You'll be able to fill in Form Oes 190T effectively in our PDFinity® PDF editor. Our team is dedicated to providing you with the perfect experience with our editor by constantly adding new capabilities and improvements. Our editor has become much more useful as the result of the latest updates! Currently, working with PDF files is simpler and faster than ever before. To start your journey, consider these easy steps:

Step 1: Open the PDF form inside our editor by pressing the "Get Form Button" in the top section of this page.

Step 2: This editor helps you customize PDF forms in a range of ways. Change it by adding your own text, adjust existing content, and place in a signature - all within a few mouse clicks!

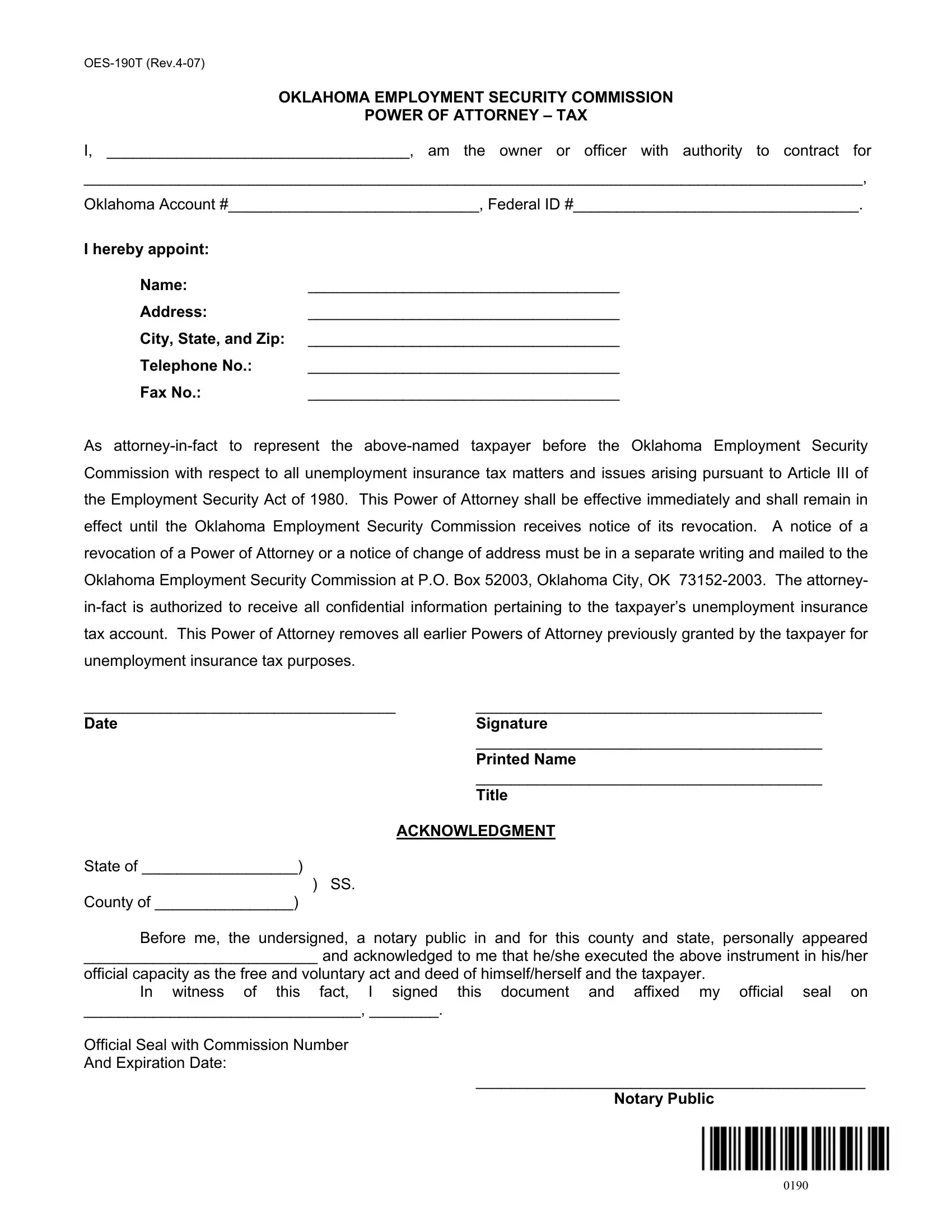

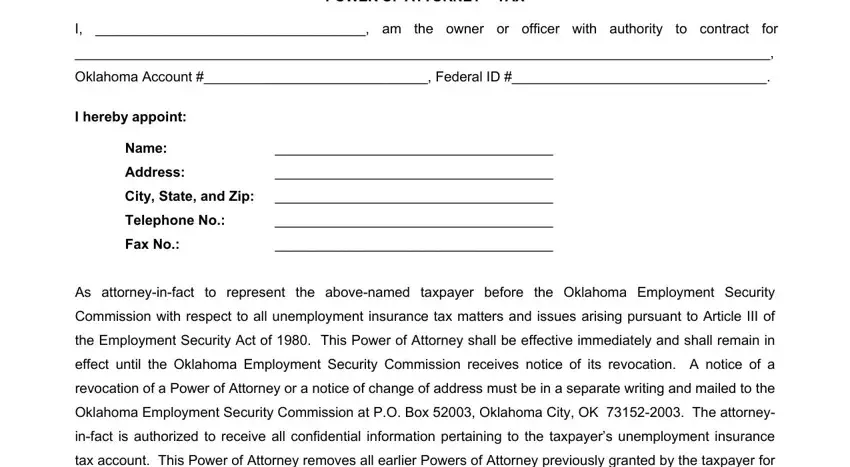

This PDF form will need some specific information; in order to ensure correctness, please make sure to consider the tips directly below:

