Filling in nc 4 tax form is not difficult. We designed our software to make it convenient to use and assist you to prepare any form online. Here are a couple steps that you should follow:

Step 1: Initially, choose the orange "Get form now" button.

Step 2: Now it's easy to manage your nc 4 tax form. This multifunctional toolbar enables you to insert, erase, customize, and highlight content material or undertake several other commands.

These particular sections will make up the PDF file that you'll be filling in:

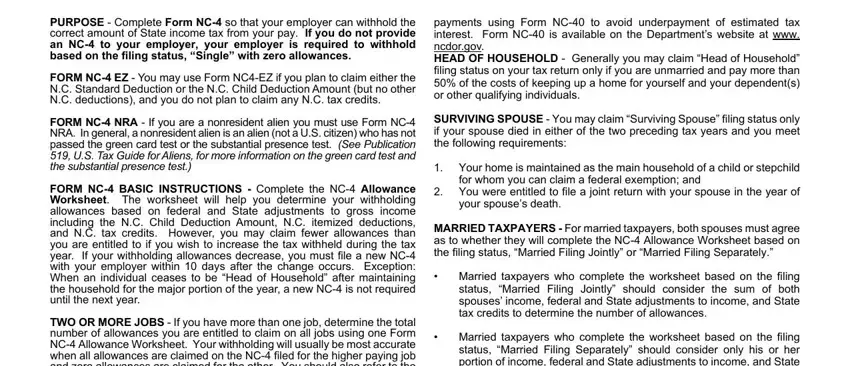

Please write down the crucial information in the PURPOSE Complete Form NC so that, FORM NC EZ You may use Form NCEZ, payments using Form NC to avoid, FORM NC NRA If you are a, FORM NC BASIC INSTRUCTIONS, TWO OR MORE JOBS If you have more, SURVIVING SPOUSE You may claim, Your home is maintained as the, MARRIED TAXPAYERS For married, Married taxpayers who complete the, and Married taxpayers who complete the area.

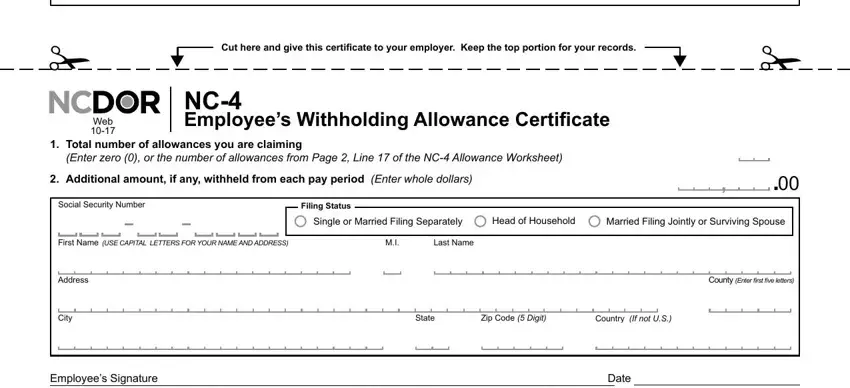

The system will ask you to include particular relevant details to effortlessly fill out the segment Web, Cut here and give this certificate, NC Employees Withholding Allowance, Total number of allowances you, Enter zero or the number of, Additional amount if any withheld, Social Security Number, Filing Status, First Name USE CAPITAL LETTERS FOR, Last Name, Single or Married Filing Separately, Head of Household, Married Filing Jointly or, Address, and City.

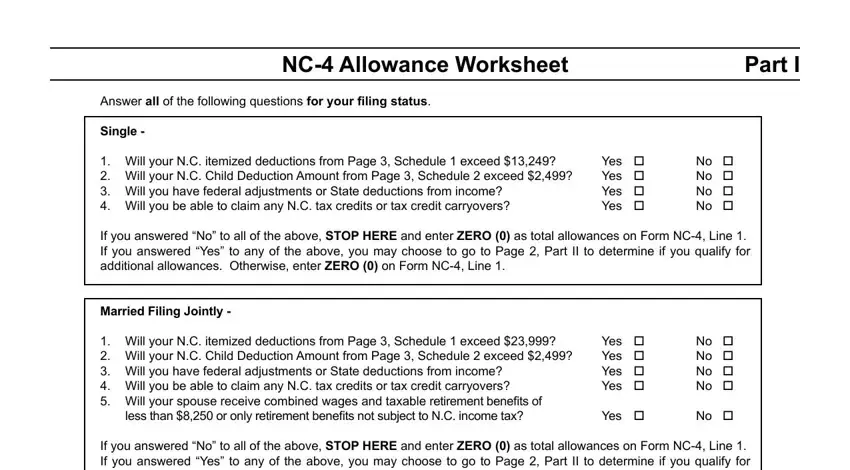

The NC Allowance Worksheet, Part I, Answer all of the following, Single, Will your NC itemized deductions, Yes o Yes o Yes o Yes o, No o No o No o No o, If you answered No to all of the, Married Filing Jointly, Will your NC itemized deductions, Yes o Yes o Yes o Yes o, Yes o, No o No o No o No o, No o, and If you answered No to all of the field should be used to note the rights or responsibilities of both parties.

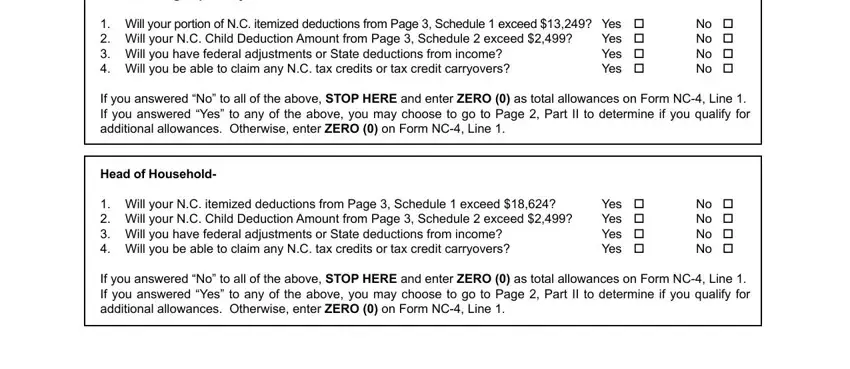

Look at the areas Married Filing Separately, Will your portion of NC itemized, No o No o No o No o, If you answered No to all of the, Head of Household, Will your NC itemized deductions, Yes o Yes o Yes o Yes o, No o No o No o No o, and If you answered No to all of the and thereafter fill them out.

Step 3: Choose the "Done" button. Next, you can export your PDF file - download it to your electronic device or forward it by using email.

Step 4: Get a copy of each single form. It will save you time and make it easier to remain away from worries later on. Also, your data won't be revealed or viewed by us.

®

® ,

,

Cut here and give this certificate to your employer. Keep the top portion for your records.

Cut here and give this certificate to your employer. Keep the top portion for your records.