seq can be completed with ease. Simply use FormsPal PDF tool to accomplish the job without delay. Our editor is constantly evolving to present the very best user experience attainable, and that's because of our dedication to constant enhancement and listening closely to feedback from customers. It merely requires several simple steps:

Step 1: Just click the "Get Form Button" above on this page to get into our pdf file editor. This way, you will find everything that is needed to work with your file.

Step 2: With this advanced PDF editor, you could do more than simply fill in blanks. Express yourself and make your forms appear faultless with custom text added, or adjust the file's original content to excellence - all that comes with an ability to insert just about any images and sign the file off.

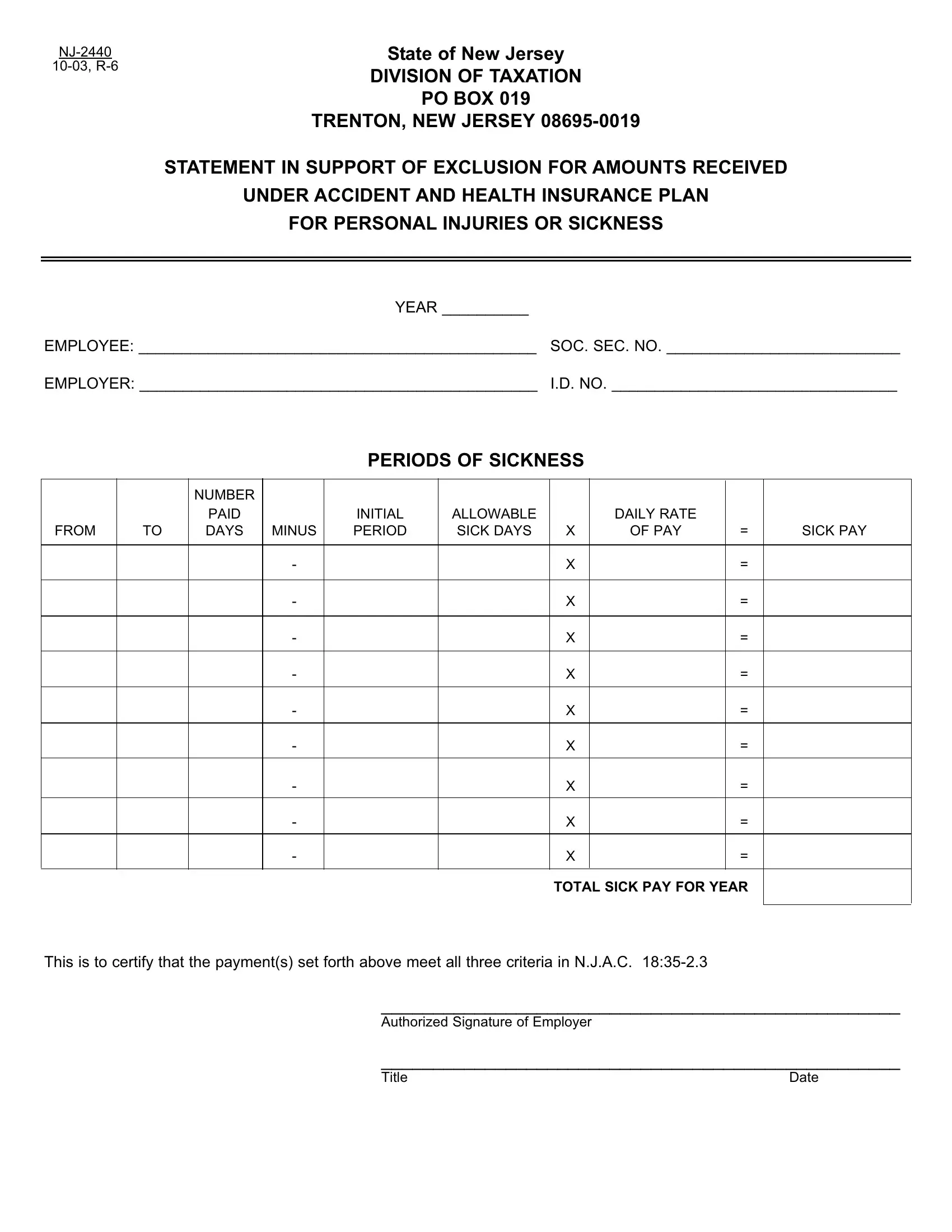

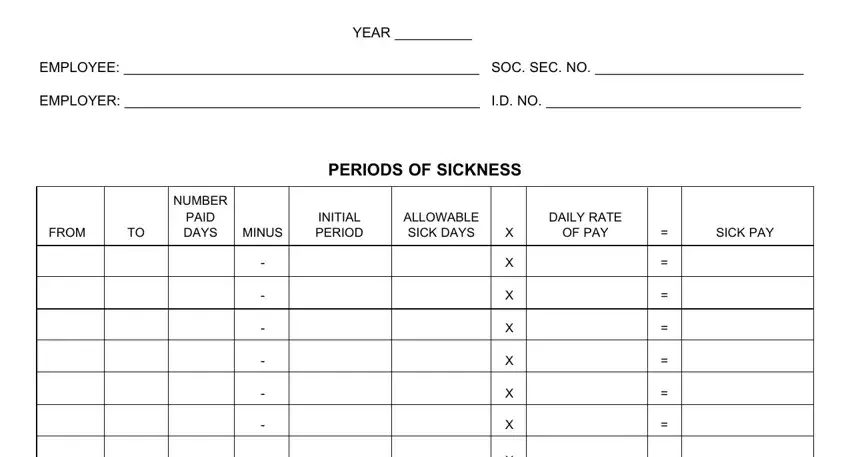

This PDF will need specific information to be typed in, hence you need to take whatever time to fill in exactly what is asked:

1. Whenever completing the seq, make certain to include all of the necessary blanks in the relevant form section. This will help to hasten the process, allowing for your information to be processed efficiently and correctly.

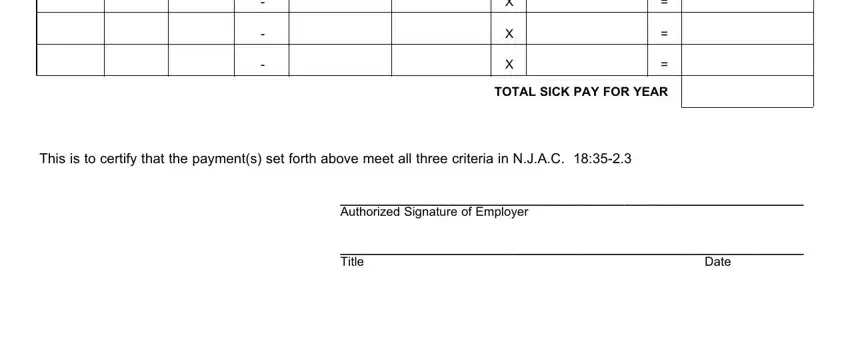

2. Soon after filling in the last section, head on to the subsequent stage and enter the essential details in all these blanks - TOTAL SICK PAY FOR YEAR, This is to certify that the, Authorized Signature of Employer, Title, and Date.

It is easy to make a mistake when completing your Title, so be sure to take another look prior to when you finalize the form.

Step 3: As soon as you have reread the details in the fields, just click "Done" to conclude your FormsPal process. Acquire your seq after you sign up for a 7-day free trial. Conveniently view the pdf form from your personal account page, along with any edits and adjustments automatically synced! When using FormsPal, you can easily complete forms without having to be concerned about data incidents or entries getting distributed. Our secure platform helps to ensure that your personal details are maintained safely.