|

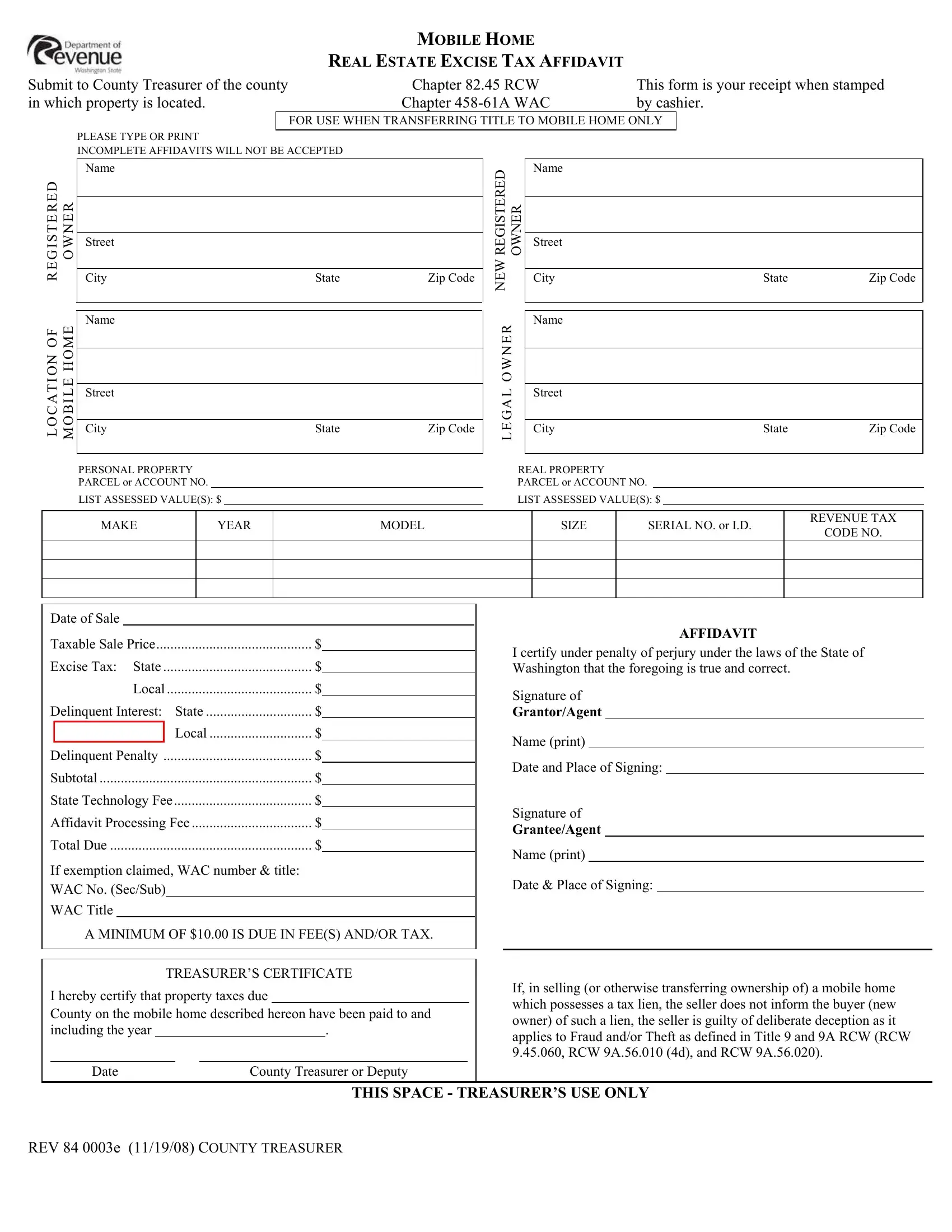

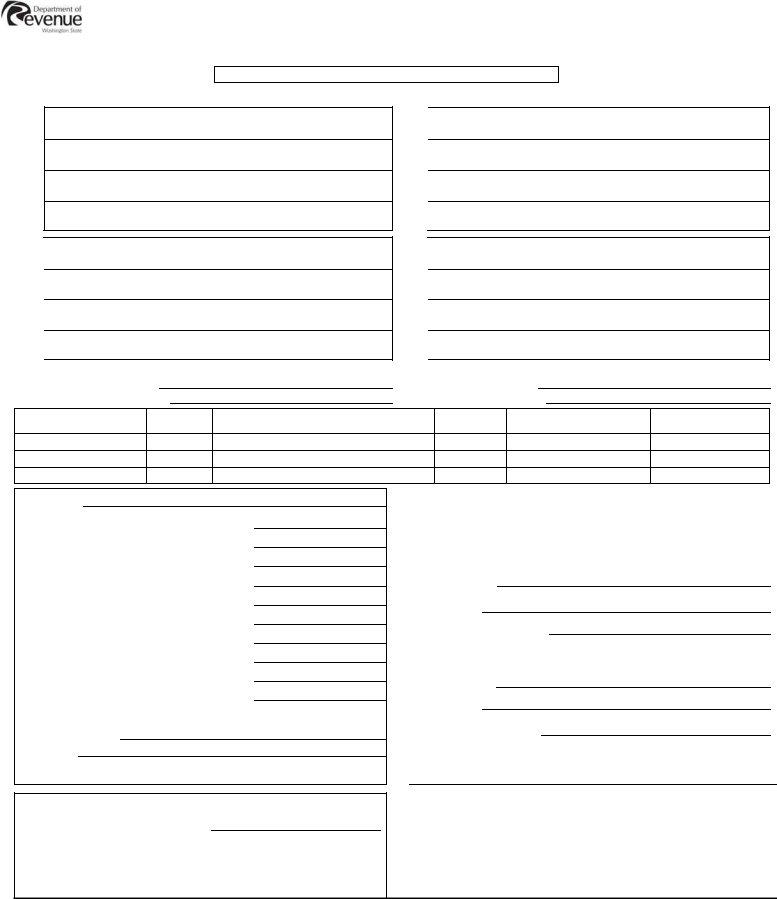

MOBILE HOME |

|

|

REAL ESTATE EXCISE TAX AFFIDAVIT |

|

Submit to County Treasurer of the county |

Chapter 82.45 RCW |

This form is your receipt when stamped |

in which property is located. |

Chapter 458-61A WAC |

by cashier. |

FOR USE WHEN TRANSFERRING TITLE TO MOBILE HOME ONLY

PLEASE TYPE OR PRINT

INCOMPLETE AFFIDAVITS WILL NOT BE ACCEPTED

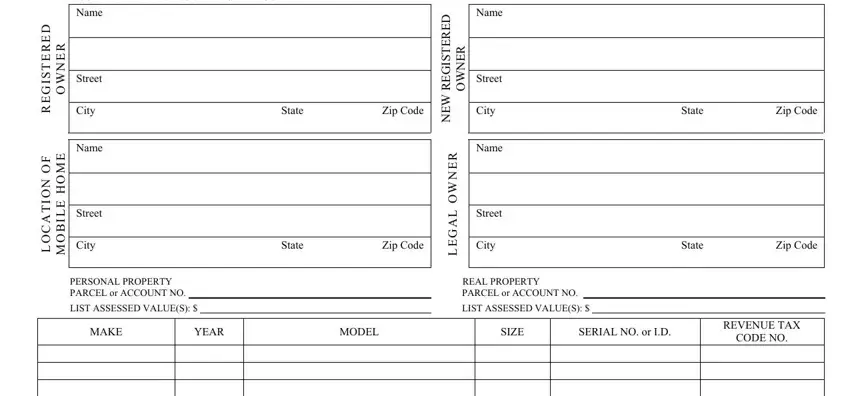

Name

REGISTERED |

OWNER |

|

Street |

|

|

|

|

|

|

City |

LOCATIONOF |

MOBILEHOME |

|

Name |

|

|

Street |

|

|

|

|

|

|

City |

|

|

|

|

PERSONAL PROPERTY

PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

REGISTERED |

|

|

Name |

OWNER |

|

Street |

