With the help of the online PDF editor by FormsPal, you may fill out or modify SAGINAW right here and now. To make our editor better and more convenient to utilize, we constantly come up with new features, with our users' suggestions in mind. Getting underway is effortless! All you need to do is follow the next easy steps directly below:

Step 1: Press the orange "Get Form" button above. It is going to open our tool so that you can begin filling out your form.

Step 2: The editor gives you the opportunity to customize your PDF document in various ways. Change it by adding your own text, adjust what is already in the file, and put in a signature - all manageable within a few minutes!

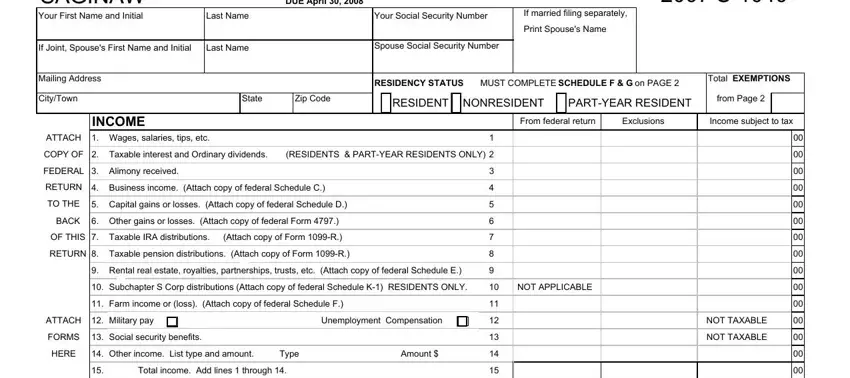

So as to complete this form, be sure to type in the information you need in each and every blank field:

1. You have to complete the SAGINAW properly, therefore be careful while filling in the parts containing all these fields:

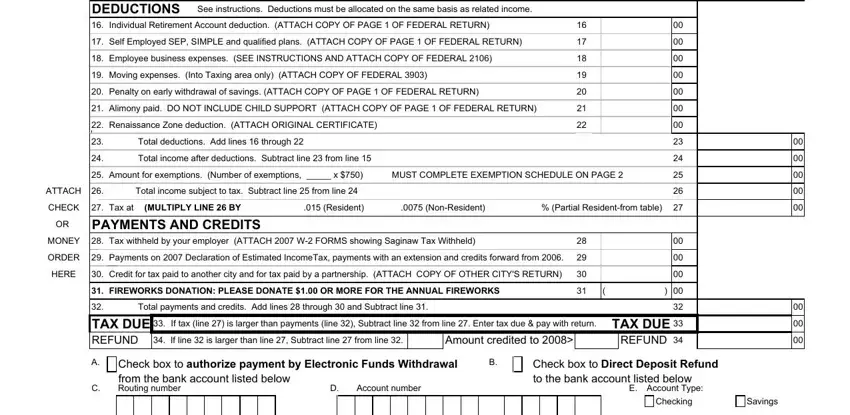

2. Once your current task is complete, take the next step – fill out all of these fields - DEDUCTIONS See instructions, Individual Retirement Account, Self Employed SEP SIMPLE and, Employee business expenses SEE, Moving expenses Into Taxing area, Penalty on early withdrawal of, Alimony paid DO NOT INCLUDE CHILD, Renaissance Zone deduction ATTACH, Total deductions Add lines, Total income after deductions, Amount for exemptions Number of, MUST COMPLETE EXEMPTION SCHEDULE, ATTACH, Total income subject to tax, and CHECK with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

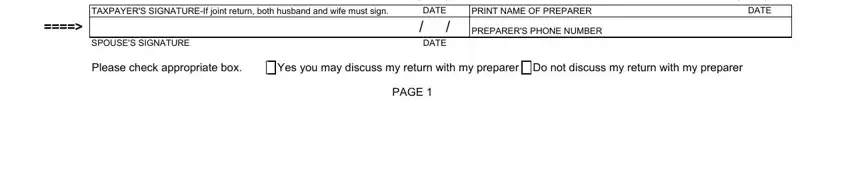

3. In this particular stage, check out TAXPAYERS SIGNATUREIf joint return, SPOUSES SIGNATURE, DATE DATE, PRINT NAME OF PREPARER, PREPARERS PHONE NUMBER, DATE, Please check appropriate box, Yes you may discuss my return with, and PAGE. All of these have to be completed with utmost accuracy.

