Working with PDF documents online is actually a breeze with our PDF editor. Anyone can fill in oto here and try out many other functions we provide. To make our editor better and more convenient to utilize, we continuously develop new features, taking into account suggestions from our users. It just takes a couple of easy steps:

Step 1: Access the PDF inside our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: With this handy PDF tool, you may do more than merely fill in blank fields. Express yourself and make your documents look high-quality with custom textual content incorporated, or fine-tune the file's original input to excellence - all backed up by the capability to insert stunning photos and sign the document off.

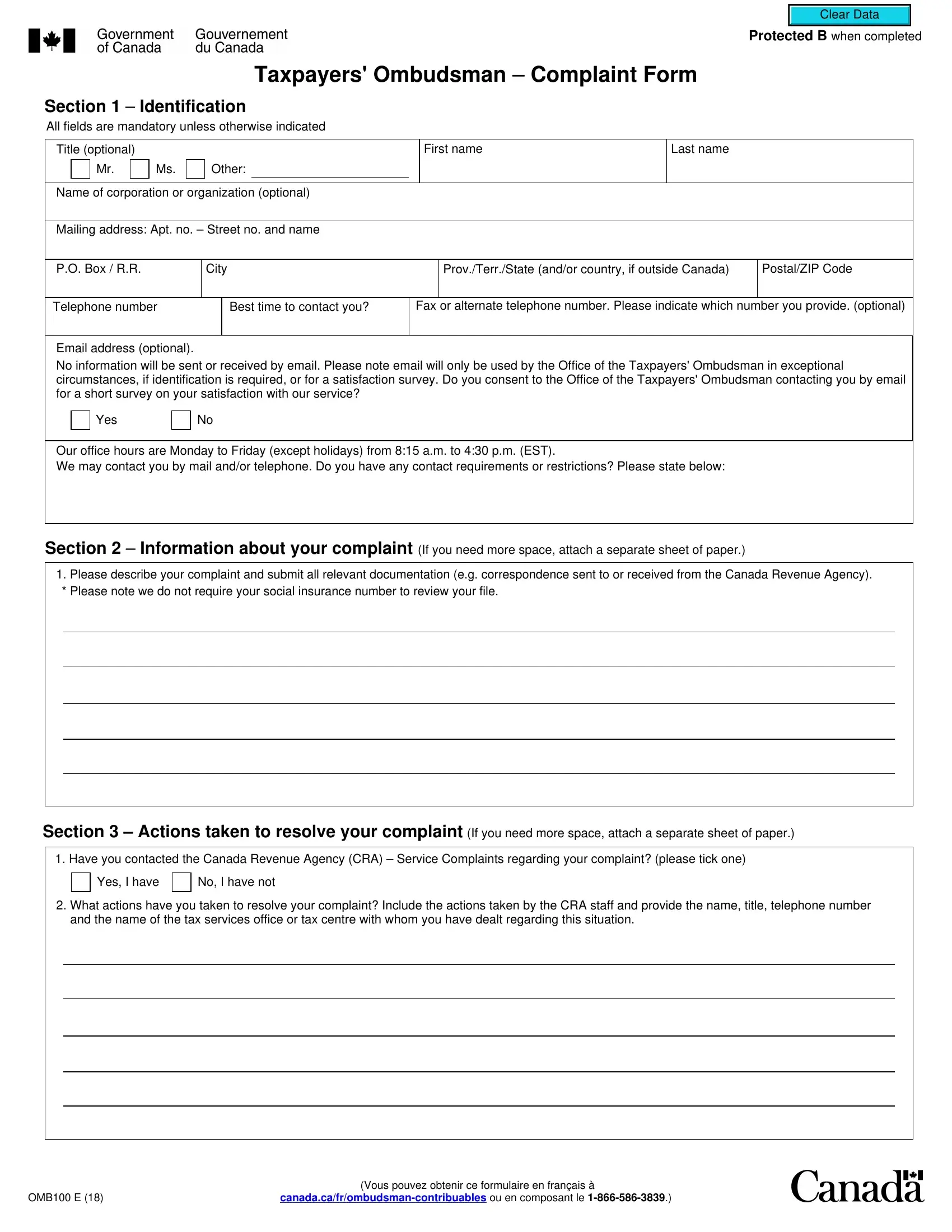

As for the blanks of this specific form, here is what you should do:

