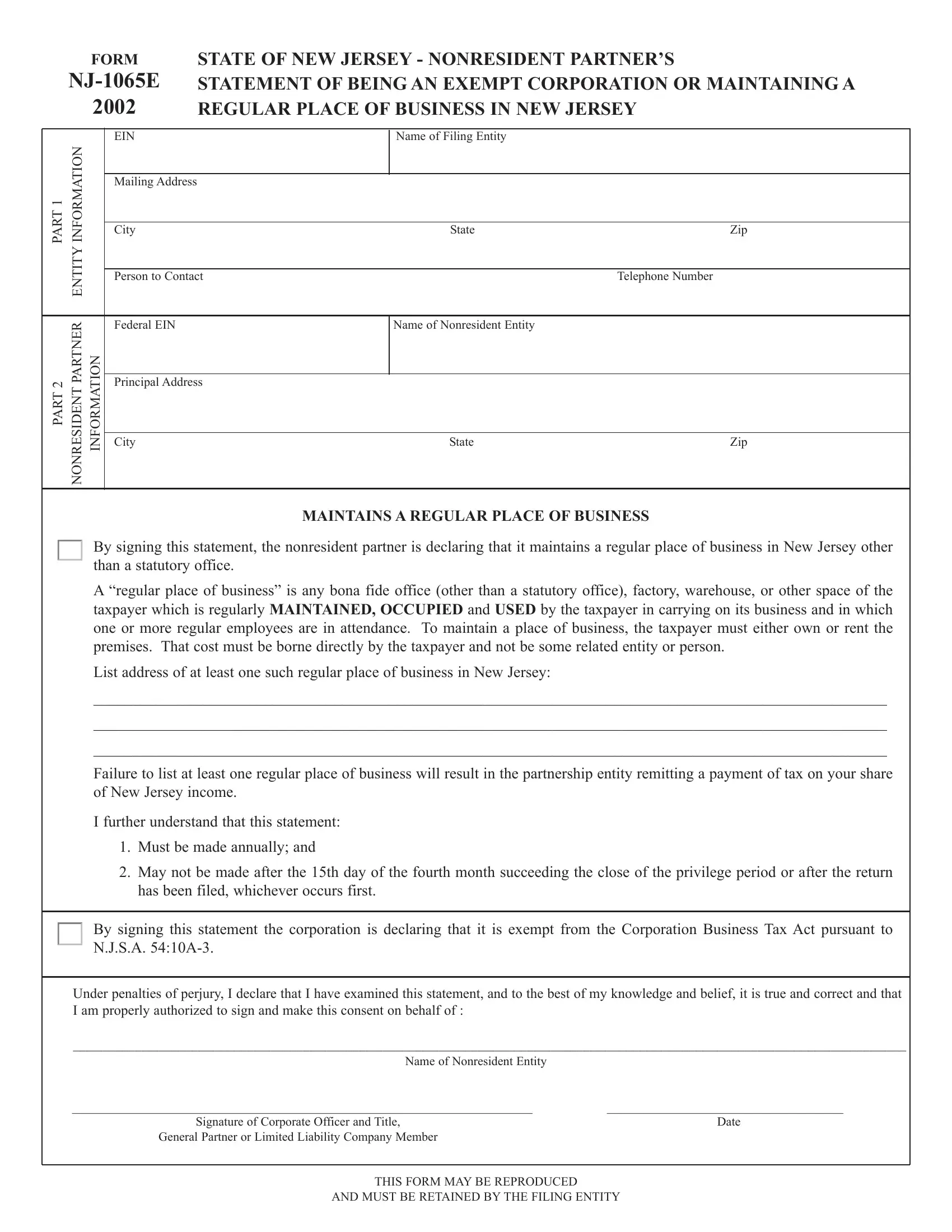

STATE OF NEW JERSEY - NONRESIDENT PARTNER’S

STATEMENT OF BEING AN EXEMPT CORPORATION OR MAINTAINING A REGULAR PLACE OF BUSINESS IN NEW JERSEY

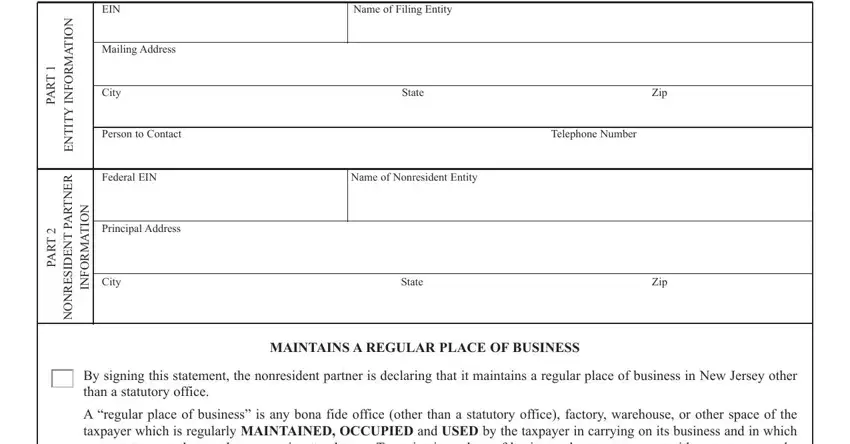

PART 1 |

INFORMATION |

|

|

ENTITY |

|

PART 2 |

NONRESIDENT PARTNER |

INFORMATION |

EIN

Mailing Address

City

Person to Contact

Federal EIN

Principal Address

City

Name of Filing Entity

Telephone Number

Name of Nonresident Entity

MAINTAINS A REGULAR PLACE OF BUSINESS

By signing this statement, the nonresident partner is declaring that it maintains a regular place of business in New Jersey other than a statutory office.

