THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND

ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE.

In order to review your loan for one of our loss mitigation programs, the enclosed Request for Mortgage Assistance (RMA) form must be completed, signed and returned to SLS with the required supporting documentation.

If you prefer that we work with a person that is not on the loan, provide the person or company name and your written and signed authorization for us to discuss your account and all necessary information with them.

To See If You Qualify For One of Our Loss Mitigation Programs:

Using one of the methods referenced below, send the items listed in the included checklist and Request for Mortgage Assistance Form (RMA), as they pertain to your specific situation. If there are less than 7 business days prior to a scheduled foreclosure sale, please contact us immediately to discuss your options.

Mail |

Secure Fax |

Secure Email |

Secure Web |

|

|

|

|

8742 Lucent Blvd, |

1-720-241-7526 |

|

|

Suite 300, |

(Page limit per |

crdocs@sls.net |

www.sls.net |

Highlands Ranch, CO 80129 |

transmission is 25 pages) |

|

|

In order to process your application for a home mortgage loan modification, a current home value must be obtained. The charge for this order will be assessed to your loan account.

If you have questions concerning this letter or need further assistance, you may contact our Customer Resolution Department at 1-800-306-6059 Monday through Friday, 6:00 a.m. until 9:00 p.m. MT. Saturday 6:00 a.m. until 12:00 p.m. MT or TDD 1-800-268-9419, Monday through Friday, 8:00 a.m. until 5:00 p.m. MT.

If you have other questions about alternatives to foreclosure that cannot be answered by SLS, you may contact HUD at 1-800-569-4287 or contact a HUD approved counselor at http://www.hud.gov/offices/hsg/sfh/hcc/fc/ . HUD sponsors housing counseling agencies throughout the country to provide free or low cost advice. For additional contact information for housing counselors you may also contact the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/mortgagehelp .

Sincerely,

Customer Resolution Department

Specialized Loan Servicing LLC

Enclosures:

•Mortgage Assistance Application Checklist

•Information on Avoiding Foreclosure

•Frequently Asked Questions (FAQ)

•Request for Mortgage Assistance Form (RMA)

•IRS Form 4506T and IRS Form 4506T-EZ with instructions on completing

•Index of Document Descriptions

SPECIALIZED LOAN SERVICING LLC IS REQUIRED BY LAW TO INFORM YOU THAT THIS COMMUNICATION IS FROM A DEBT COLLECTOR. HOWEVER, THE PURPOSE OF THIS COMMUNICATION IS TO OFFER YOU LOSS MITIGATION ASSISTANCE THAT MAY HELP YOU BRING OR KEEP YOUR LOAN CURRENT THROUGH AFFORDABLE PAYMENTS. IF YOU ARE CURRENTLY IN A BANKRUPTCY PROCEEDING, OR HAVE PREVIOUSLY OBTAINED A DISCHARGE OF THIS DEBT UNDER APPLICABLE BANKRUPTCY LAW, THIS NOTICE IS FOR INFORMATION ONLY AND IS NOT AN ATTEMPT TO COLLECT THE DEBT, A DEMAND FOR PAYMENT, OR AN ATTEMPT TO IMPOSE PERSONAL LIABILITY FOR THAT DEBT. YOU ARE NOT OBLIGATED TO DISCUSS YOUR HOME LOAN WITH US OR ENTER INTO A LOAN MODIFICATION OR OTHER LOAN-ASSISTANCE PROGRAM. YOU SHOULD CONSULT WITH YOUR BANKRUPTCY ATTORNEY OR OTHER ADVISOR ABOUT YOUR LEGAL RIGHTS AND OPTIONS. IF YOU HAVE QUESTIONS, PLEASE CONTACT US AT 1-800-306-6057.

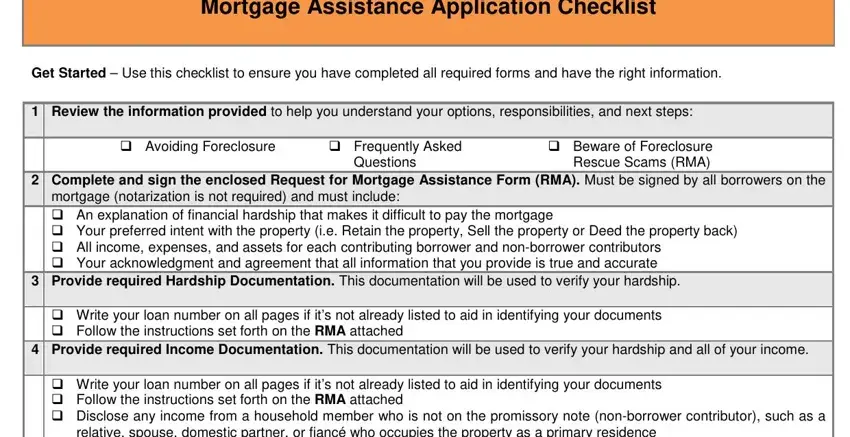

Mortgage Assistance Application Checklist

Get Started – Use this checklist to ensure you have completed all required forms and have the right information.