In terms of TAXPAYERS SIGNATUREIf joint return and PRINT NAME OF PREPARER, make sure that you double-check them in this section. Those two are considered the most important fields in this file.

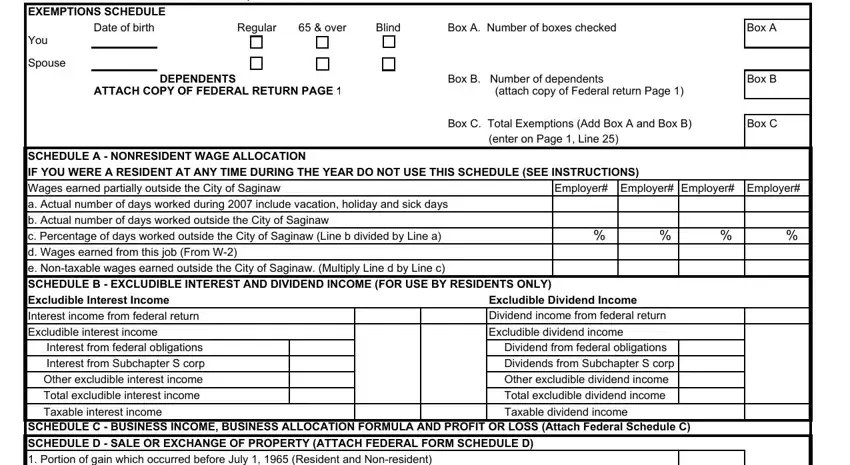

4. The next section will require your information in the following parts: ALL TOTALS FROM PAGE GO ON PAGE, You, Spouse, Date of birth, Regular, over, cid, cid, cid, cid, Blind cid, cid, Box A Number of boxes checked, DEPENDENTS, and Box B Number of dependents. Make sure you give all needed info to go onward.

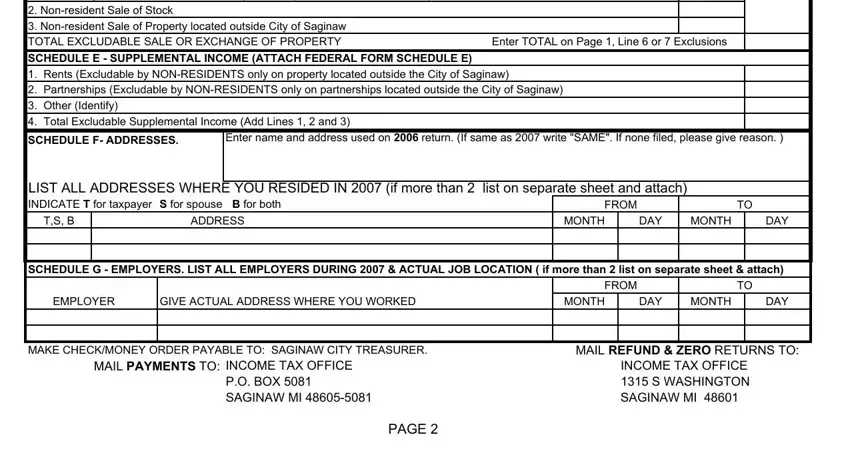

5. To finish your document, the final section features a couple of additional blank fields. Filling out SCHEDULE A NONRESIDENT WAGE, Enter TOTAL on Page Line or, SCHEDULE F ADDRESSES, Enter name and address used on, LIST ALL ADDRESSES WHERE YOU, TS B, ADDRESS, FROM MONTH DAY, TO MONTH DAY, SCHEDULE G EMPLOYERS LIST ALL, EMPLOYER, GIVE ACTUAL ADDRESS WHERE YOU, FROM MONTH DAY, TO MONTH DAY, and MAKE CHECKMONEY ORDER PAYABLE TO is going to conclude the process and you will be done in a short time!

Step 3: Before finalizing the form, check that all blank fields are filled out the correct way. The moment you are satisfied with it, press “Done." After setting up afree trial account here, you will be able to download SAGINAW or email it at once. The form will also be at your disposal via your personal account menu with your every change. FormsPal ensures your data confidentiality with a protected system that in no way saves or distributes any kind of sensitive information used. You can relax knowing your docs are kept safe whenever you work with our services!