Handling PDF documents online is quite easy with our PDF tool. Anyone can fill in Form Ptax 342 R here effortlessly. Our expert team is always working to expand the editor and enable it to be much better for clients with its many functions. Capitalize on today's innovative possibilities, and find a heap of emerging experiences! It just takes just a few basic steps:

Step 1: First, access the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This editor helps you work with PDF documents in various ways. Enhance it with any text, correct original content, and include a signature - all within a couple of clicks!

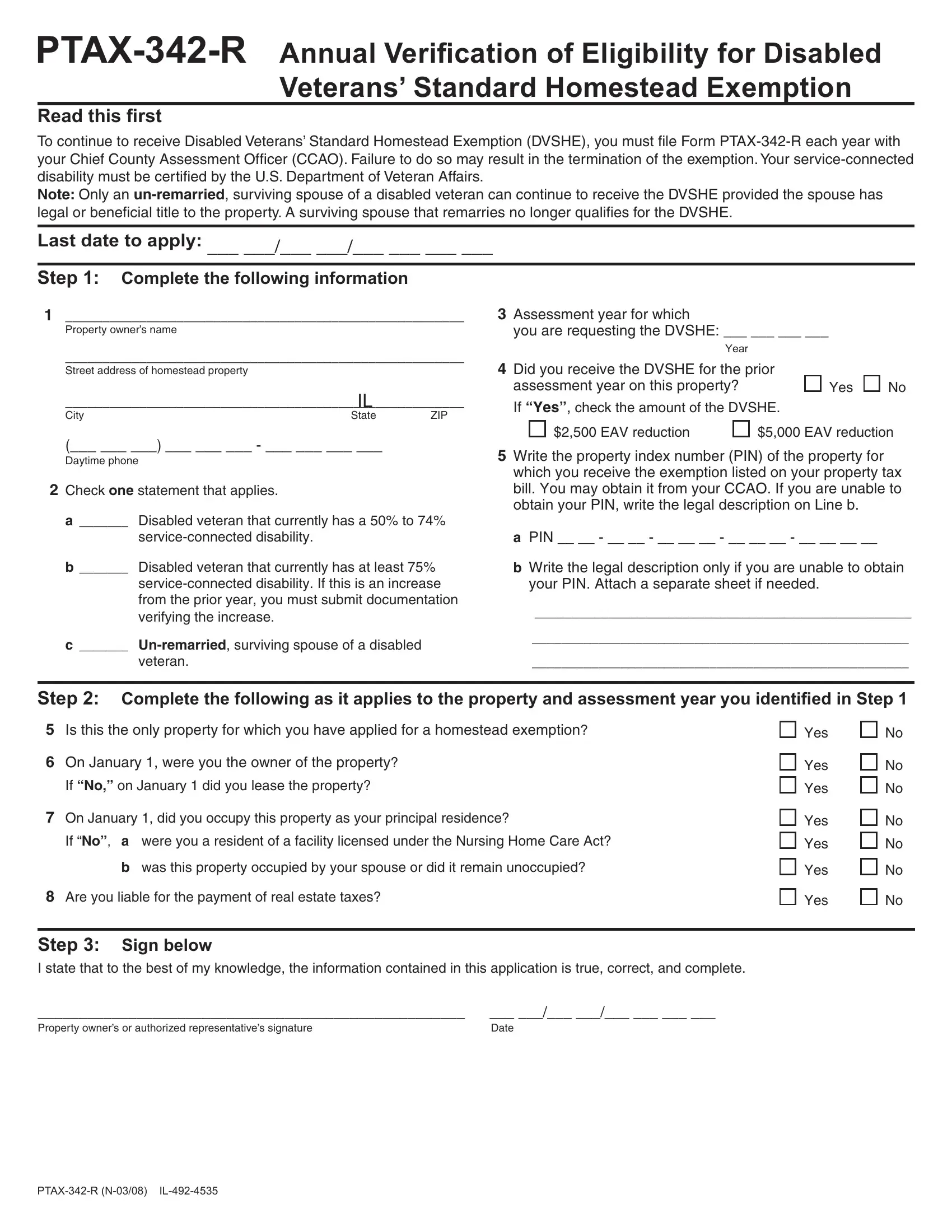

This PDF form needs specific information; in order to ensure accuracy and reliability, please make sure to take into account the following guidelines:

1. Complete your Form Ptax 342 R with a number of major fields. Consider all the important information and make sure not a single thing neglected!

