This PDF editor makes it simple to create the nys 45 att 2020 form. It will be easy to prepare the file quickly by following these easy steps.

Step 1: The initial step would be to select the orange "Get Form Now" button.

Step 2: You'll notice each of the functions which you can undertake on your document once you've got accessed the nys 45 att 2020 editing page.

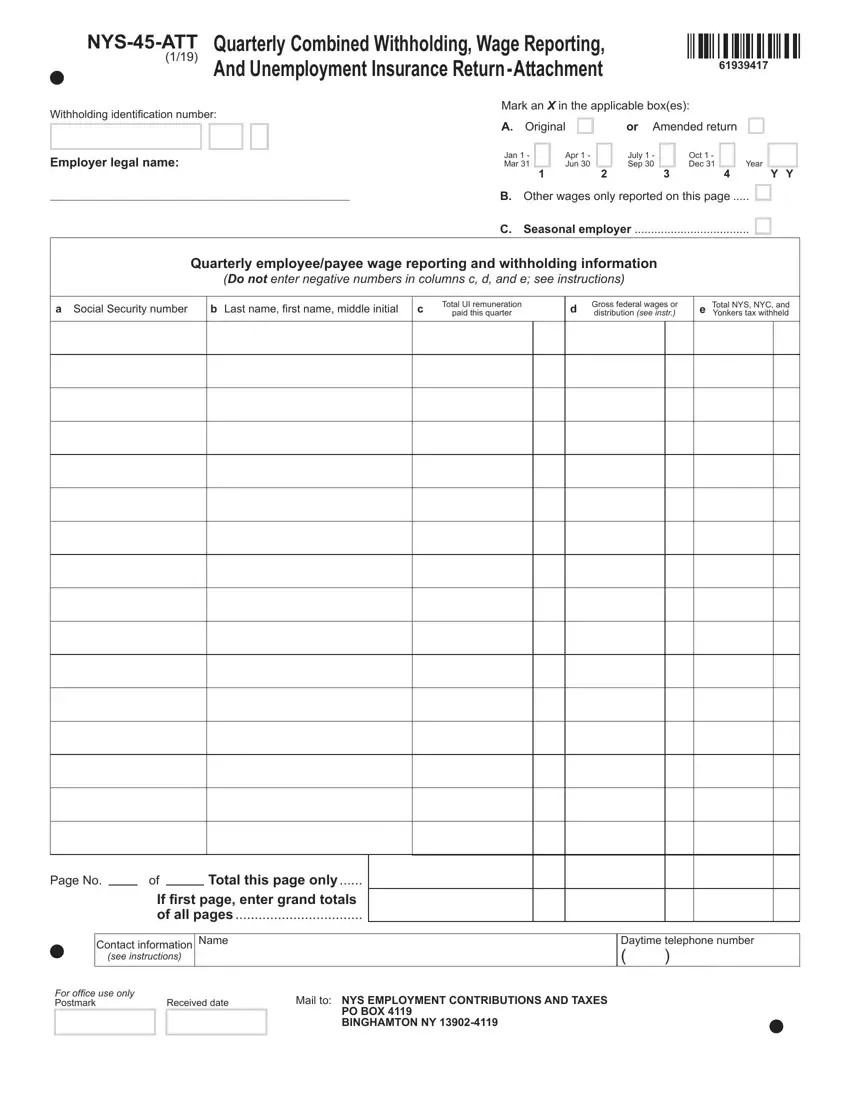

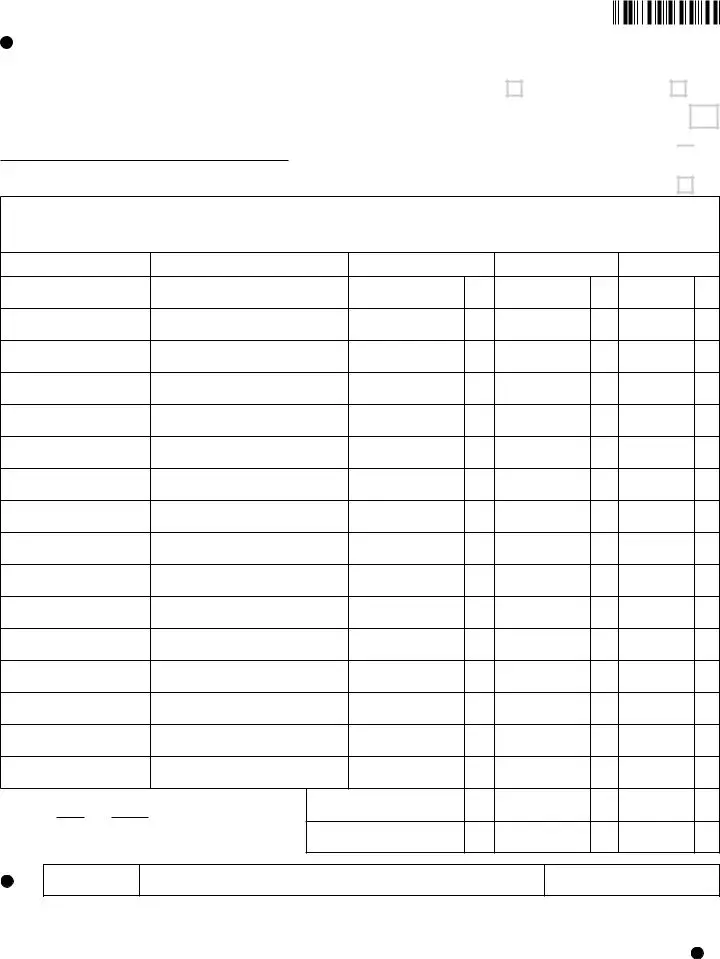

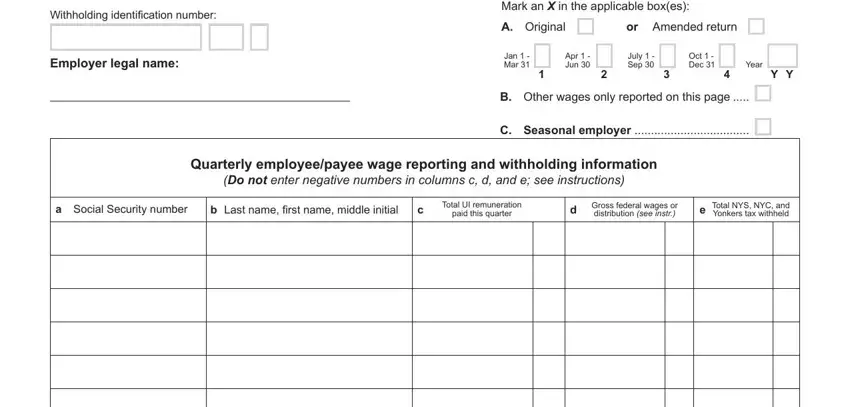

The PDF form you decide to complete will cover the next sections:

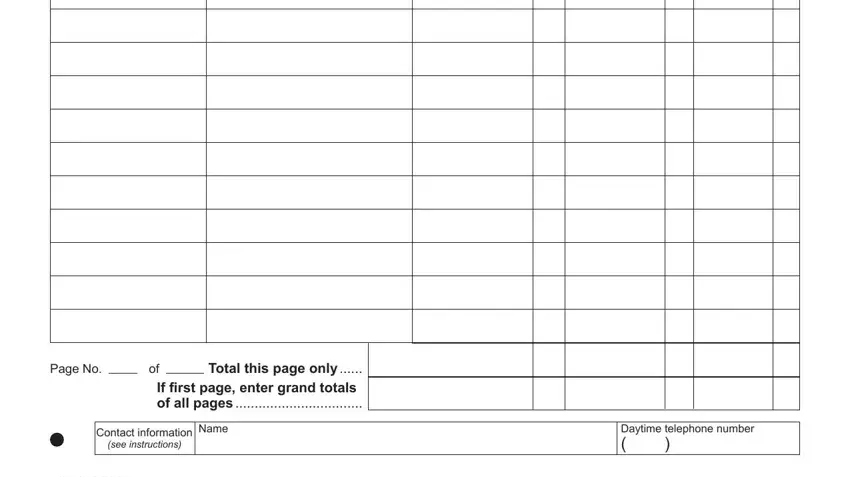

Put down the information in the Page No, Total this page only If first, Contact information Name, see instructions, and Daytime telephone number area.

Step 3: Press the "Done" button. So now, it is possible to transfer your PDF document - save it to your electronic device or send it by using electronic mail.

Step 4: Generate copies of the file - it can help you remain away from possible troubles. And don't be concerned - we don't display or look at the information you have.