1. The oto needs particular information to be inserted. Be sure the next blanks are complete:

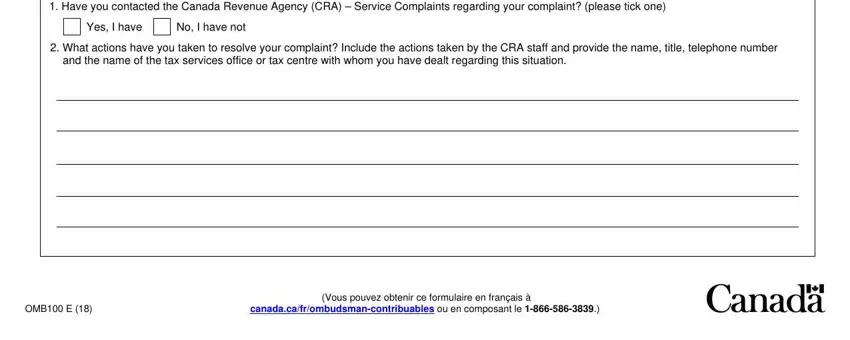

2. Once your current task is complete, take the next step – fill out all of these fields - Have you contacted the Canada, Yes I have, No I have not, What actions have you taken to, and the name of the tax services, OMB E, canadacafrombudsmancontribuables, and Vous pouvez obtenir ce formulaire with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

