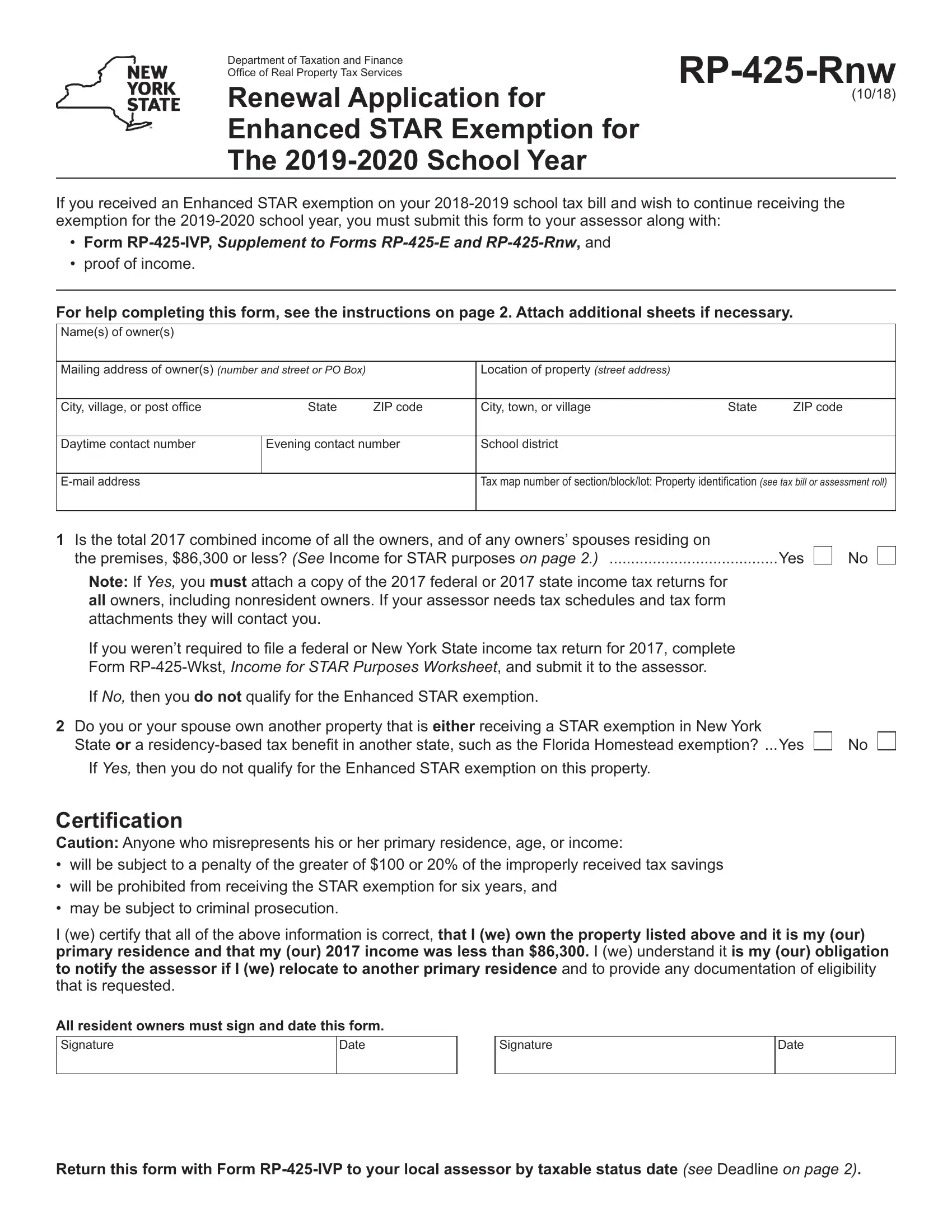

Should you would like to fill out Form Rp 425 Rnw, you don't have to install any kind of software - just try our PDF editor. FormsPal team is focused on making sure you have the perfect experience with our editor by regularly releasing new capabilities and enhancements. Our editor has become much more useful with the most recent updates! At this point, working with PDF forms is simpler and faster than ever before. With a few simple steps, you are able to begin your PDF editing:

Step 1: Open the PDF doc inside our editor by clicking on the "Get Form Button" in the top part of this webpage.

Step 2: When you start the file editor, you'll notice the form all set to be filled out. Besides filling in different blank fields, it's also possible to do several other things with the file, including adding custom words, modifying the original text, adding images, putting your signature on the PDF, and more.

Be mindful when filling in this form. Ensure every single blank field is filled out correctly.

