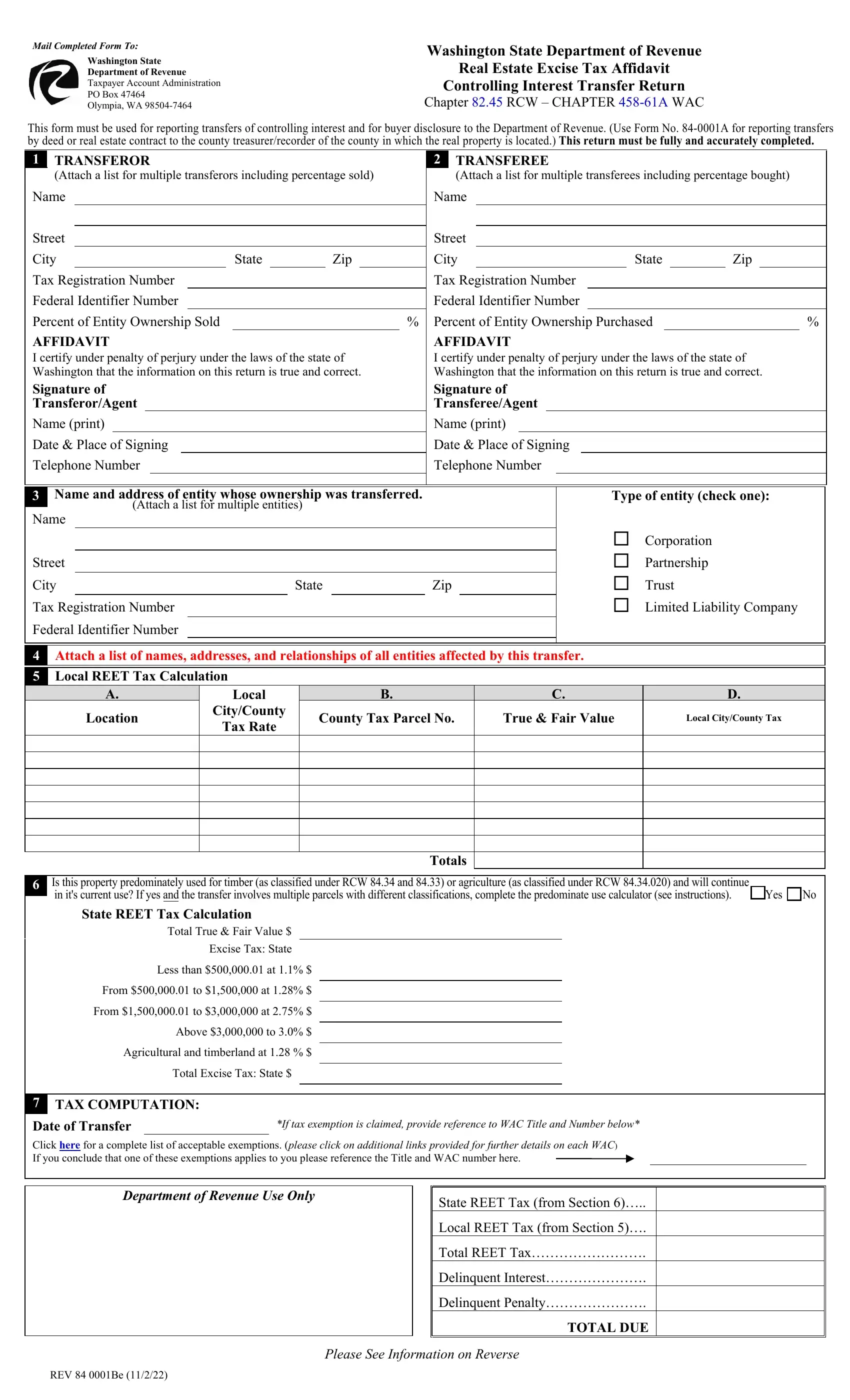

Any time you intend to fill out Form Rev 84 0001B, you won't need to download any sort of software - simply try using our online PDF editor. Our editor is continually evolving to present the best user experience attainable, and that's due to our dedication to continual improvement and listening closely to feedback from users. Should you be looking to start, this is what it will take:

Step 1: Press the orange "Get Form" button above. It is going to open up our editor so you can begin filling in your form.

Step 2: This tool will let you work with PDF documents in a variety of ways. Transform it by adding your own text, adjust what's already in the file, and put in a signature - all when you need it!