NEW |

|

|

City |

|

|

|

OWNER |

|

Name |

|

|

|

|

LEGAL |

|

Street |

|

City |

|

|

|

|

|

|

|

REAL PROPERTY PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

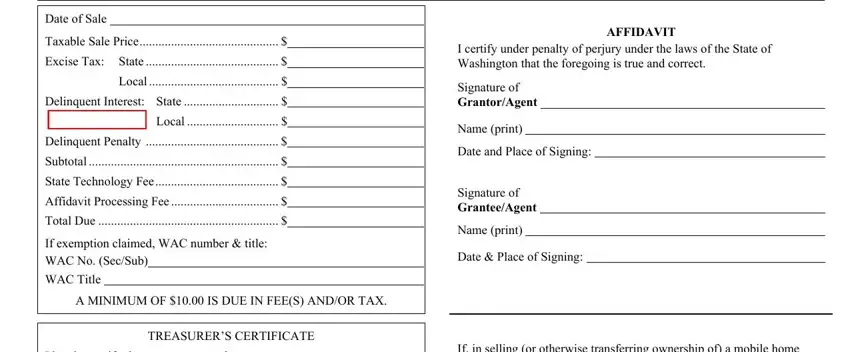

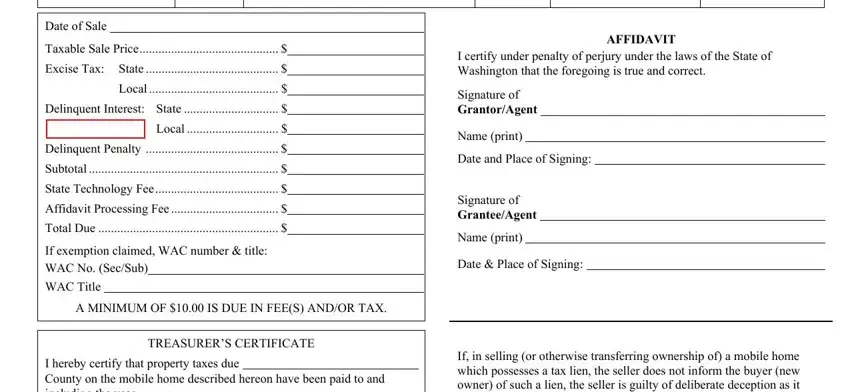

Date of Sale

Taxable Sale Price |

$ |

Excise Tax: State |

$ |

|

Local |

$ |

Delinquent Interest: State |

$ |

|

|

Local |

$ |

|

|

Delinquent Penalty |

$ |

Subtotal |

$ |

State Technology Fee |

$ |

Affidavit Processing Fee |

$ |

Total Due |

$ |

If exemption claimed, WAC number & title:

WAC No. (Sec/Sub)

WAC Title

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX.

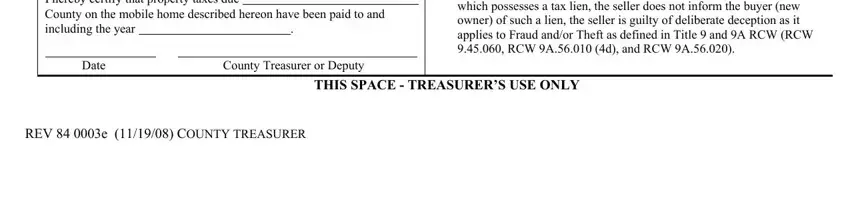

TREASURER’S CERTIFICATE

I hereby certify that property taxes due

County on the mobile home described hereon have been paid to and

|

|

|

|

|

including the year |

|

. |

|

|

|

|

Date |

|

|

County Treasurer or Deputy |

AFFIDAVIT

I certify under penalty of perjury under the laws of the State of Washington that the foregoing is true and correct.

Signature of

Grantor/Agent

Name (print)

Date and Place of Signing:

Signature of

Grantee/Agent

Name (print)

Date & Place of Signing:

If, in selling (or otherwise transferring ownership of) a mobile home which possesses a tax lien, the seller does not inform the buyer (new owner) of such a lien, the seller is guilty of deliberate deception as it applies to Fraud and/or Theft as defined in Title 9 and 9A RCW (RCW 9.45.060, RCW 9A.56.010 (4d), and RCW 9A.56.020).

