This PDF editor makes it simple to prepare the bizfile sos ca gov form si 550 form. It will be easy to prepare the form immediately through these basic steps.

Step 1: Hit the orange "Get Form Now" button on the following web page.

Step 2: Now you are on the form editing page. You can edit, add information, highlight particular words or phrases, put crosses or checks, and include images.

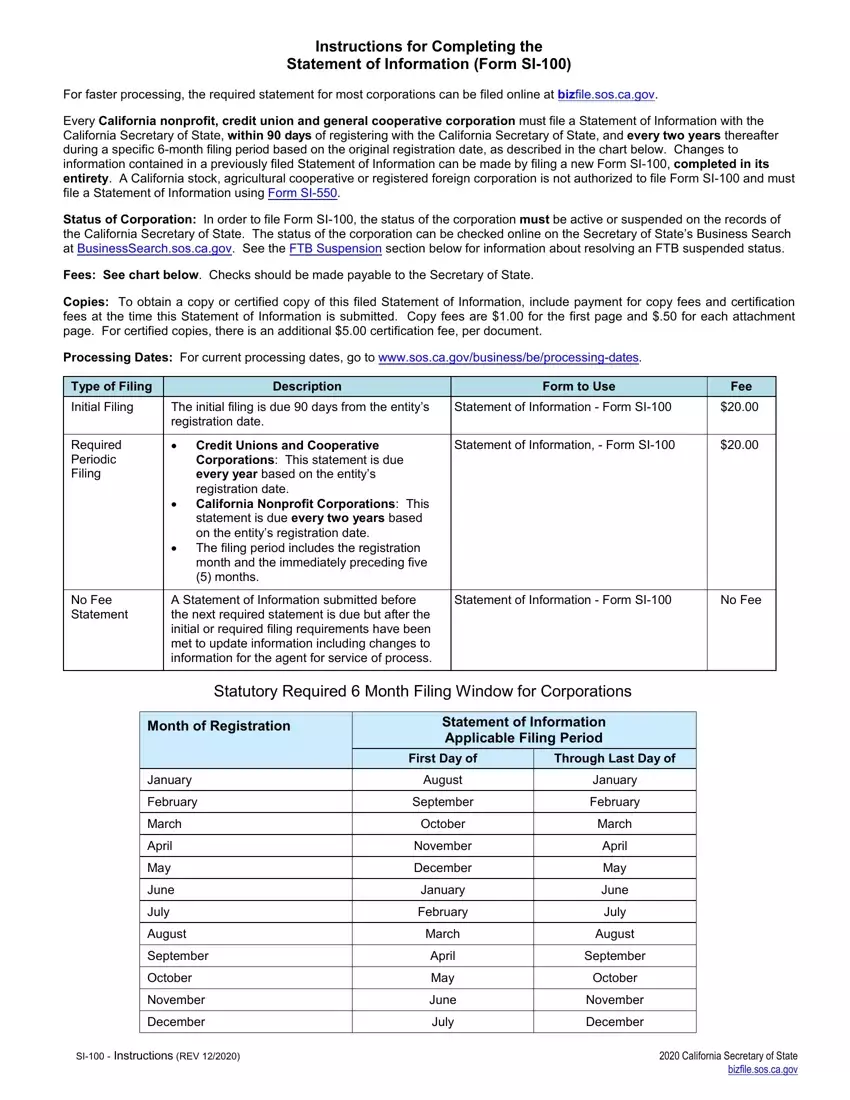

You should provide the following information to create the bizfile sos ca gov form si 550 PDF:

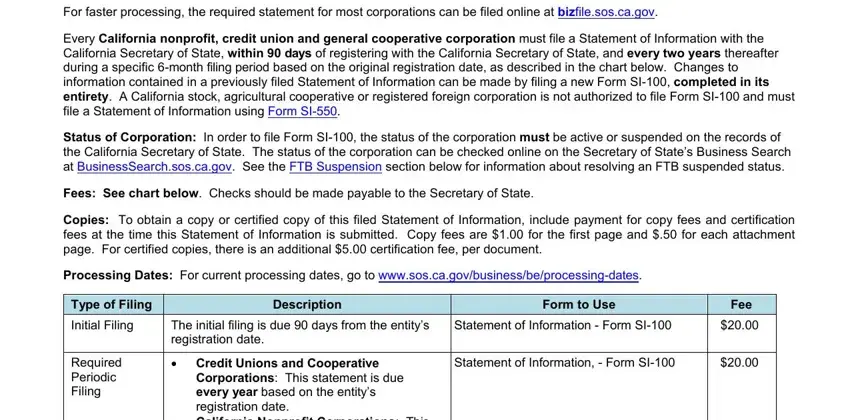

Fill out the SI Instructions REV, and California Secretary of State areas with any particulars that are asked by the system.

