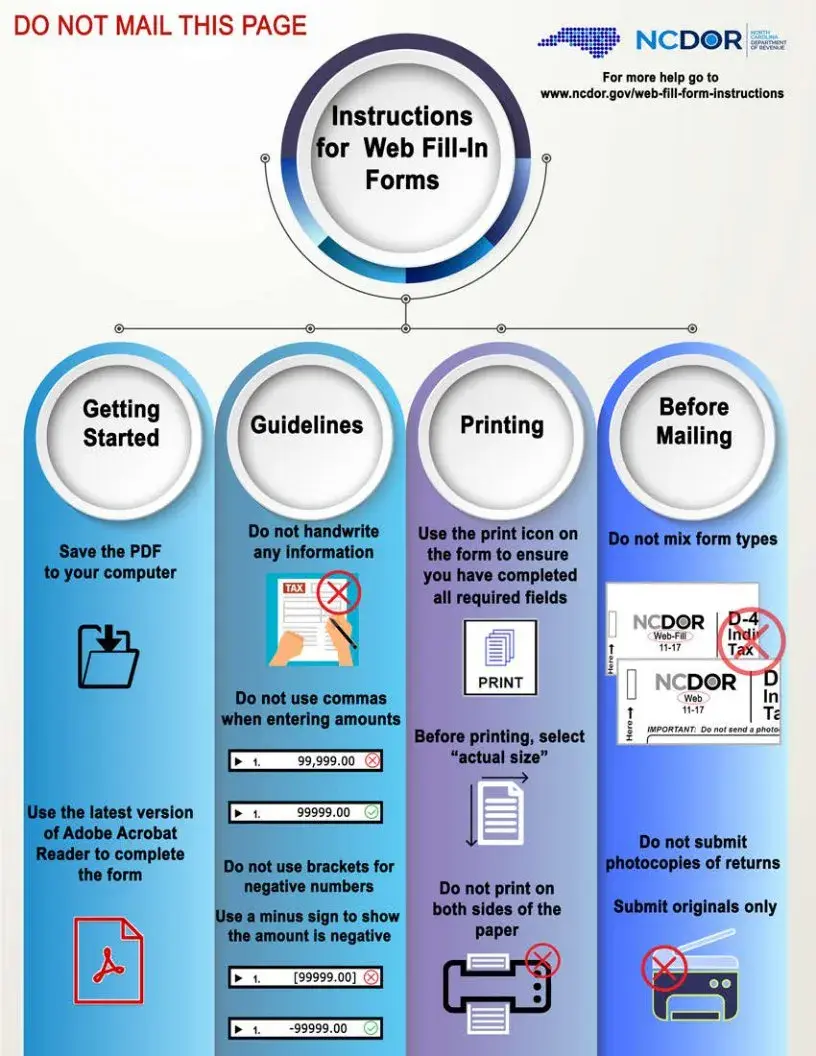

It really is very easy to complete the nc 242. Our PDF tool was developed to be easy-to-use and enable you to prepare any form fast. These are the basic steps to follow:

Step 1: The webpage includes an orange button that says "Get Form Now". Select it.

Step 2: You can now update your nc 242. The multifunctional toolbar helps you insert, delete, transform, and highlight content or perhaps undertake similar commands.

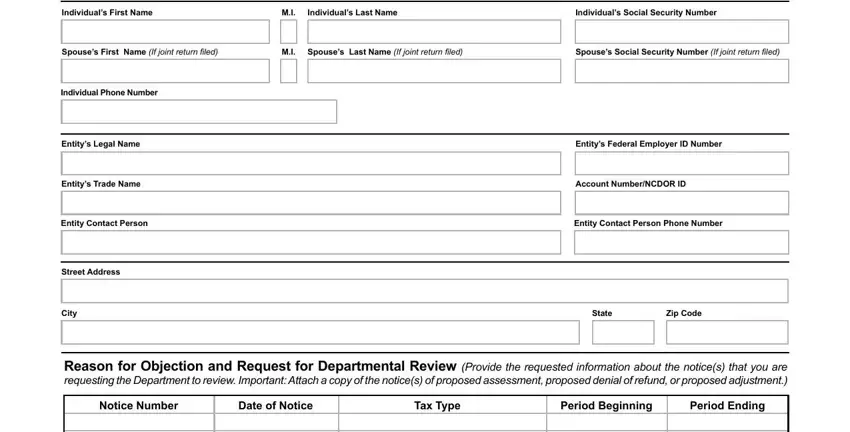

Make sure you enter the next details to prepare the nc 242 PDF:

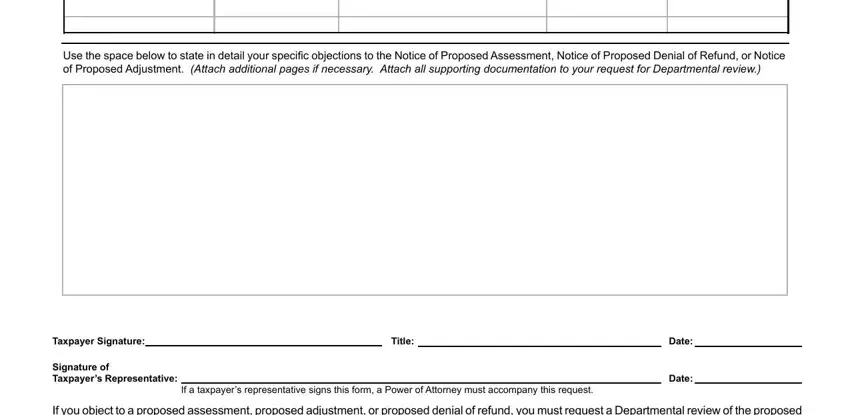

Complete the Use the space below to state in, Taxpayer Signature, Signature of Taxpayers, Title, Date, Date, If a taxpayers representative, and If you object to a proposed space with all the information requested by the system.

Step 3: After you hit the Done button, your final file is simply exportable to every of your gadgets. Or alternatively, you will be able to deliver it through email.

Step 4: In avoiding possible forthcoming complications, you should always get at least several copies of each form.