THIS SPACE - TREASURER’S USE ONLY

REV 84 0003E (11/19/08) COUNTY TREASURER

|

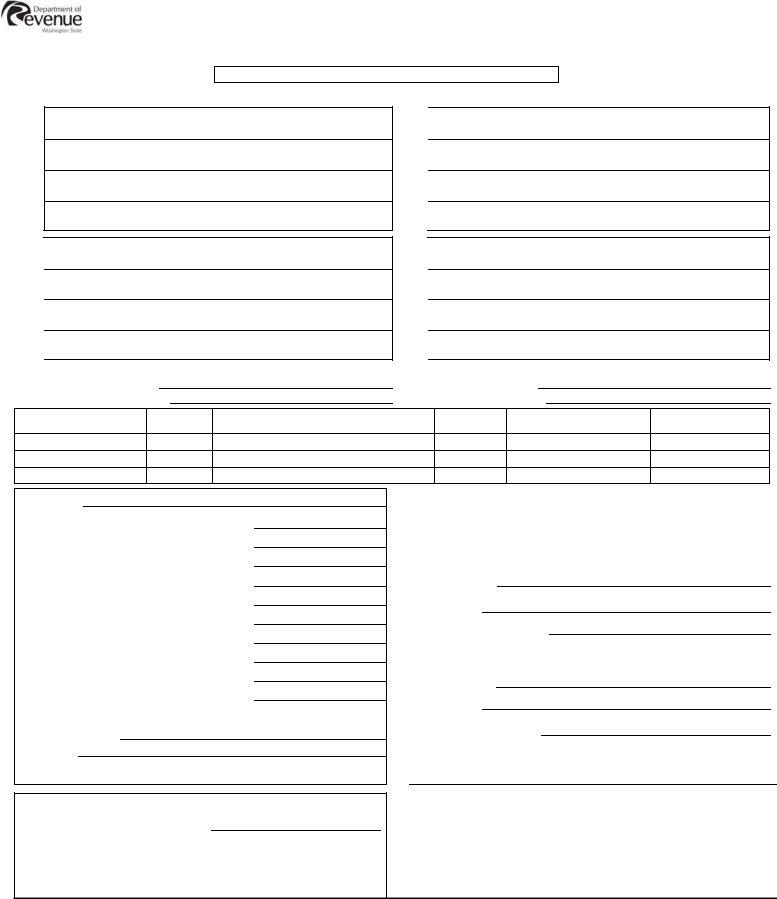

MOBILE HOME |

|

|

REAL ESTATE EXCISE TAX AFFIDAVIT |

|

Submit to County Treasurer of the county |

Chapter 82.45 RCW |

This form is your receipt when stamped |

in which property is located. |

Chapter 458-61A WAC |

by cashier. |

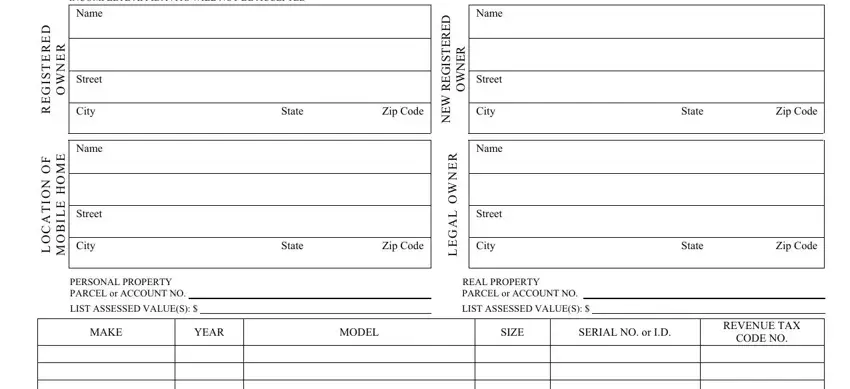

FOR USE WHEN TRANSFERRING TITLE TO MOBILE HOME ONLY

PLEASE TYPE OR PRINT

INCOMPLETE AFFIDAVITS WILL NOT BE ACCEPTED

Name

REGISTERED |

OWNER |

|

Street |

|

|

|

|

|

|

City |

LOCATIONOF |

MOBILEHOME |

|

Name |

|

|

Street |

|

|

|

|

|

|

City |

|

|

|

|

PERSONAL PROPERTY

PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

REGISTERED |

|

|

Name |

OWNER |

|

Street |

NEW |

|

|

City |

|

|

|

OWNER |

|

Name |

|

|

|

|

LEGAL |

|

Street |

|

City |

|

|

|

|

|

|

|

REAL PROPERTY PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

Date of Sale

Taxable Sale Price |

$ |

Excise Tax: State |

$ |

Local |

$ |

Delinquent Interest: State |

$ |

|

Local |

$ |

|

|

|

|

Delinquent Penalty |

$ |

Subtotal |

$ |

State Technology Fee |

$ |

Affidavit Processing Fee |

$ |

Total Due |

$ |

If exemption claimed, WAC number & title:

WAC No. (Sec/Sub)

WAC Title

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX.

TREASURER’S CERTIFICATE

I hereby certify that property taxes due

County on the mobile home described hereon have been paid to and

|

|

|

|

|

including the year |

|

. |

|

|

|

|

Date |

|

|

County Treasurer or Deputy |

AFFIDAVIT

I certify under penalty of perjury under the laws of the State of Washington that the foregoing is true and correct.

Signature of

Grantor/Agent

Name (print)

Date and Place of Signing:

Signature of

Grantee/Agent

Name (print)

Date & Place of Signing:

If, in selling (or otherwise transferring ownership of) a mobile home which possesses a tax lien, the seller does not inform the buyer (new owner) of such a lien, the seller is guilty of deliberate deception as it applies to Fraud and/or Theft as defined in Title 9 and 9A RCW (RCW 9.45.060, RCW 9A.56.010 (4d), and RCW 9A.56.020).

