18:35-1.30 Composite Returns for Nonresidents

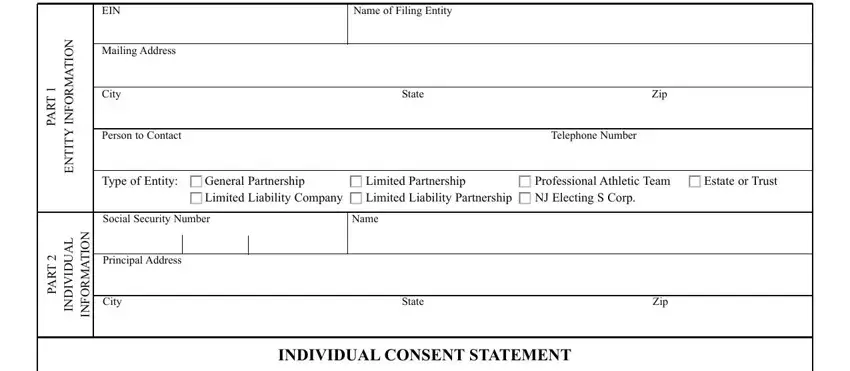

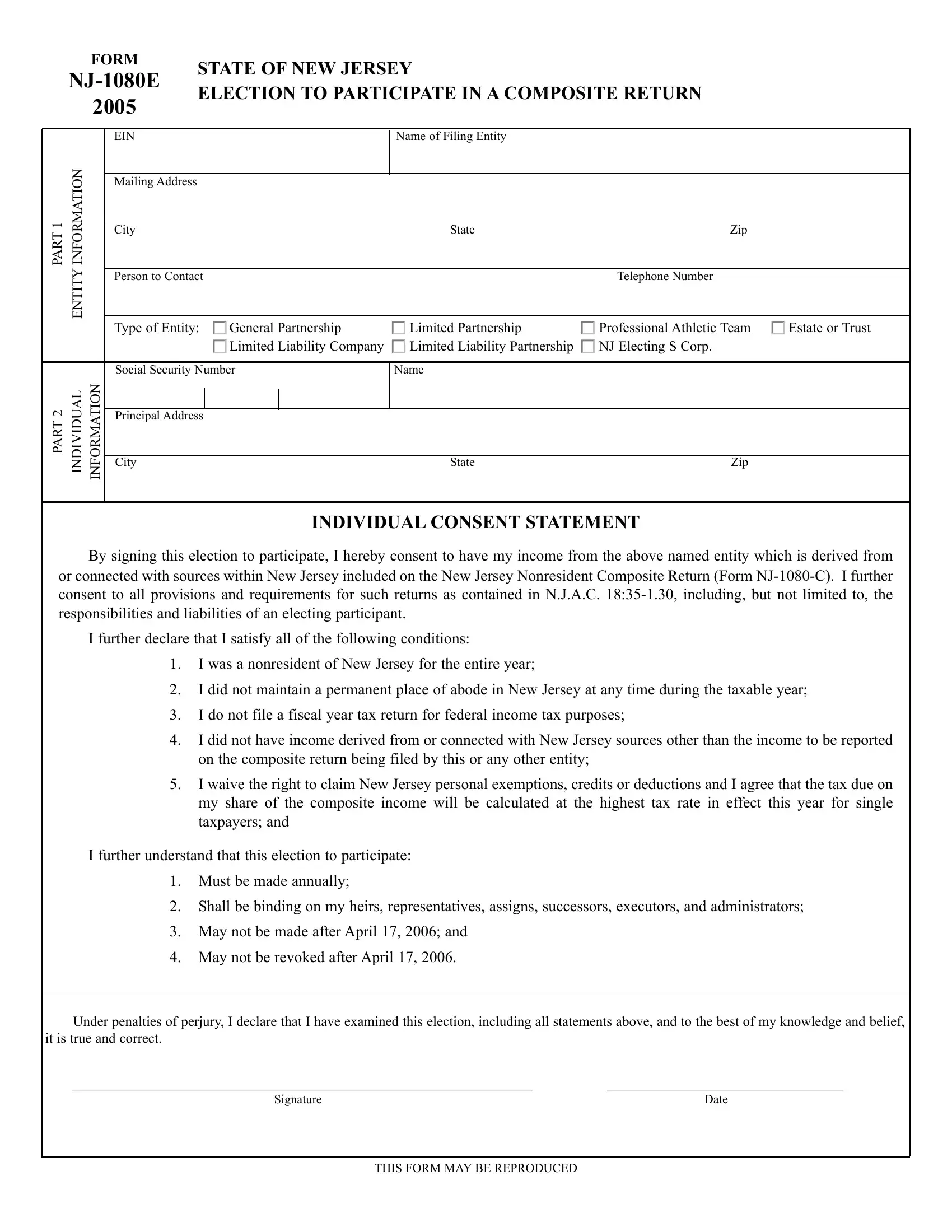

(a)A general partnership, a limited partnership, a limited liability partnership (LLP), a limited liability company (LLC), a New Jersey electing S corporation, an estate, a trust, or a professional athletic team (as defined in N.J.A.C. 18:35- 1.29) doing business or conducting activities in New Jersey or having income derived from or connected with sources within New Jersey may file a composite New Jersey Nonresident gross income tax return (Form NJ-1080-C) on behalf of its qualified nonresident individual partners, members, shareholders, or beneficiaries, as the case may be, who elected to file such return.

1. Any entity which files a composite return on behalf of its qualified nonresident individual members shall be referred to as the “filing entity”.

(b)A qualified nonresident individual is one who elects to participate in the composite return and satisfies all of the following conditions:

1. The individual was a nonresident for the entire taxable year;

2. The individual did not maintain a permanent place of abode in New Jersey at any time during the taxable year;

3. The individual was not a fiscal year filer;

4. The individual did not have income derived from or connected with New Jersey sources other than the income reported on this or any other composite return;

5. The individual waives the right to claim any New Jersey personal exemption, credit or deduction and agrees to have the tax calculated directly on such income at the highest tax rate in effect for single taxpayers for the tax year; and

6. The individual elects to be included in a composite return by completing and delivering to the filing entity a Form NJ-1080E (Election to be included in a Composite Return), or a form substantially similar thereto, prior to the filing of the composite return by the filing entity.

i.Such election must be made annually;

ii.Such election shall be binding on the participant’s heirs, representatives, assigns, successors, executors and administrators;

