With the help of the online editor for PDFs by FormsPal, it is possible to complete or edit Form R 1029 here and now. To maintain our tool on the leading edge of convenience, we work to integrate user-driven features and enhancements regularly. We are always happy to receive suggestions - join us in revampimg how we work with PDF docs. With just a couple of simple steps, it is possible to start your PDF editing:

Step 1: Click the "Get Form" button in the top part of this page to get into our editor.

Step 2: Using this state-of-the-art PDF file editor, it is easy to accomplish more than simply complete blank fields. Edit away and make your docs seem sublime with custom textual content added, or modify the original input to perfection - all that supported by the capability to add your own pictures and sign the PDF off.

It will be easy to finish the pdf using out detailed guide! Here's what you must do:

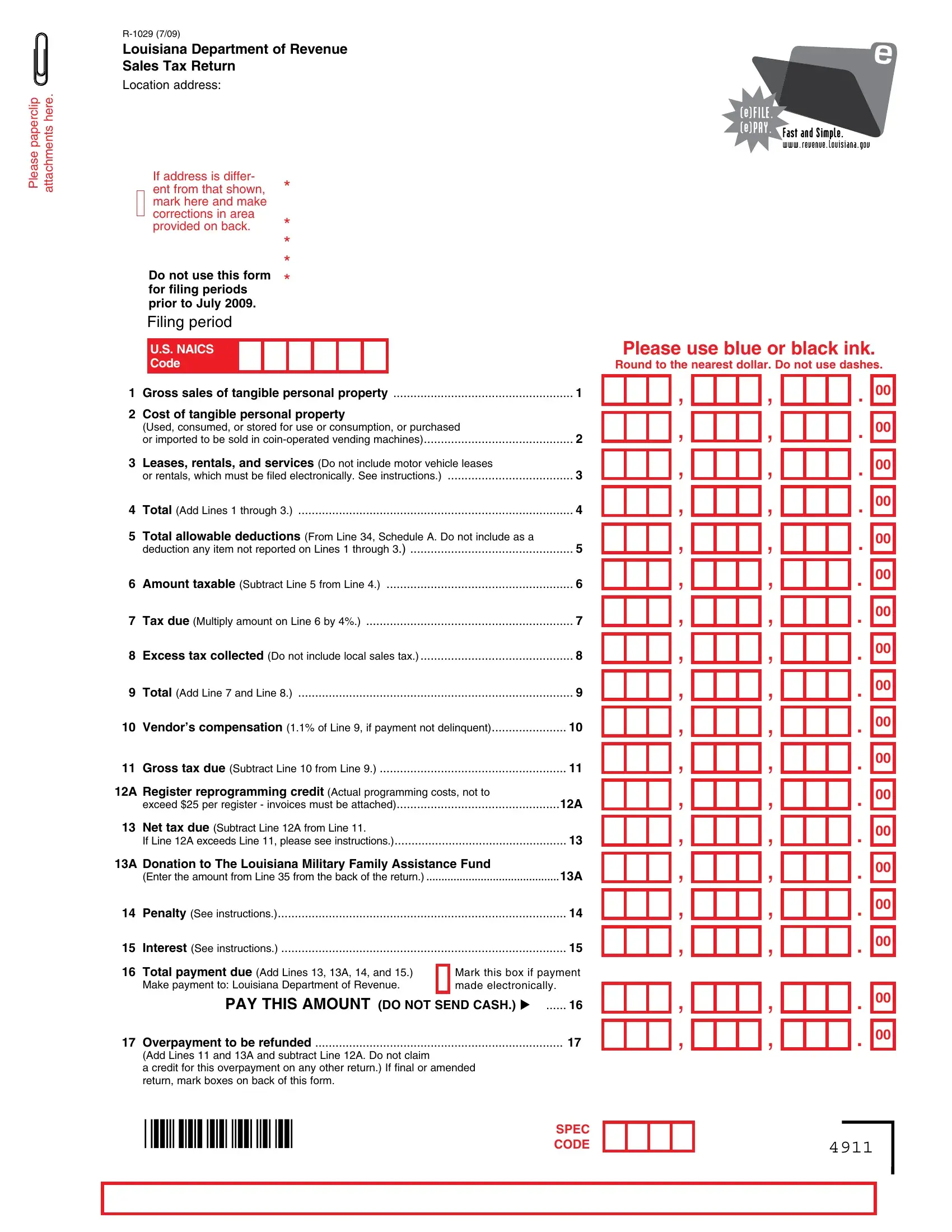

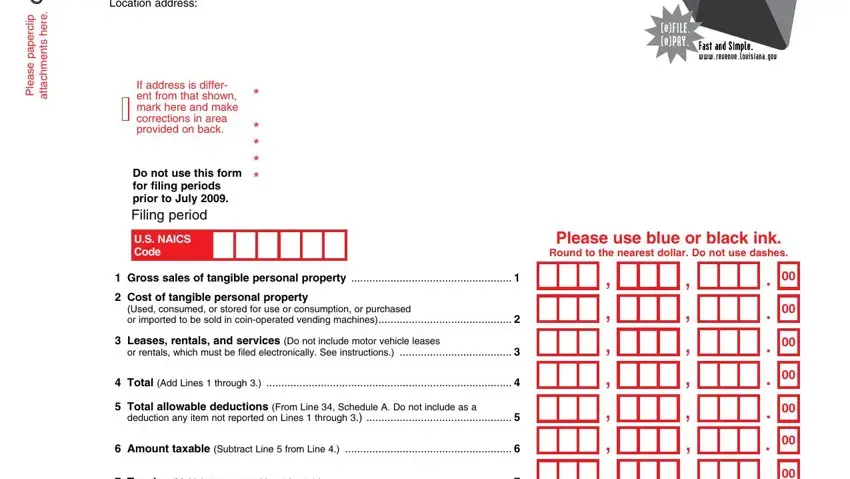

1. You'll want to complete the Form R 1029 correctly, hence pay close attention when filling out the areas that contain these blank fields:

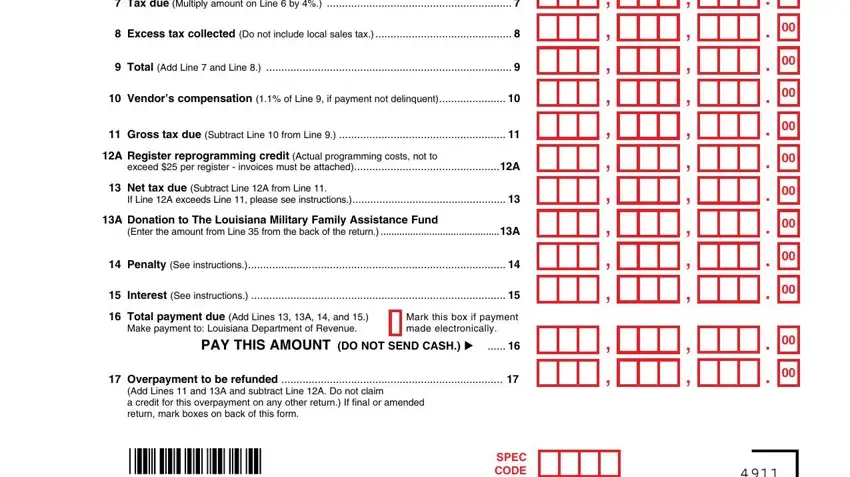

2. After performing the last part, head on to the subsequent part and enter the necessary details in these blanks - Tax due Multiply amount on Line, Excess tax collected Do not, Total Add Line and Line, Vendors compensation of Line if, Gross tax due Subtract Line from, A Register reprogramming credit, exceed per register invoices, Net tax due Subtract Line A from, If Line A exceeds Line please see, A Donation to The Louisiana, Enter the amount from Line from, Penalty See instructions, Interest See instructions, Total payment due Add Lines A, and Make payment to Louisiana.

