About this Form

The return has been designed for electronic scanning, which permits faster processing with fewer errors. In order to avoid unnecessary delays caused by manual processing, taxpayers should follow the guidelines listed below:

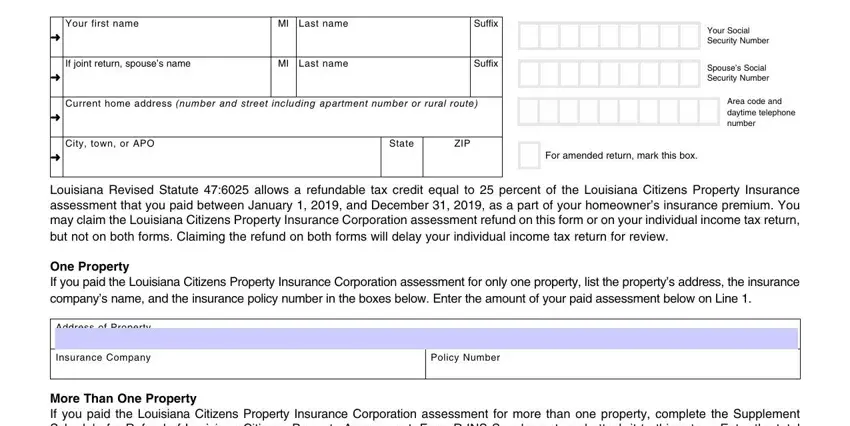

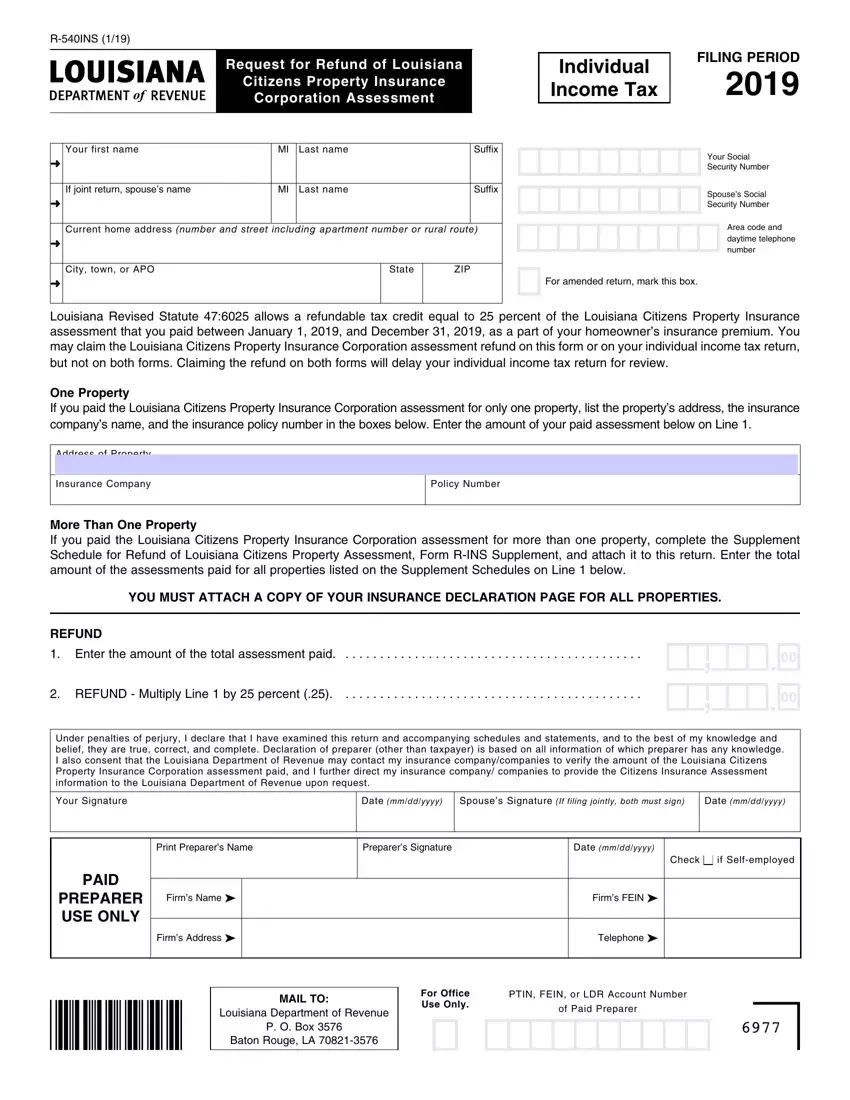

1.An individual may file this form to claim the refund of the Louisiana Citizens Property Insurance Corporation assessment(s) that was paid during calendar year 2019.