THIS SPACE - TREASURER’S USE ONLY

REV 84 0003E (11/19/08) COUNTY ASSESSOR

|

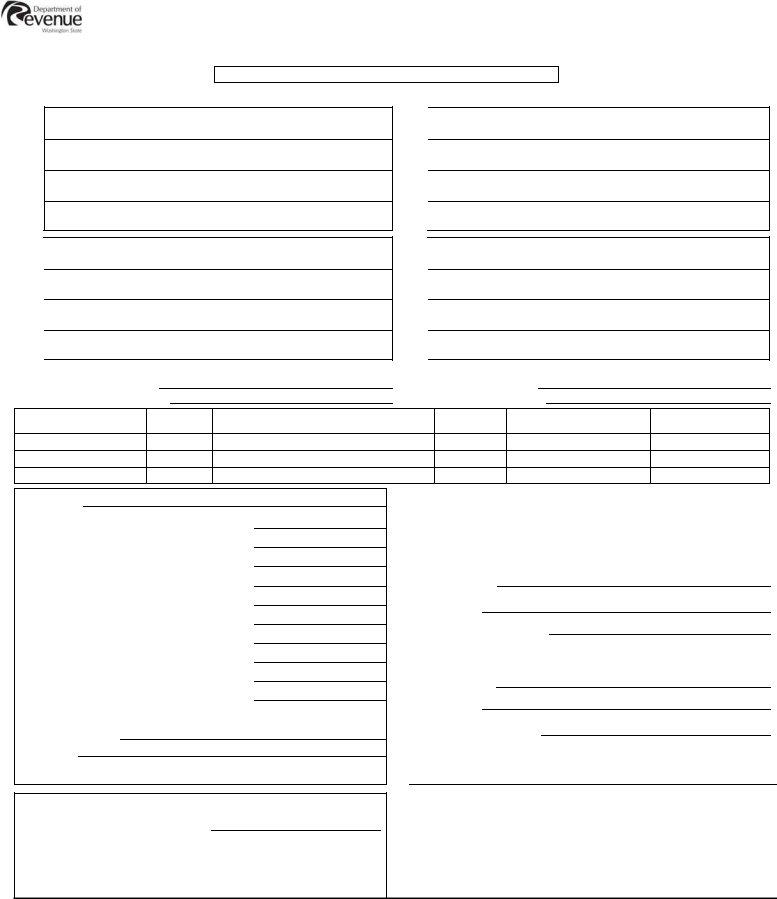

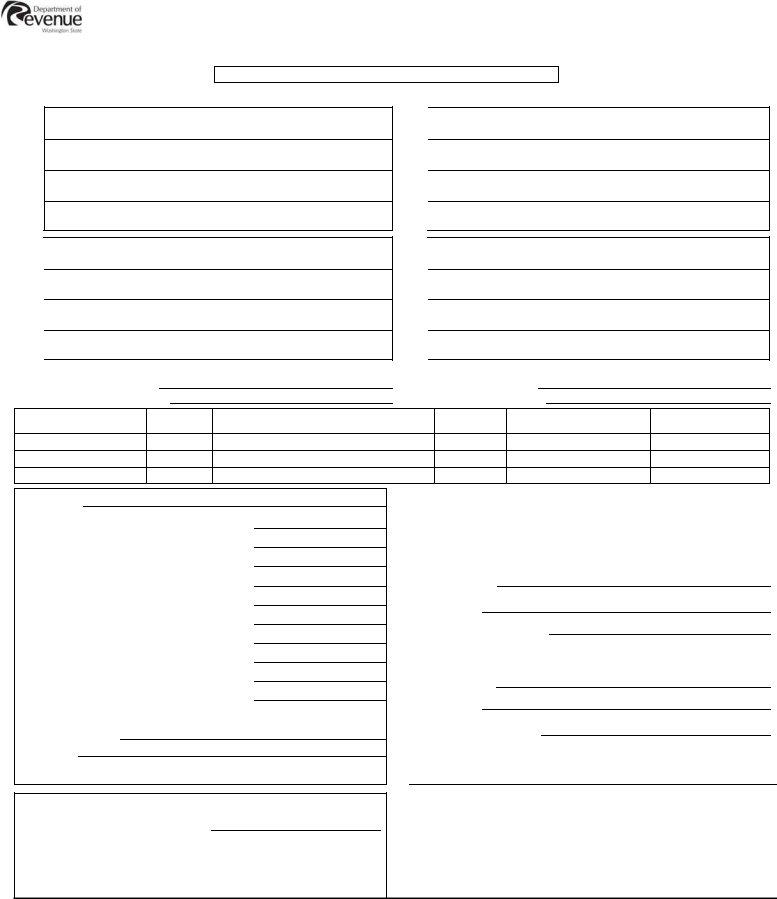

MOBILE HOME |

|

|

REAL ESTATE EXCISE TAX AFFIDAVIT |

|

Submit to County Treasurer of the county |

Chapter 82.45 RCW |

This form is your receipt when stamped |

in which property is located. |

Chapter 458-61A WAC |

by cashier. |

FOR USE WHEN TRANSFERRING TITLE TO MOBILE HOME ONLY

PLEASE TYPE OR PRINT

INCOMPLETE AFFIDAVITS WILL NOT BE ACCEPTED

Name

REGISTERED |

OWNER |

|

Street |

|

|

|

|

|

|

City |

LOCATIONOF |

MOBILEHOME |

|

Name |

|

|

Street |

|

|

|

|

|

|

City |

|

|

|

|

PERSONAL PROPERTY

PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

REGISTERED |

|

|

Name |

OWNER |

|

Street |

NEW |

|

|

City |

|

|

|

OWNER |

|

Name |

|

|

|

|

LEGAL |

|

Street |

|

City |

|

|

|

|

|

|

|

REAL PROPERTY PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

Date of Sale

Taxable Sale Price |

$ |

Excise Tax: State |

$ |

Local |

$ |

Delinquent Interest: State |

$ |

|

Local |

$ |

|

Delinquent Penalty |

$ |

Subtotal |

$ |

State Technology Fee |

$ |

Affidavit Processing Fee |

$ |

Total Due |

$ |

If exemption claimed, WAC number & title:

WAC No. (Sec/Sub)

WAC Title

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX.

TREASURER’S CERTIFICATE

I hereby certify that property taxes due

County on the mobile home described hereon have been paid to and

|

|

|

|

|

including the year |

|

. |

|

|

|

|

Date |

|

|

County Treasurer or Deputy |

AFFIDAVIT

I certify under penalty of perjury under the laws of the State of Washington that the foregoing is true and correct.

Signature of

Grantor/Agent

Name (print)

Date and Place of Signing:

Signature of

Grantee/Agent

Name (print)

Date & Place of Signing:

If, in selling (or otherwise transferring ownership of) a mobile home which possesses a tax lien, the seller does not inform the buyer (new owner) of such a lien, the seller is guilty of deliberate deception as it applies to Fraud and/or Theft as defined in Title 9 and 9A RCW (RCW 9.45.060, RCW 9A.56.010 (4d), and RCW 9A.56.020).

