THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND

ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE.

In order to review your loan for one of our loss mitigation programs, the enclosed Request for Mortgage Assistance (RMA) form must be completed, signed and returned to SLS with the required supporting documentation.

If you prefer that we work with a person that is not on the loan, provide the person or company name and your written and signed authorization for us to discuss your account and all necessary information with them.

To See If You Qualify For One of Our Loss Mitigation Programs:

Using one of the methods referenced below, send the items listed in the included checklist and Request for Mortgage Assistance Form (RMA), as they pertain to your specific situation. If there are less than 7 business days prior to a scheduled foreclosure sale, please contact us immediately to discuss your options.

Mail |

Secure Fax |

Secure Email |

Secure Web |

|

|

|

|

8742 Lucent Blvd, |

1-720-241-7526 |

|

|

Suite 300, |

(Page limit per |

crdocs@sls.net |

www.sls.net |

Highlands Ranch, CO 80129 |

transmission is 25 pages) |

|

|

In order to process your application for a home mortgage loan modification, a current home value must be obtained. The charge for this order will be assessed to your loan account.

If you have questions concerning this letter or need further assistance, you may contact our Customer Resolution Department at 1-800-306-6059 Monday through Friday, 6:00 a.m. until 9:00 p.m. MT. Saturday 6:00 a.m. until 12:00 p.m. MT or TDD 1-800-268-9419, Monday through Friday, 8:00 a.m. until 5:00 p.m. MT.

If you have other questions about alternatives to foreclosure that cannot be answered by SLS, you may contact HUD at 1-800-569-4287 or contact a HUD approved counselor at http://www.hud.gov/offices/hsg/sfh/hcc/fc/ . HUD sponsors housing counseling agencies throughout the country to provide free or low cost advice. For additional contact information for housing counselors you may also contact the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/mortgagehelp .

Sincerely,

Customer Resolution Department

Specialized Loan Servicing LLC

Enclosures:

•Mortgage Assistance Application Checklist

•Information on Avoiding Foreclosure

•Frequently Asked Questions (FAQ)

•Request for Mortgage Assistance Form (RMA)

•IRS Form 4506T and IRS Form 4506T-EZ with instructions on completing

•Index of Document Descriptions

SPECIALIZED LOAN SERVICING LLC IS REQUIRED BY LAW TO INFORM YOU THAT THIS COMMUNICATION IS FROM A DEBT COLLECTOR. HOWEVER, THE PURPOSE OF THIS COMMUNICATION IS TO OFFER YOU LOSS MITIGATION ASSISTANCE THAT MAY HELP YOU BRING OR KEEP YOUR LOAN CURRENT THROUGH AFFORDABLE PAYMENTS. IF YOU ARE CURRENTLY IN A BANKRUPTCY PROCEEDING, OR HAVE PREVIOUSLY OBTAINED A DISCHARGE OF THIS DEBT UNDER APPLICABLE BANKRUPTCY LAW, THIS NOTICE IS FOR INFORMATION ONLY AND IS NOT AN ATTEMPT TO COLLECT THE DEBT, A DEMAND FOR PAYMENT, OR AN ATTEMPT TO IMPOSE PERSONAL LIABILITY FOR THAT DEBT. YOU ARE NOT OBLIGATED TO DISCUSS YOUR HOME LOAN WITH US OR ENTER INTO A LOAN MODIFICATION OR OTHER LOAN-ASSISTANCE PROGRAM. YOU SHOULD CONSULT WITH YOUR BANKRUPTCY ATTORNEY OR OTHER ADVISOR ABOUT YOUR LEGAL RIGHTS AND OPTIONS. IF YOU HAVE QUESTIONS, PLEASE CONTACT US AT 1-800-306-6057.

