Social Security Administration

Important Information

THIS COVER LETTER IS FOR INFORMATION ONLY. DO NOT

COMPLETE THE FOLLOWING PAGES. THIS IS NOT AN

APPLICATION.

You may be eligible to get Extra Help paying for your prescription drugs.

The Medicare prescription drug program gives you a choice of prescription plans that offer various types of coverage. In addition, you may be able to get Extra Help to pay for the monthly premiums, annual deductibles, and co-payments related to the Medicare prescription drug program.

But before we can help you, you must fill out this application, put it in the enclosed envelope and mail it today. Or you may complete an online application at www.socialsecurity.gov. We will review your application and send you a letter to let you know if you qualify for Extra Help. To use the Extra Help, you must enroll in a Medicare prescription drug plan.

If you need help completing the application, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778). You can find more information at www.socialsecurity.gov.

You also may be able to get help from your State with other Medicare costs under the Medicare Savings Programs. By completing this form, you will start your application process for a Medicare Savings Program. We will send information to your State who will contact you to help you apply for a Medicare Savings Program unless you tell us not to by answering question 15 on this form.

If you need information about Medicare Savings Programs, Medicare prescription drug plans or how to enroll in a plan, call 1-800-MEDICARE (1-800-633-4227; TTY 1-877-486-2048) or visit www.medicare.gov. You also can request information about how to contact your State Health Insurance Counseling and Assistance Program (SHIP). The SHIP offers help with your Medicare questions.

Please mail your application today.

Carolyn W. Colvin

Acting Commissioner

Form SSA-1020B-OCR-SM-INST (01-2014) Recycle prior editions

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

General Instructions for Completing the Application for Extra Help with Medicare Prescription Drug Plan Costs

If You Are Assisting Someone Else With This Application

Answer the questions as if that person were completing the application. You must know that person’s Social Security number and financial information. Also, complete Section B on page 6.

Do you have Medicare and Supplemental Security Income (SSI) or Medicare and Medicaid?

If the answer is YES, do not complete this application because you automatically will get the

Extra Help.

Does your State Medicaid program pay your Medicare premiums because you belong to a Medicare Savings Program?

If the answer is YES, contact your State Medicaid office for more information. You could get the

Extra Help automatically and may not need to complete this application.