THIS SPACE - TREASURER’S USE ONLY

REV 84 0003E (11/19/08) DEPT. OF REVENUE

|

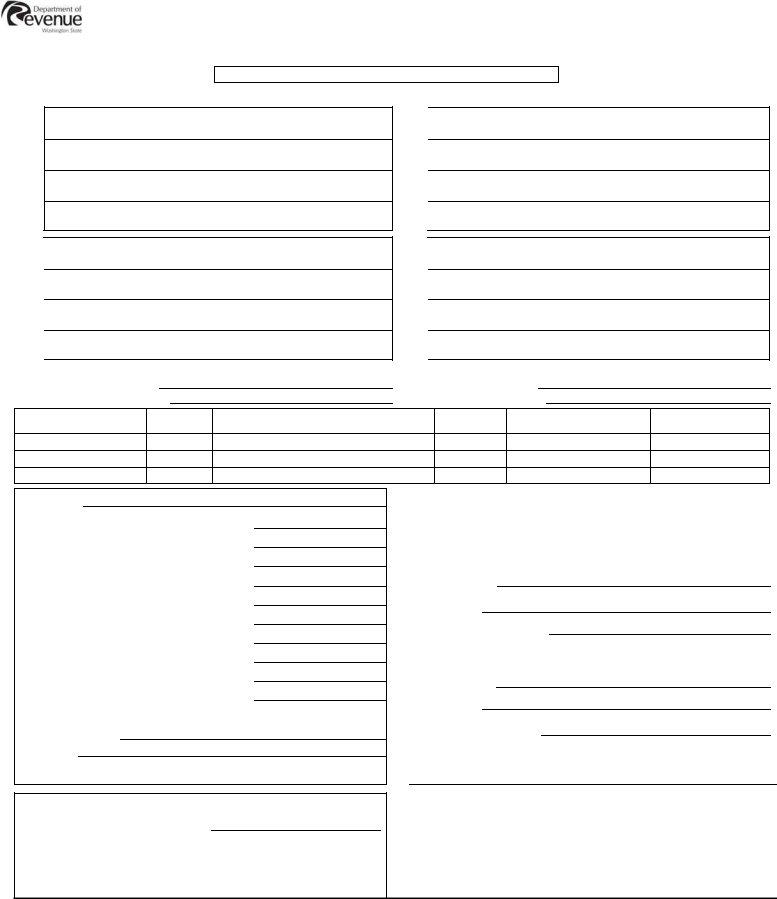

MOBILE HOME |

|

|

REAL ESTATE EXCISE TAX AFFIDAVIT |

|

Submit to County Treasurer of the county |

Chapter 82.45 RCW |

This form is your receipt when stamped |

in which property is located. |

Chapter 458-61A WAC |

by cashier. |

FOR USE WHEN TRANSFERRING TITLE TO MOBILE HOME ONLY

PLEASE TYPE OR PRINT

INCOMPLETE AFFIDAVITS WILL NOT BE ACCEPTED

Name

REGISTERED |

OWNER |

|

Street |

|

|

|

|

|

|

City |

LOCATIONOF |

MOBILEHOME |

|

Name |

|

|

Street |

|

|

|

|

|

|

City |

|

|

|

|

PERSONAL PROPERTY

PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

REGISTERED |

|

|

Name |

OWNER |

|

Street |

NEW |

|

|

City |

|

|

|

OWNER |

|

Name |

|

|

|

|

LEGAL |

|

Street |

|

City |

|

|

|

|

|

|

|

REAL PROPERTY PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

Date of Sale

Taxable Sale Price |

$ |

Excise Tax: State |

$ |

Local |

$ |

Delinquent Interest: State |

$ |

|

Local |

$ |

|

Delinquent Penalty |

$ |

Subtotal |

$ |

State Technology Fee |

$ |

Affidavit Processing Fee |

$ |

Total Due |

$ |

If exemption claimed, WAC number & title:

WAC No. (Sec/Sub)

WAC Title

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX.

TREASURER’S CERTIFICATE

I hereby certify that property taxes due

County on the mobile home described hereon have been paid to and

|

|

|

|

|

including the year |

|

. |

|

|

|

|

Date |

|

|

County Treasurer or Deputy |

AFFIDAVIT

I certify under penalty of perjury under the laws of the State of Washington that the foregoing is true and correct.

Signature of

Grantor/Agent

Name (print)

Date and Place of Signing:

Signature of

Grantee/Agent

Name (print)

Date & Place of Signing:

If, in selling (or otherwise transferring ownership of) a mobile home which possesses a tax lien, the seller does not inform the buyer (new owner) of such a lien, the seller is guilty of deliberate deception as it applies to Fraud and/or Theft as defined in Title 9 and 9A RCW (RCW 9.45.060, RCW 9A.56.010 (4d), and RCW 9A.56.020).

THIS SPACE - TREASURER’S USE ONLY

REV 84 0003E (11/19/08) COUNTY AUDITOR/LICENSING AGENT

|

MOBILE HOME |

|

|

REAL ESTATE EXCISE TAX AFFIDAVIT |

|

Submit to County Treasurer of the county |

Chapter 82.45 RCW |

This form is your receipt when stamped |

in which property is located. |

Chapter 458-61A WAC |

by cashier. |

FOR USE WHEN TRANSFERRING TITLE TO MOBILE HOME ONLY

PLEASE TYPE OR PRINT

INCOMPLETE AFFIDAVITS WILL NOT BE ACCEPTED

Name

REGISTERED |

OWNER |

|

Street |

|

|

|

|

|

|

City |

LOCATIONOF |

MOBILEHOME |

|

Name |

|

|

Street |

|

|

|

|

|

|

City |

|

|

|

|

PERSONAL PROPERTY

PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

REGISTERED |

|

|

Name |

OWNER |

|

Street |

NEW |

|

|

City |

|

|

|

OWNER |

|

Name |

|

|

|

|

LEGAL |

|

Street |

|

City |

|

|

|

|

|

|

|

REAL PROPERTY PARCEL or ACCOUNT NO.

LIST ASSESSED VALUE(S): $

Date of Sale

Taxable Sale Price |

$ |

Excise Tax: State |

$ |

Local |

$ |

Delinquent Interest: State |

$ |

|

Local |

$ |

|

Delinquent Penalty |

$ |

Subtotal |

$ |

State Technology Fee |

$ |

Affidavit Processing Fee |

$ |

Total Due |

$ |

If exemption claimed, WAC number & title:

WAC No. (Sec/Sub)

WAC Title

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX.

TREASURER’S CERTIFICATE

I hereby certify that property taxes due

County on the mobile home described hereon have been paid to and

|

|

|

|

|

including the year |

|

. |

|

|

|

|

Date |

|

|

County Treasurer or Deputy |

AFFIDAVIT

I certify under penalty of perjury under the laws of the State of Washington that the foregoing is true and correct.