1Review the information provided to help you understand your options, responsibilities, and next steps:

Avoiding Foreclosure |

Frequently Asked |

Beware of Foreclosure |

|

Questions |

Rescue Scams (RMA) |

2Complete and sign the enclosed Request for Mortgage Assistance Form (RMA). Must be signed by all borrowers on the mortgage (notarization is not required) and must include:

An explanation of financial hardship that makes it difficult to pay the mortgage

Your preferred intent with the property (i.e. Retain the property, Sell the property or Deed the property back)

All income, expenses, and assets for each contributing borrower and non-borrower contributors

Your acknowledgment and agreement that all information that you provide is true and accurate

3Provide required Hardship Documentation. This documentation will be used to verify your hardship.

Write your loan number on all pages if it’s not already listed to aid in identifying your documents

Follow the instructions set forth on the RMA attached

4Provide required Income Documentation. This documentation will be used to verify your hardship and all of your income.

Write your loan number on all pages if it’s not already listed to aid in identifying your documents

Follow the instructions set forth on the RMA attached

Disclose any income from a household member who is not on the promissory note (non-borrower contributor), such as a relative, spouse, domestic partner, or fiancé who occupies the property as a primary residence

•If you elect to disclose and rely upon this income to qualify, the required income documentation is the same as the income documentation required for a borrower in addition to the credit authorization form

•See the RMA for specific details on income documentation.

Proof of Income must be provided for all borrowers and non-borrower contributors

If noted as required for your income type, complete and sign a dated copy of the enclosed IRS Form 4506T-EZ or 4506T (self-employed)

5Send your completed application package. Send in all required documentation listed in steps 2-4 above, and summarized below:

Complete and Executed Request for Mortgage Assistance Form (RMA)

Hardship Documentation as outlined in the RMA

Income Documentation for each borrower and non-borrower contributor as outlined in the RMA

|

Mail |

|

Fax |

|

Email |

|

Web |

|

8742 Lucent Blvd, |

1-720-241-7526 |

|

|

|

|

|

|

(Page limit per transmission |

|

|

|

|

|

Suite 300, |

|

|

crdocs@sls.net |

|

www.sls.net |

|

|

is 25 pages) |

|

|

|

Highlands Ranch, CO 80129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT INFORMATION:

•If you cannot provide the documentation within the time frame provided, have other types of income not specified on the RMA, cannot locate some or all of the required documents, or If you have any questions regarding this information, please contact our Customer Resolution Department toll free at 1-800-306-6059, Monday through Friday, 6:00 a.m. until 9:00 p.m. MT. Saturday 6:00 a.m. until 12:00 p.m. MT or TDD 1-800-268-9419, Monday through Friday, 8:00 a.m. until 5:00 p.m. MT

•Don’t send original income or hardship documents. Copies are acceptable.

•Upon receipt of your complete application, SLS will utilize the intent you’ve noted in your RMA to determine which program we will evaluate you for first. However, SLS will perform an evaluation to determine your eligibility of all available programs offered by your investor. The results of our evaluation will be communicated to you in a decision letter.

•SLS encourages you to consider contacting other servicers of loans secured by the same property to discuss loss mitigation options.

This Document is for your reference only. Do not return with your application package.

