Dec can be filled in online in no time. Just try FormsPal PDF editing tool to get it done fast. Our expert team is ceaselessly endeavoring to develop the editor and ensure it is much faster for people with its extensive functions. Unlock an constantly progressive experience today - check out and uncover new possibilities as you go! By taking some basic steps, you may begin your PDF journey:

Step 1: Simply press the "Get Form Button" in the top section of this page to access our pdf editing tool. This way, you'll find all that is needed to work with your file.

Step 2: Once you start the tool, there'll be the document ready to be filled in. Apart from filling in different blank fields, you may also do many other things with the PDF, such as adding any textual content, modifying the initial text, adding graphics, signing the document, and a lot more.

This PDF doc requires specific information; in order to guarantee consistency, please make sure to take into account the following recommendations:

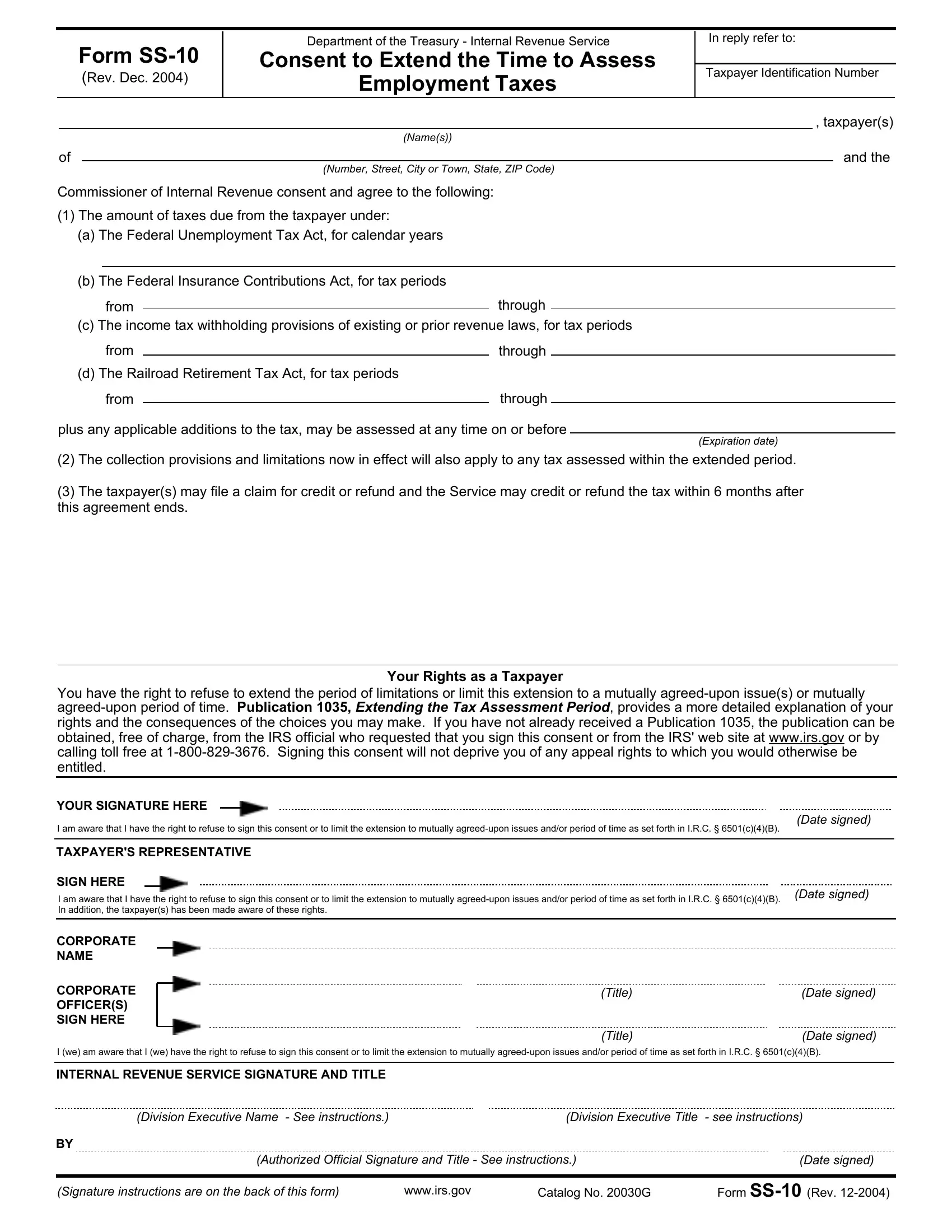

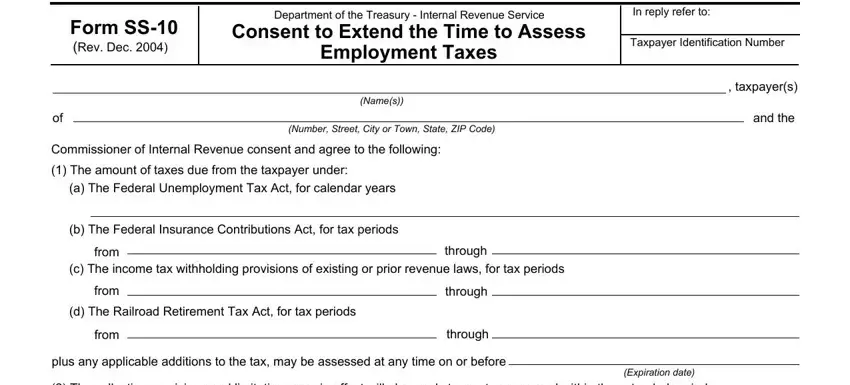

1. Fill out the Dec with a number of essential fields. Note all of the important information and make certain not a single thing forgotten!

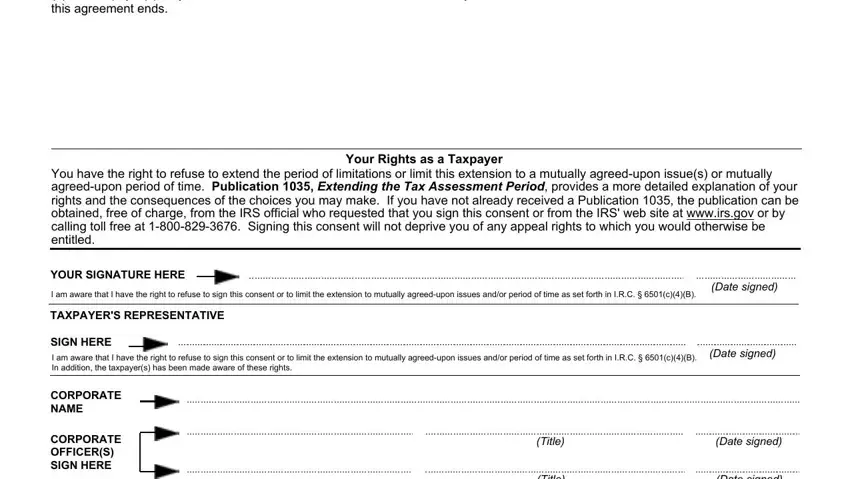