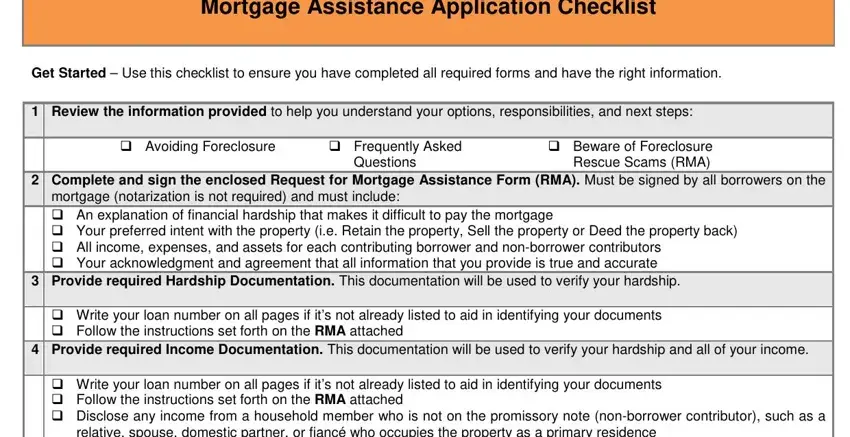

Mortgage Assistance Application Checklist

Get Started – Use this checklist to ensure you have completed all required forms and have the right information.

1Review the information provided to help you understand your options, responsibilities, and next steps:

Avoiding Foreclosure |

Frequently Asked |

Beware of Foreclosure |

|

Questions |

Rescue Scams (RMA) |

2Complete and sign the enclosed Request for Mortgage Assistance Form (RMA). Must be signed by all borrowers on the mortgage (notarization is not required) and must include:

An explanation of financial hardship that makes it difficult to pay the mortgage

Your preferred intent with the property (i.e. Retain the property, Sell the property or Deed the property back)

All income, expenses, and assets for each contributing borrower and non-borrower contributors

Your acknowledgment and agreement that all information that you provide is true and accurate

3Provide required Hardship Documentation. This documentation will be used to verify your hardship.

Write your loan number on all pages if it’s not already listed to aid in identifying your documents

Follow the instructions set forth on the RMA attached

4Provide required Income Documentation. This documentation will be used to verify your hardship and all of your income.

Write your loan number on all pages if it’s not already listed to aid in identifying your documents

Follow the instructions set forth on the RMA attached

Disclose any income from a household member who is not on the promissory note (non-borrower contributor), such as a relative, spouse, domestic partner, or fiancé who occupies the property as a primary residence

•If you elect to disclose and rely upon this income to qualify, the required income documentation is the same as the income documentation required for a borrower in addition to the credit authorization form

•See the RMA for specific details on income documentation.

Proof of Income must be provided for all borrowers and non-borrower contributors

If noted as required for your income type, complete and sign a dated copy of the enclosed IRS Form 4506T-EZ or 4506T (self-employed)

5Send your completed application package. Send in all required documentation listed in steps 2-4 above, and summarized below:

Complete and Executed Request for Mortgage Assistance Form (RMA)

Hardship Documentation as outlined in the RMA

Income Documentation for each borrower and non-borrower contributor as outlined in the RMA

|

Mail |

|

Fax |

|

Email |

|

Web |

|

8742 Lucent Blvd, |

1-720-241-7526 |

|

|

|

|

|

|

(Page limit per transmission |

|

|

|

|

|

Suite 300, |

|

|

crdocs@sls.net |

|

www.sls.net |

|

|

is 25 pages) |

|

|

|

Highlands Ranch, CO 80129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT INFORMATION:

•If you cannot provide the documentation within the time frame provided, have other types of income not specified on the RMA, cannot locate some or all of the required documents, or If you have any questions regarding this information, please contact our Customer Resolution Department toll free at 1-800-306-6059, Monday through Friday, 6:00 a.m. until 9:00 p.m. MT. Saturday 6:00 a.m. until 12:00 p.m. MT or TDD 1-800-268-9419, Monday through Friday, 8:00 a.m. until 5:00 p.m. MT

•Don’t send original income or hardship documents. Copies are acceptable.

•Upon receipt of your complete application, SLS will utilize the intent you’ve noted in your RMA to determine which program we will evaluate you for first. However, SLS will perform an evaluation to determine your eligibility of all available programs offered by your investor. The results of our evaluation will be communicated to you in a decision letter.

•SLS encourages you to consider contacting other servicers of loans secured by the same property to discuss loss mitigation options.