It will be straightforward to finish the pdf using out practical tutorial! Here's what you must do:

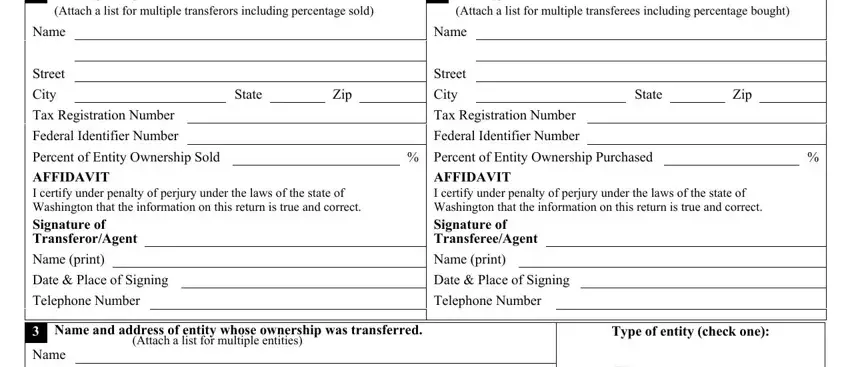

1. When filling out the Form Rev 84 0001B, be certain to incorporate all of the important fields in their relevant part. It will help to expedite the work, making it possible for your information to be handled fast and appropriately.

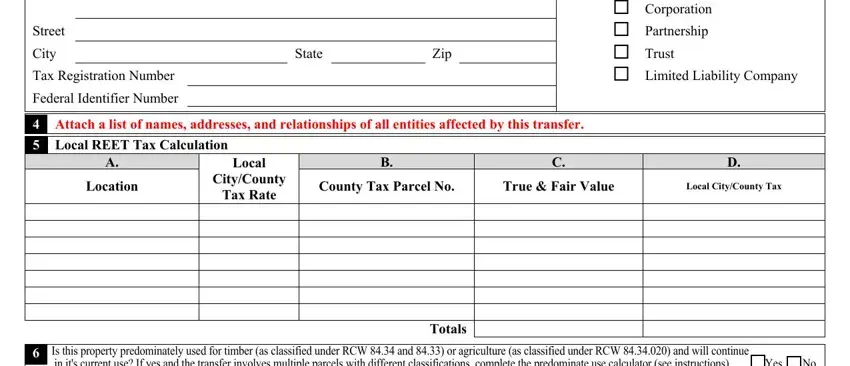

2. Right after finishing the last part, go to the subsequent step and complete the essential particulars in these blanks - Street, City, Tax Registration Number, Federal Identifier Number, State, Zip, Corporation Partnership Trust, Attach a list of names addresses, Local REET Tax Calculation, Location, Local, CityCounty, Tax Rate, County Tax Parcel No, and True Fair Value.

People often get some things wrong while filling out Zip in this part. You need to review what you type in here.

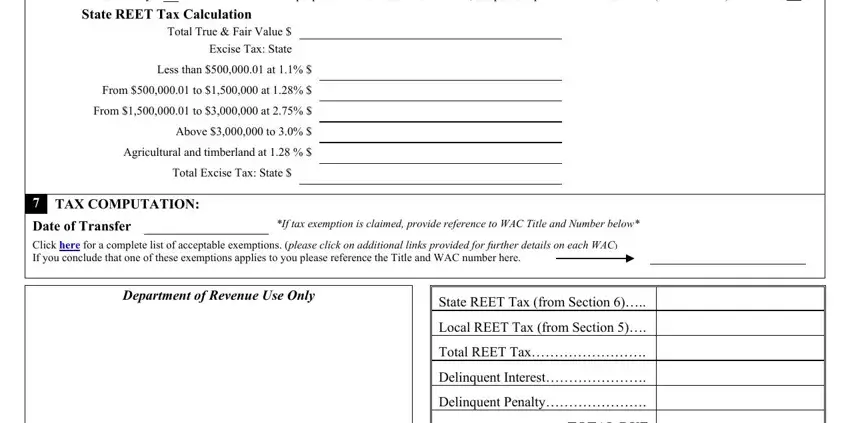

3. The third step will be easy - fill in every one of the blanks in Is this property predominately, Yes No, State REET Tax Calculation, Total True Fair Value, Excise Tax State, Less than at, From to at, From to at, Above to, Agricultural and timberland at, Total Excise Tax State, TAX COMPUTATION, Date of Transfer, If tax exemption is claimed, and Click here for a complete list of to complete this part.

Step 3: Right after you've glanced through the information in the document, just click "Done" to conclude your document creation. Download your Form Rev 84 0001B as soon as you join for a 7-day free trial. Quickly use the document from your personal account, with any edits and changes being conveniently saved! FormsPal guarantees your information confidentiality by using a protected method that in no way records or shares any kind of personal data used. Rest assured knowing your paperwork are kept confidential whenever you use our services!