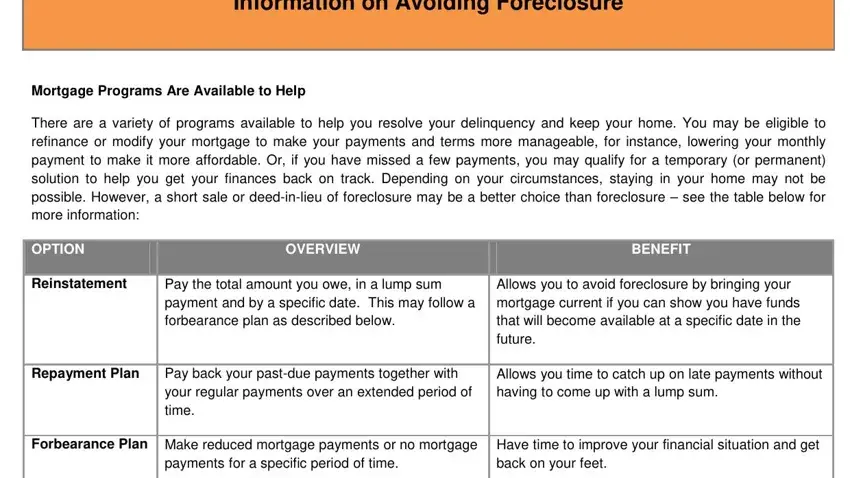

Information on Avoiding Foreclosure

Mortgage Programs Are Available to Help

There are a variety of programs available to help you resolve your delinquency and keep your home. You may be eligible to refinance or modify your mortgage to make your payments and terms more manageable, for instance, lowering your monthly payment to make it more affordable. Or, if you have missed a few payments, you may qualify for a temporary (or permanent) solution to help you get your finances back on track. Depending on your circumstances, staying in your home may not be possible. However, a short sale or deed-in-lieu of foreclosure may be a better choice than foreclosure – see the table below for more information:

|

|

OPTION |

|

|

OVERVIEW |

|

|

BENEFIT |

|

|

|

|

|

|

|

|

|

|

|

|

Reinstatement |

|

Pay the total amount you owe, in a lump sum |

|

Allows you to avoid foreclosure by bringing your |

|

|

|

|

|

payment and by a specific date. This may follow a |

|

mortgage current if you can show you have funds |

|

|

|

|

|

forbearance plan as described below. |

|

that will become available at a specific date in the |

|

|

|

|

|

|

|

|

future. |

|

|

|

|

|

|

|

Repayment Plan |

|

Pay back your past-due payments together with |

|

Allows you time to catch up on late payments without |

|

|

|

|

|

your regular payments over an extended period of |

|

having to come up with a lump sum. |

|

|

|

|

|

time. |

|

|

|

|

|

|

|

|

|

|

Forbearance Plan |

|

Make reduced mortgage payments or no mortgage |

|

Have time to improve your financial situation and get |

|

|

|

|

|

payments for a specific period of time. |

|

back on your feet. |

|

|

|

|

|

|

|

Modification |

|

Receive modified terms of your mortgage to make |

|

Permanently modifies your mortgage so that your |

|

|

|

|

|

it more affordable or manageable after successfully |

|

payments or terms are more manageable as a |

|

|

|

|

|

making the reduced payment during a “trial period” |

|

permanent solution to a long-term or permanent |

|

|

|

|

|

(i.e., completing a three month trial period plan). |

|

hardship. |

|

|

|

|

|

|

|

Short Sale |

|

Sell your home and pay off a portion of your |

|

Allows you to transition out of your home without |

|

|

|

|

|

mortgage balance when you owe more on the |

|

going through foreclosure. In some cases, relocation |

|

|

|

|

|

home than it is worth. |

|

assistance may be available. |

|

|

|

|

|

|

|

Deed-in-Lieu of |

|

Transfer the ownership of your property to us. |

|

Allows you to transition out of your home without |

|

Foreclosure |

|

|

|

|

going through foreclosure. In some cases, relocation |

|

|

|

|

|

|

|

|

assistance may be available. This is useful when |

|

|

|

|

|

|

|

|

there are no other liens on your property. |

|

|

|

|

|

|

|

|

|

|

This Document is for your reference only. Do not return with your application package.