This Document is for your reference only. Do not return with your application package.

Information on Avoiding Foreclosure

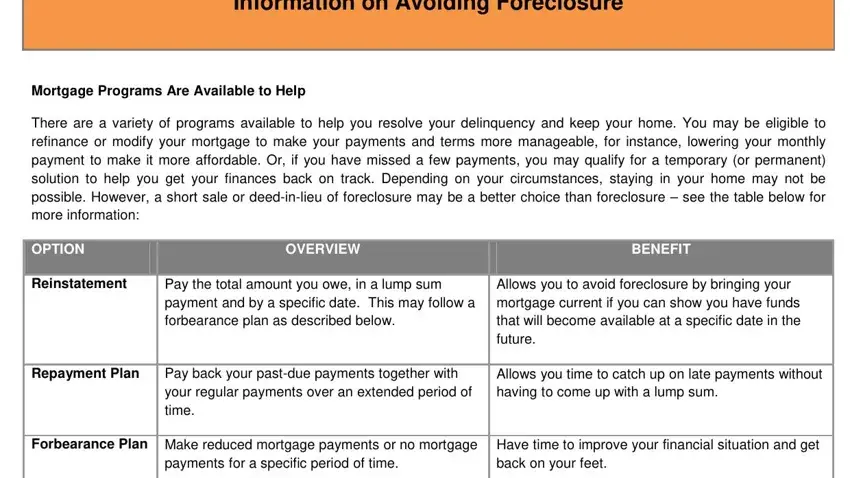

Mortgage Programs Are Available to Help

There are a variety of programs available to help you resolve your delinquency and keep your home. You may be eligible to refinance or modify your mortgage to make your payments and terms more manageable, for instance, lowering your monthly payment to make it more affordable. Or, if you have missed a few payments, you may qualify for a temporary (or permanent) solution to help you get your finances back on track. Depending on your circumstances, staying in your home may not be possible. However, a short sale or deed-in-lieu of foreclosure may be a better choice than foreclosure – see the table below for more information:

|

|

OPTION |

|

|

OVERVIEW |

|

|

BENEFIT |

|

|

|

|

|

|

|

|

|

|

|

|

Reinstatement |

|

Pay the total amount you owe, in a lump sum |

|

Allows you to avoid foreclosure by bringing your |

|

|

|

|

|

payment and by a specific date. This may follow a |

|

mortgage current if you can show you have funds |

|

|

|

|

|

forbearance plan as described below. |

|

that will become available at a specific date in the |

|

|

|

|

|

|

|

|

future. |

|

|

|

|

|

|

|

Repayment Plan |

|

Pay back your past-due payments together with |

|

Allows you time to catch up on late payments without |

|

|

|

|

|

your regular payments over an extended period of |

|

having to come up with a lump sum. |

|

|

|

|

|

time. |

|

|

|

|

|

|

|

|

|

|

Forbearance Plan |

|

Make reduced mortgage payments or no mortgage |

|

Have time to improve your financial situation and get |

|

|

|

|

|

payments for a specific period of time. |

|

back on your feet. |

|

|

|

|

|

|

|

Modification |

|

Receive modified terms of your mortgage to make |

|

Permanently modifies your mortgage so that your |

|

|

|

|

|

it more affordable or manageable after successfully |

|

payments or terms are more manageable as a |

|

|

|

|

|

making the reduced payment during a “trial period” |

|

permanent solution to a long-term or permanent |

|

|

|

|

|

(i.e., completing a three month trial period plan). |

|

hardship. |

|

|

|

|

|

|

|

Short Sale |

|

Sell your home and pay off a portion of your |

|

Allows you to transition out of your home without |

|

|

|

|

|

mortgage balance when you owe more on the |

|

going through foreclosure. In some cases, relocation |

|

|

|

|

|

home than it is worth. |

|

assistance may be available. |

|

|

|

|

|

|

|

Deed-in-Lieu of |

|

Transfer the ownership of your property to us. |

|

Allows you to transition out of your home without |

|

Foreclosure |

|

|

|

|

going through foreclosure. In some cases, relocation |

|

|

|

|

|

|

|

|

assistance may be available. This is useful when |

|

|

|

|

|

|

|

|

there are no other liens on your property. |

|

|

|

|

|

|

|

|

|

|

This Document is for your reference only. Do not return with your application package.

