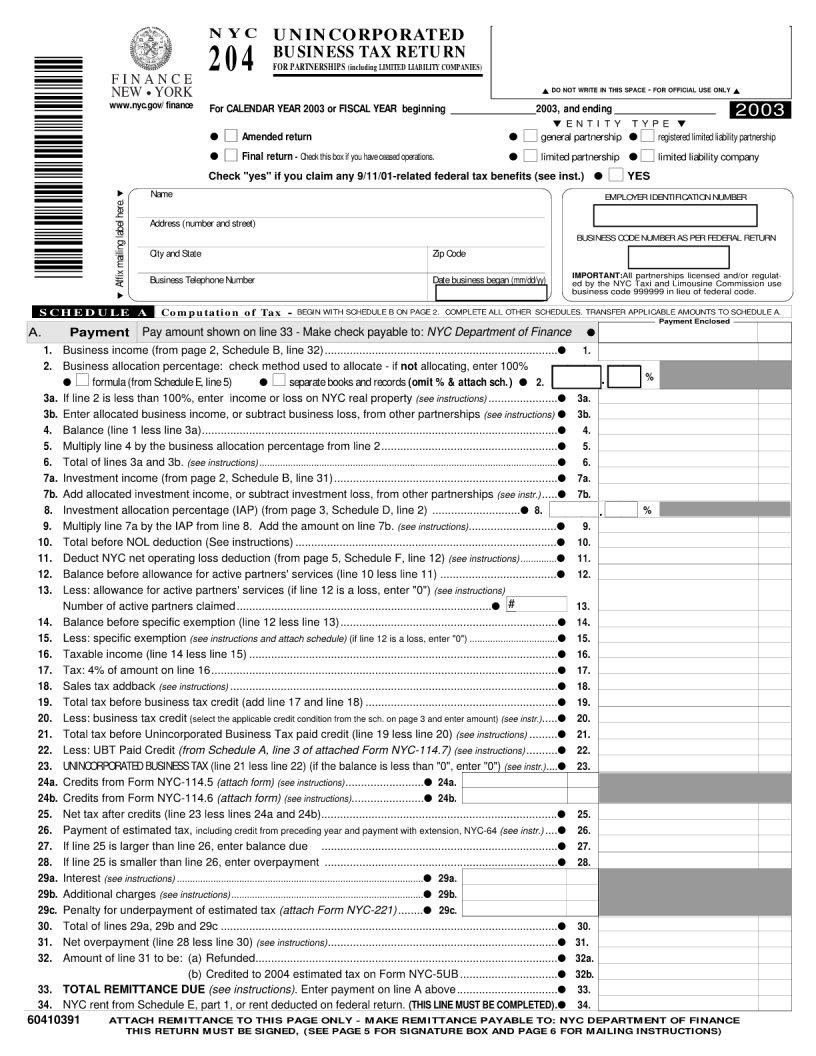

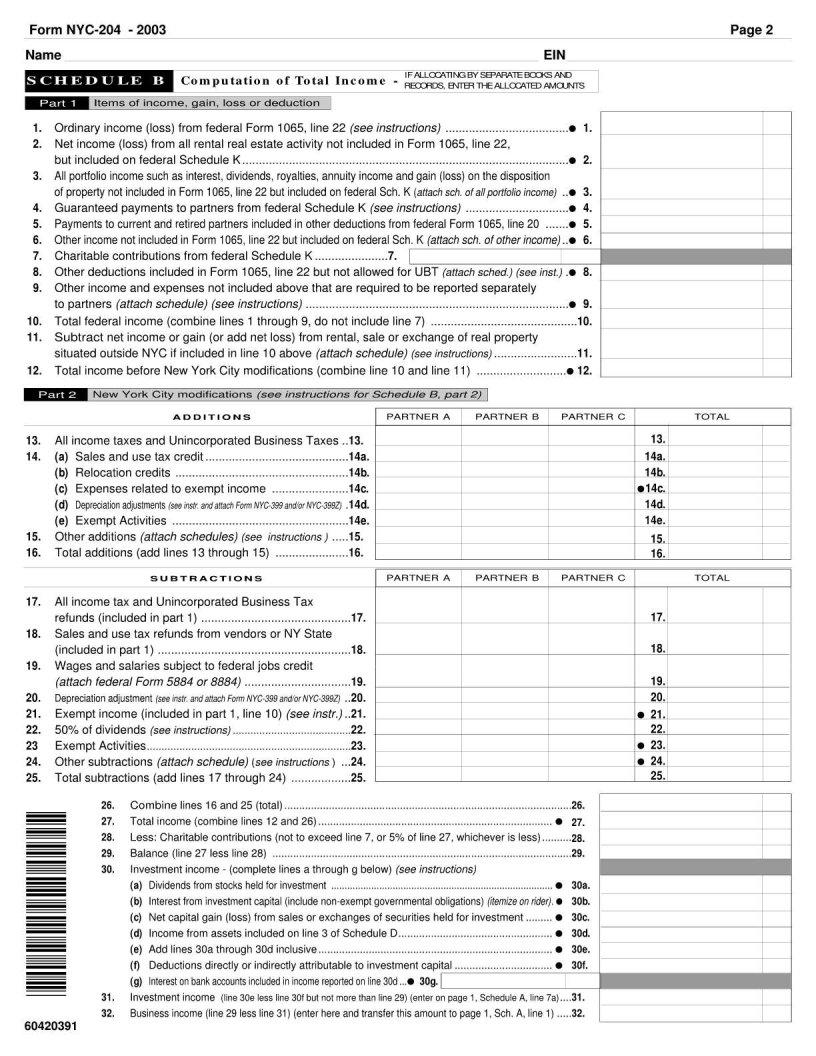

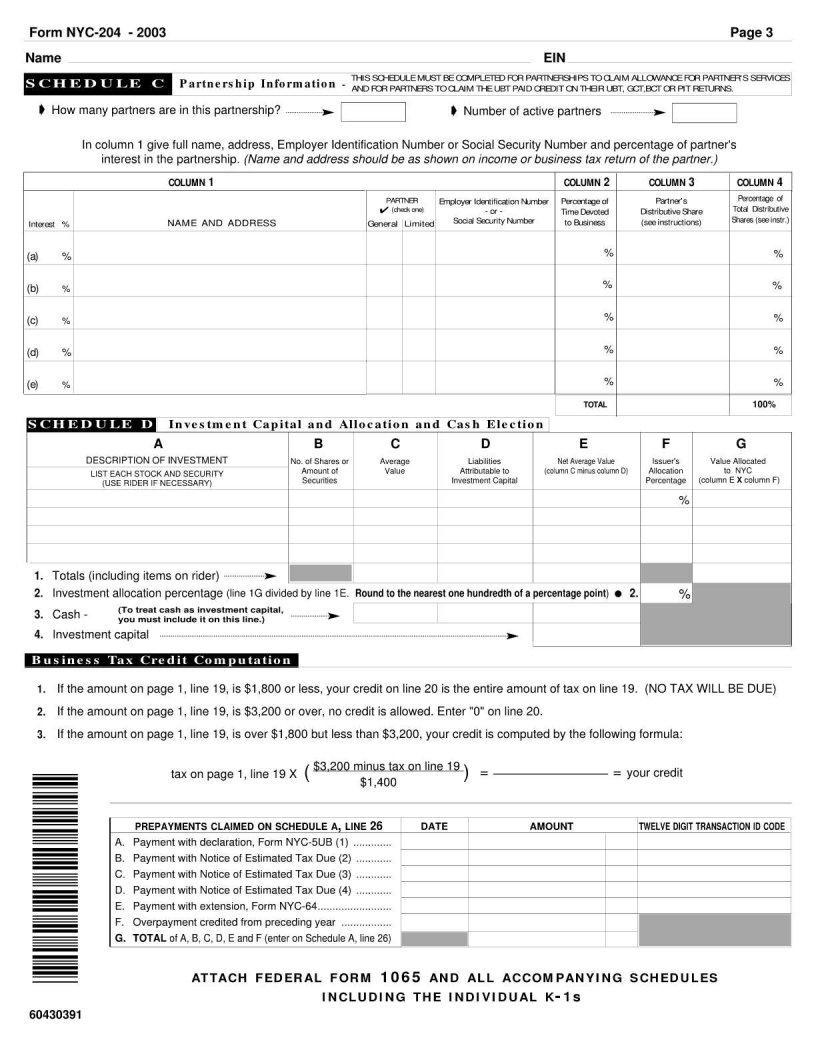

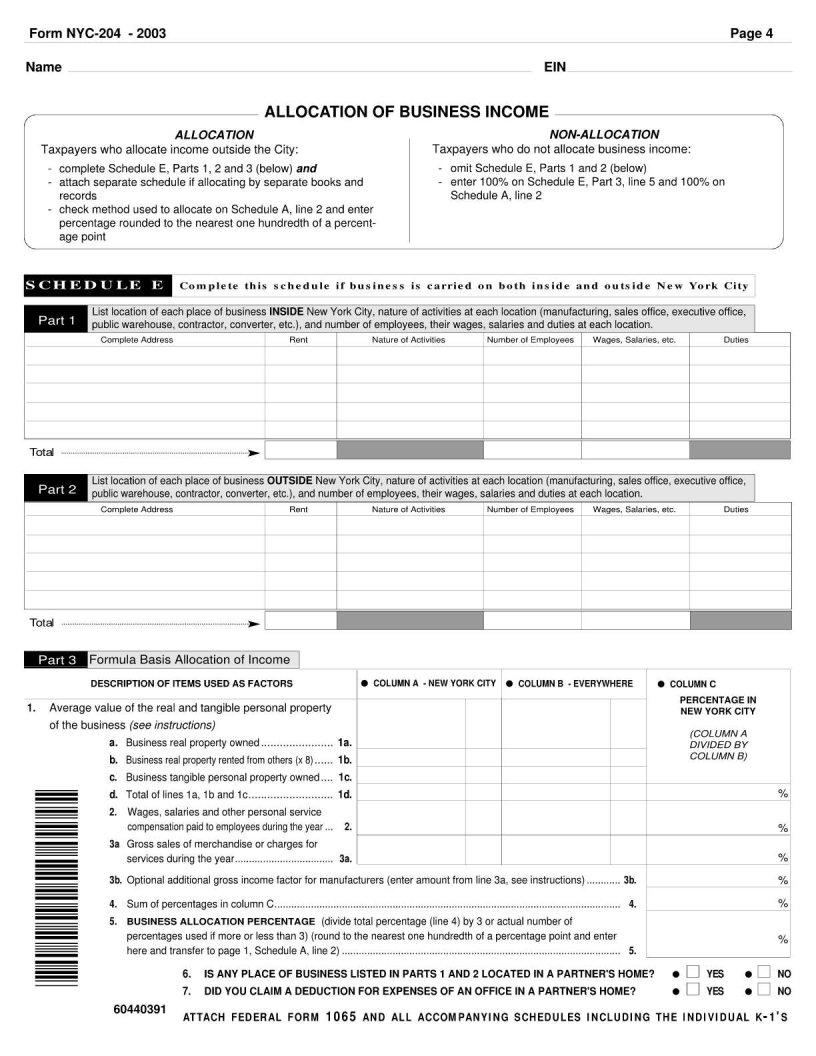

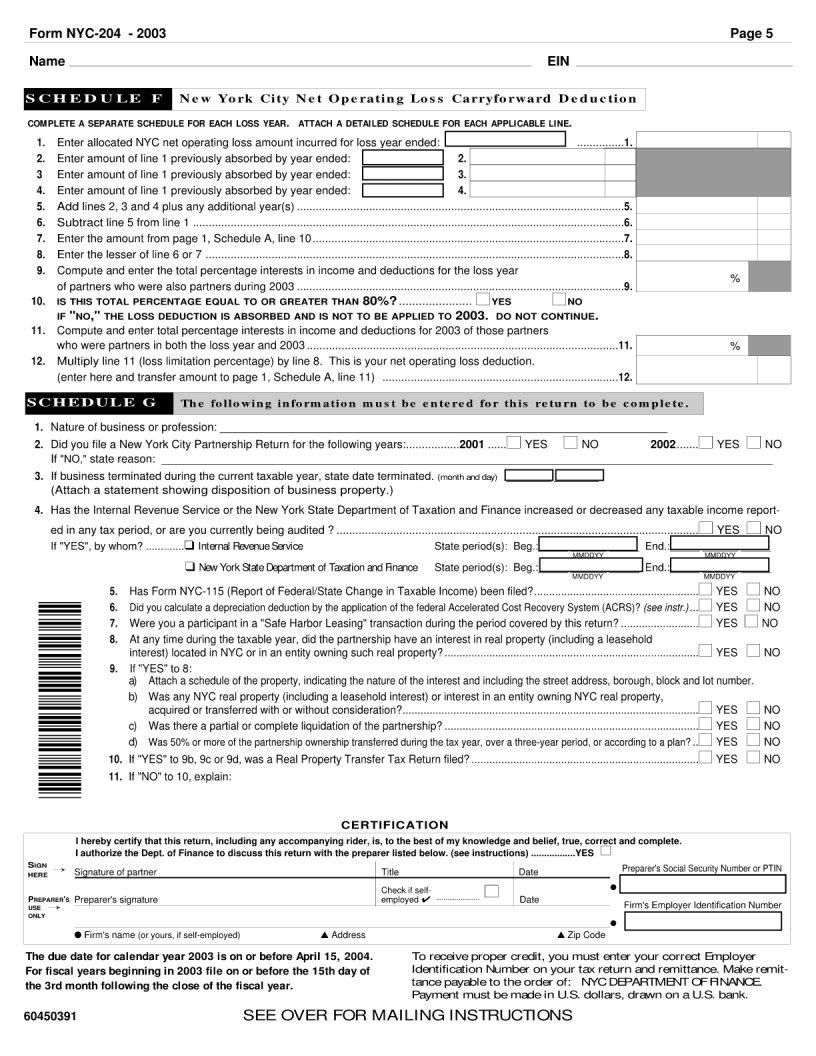

In navigating the complex landscape of tax obligations for nonresident employees working in New York City, the NYC 204 form emerges as a crucial document. This form is tailored for individuals who earn income in New York City but reside elsewhere, marking a significant aspect of tax compliance for both employers and employees. Its primary role is to calculate the amount of city tax owed based on income earned within New York City, factoring in various deductions and credits applicable to nonresident taxpayers. Understanding and accurately completing the NYC 204 form can lead to substantial tax savings and ensure compliance with New York City's tax laws. Moreover, the form serves as a vital tool for employers to withhold the correct amount of taxes, thereby avoiding penalties and interest for underpayment. The relevance of the NYC 204 form underscores the interconnectedness of tax laws and the importance of diligent tax planning and preparation for individuals and businesses alike.

| Question | Answer |

|---|---|

| Form Name | Form Nyc 204 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | nyc 204 form, NYC, preparer, EIN |