iii.Such election shall be an express consent to personal jurisdiction in New Jersey for New Jersey personal income tax purposes; and

iv.A qualified electing nonresident participant may not revoke an election to be included in the composite return or make an election to be included in the composite return after April 15 following the close of the taxable year.

(c)Each filing entity must retain the completed and signed election forms (Form NJ-1080E) submitted by the qualified electing nonresident participants. Such forms must be made available to the Division of Taxation upon request.

(d)An individual may participate in more than one New Jersey gross income tax composite return, providing the requirements of subsections (b)1 through (b)6, above, are satisfied.

(e)Nonresident individuals who are not eligible to participate in the composite return because they do not satisfy all of the requirements of subsection (b), or who do not wish to participate in the composite return, must file a Form NJ- 1040NR reflecting their income from all sources, as well as from New Jersey sources.

(f)The composite return shall be due on the fifteenth day of the fourth month following the close of the taxable year of the qualified electing nonresident participants. An extension of time to file will be granted on a composite basis only and must be requested in accordance with N.J.A.C. 18:35-1.18. The request must be made on From NJ-630 and must be made under the filing entity’s federal identification number.

(g)If the filing entity has filed a composite return previously and the amount which the filing entity estimates to be the total income tax liability for the composite return for the current tax year exceeds $100, the filing entity must file a declaration of estimated tax and make quarterly estimated tax payments in accordance with N.J.S.A. 54A:8-4 and 8-5, using Form 1040-ES. Credit will not be given on the composite return for individual estimated tax payments made by, or on behalf of, any of the qualified electing nonresident participants.