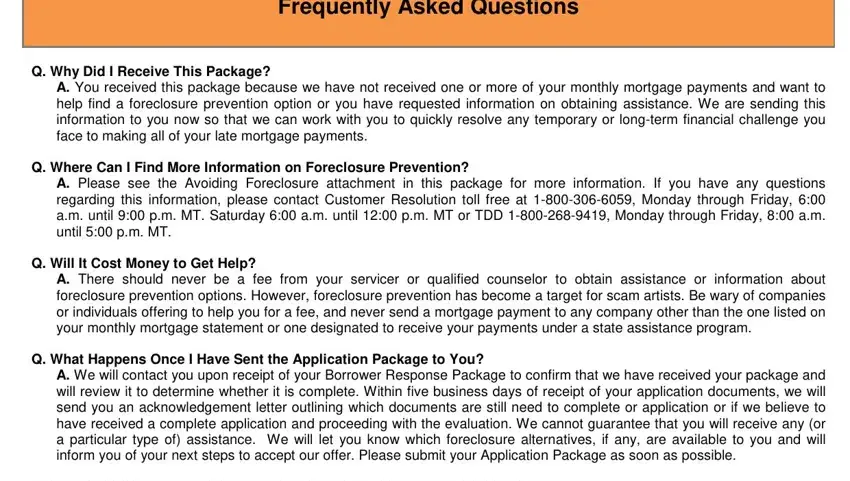

Frequently Asked Questions

Q. Why Did I Receive This Package?

A. You received this package because we have not received one or more of your monthly mortgage payments and want to help find a foreclosure prevention option or you have requested information on obtaining assistance. We are sending this information to you now so that we can work with you to quickly resolve any temporary or long-term financial challenge you face to making all of your late mortgage payments.

Q. Where Can I Find More Information on Foreclosure Prevention?

A. Please see the Avoiding Foreclosure attachment in this package for more information. If you have any questions regarding this information, please contact Customer Resolution toll free at 1-800-306-6059, Monday through Friday, 6:00 a.m. until 9:00 p.m. MT. Saturday 6:00 a.m. until 12:00 p.m. MT or TDD 1-800-268-9419, Monday through Friday, 8:00 a.m. until 5:00 p.m. MT.

Q. Will It Cost Money to Get Help?

A. There should never be a fee from your servicer or qualified counselor to obtain assistance or information about foreclosure prevention options. However, foreclosure prevention has become a target for scam artists. Be wary of companies or individuals offering to help you for a fee, and never send a mortgage payment to any company other than the one listed on your monthly mortgage statement or one designated to receive your payments under a state assistance program.

Q. What Happens Once I Have Sent the Application Package to You?

A. We will contact you upon receipt of your Borrower Response Package to confirm that we have received your package and will review it to determine whether it is complete. Within five business days of receipt of your application documents, we will send you an acknowledgement letter outlining which documents are still need to complete or application or if we believe to have received a complete application and proceeding with the evaluation. We cannot guarantee that you will receive any (or a particular type of) assistance. We will let you know which foreclosure alternatives, if any, are available to you and will inform you of your next steps to accept our offer. Please submit your Application Package as soon as possible.

Q. What Happens to My Mortgage While You Are Evaluating My Application Package?

A. You remain obligated to make all mortgage payments as they come due, even while we are evaluating the types of assistance that may be available.

Q. Will the Foreclosure Process Begin If I Do Not Respond to this Letter?

A. If we do not receive an application within the timeline disclosed and you have missed four monthly payments or there is reason to believe the property is vacant or abandoned, we may refer your mortgage to foreclosure.

Q. What if My Property is scheduled for a Foreclosure Sale in the Future?

A.

oIf this is your first review or if you have had a qualifying change in circumstance and you submit a complete loss mitigation application and SLS has not made the first notice or filing required by applicable law for any judicial or

non-judicial foreclosure process SLS will not initiate foreclosure proceedings

oIf this is your first review or if you have had a qualifying change in circumstance and you submit a complete loss mitigation application after a SLS has made the first notice or filing required by applicable law for any judicial or non-judicial foreclosure process but more than 37 days before a foreclosure sale, SLS will not move for foreclosure judgment or order of sale, or conduct a foreclosure sale

oIf SLS has already moved for a foreclosure judgment or order of sale prior to receiving a completed application but more than 37 days before a foreclosure sale, SLS will take reasonable steps, such as requesting the court delay the consideration of the motion, to avoid a ruling on such a motion until SLS has completed the loss mitigation evaluation, however, there is no guarantee that we will be able to postpone a scheduled sale, because a court with jurisdiction over the foreclosure proceeding (if any) or public official charged with carrying out the sale may not agree to halt the scheduled sale

Q.Will My Property be Sold at a Foreclosure Sale If I Accept a Foreclosure Alternative?

A. No. If you are approved for a foreclosure prevention option and accept, any foreclosure sale will not occur if you continue

to honor the terms of the Agreement. However, if you fail to comply with the terms of the Agreement and do not make other arrangements with us, your loan will be enforced according to its original terms. This could include foreclosure. In addition, if you are currently in a bankruptcy proceeding, approval of any foreclosure prevention alternative for which you may be eligible is contingent on approval of the bankruptcy court in your bankruptcy case.

This Document is for your reference only. Do not return with your application package.