A “regular place of business” is any bona fide office (other than a statutory office), factory, warehouse, or other space of the taxpayer which is regularly MAINTAINED, OCCUPIED and USED by the taxpayer in carrying on its business and in which one or more regular employees are in attendance. To maintain a place of business, the taxpayer must either own or rent the premises. That cost must be borne directly by the taxpayer and not be some related entity or person.

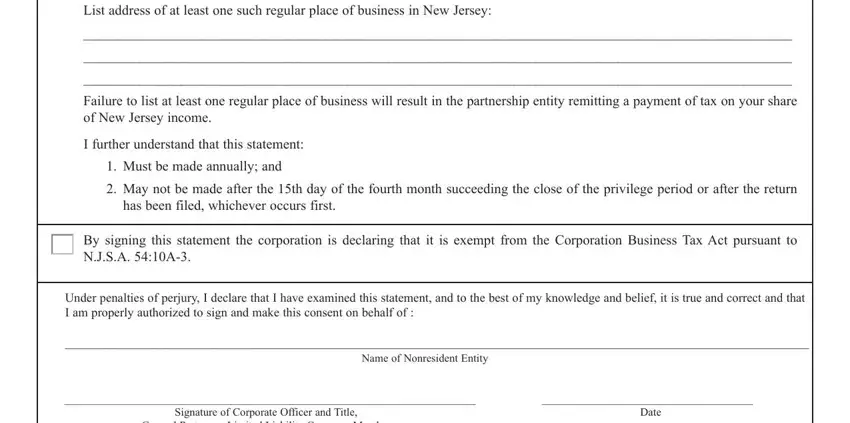

List address of at least one such regular place of business in New Jersey:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Failure to list at least one regular place of business will result in the partnership entity remitting a payment of tax on your share of New Jersey income.

I further understand that this statement:

1.Must be made annually; and

2.May not be made after the 15th day of the fourth month succeeding the close of the privilege period or after the return has been filed, whichever occurs first.

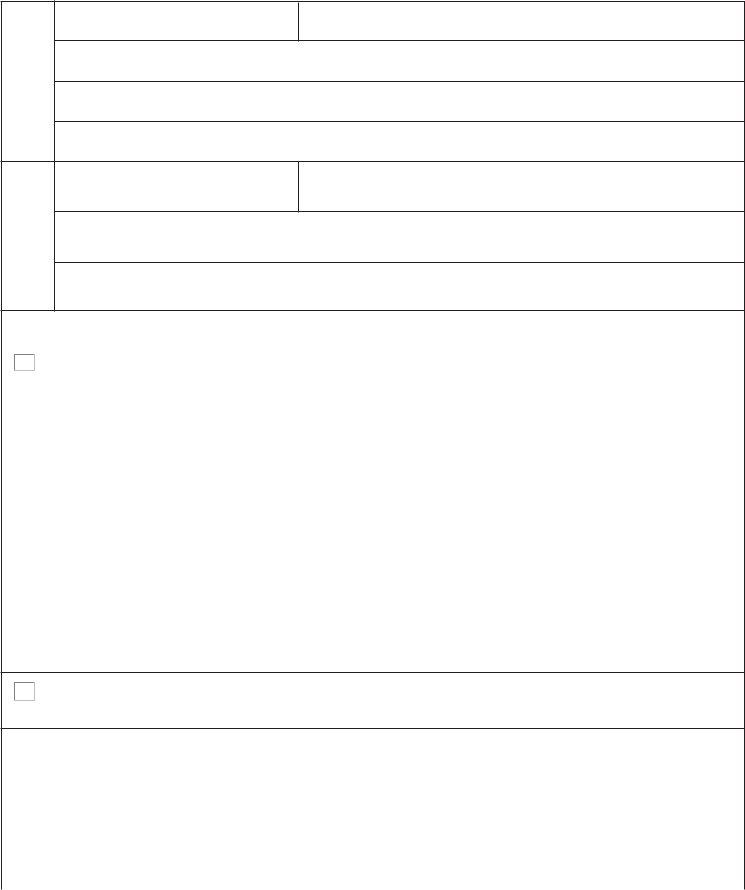

By signing this statement the corporation is declaring that it is exempt from the Corporation Business Tax Act pursuant to N.J.S.A. 54:10A-3.