1. You will want to fill out the Form Oes 190T correctly, so be mindful while working with the segments comprising all of these blank fields:

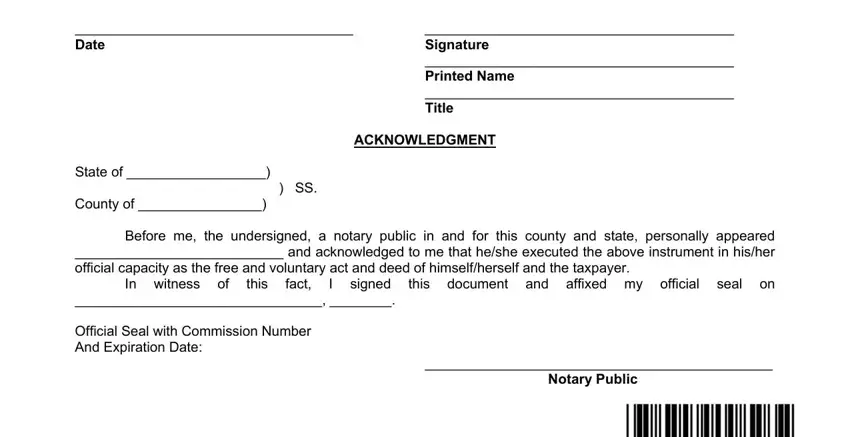

2. The third part would be to submit these blanks: Date, Signature Printed Name Title, ACKNOWLEDGMENT, State of County of Before me the, this document and affixed my, Notary Public, In witness of, this, and fact.

It's simple to get it wrong while completing the this document and affixed my, therefore make sure to go through it again before you'll submit it.

Step 3: After you've looked once more at the details in the document, simply click "Done" to finalize your document creation. Join FormsPal today and easily gain access to Form Oes 190T, available for downloading. Every last edit made is handily kept , enabling you to modify the form later on if needed. FormsPal provides safe document editor without personal information record-keeping or sharing. Be assured that your data is in good hands here!