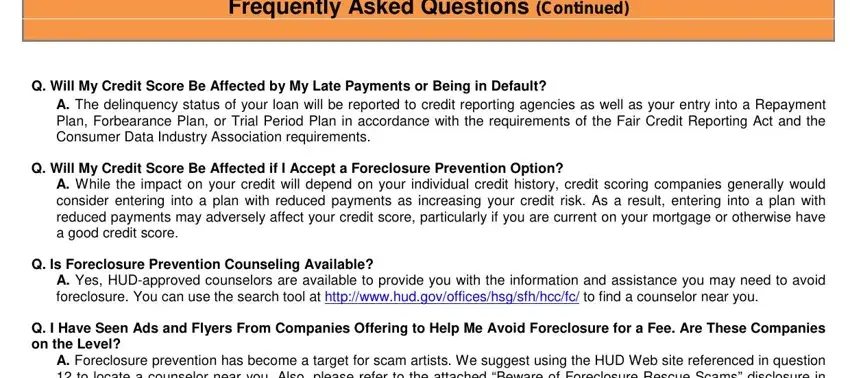

Frequently Asked Questions (Continued)

Q. Will My Credit Score Be Affected by My Late Payments or Being in Default?

A. The delinquency status of your loan will be reported to credit reporting agencies as well as your entry into a Repayment Plan, Forbearance Plan, or Trial Period Plan in accordance with the requirements of the Fair Credit Reporting Act and the Consumer Data Industry Association requirements.

Q. Will My Credit Score Be Affected if I Accept a Foreclosure Prevention Option?

A. While the impact on your credit will depend on your individual credit history, credit scoring companies generally would consider entering into a plan with reduced payments as increasing your credit risk. As a result, entering into a plan with reduced payments may adversely affect your credit score, particularly if you are current on your mortgage or otherwise have a good credit score.

Q. Is Foreclosure Prevention Counseling Available?

A. Yes, HUD-approved counselors are available to provide you with the information and assistance you may need to avoid foreclosure. You can use the search tool at http://www.hud.gov/offices/hsg/sfh/hcc/fc/ to find a counselor near you.

Q. I Have Seen Ads and Flyers From Companies Offering to Help Me Avoid Foreclosure for a Fee. Are These Companies on the Level?

A. Foreclosure prevention has become a target for scam artists. We suggest using the HUD Web site referenced in question 12 to locate a counselor near you. Also, please refer to the attached “Beware of Foreclosure Rescue Scams” disclosure in your Request for Mortgage Assistance form (RMA) for more information.

This Document is for your reference only. Do not return with your application package.

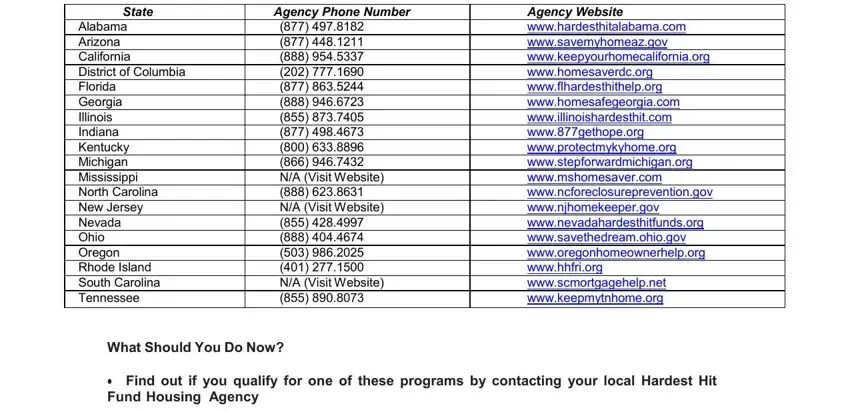

Government Assistance May Be Available!

As part of the newly established Hardest Hit Fund SM, the U.S. Treasury Department has implemented programs which may help preserve homeownership for some United States homeowners. If you live in one of the following states you may be eligible for assistance:

State |

Agency Phone Number |

Agency Website |

Alabama |

(877) 497.8182 |

www.hardesthitalabama.com |

Arizona |

(877) 448.1211 |

www.savemyhomeaz.gov |

California |

(888) 954.5337 |

www.keepyourhomecalifornia.org |

District of Columbia |

(202) 777.1690 |

www.homesaverdc.org |

Florida |

(877) 863.5244 |

www.flhardesthithelp.org |

Georgia |

(888) 946.6723 |

www.homesafegeorgia.com |

Illinois |

(855) 873.7405 |

www.illinoishardesthit.com |

Indiana |

(877) 498.4673 |

www.877gethope.org |

Kentucky |

(800) 633.8896 |

www.protectmykyhome.org |

Michigan |

(866) 946.7432 |

www.stepforwardmichigan.org |

Mississippi |

N/A (Visit Website) |

www.mshomesaver.com |

North Carolina |

(888) 623.8631 |

www.ncforeclosureprevention.gov |

New Jersey |

N/A (Visit Website) |

www.njhomekeeper.gov |

Nevada |

(855) 428.4997 |

www.nevadahardesthitfunds.org |

Ohio |

(888) 404.4674 |

www.savethedream.ohio.gov |

Oregon |

(503) 986.2025 |

www.oregonhomeownerhelp.org |

Rhode Island |

(401) 277.1500 |

www.hhfri.org |

South Carolina |

N/A (Visit Website) |

www.scmortgagehelp.net |

Tennessee |

(855) 890.8073 |

www.keepmytnhome.org |

|

|

|

What Should You Do Now?

•Find out if you qualify for one of these programs by contacting your local Hardest Hit Fund Housing Agency

•Once you have established an action plan with a Hardest Hit Fund representative you should contact Specialized Loan Servicing LLC to reach a joint resolution.

Please be advised that all HHF contact information has been obtained directly from the HHF housing authority and may be subject to change based on state program updates

This is not an offer to extend credit. Program subject to conditions and eligibility requirements. Offer invalid if your loan is sold prior to satisfaction of the debt. Calls will be monitored and recorded for quality assurance purposes. If you do not wish for your call to be recorded, please notify the Customer Assistance Associate when calling.

If you have other questions about HAMP that cannot be answered by us, please call the Homeowner’s HOPE™ Hotline at 1- 888-995-HOPE (4673). This Hotline can help with questions about the program and offers access to free HUD-certified counseling services in English and Spanish.

You may have received documents from SLS concerning a home mortgage loan modification. The purpose of this solicitation is to offer you another option with respect to your loan, if you qualify; however it is not meant to take the place of the HAMP option, if applicable.

If you are experiencing a financial hardship and need help, you must complete and submit this form along with other required documentation to be considered |

for foreclosure prevention options under the Making Home Affordable (MHA) Program. You must provide information about yourself and your intentions to either |

keep or transition out of your property; a description of the hardship that prevents you from paying your mortgage(s); information about all of your income, expenses |

and financial |

assets; whether you have declared bankruptcy; and information about the mortgage(s) on your principal residence and other single family real estate that |

you own. When you sign and date this form, you will make important certifications, representations and agreements, including certifying that all of the information in |

this RMA is |

accurate and truthful. |

SLS Loan Number:

|

|

|

|

|

|

SECTION 1: BORROWER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRIMARY BORROWER |

|

|

|

|

|

|

CO-BORROWER 1 |

|

|

|

|

BORROWER’S NAME |

|

|

|

|

|

|

|

|

CO-BORROWER’S NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|

|

DATE OF BIRTH (MM/DD/YY) |

|

|

SOCIAL SECURITY NUMBER |

|

|

|

DATE OF BIRTH (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|

|

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

MAILING ADDRESS (IF SAME AS BORROWER, WRITE “SAME”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CO-BORROWER 2 |

|

|

|

|

|

|

CO-BORROWER 3 |

|

|

|

|

BORROWER’S NAME |

|

|

|

|

|

|

|

|

CO-BORROWER’S NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|

|

DATE OF BIRTH (MM/DD/YY) |

|

|

SOCIAL SECURITY NUMBER |

|

|

|

DATE OF BIRTH (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|

|

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS (IF SAME AS BORROWER, WRITE “SAME”) |

|

|

MAILING ADDRESS (IF SAME AS BORROWER, WRITE “SAME”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

My intent with the property is: |

|

Keep the Property |

Sell the Property |

|

Deed the Property back |

I’m Unsure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: SLS will perform an evaluation to determine your eligibility for all available programs offered by your investor. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The property is currently: |

|

|

My Primary Residence |

|

|

A Second Home |

|

|

An Investment Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The property is currently: |

|

|

Owner Occupied |

|

|

|

Renter Occupied |

|

|

Vacant |

|

|

|

|

|

Has any borrower filed for bankruptcy? |

|

Chapter 7 |

Chapter 13 |

|

Is any borrower a Service member? |

|

Yes |

No |

|

|

|

|

Filing date: ___ /___ /___ |

Case Number: _______________ |

|

Have you recently been deployed away from your principal residence or |

|

|

recently received a permanent change of station order? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is any borrower the surviving spouse of a deceased service member who was on |

|

Has your bankruptcy been discharged? |

|

Yes |

No |

|

|

active duty at the time of death? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you contacted a credit counseling agency for help? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