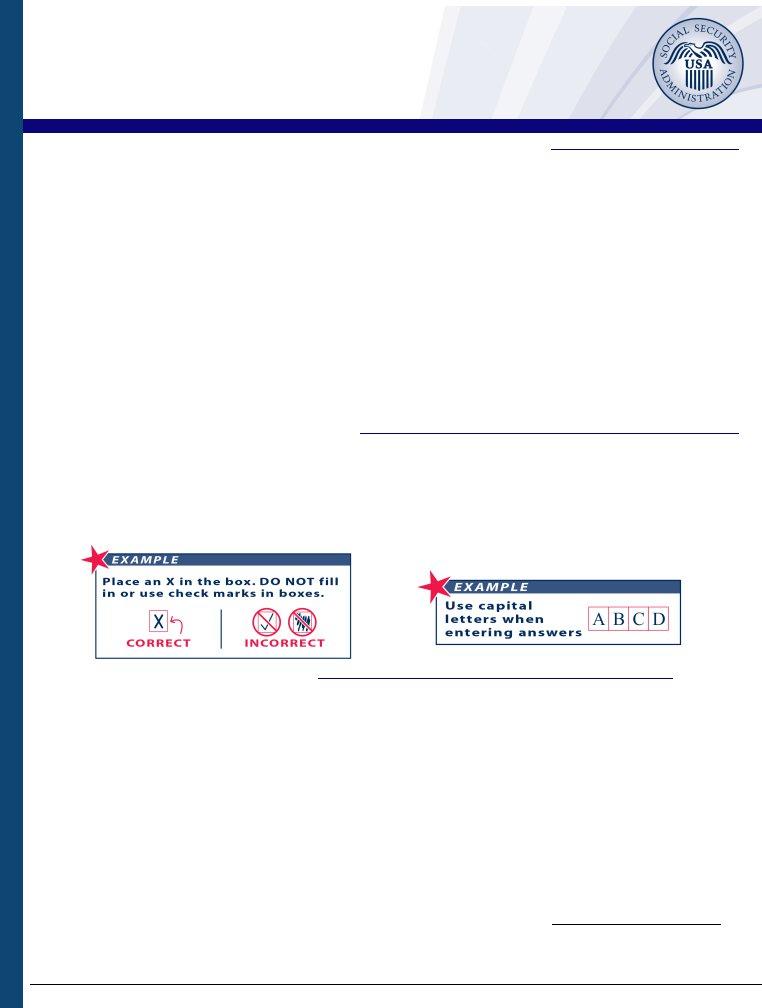

How To Complete This Application

•Use BLACK INK only;

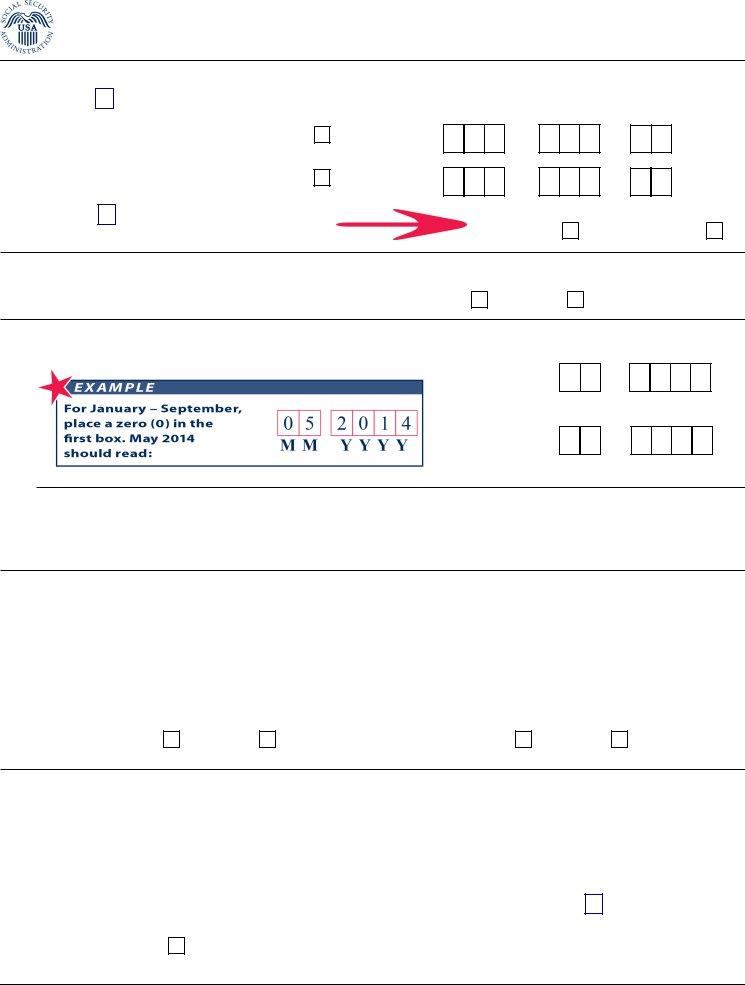

•Keep your numbers, letters and Xs inside the boxes; use only CAPITAL letters;

•Do not add any handwritten comments on the application;

•Do not use dollar signs when entering money amounts; and

•Cents can be rounded to the nearest whole dollar.

Completing Your Application

You may complete the online application at www.socialsecurity.gov or use the enclosed pre-addressed stamped envelope to return your completed and signed application to:

Social Security Administration

Wilkes-Barre Data Operations Center

P.O. Box 1020

Wilkes-Barre, PA 18767-9910

Return this application package in the enclosed envelope. Do not include anything else in the envelope. If we need more information, we will contact you.

NOTE: To apply, you must live in one of the 50 States or the District of Columbia.

If You Have Questions Or Need Help Completing This Application

You can call us toll-free at 1-800-772-1213, or if you are deaf or hard of hearing, you may call our TTY number, 1-800-325-0778.