Signature of

Grantor/Agent

Name (print)

Date and Place of Signing:

Signature of

Grantee/Agent

Name (print)

Date & Place of Signing:

If, in selling (or otherwise transferring ownership of) a mobile home which possesses a tax lien, the seller does not inform the buyer (new owner) of such a lien, the seller is guilty of deliberate deception as it applies to Fraud and/or Theft as defined in Title 9 and 9A RCW (RCW 9.45.060, RCW 9A.56.010 (4d), and RCW 9A.56.020).

THIS SPACE - TREASURER’S USE ONLY

REV 84 0003E (11/19/08) TAXPAYER

TAX LIABILITY

RCW 82.45.080 subjects the seller of real estate to the payment of the excise tax, and RCW 82.08.050 and 82.12.020 subjects the buyer or user of personal property to the retail sales or use tax. Therefore, if the transfer is subject to the excise tax, it is the liability of the seller and if the transfer is subject to the retail sales or use tax, it is the liability of the purchaser or user.

DEFINITION OF REAL ESTATE

A used mobile home is defined as real estate for purposes of this tax when the following conditions are met:

1.The mobile home was previously taxed by: (a) having been sold at retail and the retail sales tax has been paid (Chapter 82.08 RCW), or (b) having been used, and the use tax has been paid (Chapter 82.12.RCW).

2.The mobile home has substantially lost its identity as a mobile unit by virtue of : (a) being fixed in location upon land owed or leased by the owner of the mobile home, (b) being placed on a foundation (posts & blocks), and (c) having fixed pipe connections with sewer, water, and other utilities.

TRANSFER SUBJECT TO EXCISE TAX

The transfer of a used mobile home will be subject to the real estate excise tax (Chapter 82.45 RCW) on the following transactions:

1.Transfers between individuals, and there is no requirement that the unit be moved.

2.Transfer from individual to dealer (trade-in), and there is no requirement that the unit be moved.

3.Transfer from a dealer to individual, and there is no requirement that the unit is to be moved. Dealer may be allowed credit on the excise tax if unit was taken in trade, was not moved, and resale occurred within nine months.

TRANSFER SUBJECT TO THE RETAIL SALES OR USE TAX

The transfer of a new or used mobile home will be subject to the retail sales tax (Chapter 82.08 RCW) or use tax (Chapter 82.12 RCW) on the following transactions:

1.Transfers between individuals when as part of the enforceable written agreement the unit is required to be moved.

2.Transfers of a mobile home upon which neither the retail sales tax, use tax, nor the real estate excise tax has been paid, whether the unit is to be moved or not.

3.All transfers from a dealer’s sales lot.

CERTIFICATION OF TAXES PAID

The law requires that a copy of the excise tax affidavit and a copy of a treasurer’s certificate, stating that the property taxes have been paid, be used as evidence of payment of the taxes. The Department of Licensing is prohibited from transferring or issuing a certificate of ownership until it has verified that:

1.The excise tax on the sale, if due, has been paid, or the sales or use tax, if due, has been paid, and

2.Any property taxes, whether real or personal, which are due on the mobile home have been paid.

LOCAL REAL ESTATE EXCISE TAX

Cities and/or counties are authorized to adopt by ordinance additional real estate excise tax to be collected and distributed by the county treasurer (Chapter 82.46 RCW).

DUE DATE, INTEREST AND PENALTIES

Tax is due at the time of sale/transfer. If tax is not paid within one month of the date of sale/transfer, interest and penalties will apply. The interest rate is variable and determined per RCW 82.32.050. Delinquent penalties are 5% one month after the due date; 10% two months after the due date; and 20% three months after the due date. (RCW 82.45.100)

•State Technology Fee: A $5.00 Electronic Technology Fee is due on all transactions.

•Affidavit Processing Fee: A minimum of $5.00 shall be collected in the form of tax and processing fee. A processing fee is due on all transactions where no tax is due and on all taxable transactions where the tax due is less than $5.00.

AUDIT

Information you provide on this form is subject to audit by the Department of Revenue. Underpayments of tax will result in the issuance of a tax assessment with interest and penalties. Note: in the event of an audit, it is the taxpayers’ responsibility to provide documentation to support the selling price or any exemption claimed. This documentation must be maintained for a minimum of

four years from date of sale. (RCW 82.45.100)

RULING REQUESTS

You may request a predetermination of your tax liability. The written opinion will be binding on both you and the Department based on the facts presented (WAC 458-20-100(9)). Send your ruling request to:

Department of Revenue

Taxpayer Information & Education

P.O. Box 47478

Olympia, WA 98504-7478

FAX (360) 705-6655

For tax assistance, contact your local County Treasurer/Recorder or visit dor.wa.gov or call (360) 570-3265. To inquire about the availability of this document in an alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users please call 1-800-451-7985.

REV 84 0003E (11/19/08)