Counselors Name:______________________________ |

Counselors Phone Number:___________/____________/_________________ |

|

|

|

Agency’s Name:________________________________ |

Counselors Email Address:___________________________________________ |

|

|

|

|

|

|

|

Has the mortgage on your principal residence ever had a Home Affordable Modification Program (HAMP) trial period plan or other permanent |

|

|

|

modification? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Has any property that you or any co-borrower own had a permanent HAMP modification? |

Yes |

No If “Yes”, how many? __________ |

|

|

|

|

|

|

|

Are you or any co-borrower currently in or being considered for a HAMP trial period plan on a property other than your principal residence? |

|

|

SECTION 2: HARDSHIP AFFIDAVIT

I am requesting review of my current financial situation to determine whether I qualify for temporary or permanent mortgage relief options.

Date Hardship Began is:_______________

I Believe my situation is:

___ Short Term (under 6 months) |

___ Medium term (6-12 months) |

___Long Term/Permanent (Greater than 12 months) |

I (We) am/are requesting review under the Specialized Loan Servicing Loan Modification Program.

I am having difficulty making my monthly payment because of reason set forth below:

(Please check the primary reason and submit required documentation demonstrating your primary hardship)

|

If your hardship is: |

Then the required hardship documentation is: |

|

I am unemployed and (a) I am receiving/will receive unemployment |

No Hardship Documentation Required. |

|

benefits or (b) my unemployment benefits ended less than 6 months |

|

|

ago. |

|

|

Reduction in Income: a hardship that has caused a decrease in your |

No Hardship Documentation Required. |

|

income due to circumstances outside of your control (e.g., |

|

|

elimination of overtime, reduction in regular working hours, a |

|

|

reduction in base pay) |

|

|

Increase in Housing Expenses: a hardship that has caused an |

No Hardship Documentation Required. |

|

increase in your housing expenses due to circumstances outside of |

|

|

your control. |

|

|

Divorce or legal separation; Separation of Borrowers unrelated by |

Divorce Decree filed by the court; OR |

|

marriage, civil union or similar domestic partnership under |

Separation agreement filed by the court; OR |

|

applicable law. |

Current Credit Report evidencing divorce, separation, or non-occupying |

|

|

borrower has a different address; OR |

|

|

Recorded quitclaim deed evidencing that the non-occupying Borrower or |

|

|

Co-Borrower has relinquished all rights to property |

|

Death of a borrower or death of either the primary or secondary |

Death certificate; OR |

|

wage earner in the household |

Obituary or newspaper article reporting the death |

Long-Term or permanent disability; serious illness of a borrower/co- Proof of monthly insurance benefits or government assistance (if app); OR

borrower or dependent family member |

Written statement or other documentation verifying disability or illness; |

|

OR |

|

Doctor’s certificate of illness or disability; OR |

|

Medical bills |

|

*None of the above shall require providing detailed medical information |

Disaster (natural or man-made) adversely impacting the property or |

Insurance claim; OR |

Borrower’s place of employment |

Federal Emergency Management Agency grant or Small Business |

|

Administration loan; OR |

|

Borrower or Employer Property located in a federally declared disaster |

|

area |

Distant employment transfer/relocation |

For active duty service members: |

|

Notice of permanent change of station (PCS) or actual PCS orders. |

|

For employment transfers/new employment: |

|

Copy of signed offer letter or notice from employer showing transfer of |

|

new employment location; OR |

|

Pay stub from new employer; OR |

|

If none of these apply, provide written explanation |

|

In addition to the above, documentation that reflects the amount of any |

|

relocation assistance provided, if applicable (not required for those with PCS |

|

orders) |

Business Failure |

Tax return from the previous year (including all schedules) AND |

|

Proof of business failure supported by one of the following: |

|

Bankruptcy Filing for business; OR |

|

Two months of recent bank statements for the business account |

|

evidencing cessation of business activity; OR |

|

Most recent signed and dated quarterly or year-to-date profit and loss |

|

statement |

Other: a hardship not covered above |

Written explanation describing the details of the hardship and relevant |

|

documentation (below) |

Additional Explanation (continue on a separate sheet of paper if necessary): |

|

SECTION 3: COMBINED INCOME AND EXPENSES FOR BORROWER AND CO-BORROWER(S)

*Details regarding the required supporting documentation can be found in Section 5

Only include income information for household contributing BORROWERS

If you include income from a contributor who is NOT a Borrower, specify their income in Section 4

You are not required to disclose Child Support, Alimony or Separation Maintenance income, unless you choose to have it considered.

