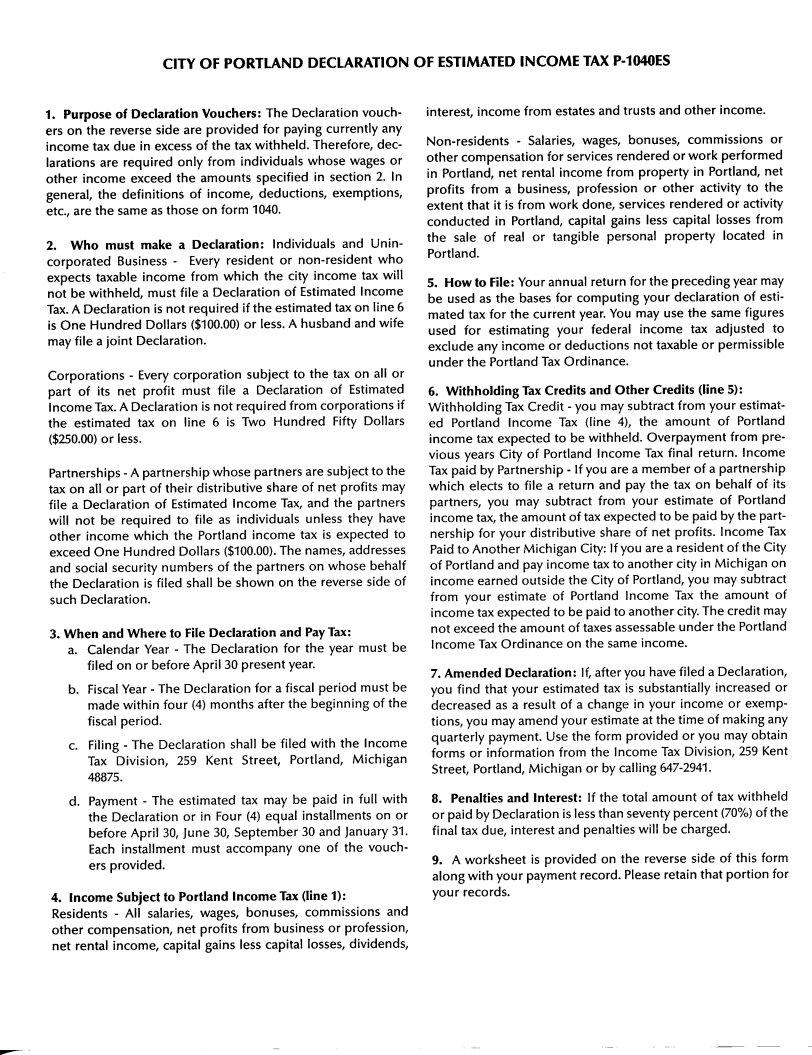

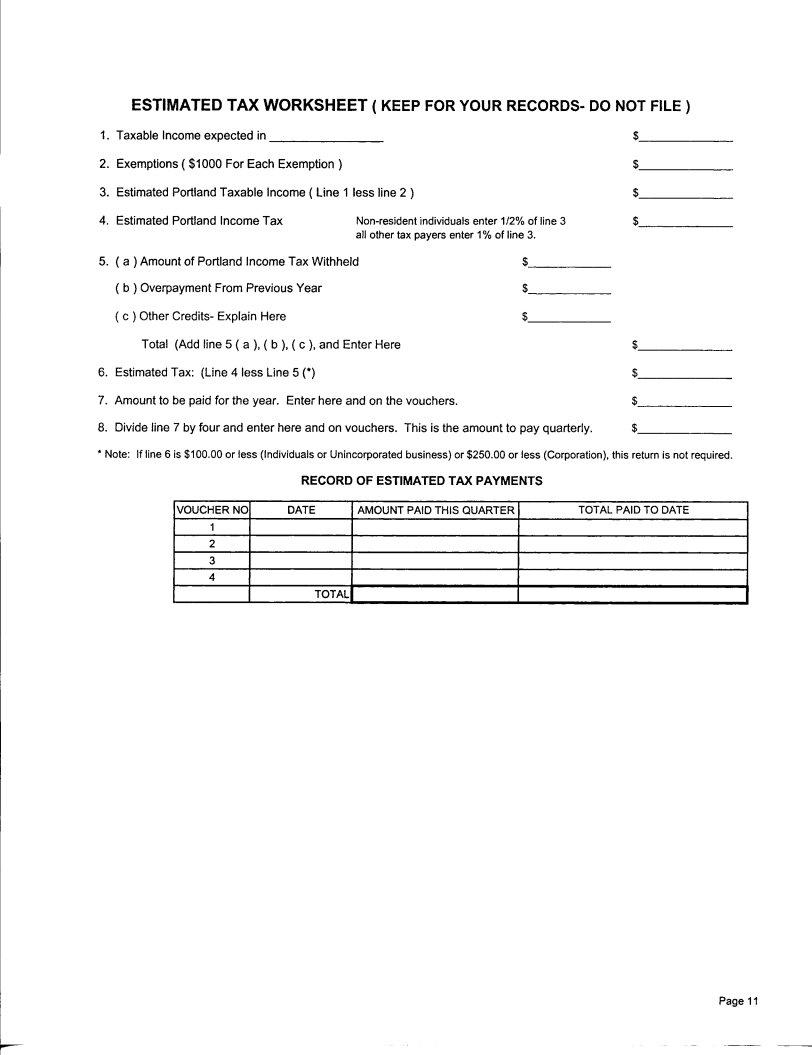

Navigating tax obligations can often feel overwhelming, but understanding the essentials can simplify things. Take, for instance, the P-1040ES form for those living or working in Portland. This form is crucial for residents and employees within the Portland jurisdiction, serving as a declaration and payment voucher for estimated taxes for the calendar year 2008. Its purpose is divided across four critical deadlines—April 30, June 30, September 30, and the final quarter due by January 31 of the following year. Each voucher requires details such as social security numbers for individuals or employer identification numbers for businesses, alongside name, address, and the estimated tax amount due. Payments made with the P-1040ES form should be directed to the Treasurer, City of Portland, ensuring they reach the Income Tax Division's office on Kent Street. This structured approach to estimated tax payments helps both the city and its taxpayers manage finances more predictably, laying a clear path for compliance.

| Question | Answer |

|---|---|

| Form Name | Form P 1040Es |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | 1040_est city of portland mi income tax form |

|

CITY OF PORTLAND |

|

|

|

|

|

||

CITY OF PORTLAND |

|

ESTIMATED TAX |

|

|

VOUCHER 1 |

|||

Income Tax Division |

|

FOR THE YEAR 2008 |

|

(Calendar year- Due April 30) |

||||

|

|

TO BE USED FOR MAKING DECLARATION AND PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

Social Security No. |

|

Employer I.D. NO. |

|

|

||

|

|

|

|

|

|

|

|

|

First Name |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (No. and Street) |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax…… |

$ |

|

||

City, State, and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of this Payment.. |

$ |

|

||

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: "TREASURER, |

|

|

|

|

|

|||

CITY OF PORTLAND" AND MAIL TO: Income Tax Division, 259 Kent Street, PORTLAND, |

|

|

|

|

|

|||

MICHIGAN 48875. |

|

|

|

SIGN HERE |

|

|

||

|

|

(DETACH HERE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY OF PORTLAND |

|

|

|

|

|

||

CITY OF PORTLAND |

|

ESTIMATED TAX |

|

|

VOUCHER 2 |

|||

Income Tax Division |

|

FOR THE YEAR 2008 |

|

(Calendar year- Due June 30) |

||||

|

|

TO BE USED FOR MAKING DECLARATION AND PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Social Security No. |