Form SSA-1020B-OCR-SM-INST (01-2014) Page 1

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

Form Approved

OMB No. 0960-0696

Application for Extra Help with Medicare Prescription Drug Plan Costs

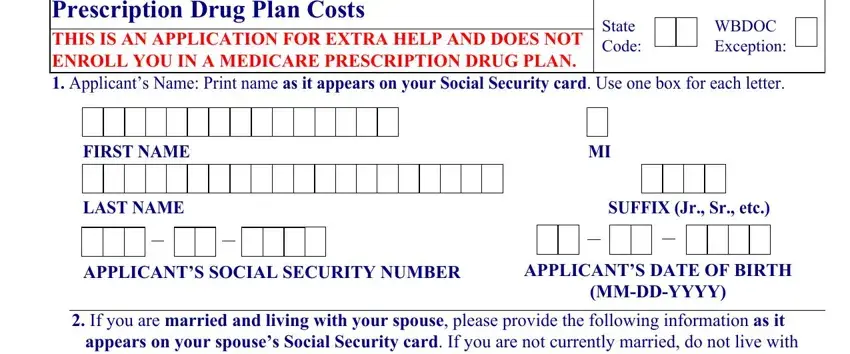

THIS IS AN APPLICATION FOR EXTRA HELP AND DOES NOT ENROLL YOU IN A MEDICARE PRESCRIPTION DRUG PLAN.

FOR OFFICIAL USE ONLY

State |

|

|

WBDOC |

Code: |

|

|

Exception: |

|

|

1.Applicant’s Name: Print name as it appears on your Social Security card. Use one box for each letter.

FIRST NAME |

|

|

|

|

|

|

MI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

|

|

|

|

|

|

|

SUFFIX (Jr., Sr., etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT’S DATE OF BIRTH |

APPLICANT’S SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM-DD-YYYY) |

2.If you are married and living with your spouse, please provide the following information as it appears on your spouse’s Social Security card. If you are not currently married, do not live with your spouse or are widowed, skip to question 3 and do not include any information about your spouse on this application.

LAST NAME |

|

|

|

|

SUFFIX (Jr., Sr., etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S SOCIAL SECURITY NUMBER |

SPOUSE’S DATE OF BIRTH |

|

(MM-DD-YYYY) |

If your spouse has Medicare, does he or she also wish to apply for the Extra Help? YES

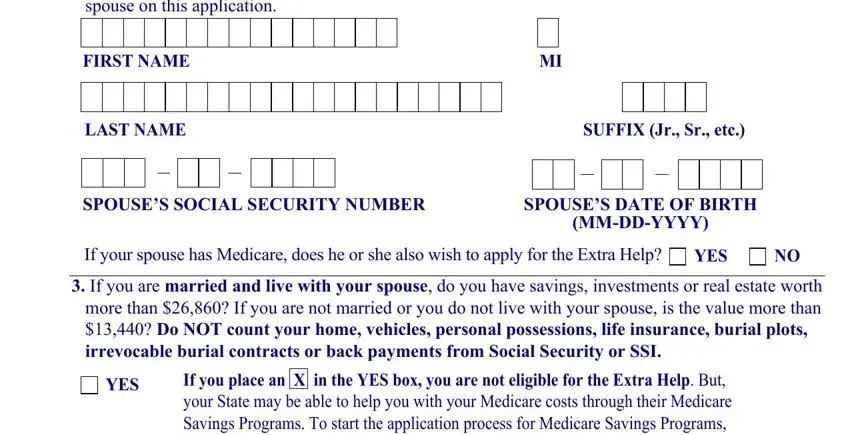

3.If you are married and live with your spouse, do you have savings, investments or real estate worth more than $26,860? If you are not married or you do not live with your spouse, is the value more than $13,440? Do NOT count your home, vehicles, personal possessions, life insurance, burial plots, irrevocable burial contracts or back payments from Social Security or SSI.

YES |

If you place an X in the YES box, you are not eligible for the Extra Help. But, |

|

|

your State may be able to help you with your Medicare costs through their Medicare |

Savings Programs. To start the application process for Medicare Savings Programs, skip to page 6, sign this application and return it to us. If you are not interested in Medicare Savings Programs, skip to question 15 on page 5.