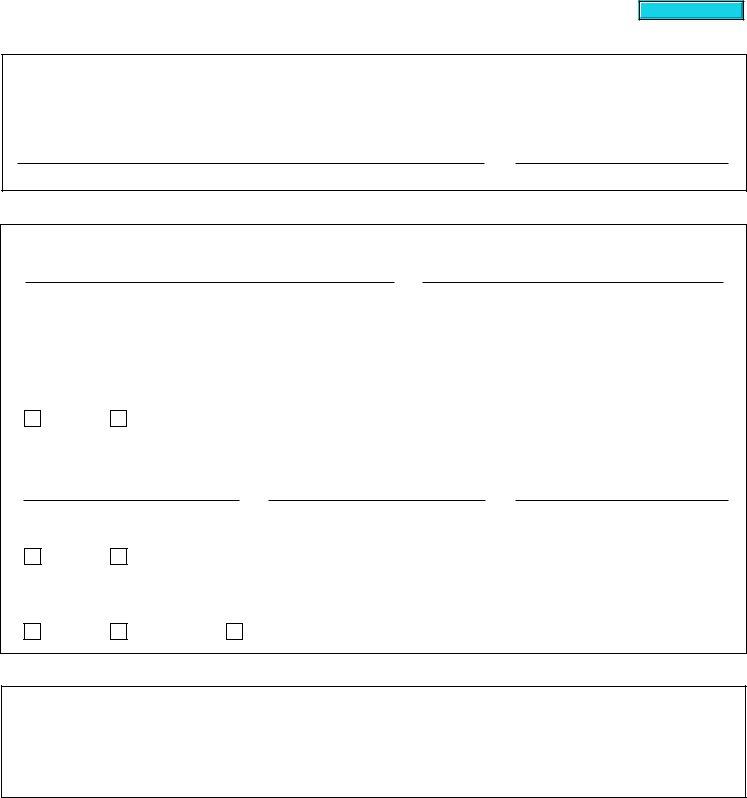

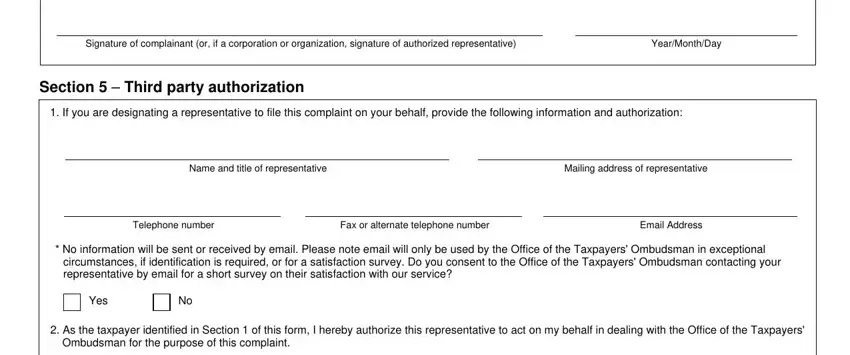

3. This next portion is mostly about Signature of complainant or if a, YearMonthDay, Section Third party authorization, If you are designating a, Name and title of representative, Mailing address of representative, Telephone number, Fax or alternate telephone number, Email Address, No information will be sent or, circumstances if identification is, Yes, As the taxpayer identified in, and Ombudsman for the purpose of this - fill out each of these blanks.

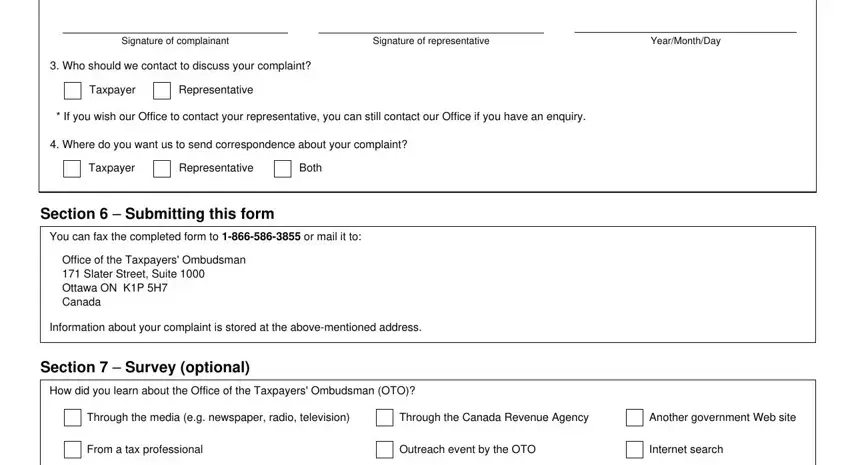

4. Filling in Signature of complainant, Signature of representative, YearMonthDay, Who should we contact to discuss, Taxpayer, Representative, If you wish our Office to contact, Where do you want us to send, Taxpayer, Representative, Both, Section Submitting this form, You can fax the completed form to, Office of the Taxpayers Ombudsman, and Information about your complaint is essential in this step - ensure that you spend some time and take a close look at each and every blank area!

As for Signature of complainant and If you wish our Office to contact, make certain you get them right in this section. These two are the key fields in the file.

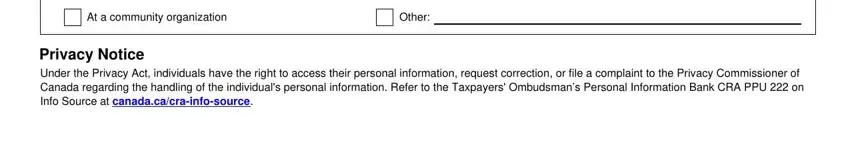

5. To wrap up your document, this last section requires a few extra blank fields. Filling out At a community organization, Other, and Privacy Notice Under the Privacy is going to finalize the process and you'll definitely be done in an instant!

Step 3: Soon after looking through your fields and details, press "Done" and you're all set! Create a free trial account at FormsPal and gain immediate access to oto - download or edit from your personal account. When you use FormsPal, you can complete forms without being concerned about personal data breaches or records being distributed. Our protected software helps to ensure that your personal details are stored safe.