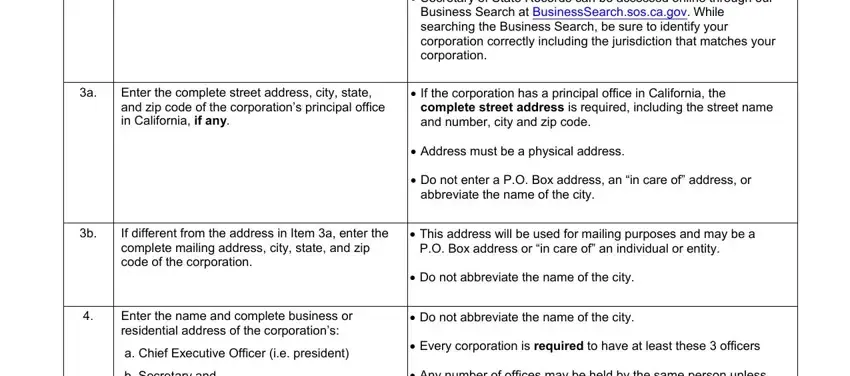

The application will request you to write certain vital particulars to easily fill in the area Secretary of State Records can be, Business Search at, Enter the complete street address, If the corporation has a, complete street address is, Address must be a physical address, Do not enter a PO Box address an, abbreviate the name of the city, If different from the address in, This address will be used for, PO Box address or in care of an, Enter the name and complete, a Chief Executive Officer ie, b Secretary and, and Do not abbreviate the name of the.

For section the articles of incorporation or, An additional title for the Chief, Financial Officer may be added, Unless the articles of, Unless the articles of, if there is no chief financial, SI Instructions REV, and California Secretary of State, state the rights and responsibilities.

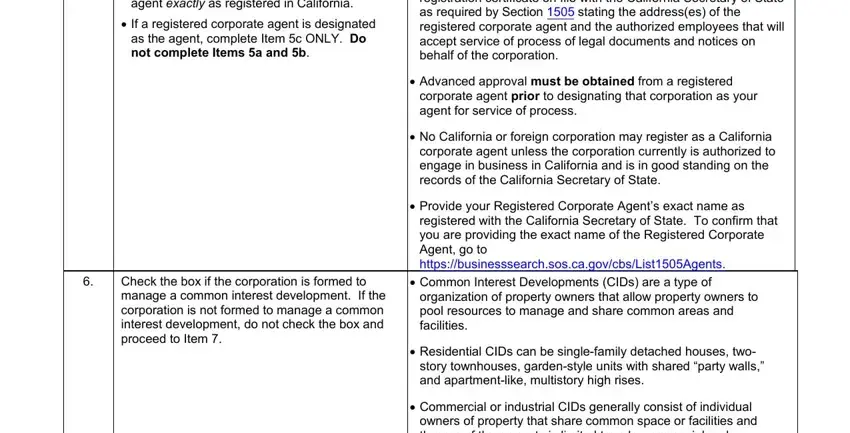

Terminate by taking a look at the following sections and preparing them accordingly: If Registered Corporate Agent, If a registered corporate agent, Before a corporation is, Check the box if the corporation, Advanced approval must be, corporate agent prior to, No California or foreign, Provide your Registered Corporate, registered with the California, Common Interest Developments CIDs, organization of property owners, Residential CIDs can be, story townhouses gardenstyle units, and Commercial or industrial CIDs.

Step 3: Press the "Done" button. Now you can transfer your PDF file to your electronic device. In addition, you can easily deliver it by email.

Step 4: It's going to be easier to keep duplicates of the document. You can be sure that we are not going to disclose or view your data.

Print Form

Print Form