NO or |

If you place an in X the NO or NOT SURE box, complete the rest of this |

NOT SURE |

application and return it to us. |

Form SSA-1020B-OCR-SM-INST (01-2014) Page 2

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

If you placed an X in the NO or NOT SURE box in question 3, answer all of the following questions. If you are married and living with your spouse, you must answer all of the questions for both of you.

4.Enter below money amounts of all bank accounts, investments or cash that you, your spouse, if married and living together, or both of you own. Also include items that either of you own with another person. Include only dollar figures not account numbers. If you or your spouse do not own any item listed, alone or with another person, place an X in the NONE box. Do NOT include a back payment from Social Security or SSI received in the last 10 months.

• |

Combined total of all bank accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(checking, savings and certificates |

NONE |

$ |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

of deposit) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Combined total of all stocks, bonds, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

savings bonds, mutual funds, |

NONE |

$ |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Retirement Accounts or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

other similar investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Any other cash at home or |

NONE |

$ |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

anywhere else |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.Will some money from the sources listed in question 4 be used to pay for funeral or burial expenses?

If YES, skip to question 6.

If NO, place an X in the NO box, then go to question 6.

6.Other than your home and the property on which it is located, do you or your spouse, if married and living together, own any real estate? Examples of other real estate are summer homes, rental properties or undeveloped land you own which is separate from your home.

7.For this question, a relative is someone related to you by blood, adoption, or marriage (but not including your spouse). How many relatives live with you and depend on you or your spouse for at least one-half of their financial support?

Please do not include yourself or your spouse in the number you enter. If your household consists only of you or you and your spouse, place an X in the ZERO box. Place an X in only one box.

ZERO 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 or more |

Form SSA-1020B-OCR-SM-INST (01-2014) Page 3

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

8.If you or your spouse, if married and living together, receive income from any of the sources listed below, you must answer the questions for both of you. Please enter the total amount you receive each month. If the amount changes from month to month or you do not receive it every month, enter the average monthly income for the past year for each type in the appropriate boxes. Do not list wages and self-employment, interest income, public assistance, medical reimbursements or foster care payments here. If you or your spouse do not receive income from a source listed below, place an X in the NONE box for that source.

|

|

|

|

|

|

|

|

|

Monthly Benefit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Social Security benefits |

NONE |

$ |

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

before deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Railroad Retirement benefits |

NONE |

$ |

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

before deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Veterans benefits before deductions |

NONE |

$ |

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Other pensions or annuities before |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deductions. Do not include money |

NONE |

$ |

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

you receive from any item you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

included in question 4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Other income not listed above, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

including alimony, net rental income, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

workers compensation, unemployment, |

NONE |

$ |

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

private or State disability payments, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Specify): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.Have any of the amounts you included in question 8 decreased during the last two years?

If you have worked in the last two years, you need to answer questions 10-14. If you are married and living with your spouse and either one of you has worked in the last two years, you need to answer questions 10-14. Otherwise, skip to question 15.

10.What do you expect to earn in wages before taxes and deductions this calendar year?

Form SSA-1020B-OCR-SM-INST (01-2014) Page 4

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

11.What do you expect your net earnings from self-employment to be this calendar year? Place an X in the NONE box if you are not self-employed and go to question 12.

YOU:

SPOUSE:

Place an X in the box(es) if you or your spouse expect a net loss.

12.Have the amounts you included in questions 10 or 11 decreased in the last two years?

13.If you or your spouse, stopped working in 2013 or 2014, or plan to stop working in 2014 or 2015, enter the month and year.

YOU:

M M Y Y Y Y

SPOUSE:

M M Y Y Y Y

If you are younger than age 65, answer question 14. If you are married and living with your spouse and either one of you is younger than age 65, continue to question 14. Otherwise, skip to question 15.

14.Do you or your spouse have to pay for things that enable you to work? We will count only a part of your earnings toward the income limit if you work and receive Social Security benefits based

on a disability or blindness and you have work-related expenses for which you are not reimbursed. Examples of such expenses are: the cost of medical treatment and drugs for AIDS, cancer, depression or epilepsy; a wheelchair; personal attendant services; vehicle modifications, driver assistance or other special work-related transportation needs; work-related assistive technology; guide dog expenses; sensory and visual aids; and Braille translations.

