If you wish to fill out form rd 3560 8, you don't need to download any kind of applications - just give a try to our PDF tool. The tool is constantly upgraded by our staff, acquiring awesome functions and becoming more versatile. For anyone who is looking to get going, here's what it takes:

Step 1: Firstly, access the tool by clicking the "Get Form Button" above on this site.

Step 2: As soon as you launch the PDF editor, you will notice the document made ready to be filled in. Apart from filling in different fields, you can also do many other actions with the form, specifically adding any textual content, editing the original textual content, adding images, signing the form, and much more.

Filling out this PDF calls for attention to detail. Make certain all mandatory areas are completed accurately.

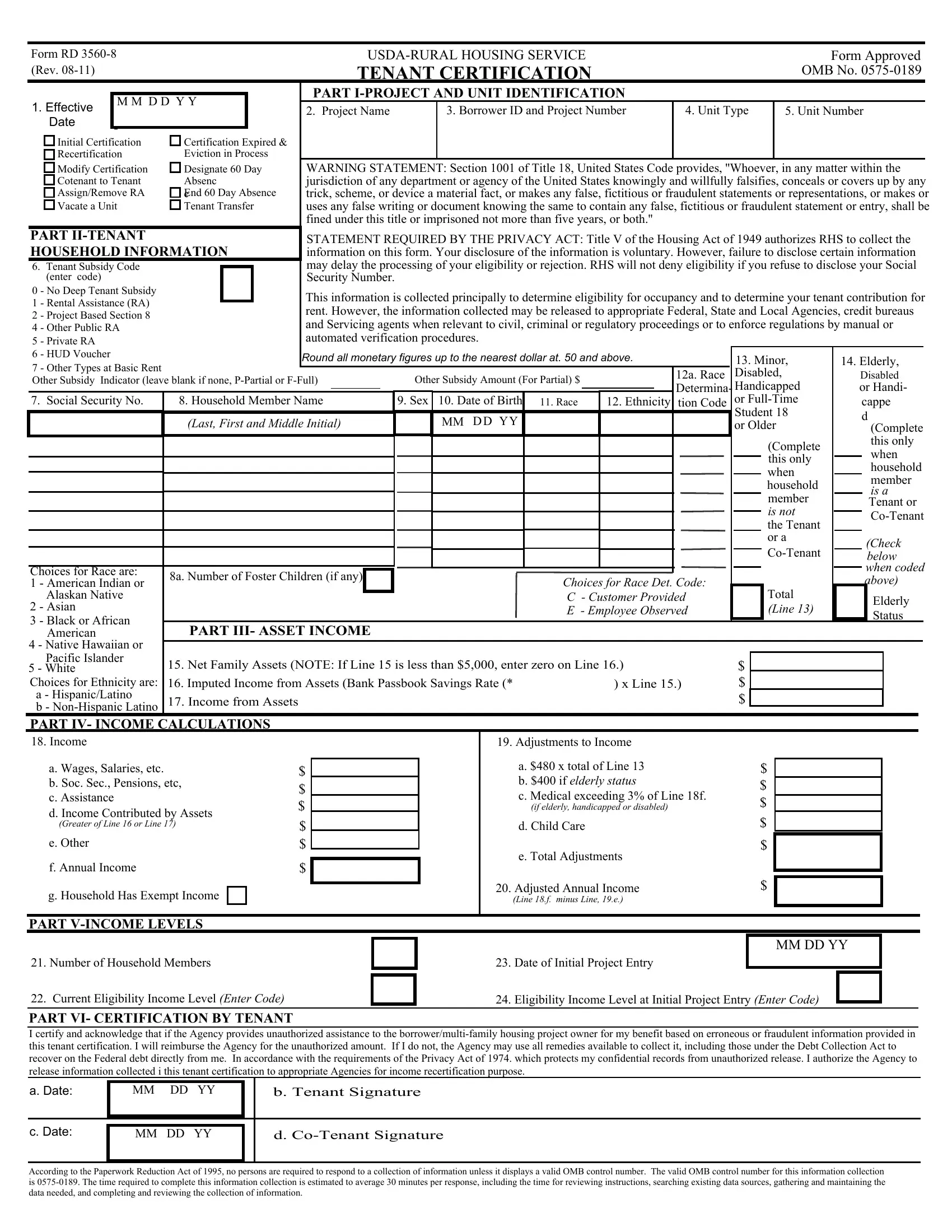

1. Begin completing your form rd 3560 8 with a number of major blank fields. Collect all the important information and be sure not a single thing left out!