|

Social Security No. |

|

Employer I.D. NO. |

|

|

||

|

|

|

|

|

|

|

|

|

First Name |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (No. and Street) |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax…… |

$ |

|

||

City, State, and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of this Payment.. |

$ |

|

||

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: "TREASURER, |

|

|

|

|

|

|||

CITY OF PORTLAND" AND MAIL TO: Income Tax Division, 259 Kent Street, PORTLAND, |

|

|

|

|

|

|||

MICHIGAN 48875. |

|

|

|

SIGN HERE |

|

|

||

|

|

(DETACH HERE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY OF PORTLAND |

|

|

|

|

|

||

CITY OF PORTLAND |

|

ESTIMATED TAX |

|

|

VOUCHER 3 |

|||

Income Tax Division |

|

FOR THE YEAR 2008 |

|

(Calendar year- Due September 30) |

||||

|

|

TO BE USED FOR MAKING DECLARATION AND PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Social Security No. |

|

Social Security No. |

|

Employer I.D. NO. |

|

|

||

|

|

|

|

|

|

|

|

|

First Name |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (No. and Street) |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax…… |

$ |

|

||

City, State, and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of this Payment.. |

$ |

|

||

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: "TREASURER, |

|

|

|

|

|

|||

CITY OF PORTLAND" AND MAIL TO: Income Tax Division, 259 Kent Street, PORTLAND, |

|

|

|

|

|

|||

MICHIGAN 48875. |

|

|

|

SIGN HERE |

|

|

||

|

|

(DETACH HERE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY OF PORTLAND |

|

|

|

|

|

||

CITY OF PORTLAND |

|

ESTIMATED TAX |

|

|

VOUCHER 4 |

|||

Income Tax Division |

|

FOR THE YEAR 2008 |

|

(Calendar year- Due January 31) |

||||

|

|

TO BE USED FOR MAKING DECLARATION AND PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

Social Security No. |

|

Employer I.D. NO. |

|

|

||

|

|

|

|

|

|

|

|

|

First Name |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (No. and Street) |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax…… |

$ |

|

||

City, State, and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of this Payment.. |

$ |

|

||

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: "TREASURER, |

|

|

|

|

|

|||

CITY OF PORTLAND" AND MAIL TO: Income Tax Division, 259 Kent Street, PORTLAND, |

|

|

|

|

|

|||

MICHIGAN 48875. |

|

|

|

SIGN HERE |

|

|

||

Page 12