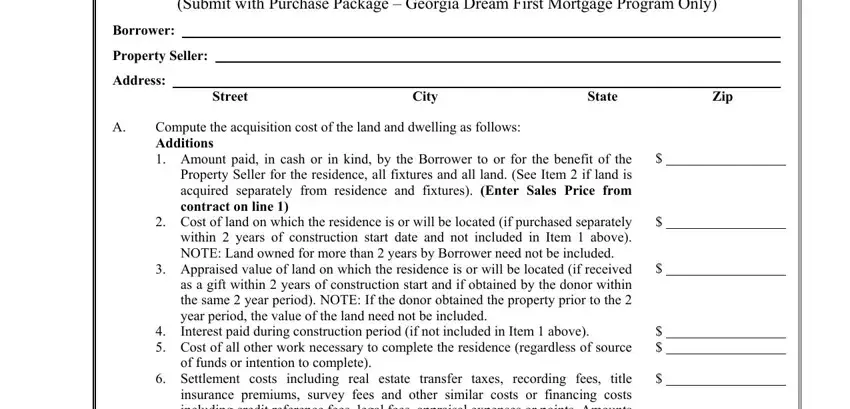

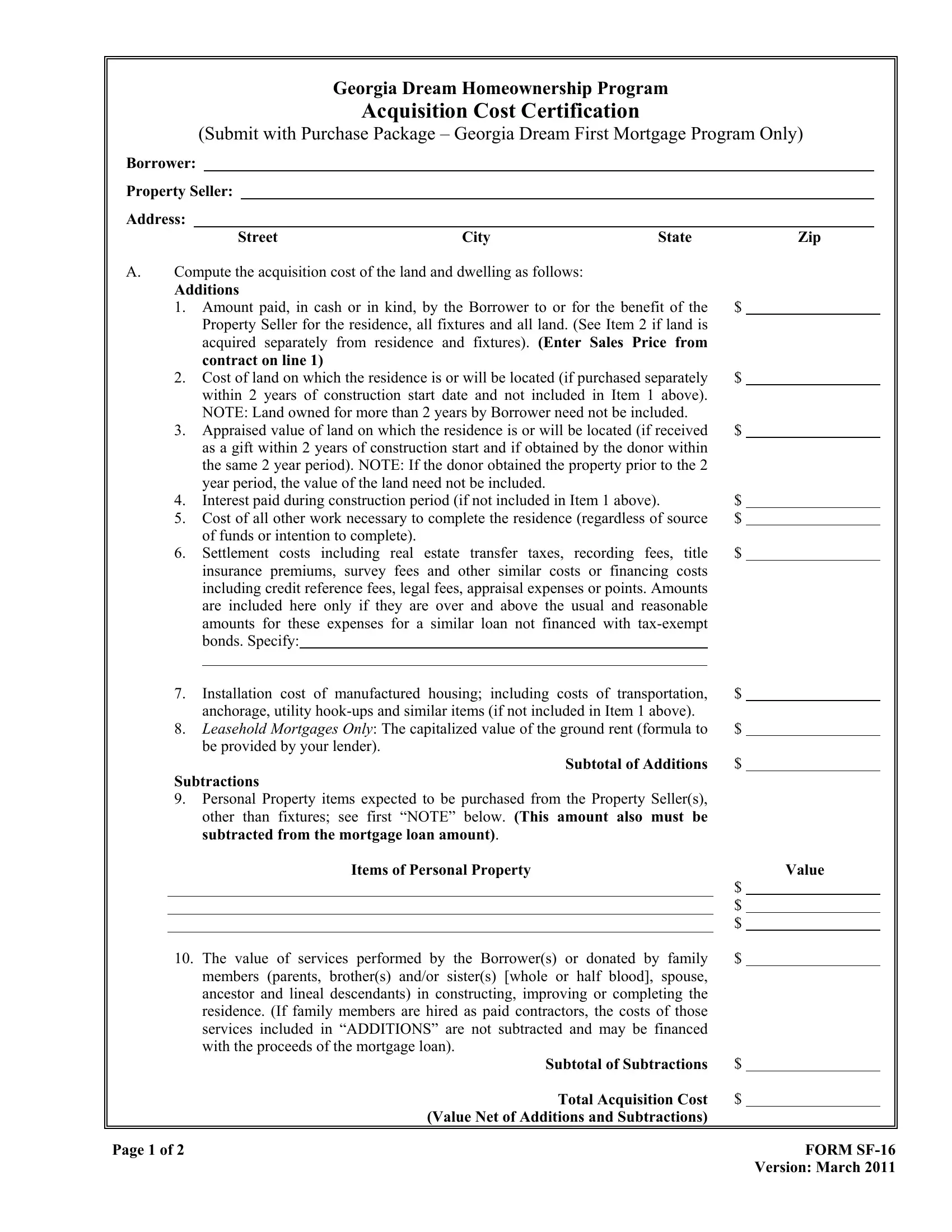

Georgia Dream Homeownership Program

Acquisition Cost Certification

(Submit with Purchase Package – Georgia Dream First Mortgage Program Only)