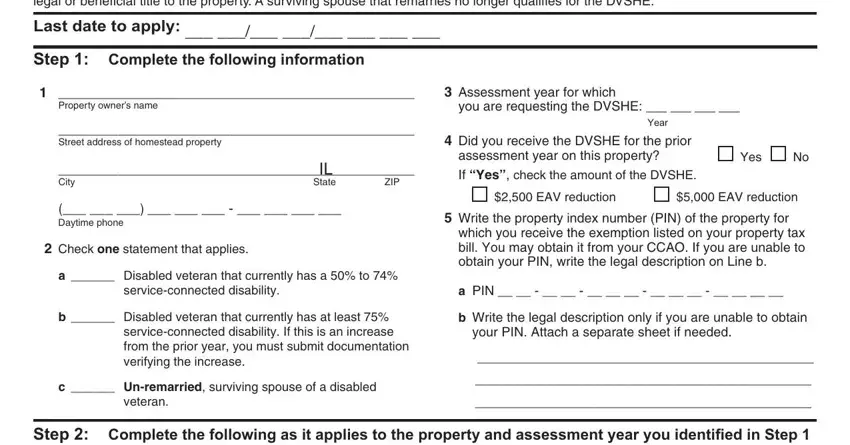

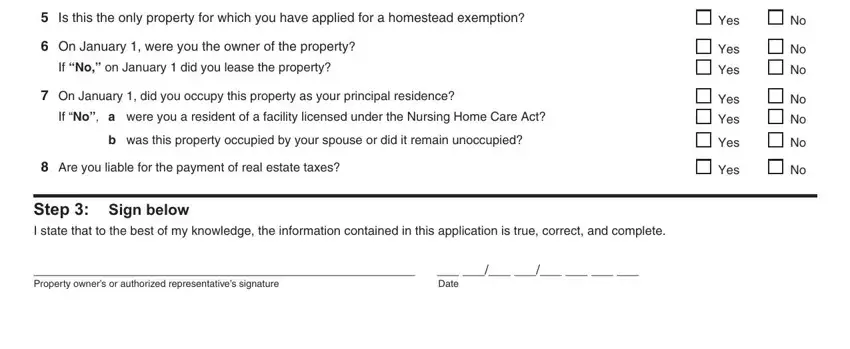

2. Once this array of fields is done, you're ready to insert the required specifics in Step Complete the following as it, Yes, On January were you the owner of, If No on January did you lease, On January did you occupy this, If No a were you a resident of a, b was this property occupied by, Are you liable for the payment of, Step Sign below I state that to, Property owners or, Date, Yes, Yes, Yes, and Yes so you can go to the 3rd part.

Always be really mindful when filling out Date and On January did you occupy this, because this is the part in which many people make a few mistakes.

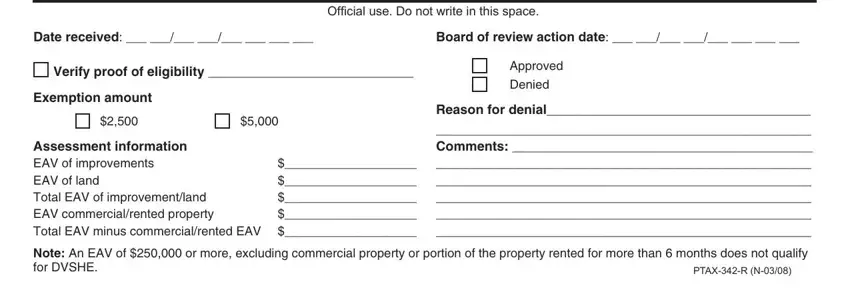

3. Within this stage, review Date received, Board of review action date, Oficial use Do not write in this, Verify proof of eligibility, Exemption amount Assessment, Approved Denied, Note An EAV of or more excluding, and PTAXR N. These should be completed with greatest accuracy.

Step 3: Reread what you have typed into the blank fields and then click the "Done" button. After setting up afree trial account with us, you'll be able to download Form Ptax 342 R or email it directly. The form will also be readily available through your personal account menu with your each modification. Whenever you work with FormsPal, you're able to complete documents without stressing about personal data leaks or records being distributed. Our protected software ensures that your private data is stored safe.