Under penalties of perjury, I declare that I have examined this statement, and to the best of my knowledge and belief, it is true and correct and that I am properly authorized to sign and make this consent on behalf of :

_______________________________________________________________________________________________________________________

Name of Nonresident Entity |

|

__________________________________________________________________________ |

______________________________________ |

Signature of Corporate Officer and Title, |

Date |

General Partner or Limited Liability Company Member |

|

|

|

THIS FORM MAY BE REPRODUCED |

|

AND MUST BE RETAINED BY THE FILING ENTITY

REVISED STATUTES OF NEW JERSEY, 1937, TITLE 54 TAXATION, SUBTITLE 4 PARTICULAR TAXES ON CORPORATIONS AND OTHERS, PART 1PROVISIONS APPLICABLE TO CORPORATIONS GENERALLY, Ch. 10A Corporation Business Tax Act (1945)

Sec. 54:10A-3. Exempt corporations -

The following corporations shall be exempt from the tax imposed by this act:

(a)Corporations subject to a tax assessed upon the basis of gross receipts, other than the alternative minimum assessment determined pursuant to section 7 of P.L.2002, c.40 (C.54:10A-5a), and corporations subject to a tax assessed upon the basis of insurance premiums collected;

(b)Corporations which operate regular route autobus service within this State under operating authority conferred pursuant to R.S.48:4-3, provided, however, that such corporations shall not be exempt from the tax on net income imposed by section 5(c) of P.L.1945, c.162 (C.54:10A-5);

(c)Railroad, canal corporations, production credit associations organized under the Farm Credit Act of 1933, or agricultural cooperative associations incorporated or domesticated under or subject to chapter 13 of Title 4 of the Revised Statutes and exempt under Subtitle A, Chapter 1F, Part IV, Section 521 of the federal Internal Revenue Code (26 U.S.C. s.521);

(d)Cemetery corporations not conducted for pecuniary profit or any private shareholder or individual;

(e)Nonprofit corporations, associations or organizations established, organized or chartered, without capital stock, under the provisions of Title 15, 16 or 17 of the Revised Statutes, Title 15A of the New Jersey Statutes or under a special charter or under any similar general or special law of this or any other state, and not conducted for pecuniary profit of any private shareholders or individual;

(f)Sewerage and water corporations subject to a tax under the provisions of P.L.1940, c.5 (C.54:30A-49 et seq.) or any statute or law imposing a similar tax or taxes;

(g)Nonstock corporations organized under the laws of this State or of any other state of the United States to provide mutual ownership housing under federal law by tenants, provided, however, that the exemption hereunder shall continue only so long as the corporations remain subject to rules and regulations of the Federal Housing Authority and the Commissioner of the Federal Housing Authority holds membership certificates in the corporations and the corporate property is encumbered by a mortgage deed or deed of trust insured under the National Housing Act (48 Stat.1246) as amended by subsequent Acts of Congress. In order to be exempted under this subsection, corporations shall annually file a report on or before August 15 with the commissioner, in the form required by the commissioner, to claim such exemption, and shall pay a filing fee of $25.00;

(h)Corporations not for profit organized under any law of this State where the primary purpose thereof is to provide for its shareholders or members housing in a retirement community as the same is defined under the provisions of the "Retirement Community Full Disclosure Act," P.L.1969, c.215 (C.45:22A-1 et seq.);

(i)Corporations which are licensed as insurance companies under the laws of another state, including corporations which are surplus lines insurers declared eligible by the Commissioner of Banking and Insurance pursuant to section 11 of P.L.1960, c.32 (C.17:22- 6.45) to insure risks within this State; and

(j)(1) Municipal electric corporations that were in existence as of January 1, 1995 provided that all of their income is from sales, exchanges or deliveries of electricity derived from customers using electricity within their municipal boundaries; and (2) Municipal electric utilities that were in existence as of January 1, 1995 provided that all of their income is from sales, exchanges or deliveries of electricity derived from customers using electricity within their franchise area existing as of January 1, 1995. If a municipal electric corporation derives income from sales, exchanges or deliveries of electricity from customers using the electricity outside its municipal boundaries, such municipal electric corporation shall be subject to the tax imposed by this act on all income. If a municipal electric utility derives income from sales, exchanges or deliveries of electricity from customers using electricity outside its franchise area existing as of January 1, 1995, such municipal electric utility shall be subject to the tax imposed by the act on all income.

(As amended by Ch. 236, Laws 1949; Ch. 130, Laws 1951; Ch. 174, Laws 1960; Ch. 59, Laws 1963; Ch. 48, Laws 1967; Ch. 211, Laws 1972; Ch. 275, Laws 1973; Ch. 170, Laws 1975; Ch. 184, Laws 1991; Ch. 338, Laws 1993; Ch. 162, Laws 1997; Ch. 114 (A.B. 262), Laws 1998; Ch. 40 (A. B. 2501), Laws 2002, applicable to privilege periods and taxable years beginning on or after January 1, 2002.