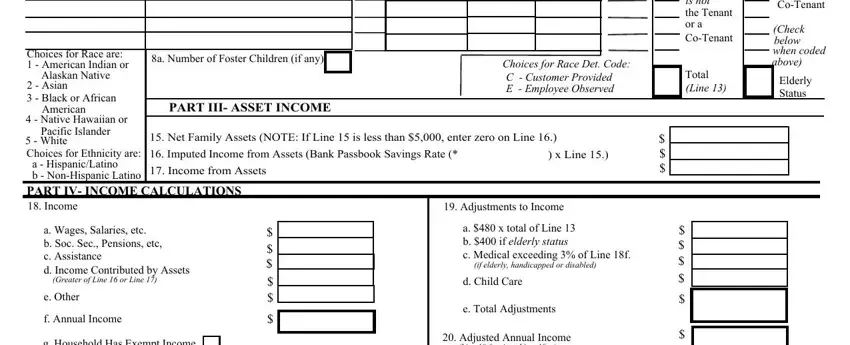

2. Once your current task is complete, take the next step – fill out all of these fields - Complete this only when household, Check below when coded above, Elderly Status, Complete this only when household, Total Line, Choices for Race are American, Alaskan Native, Asian Black or African, American, Native Hawaiian or, a Number of Foster Children if any, PART III ASSET INCOME, Choices for Race Det Code C, Net Family Assets NOTE If Line, and Imputed Income from Assets Bank with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

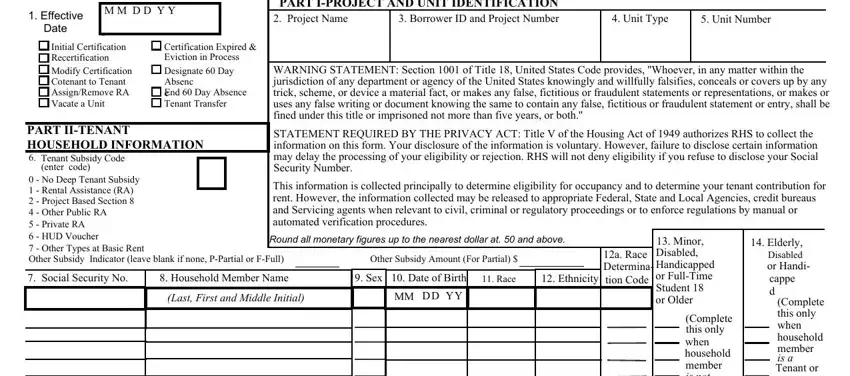

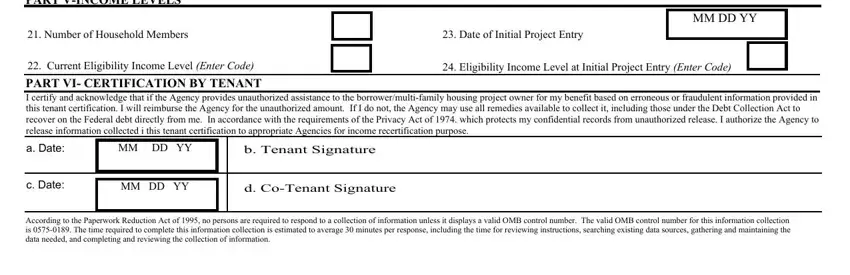

3. Within this stage, take a look at PART VINCOME LEVELS, Number of Household Members, Date of Initial Project Entry, MM DD YY, Current Eligibility Income Level, Eligibility Income Level at, PART VI CERTIFICATION BY TENANT I, a Date, MM DD YY, b Tenant Signature, c Date, MM DD YY, d CoTenant Signature, and According to the Paperwork. All of these will have to be taken care of with utmost awareness of detail.

It's simple to make a mistake when filling in the MM DD YY, therefore you'll want to look again prior to deciding to submit it.