Include mortgage payments on all properties you own EXCEPT your principal residence and the property you are seeking assistance in Section 7.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower Name: ________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child |

|

|

Other (investment |

|

|

|

|

|

|

Monthly Gross Wages |

|

|

$ |

|

income, royalties, |

$ |

|

|

|

|

|

$ |

|

Support/Alimony/Separation |

|

|

|

|

|

|

|

|

|

|

dividends, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overtime |

$ |

|

Social Security/SSDI |

$ |

|

Gross Rents Received |

$ |

|

|

|

|

|

|

(Taxable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tips, commissions, |

$ |

|

Social Security/SSDI (Non- |

$ |

|

Other: |

$ |

|

|

|

|

|

bonus |

|

Taxable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-Employment |

$ |

|

Public Assistance |

$ |

|

Other: |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unemployment |

|

|

Other monthly income: |

|

|

|

|

|

|

|

|

|

$ |

|

pension, annuity, retirement, |

$ |

|

Total (Gross Income) |

$ |

|

|

|

|

|

Income |

|

|

|

|

|

|

|

|

|

etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Co-Borrower Name: ________________________ |

|

|

|

|

|

|

Monthly Gross |

$ |

|

Wages |

|

|

|

|

|

|

Overtime |

$ |

|

|

|

|

Tips, commissions, |

$ |

|

|

bonus |

|

|

|

Self-Employment |

$ |

|

|

Income |

|

|

|

Unemployment |

$ |

|

|

Income |

|

|

|

|

|

|

|

Child |

$ |

|

Support/Alimony/Separation |

|

|

|

Social Security/SSDI (Taxable) |

$ |

|

Social Security/SSDI (Non- |

$ |

|

Taxable) |

|

|

|

Public Assistance |

$ |

|

Other monthly income: |

|

|

|

|

|

|

pension, annuity, retirement, |

|

$ |

|

etc. |

|

|

|

|

|

|

|

Other (investment |

|

|

income, royalties, |

$ |

|

dividends, etc.) |

|

|

|

|

|

Gross Rents Received |

$ |

|

|

|

|

Other: |

$ |

|

|

|

|

Other: |

$ |

|

|

|

|

|

|

|

Total (Gross Income) |

$ |

|

|

|

Co-Borrower Name: ________________________

Monthly Gross |

$ |

|

Wages |

|

|

|

|

|

|

Overtime |

$ |

|

|

|

|

|

Tips, commissions, |

$ |

|

|

bonus |

|

|

|

Self-Employment |

$ |

|

|

Income |

|

|

|

Unemployment |

$ |

|

|

Income |

|

|

|

|

|

|

|

Child |

$ |

|

Support/Alimony/Separation |

|

|

|

Social Security/SSDI (Taxable) |

$ |

|

Social Security/SSDI (Non- |

$ |

|

Taxable) |

|

|

|

Public Assistance |

$ |

|

Other monthly income: |

|

|

|

|

|

|

pension, annuity, retirement, |

|

$ |

|

etc. |

|

|

|

|

|

|

|

Other (investment |

|

|

income, royalties, |

$ |

|

dividends, etc.) |

|

|

|

|

|

Gross Rents Received |

$ |

|

|

|

|

Other: |

$ |

|

|

|

|

Other: |

$ |

|

|

|

|

|

|

|

Total (Gross Income) |

$ |

|

|

|

Co-Borrower Name: ________________________

Monthly Gross |

$ |

|

Wages |

|

|

|

|

|

|

Overtime |

$ |

|

|

|

|

|

Tips, commissions, |

$ |

|

|

bonus |

|

|

|

Self-Employment |

$ |

|

|

Income |

|

|

|

Unemployment |

$ |

|

|

Income |

|

|

|

|

|

|

|

Child |

$ |

|

Support/Alimony/Separation |

|

|

|

Social Security/SSDI (Taxable) |

$ |

|

Social Security/SSDI (Non- |

$ |

|

Taxable) |

|

|

|

Public Assistance |

$ |

|

Other monthly income: |

|

|

|

|

|

|

pension, annuity, retirement, |

|

$ |

|

etc. |

|

|

|

|

|

|

|

|

Other (investment |

|

|

|

|

|

income, royalties, |

$ |

|

|

|

dividends, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Rents Received |

$ |

|

|

|

|

|

|

|

|

|

|

Other: |

$ |

|

|

|

|

|

|

|

|

|

|

Other: |

$ |

|

|

|

|

|

|

|

|

|

|

Total (Gross Income) |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|