The entire process of completing the bizfile sos ca gov form si 550 nc is pretty hassle-free. Our experts made certain our PDF editor is not hard to use and can help prepare any form without delay. Have a look at the four steps you will need to take:

Step 1: Click the button "Get form here" to open it.

Step 2: Once you've got accessed the editing page bizfile sos ca gov form si 550 nc, you'll be able to notice every one of the actions intended for the form in the top menu.

You will have to provide the following data to fill out the file:

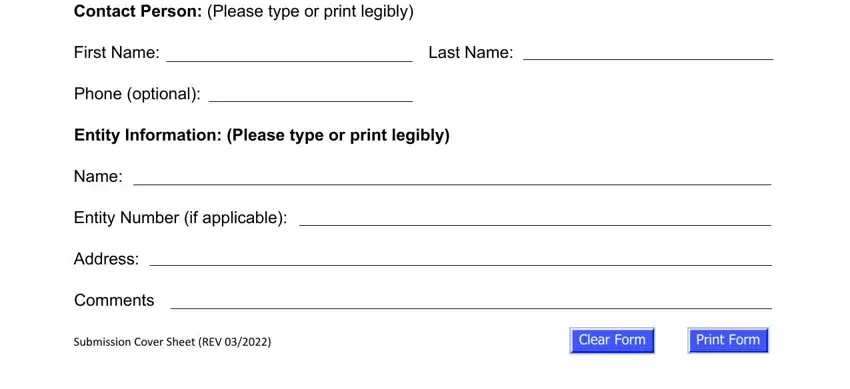

Fill in the Contact Person Please type or, First Name, Phone optional, Last Name, Entity Information Please type or, Name, Entity Number if applicable, Address, Comments, and Submission Cover Sheet REV areas with any content that is demanded by the program.

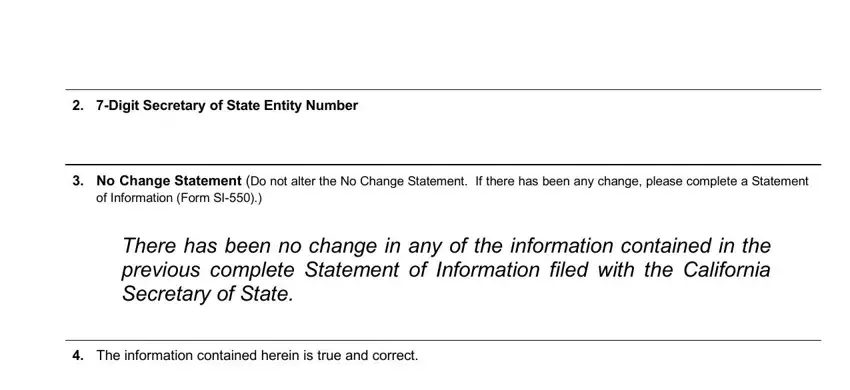

In the you registered in California using, Digit Secretary of State Entity, No Change Statement Do not alter, of Information Form SI, There has been no change in any of, and The information contained herein field, describe the relevant particulars.

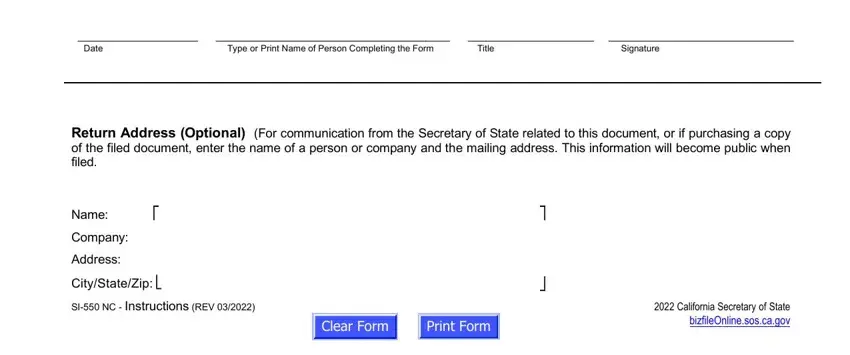

The Date, Type or Print Name of Person, Title, Signature, Return Address Optional For, Name, Company, Address, CityStateZip, SI NC Instructions REV, and California Secretary of State field could be used to point out the rights and responsibilities of both sides.

Step 3: Once you've clicked the Done button, your document is going to be readily available export to every device or email you specify.

Step 4: To protect yourself from all of the troubles later on, you will need to have a minimum of several duplicates of the document.