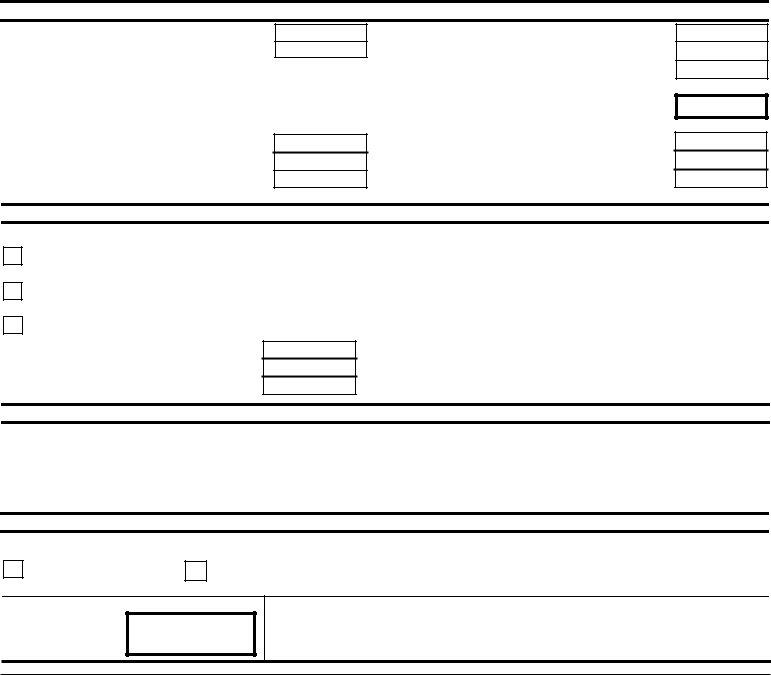

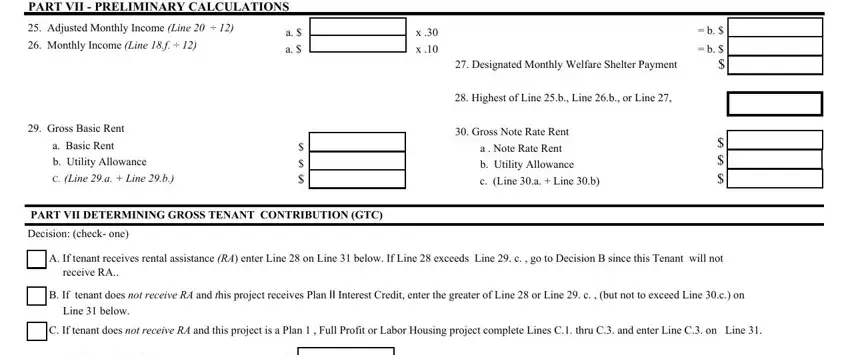

4. The following part needs your involvement in the following parts: PART VII PRELIMINARY CALCULATIONS, Adjusted Monthly Income Line, Monthly Income Line f, Gross Basic Rent, a Basic Rent, b Utility Allowance, C Line a Line b, Designated Monthly Welfare, Highest of Line b Line b or Line, Gross Note Rate Rent, a Note Rate Rent, b Utility Allowance, c Line a Line b, PART VII DETERMINING GROSS TENANT, and Decision check one. Be sure to provide all of the requested information to go further.

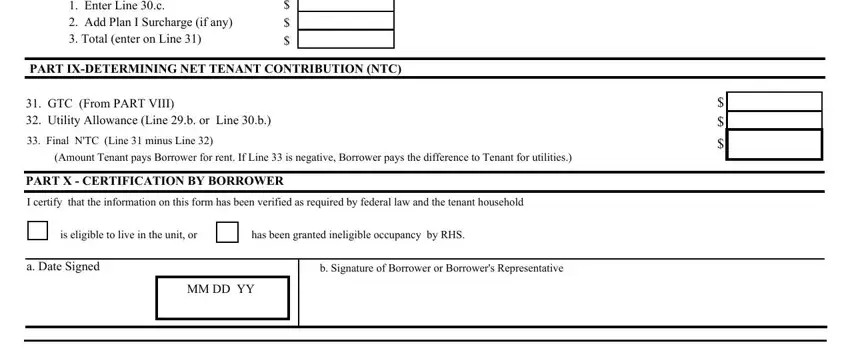

5. To conclude your form, this last part features several extra fields. Typing in Enter Line c Add Plan I, PART IXDETERMINING NET TENANT, GTC From PART VIII Utility, Final NTC Line minus Line, Amount Tenant pays Borrower for, PART X CERTIFICATION BY BORROWER, I certify that the information on, is eligible to live in the unit or, has been granted ineligible, a Date Signed, b Signature of Borrower or, and MM DD YY should conclude everything and you're going to be done very quickly!

Step 3: Soon after taking another look at your fields, click "Done" and you are good to go! After registering a7-day free trial account here, you'll be able to download form rd 3560 8 or email it right off. The PDF form will also be accessible via your personal account menu with all of your adjustments. We do not sell or share the details that you type in while completing forms at our site.