(h)The tax due shall be calculated using the highest gross income tax rate in effect for single taxpayers for the tax year for which the composite return is being filed, without benefit of personal exemptions, deductions or credits.

(i)The filing of a composite return shall be considered to be a group of separate returns meeting the individual filing requirements for each qualified electing nonresident participant as imposed by the Gross Income Tax Act. N.J.S.A 54A:1-1 et seq.

1.Each qualified electing nonresident participant is personally liable for the timely filing of returns and payment of such individual’s liability, including, but not limited to, any assessment resulting from an audit of the composite return.

2.Each qualified electing nonresident participant adopts the statements contained in the filed composite return relating to the filing entity and to him or herself (but not as to statements made on the composite return relating solely to other participants), and shall take, under penalties of perjury, full responsibility for the truth of the statements contained in the filed composite return.

3.Each qualified electing nonresident participant adopts, as his or her own, any actions of the filing entity that may affect the composite return, including, but not limited to, a waiver of the statute of limitations for assessment or any decision to accept the results of an audit by the Division.

4.The Director retains the right to require the filing of an individual New Jersey Nonresident Gross Income Tax Return (Form NJ-1040NR) by any individual who participates in a composite return when the Director deems that the filing of a separate individual return is necessary to acquire complete facts and information or to enforce the provisions of the Gross Income Tax Act.

(j)Each composite return shall include the following for each qualified electing nonresident participant:

1.Name and address;

2.Social Security Number;

3.The participant’s share of income derived from or connected with New Jersey sources;

4.The New Jersey gross income tax attributable to the participant’s share of income derived from or connected with New Jersey source; and

5.A copy of the following;

i.Schedule NJK-1, Form NJ-1065, if the filing entity is a partnership, limited liability company or limited liability partnership;

ii.Schedule NJ-K-1, Form CBT-100S, if the filing entity is a New Jersey electing S corporation;

iii.Schedule K-1, Federal Form 1041, if the filing entity is a trust or estate; or

iv.Form W-2, if the filing entity is a professional athletic team.

(k)Each return must include the names, addresses, and social security numbers of all members of the filing entity who are not included in the composite return.

(l)Any composite return which is filed on behalf of 25 or more participants must be filed on diskette or by using magnetic media.

(m)The composite New Jersey Nonresident gross income tax return (Form NJ-1080-C) must be signed by:

1.The tax matters partner, if the filing entity is a general partnership, a limited partnership, or a limited liability partnership;

2.An officer of the corporation, if the filing entity is an S corporation;

3.The executor or administrator, if the filing entity is an estate;

4.A trustee, if the filing entity is a trust; or

5.An authorized member, if the filing entity is a limited liability company.

6.If the filing entity is a professional athletic team the return must be signed as required in subsections 1 through 5 above, depending on the entity type of the team.

(n)If, after the final composite return has been filed, a qualified, electing, nonresident participant discovers income derived from or connected with New Jersey sources other than from the filing entity, such participant shall file a Nonresident New Jersey Gross Income Tax Return (Form NJ-1040NR) which includes all income derived from New Jersey sources (including the share of income reported on the composite return).

1.The participant’s Form NJ-1040NR must include a schedule indicating the name of the filing entity(s) for which the participant was included in a composite return, and showing the amount of income included on the participant’s behalf for each composite return and the tax paid thereon.

2.Such participant shall be entitled to a credit on the Form NJ-1040NR for the gross income tax paid on behalf of such participant on the composite return (Form NJ-1080-C).

(o)For members of general and limited partnerships and professional athletic teams this rule shall apply to all tax years beginning on or after January 1, 1995. For members of New Jersey electing S corporations, limited liability partnerships, limited liability companies, and estates and trusts this rule shall apply to all tax years beginning on or after January 1, 1996.