Frequently Asked Questions

Q. Why Did I Receive This Package?

A. You received this package because we have not received one or more of your monthly mortgage payments and want to help find a foreclosure prevention option or you have requested information on obtaining assistance. We are sending this information to you now so that we can work with you to quickly resolve any temporary or long-term financial challenge you face to making all of your late mortgage payments.

Q. Where Can I Find More Information on Foreclosure Prevention?

A. Please see the Avoiding Foreclosure attachment in this package for more information. If you have any questions regarding this information, please contact Customer Resolution toll free at 1-800-306-6059, Monday through Friday, 6:00 a.m. until 9:00 p.m. MT. Saturday 6:00 a.m. until 12:00 p.m. MT or TDD 1-800-268-9419, Monday through Friday, 8:00 a.m. until 5:00 p.m. MT.

Q. Will It Cost Money to Get Help?

A. There should never be a fee from your servicer or qualified counselor to obtain assistance or information about foreclosure prevention options. However, foreclosure prevention has become a target for scam artists. Be wary of companies or individuals offering to help you for a fee, and never send a mortgage payment to any company other than the one listed on your monthly mortgage statement or one designated to receive your payments under a state assistance program.

Q. What Happens Once I Have Sent the Application Package to You?

A. We will contact you upon receipt of your Borrower Response Package to confirm that we have received your package and will review it to determine whether it is complete. Within five business days of receipt of your application documents, we will send you an acknowledgement letter outlining which documents are still need to complete or application or if we believe to have received a complete application and proceeding with the evaluation. We cannot guarantee that you will receive any (or a particular type of) assistance. We will let you know which foreclosure alternatives, if any, are available to you and will inform you of your next steps to accept our offer. Please submit your Application Package as soon as possible.

Q. What Happens to My Mortgage While You Are Evaluating My Application Package?

A. You remain obligated to make all mortgage payments as they come due, even while we are evaluating the types of assistance that may be available.

Q. Will the Foreclosure Process Begin If I Do Not Respond to this Letter?

A. If we do not receive an application within the timeline disclosed and you have missed four monthly payments or there is reason to believe the property is vacant or abandoned, we may refer your mortgage to foreclosure.

Q. What if My Property is scheduled for a Foreclosure Sale in the Future?

A.

oIf this is your first review or if you have had a qualifying change in circumstance and you submit a complete loss mitigation application and SLS has not made the first notice or filing required by applicable law for any judicial or

non-judicial foreclosure process SLS will not initiate foreclosure proceedings

oIf this is your first review or if you have had a qualifying change in circumstance and you submit a complete loss mitigation application after a SLS has made the first notice or filing required by applicable law for any judicial or non-judicial foreclosure process but more than 37 days before a foreclosure sale, SLS will not move for foreclosure judgment or order of sale, or conduct a foreclosure sale

oIf SLS has already moved for a foreclosure judgment or order of sale prior to receiving a completed application but more than 37 days before a foreclosure sale, SLS will take reasonable steps, such as requesting the court delay the consideration of the motion, to avoid a ruling on such a motion until SLS has completed the loss mitigation evaluation, however, there is no guarantee that we will be able to postpone a scheduled sale, because a court with jurisdiction over the foreclosure proceeding (if any) or public official charged with carrying out the sale may not agree to halt the scheduled sale

Q.Will My Property be Sold at a Foreclosure Sale If I Accept a Foreclosure Alternative?

A. No. If you are approved for a foreclosure prevention option and accept, any foreclosure sale will not occur if you continue

to honor the terms of the Agreement. However, if you fail to comply with the terms of the Agreement and do not make other arrangements with us, your loan will be enforced according to its original terms. This could include foreclosure. In addition, if you are currently in a bankruptcy proceeding, approval of any foreclosure prevention alternative for which you may be eligible is contingent on approval of the bankruptcy court in your bankruptcy case.

This Document is for your reference only. Do not return with your application package.