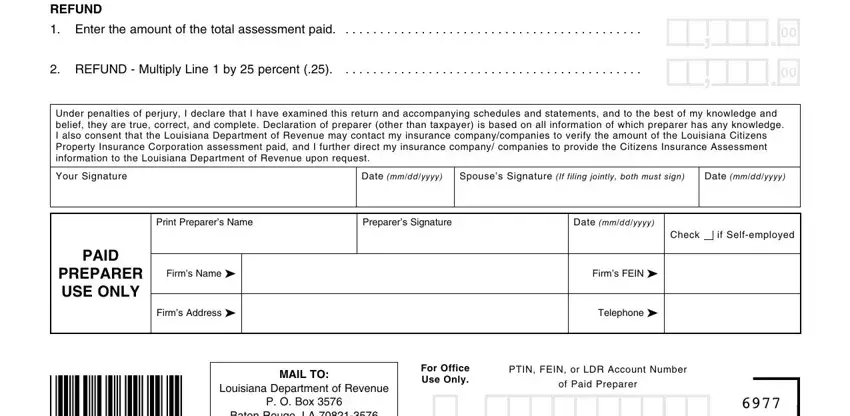

2.Enter the amount only on the line that is applicable.

3.Complete the form by using a pen with black ink.

4. Because this form is read by a machine, please enter your numbers inside the boxes like this: 1 2 3 4 5

5.All numbers should be rounded to the nearest dollar.

6.Numbers should NOT be entered over the pre-printed zeros, in the boxes on the far right, which are used to designate cents (.00).

7. If you are filing an amended return, mark an “X” in the “Amended Return” box.

8.Failure to attach the Insurance Declaration Page(s) will result in this form being returned to you.

Name(s), address, and Social Security Number(s) – Enter your name(s), address, and Social Security Number(s) in the space provided. If married, please enter Social Security Numbers for both you and your spouse.

Information concerning the assessment amounts and Insurance Declaration Page – The amount of this assessment may appear as separate line items on what is referred to as the “Declaration Page” of your property insurance premium notice. The Declaration Page names the policyholder, describes the property or liability to be insured, type of coverage, and policy limits. Depending on the location of the insured property, these line item charges may be listed as: Louisiana Citizens FAIR Plan REGULAR Assessment, Louisiana Citizens FAIR Plan EMERGENCY Assessment, Louisiana Citizens Coastal Plan REGULAR Assessment, and/or Louisiana Citizens Coastal Plan EMERGENCY Assessment. Your total assessment paid is the total of these amounts, if they are shown on the Declaration Page.

Important note: If you are a customer of the Louisiana Citizens Insurance Corporation and you paid the Tax Exempt Surcharge, this surcharge may not be claimed.

•Enter the address of the property, the insurance company’s name, and the policy number in the spaces provided.

•Do you own more than one property that incurred an assessment?

If you had more than one property during 2019 that incurred an assessment, prepare and attach Form R-INS Supplement. For more than four properties, use additional R-INS Supplement forms. You must attach the Declaration Page for each property listed. Add all of the assessments that appear on the R-INS Supplement Form, and enter the total on Line 1.

9.Sign and date the return. Mail the return to the address at the top of this form.

Paid Preparer Instructions

If your return was prepared by a paid preparer, that person must also sign in the appropriate space, complete the information in the “Paid Preparer Use Only” box and enter his or her identification number in the space provided under the box. If the paid preparer has a Preparer Tax Identification Number (PTIN), the PTIN must be entered in the space provided under the box, otherwise enter the Federal Employer Identification Number (FEIN) or LDR account number. If the paid preparer represents a firm, the firm’s FEIN must be entered in the “Paid Preparer Use Only” box. The failure of a paid preparer to sign or provide an identification number will result in the assessment of the unidentified preparer penalty on the preparer. The penalty of $50 is for each occurrence of failing to sign or failing to provide an identification number.