1. The Form Rp 425 Rnw usually requires specific details to be typed in. Be sure the subsequent blank fields are filled out:

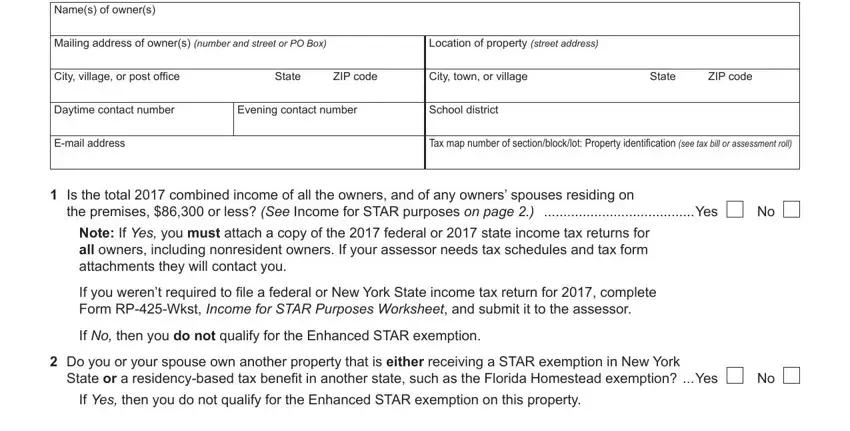

2. Once your current task is complete, take the next step – fill out all of these fields - All resident owners must sign and, Date, Signature, Date, and Return this form with Form RPIVP with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

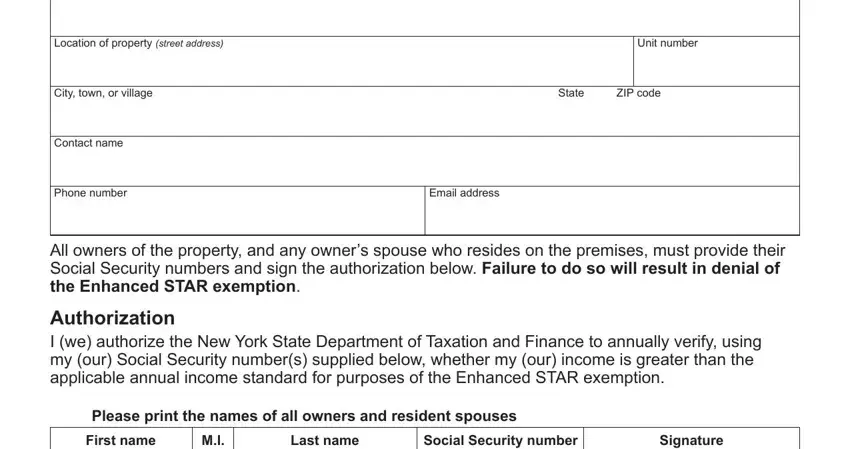

3. Completing Location of property Property, Location of property street address, Unit number, City town or village, Contact name, Phone number, State, ZIP code, Email address, All owners of the property and any, Authorization I we authorize the, Please print the names of all, First name, Last name, and Social Security number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

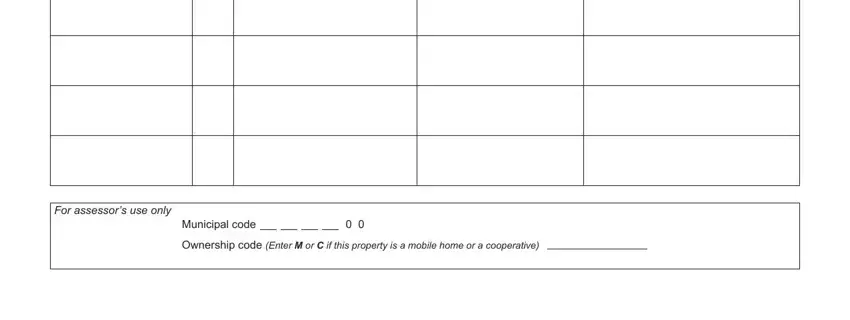

4. This next section requires some additional information. Ensure you complete all the necessary fields - For assessors use only, and Municipal code Ownership code - to proceed further in your process!

People who use this form frequently make some errors when filling out For assessors use only in this part. You should go over what you enter right here.

Step 3: Before finishing this document, you should make sure that blank fields are filled out the proper way. When you believe it is all fine, click on “Done." Try a 7-day free trial option with us and get direct access to Form Rp 425 Rnw - which you are able to then begin to use as you wish inside your personal account. FormsPal is devoted to the personal privacy of our users; we always make sure that all personal information put into our tool is secure.