Borrower:

Property Seller:

Address:

A.Compute the acquisition cost of the land and dwelling as follows:

Additions |

|

1. |

Amount paid, in cash or in kind, by the Borrower to or for the benefit of the |

$ |

|

Property Seller for the residence, all fixtures and all land. (See Item 2 if land is |

|

|

acquired separately from residence and fixtures). (Enter Sales Price from |

|

|

contract on line 1) |

|

2. |

Cost of land on which the residence is or will be located (if purchased separately |

$ |

|

within 2 years of construction start date and not included in Item 1 above). |

|

|

NOTE: Land owned for more than 2 years by Borrower need not be included. |

|

3. |

Appraised value of land on which the residence is or will be located (if received |

$ |

|

as a gift within 2 years of construction start and if obtained by the donor within |

|

|

the same 2 year period). NOTE: If the donor obtained the property prior to the 2 |

|

|

year period, the value of the land need not be included. |

|

4. |

Interest paid during construction period (if not included in Item 1 above). |

$ |

5. |

Cost of all other work necessary to complete the residence (regardless of source |

$ |

|

of funds or intention to complete). |

|

6. |

Settlement costs including real estate transfer taxes, recording fees, title |

$ |

|

insurance premiums, survey fees and other similar costs or financing costs |

|

including credit reference fees, legal fees, appraisal expenses or points. Amounts are included here only if they are over and above the usual and reasonable amounts for these expenses for a similar loan not financed with tax-exempt bonds. Specify:

7. |

Installation cost of manufactured housing; including costs of transportation, |

$ |

|

anchorage, utility hook-ups and similar items (if not included in Item 1 above). |

|

8. |

Leasehold Mortgages Only: The capitalized value of the ground rent (formula to |

$ |

|

be provided by your lender). |

|

|

Subtotal of Additions |

$ |

Subtractions

9.Personal Property items expected to be purchased from the Property Seller(s), other than fixtures; see first “NOTE” below. (This amount also must be subtracted from the mortgage loan amount).

Items of Personal Property

$

$

$

|

10. The value of services performed by the Borrower(s) or donated by family |

$ |

|

|

|

|

members (parents, brother(s) and/or sister(s) [whole or half blood], spouse, |

|

|

|

|

|

ancestor and lineal descendants) in constructing, improving or completing the |

|

|

|

|

|

residence. (If family members are hired as paid contractors, the costs of those |

|

|

|

|

|

services included in “ADDITIONS” are not subtracted and may be financed |

|

|

|

|

|

with the proceeds of the mortgage loan). |

|

|

|

|

|

Subtotal of Subtractions |

$ |

|

|

|

|

Total Acquisition Cost |

$ |

|

|

|

|

(Value Net of Additions and Subtractions) |

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

FORM SF-16 |

|

|

|

Version: March 2011 |

NOTE: A “fixture” is property that is affixed to real estate, which the Borrower(s) intend(s) (i): to keep so affixed during its useful life, and (ii) to be part of the real estate. Refrigerators, free-standing stoves, washer and dryers, unless actually built into the residence, are considered to be personal property and not fixtures.

NOTE: The acquisition cost of a Single Family Dwelling does not include:

(1)Usual and reasonable settlement and financing costs; “Settlement Costs” include titling and transfer costs, title insurance, survey fees and other similar costs; and “Financing Costs” include credit reference fees, legal fees, appraisal expenses, points which are paid by the Borrower, or other costs of financing the residence. Such amounts must not exceed the usual and reasonable costs which otherwise would be paid for in a similar loan,

(2)The imputed value of services performed by the Borrower or members of his family (which include only the Borrower’s parents, brother(s) and/or sister(s) [whether by whole or half blood], spouse, ancestors and lineal descendant(s) in constructing or completing the residence, or

(3)The cost of land which has been owned by the Borrower for at least 2 years before the date on which the construction of the structure comprising the Single Family Residence begins.

B.To the best of our knowledge, all of the land sold with this residence reasonably maintains the basic livability of the residence.

I fully understand the information set forth above is material to the Georgia Department of Community Affairs and declare under penalty of perjury, which is a felony offense in the State of Georgia that the above information is true and correct.

Subject Property Address: ________________________________________________________________

__________________________________________________________________ , Georgia

Borrower’s Signature |

|

Date |

|

|

|

Co-Borrower’s Signature |

|

Date |

|

|

|

Property Seller’s Signature |

|

Date |

|

|

|

Property Seller’s Signature |

|

Date |

I further certify that the real estate on which the home is located does not provide a source of income to the borrower.

______________________________________________________ |

________________________________ |

Borrower’s Signature |

Date |

______________________________________________________ |

________________________________ |

Co Borrower’s Signature |

Date |

Page 2 of 2 |

FORM SF-16 |

|

Version: March 2011 |