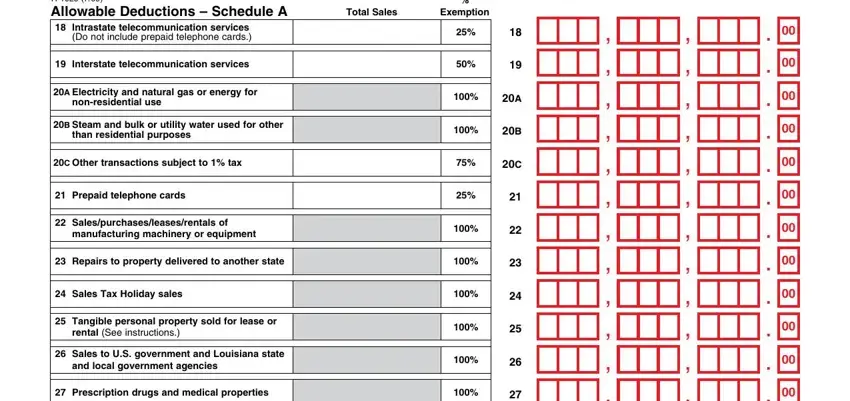

3. In this particular part, have a look at R Allowable Deductions Schedule, Interstate telecommunication, A Electricity and natural gas or, nonresidential use, B Steam and bulk or utility water, than residential purposes, C Other transactions subject to, Prepaid telephone cards, Salespurchasesleasesrentals of, manufacturing machinery or, Repairs to property delivered to, Sales Tax Holiday sales, Tangible personal property sold, rental See instructions, and Sales to US government and. Each one of these need to be completed with highest precision.

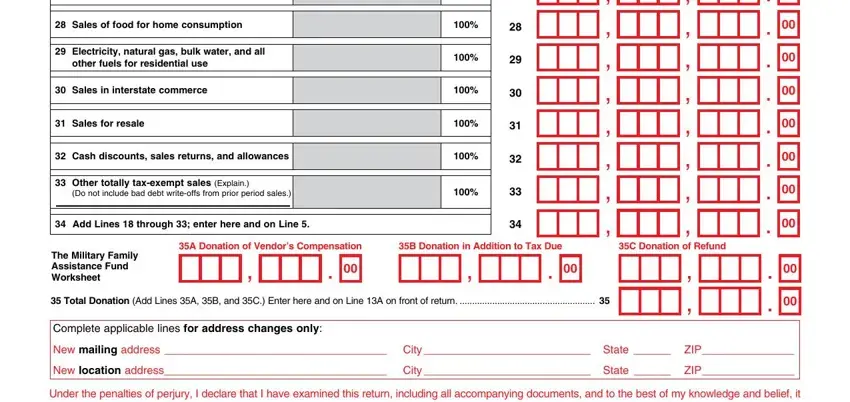

4. The following section comes next with the next few form blanks to enter your details in: Sales of food for home consumption, Electricity natural gas bulk, other fuels for residential use, Sales in interstate commerce, Sales for resale, Cash discounts sales returns and, Other totally taxexempt sales, Do not include bad debt writeoffs, Add Lines through enter here, A Donation of Vendors Compensation, B Donation in Addition to Tax Due, C Donation of Refund, The Military Family Assistance, Total Donation Add Lines A B and, and Complete applicable lines for.

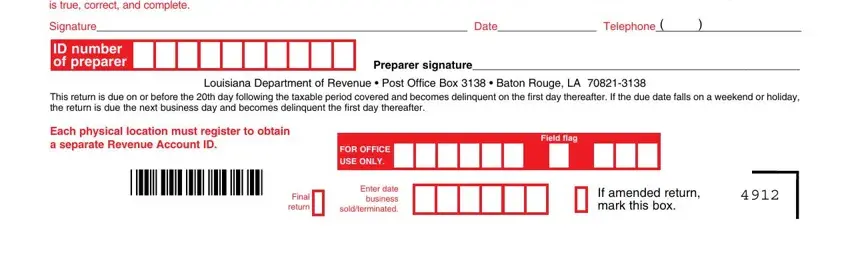

5. Last of all, the following last segment is precisely what you have to wrap up before closing the document. The blanks in question include the next: Under the penalties of perjury I, Signature Date Telephone, ID number of preparer, Preparer signature, This return is due on or before, Louisiana Department of Revenue, Each physical location must, FOR OFFICE USE ONLY, Field lag, Final return, Enter date business soldterminated, and If amended return mark this box.

Regarding Each physical location must and Final return, make certain you double-check them in this current part. These two could be the most significant fields in this form.

Step 3: Before submitting your document, ensure that all blanks have been filled out right. The moment you believe it is all good, press “Done." Join FormsPal right now and instantly access Form R 1029, ready for download. All changes made by you are preserved , enabling you to edit the form later anytime. We do not share or sell the information that you enter while working with forms at FormsPal.