2. The next part is to fill out the following blanks: The taxpayers may file a claim, You have the right to refuse to, Your Rights as a Taxpayer, YOUR SIGNATURE HERE, I am aware that I have the right, TAXPAYERS REPRESENTATIVE, SIGN HERE, I am aware that I have the right, CORPORATE NAME, CORPORATE OFFICERS SIGN HERE, Title, Title, Date signed, Date signed, and Date signed.

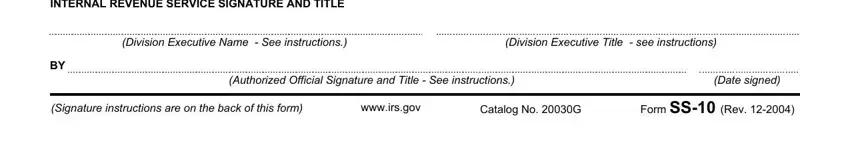

3. This subsequent segment should also be fairly straightforward, INTERNAL REVENUE SERVICE SIGNATURE, Division Executive Name See, Division Executive Title see, Authorized Official Signature and, Date signed, Signature instructions are on the, wwwirsgov, Catalog No G, and Form SS Rev - these empty fields needs to be filled in here.

People often get some points incorrect when completing Catalog No G in this part. Ensure you go over everything you type in here.

Step 3: Prior to submitting the file, you should make sure that form fields are filled in the correct way. The moment you are satisfied with it, press “Done." After getting a7-day free trial account with us, you will be able to download Dec or email it at once. The PDF document will also be easily accessible in your personal cabinet with your every modification. FormsPal is dedicated to the privacy of our users; we ensure that all information entered into our system remains secure.