15.Information about Medicare Savings Programs: You may be able to get help from your State with your Medicare costs under the Medicare Savings Programs. To start your application process for the Medicare Savings Programs, Social Security will send information from this form to your State unless you tell us not to. If you want to get help from the Medicare Savings Programs, do not complete this question. Just sign and date the application and your State will contact you.

If you are not interested in filing for the Medicare Savings Programs, place an

No, do not send the information to the State.

Form SSA-1020B-OCR-SM-INST (01-2014) Page 5

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

Signatures

IMPORTANT INFORMATION - PLEASE READ CAREFULLY

I/We understand that the Social Security Administration (SSA) will check my/our statements and compare its records with records from Federal, State, and local government agencies, including the Internal Revenue Service (IRS) to make sure the determination is correct.

By submitting this application, I am/we are authorizing SSA to obtain and disclose information related to my/our income, resources, and assets, foreign and domestic, consistent with applicable privacy laws. This information may include, but is not limited to, information about my/our wages, account balances, investments, benefits, and pensions. Unless I/we answered “No” to Question 15, I am/we are authorizing SSA to disclose to the State the financial information listed above and other individually identifiable information from my/our file, such as my/our name(s), date of birth, gender and Social Security number(s) to start the application process for Medicare Savings Programs. I/We declare under penalty of perjury that I/we have examined all the information on this form and it is true and correct to the best of my/our knowledge.

Please complete Section A. If you cannot sign, a representative may sign for you. If someone assisted you, complete Section B as well.

Section A

Your Signature: |

|

Date: |

|

|

|

Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's Signature: |

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

State: |

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you changed your mailing address within the last three months, place an |

|

|

here: |

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you would prefer that we contact someone else if we have additional questions, please provide the person’s name and a daytime phone number.

If someone assisted you, place an information requested below.

in the box that describes that person and provide the rest of the

Other Advocate

Social Worker

Form SSA-1020B-OCR-SM-INST (01-2014) Page 6

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

Privacy Act / Paperwork Reduction Notice

Section 1860 D-14 of the Social Security Act, as amended, authorizes us to collect this information. We will use the information you provide to determine if you are eligible for help paying your share of the cost of a Medicare prescription drug plan.

Furnishing us this information is voluntary. However, failing to provide us with all or part of the information could prevent us from making an accurate and timely decision on your application.

We rarely use the information you supply for any purpose other than to determine your eligibility for Extra Help with Medicare Prescription Drug Plan Costs. We may also disclose information to another person or to another agency in accordance with approved routine uses, which include but are not limited to the following:

1.To enable a third party or an agency to assist Social Security in establishing rights to Social Security benefits and/or coverage;

2.To comply with Federal laws requiring the release of information from Social Security records (e.g., to the Government Accountability Office and Department of Veterans’ Affairs);

3.To make determinations for eligibility in similar health and income maintenance programs at the Federal, State, and local level; and,

4.To facilitate statistical research, audit, or investigative activities necessary to assure the integrity and improvement of Social Security programs (e.g., to the Bureau of the Census and private concerns under contract to Social Security).

We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person’s eligibility for federally-funded or administered benefit programs and for repayment of payments or delinquent debts under these programs.

A complete list of routine uses for this information are available in Systems of Records Notices entitled, Master Beneficiary Record, 60-0090, and Medicare Database File, 60-0321. These notices, additional information regarding this form, and information regarding our programs and systems, are available on-line at www.socialsecurity.gov or at your local Social Security office.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C.

§3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. The OMB control number for this collection is 0960-0696. We estimate that it will take 30 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401.

SEND THE COMPLETED FORM TO US AT THE ADDRESS SHOWN ON THE ENCLOSED PRE-ADDRESSED, POSTAGE-PAID ENVELOPE:

Social Security Administration

Wilkes-Barre Data Operations Center

P.O. Box 1020

Wilkes-Barre, PA 18767-9910

Form SSA-1020B-OCR-SM-INST (01-2014) Page 7