By using the online tool for PDF editing by FormsPal, you can easily complete or edit form 21 right here. The editor is continually improved by our team, acquiring awesome features and growing to be better. For anyone who is looking to get started, here is what it takes:

Step 1: Access the PDF in our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: With the help of our state-of-the-art PDF tool, you can accomplish more than merely complete forms. Edit away and make your forms appear sublime with custom textual content added, or modify the original content to perfection - all that backed up by the capability to insert just about any photos and sign it off.

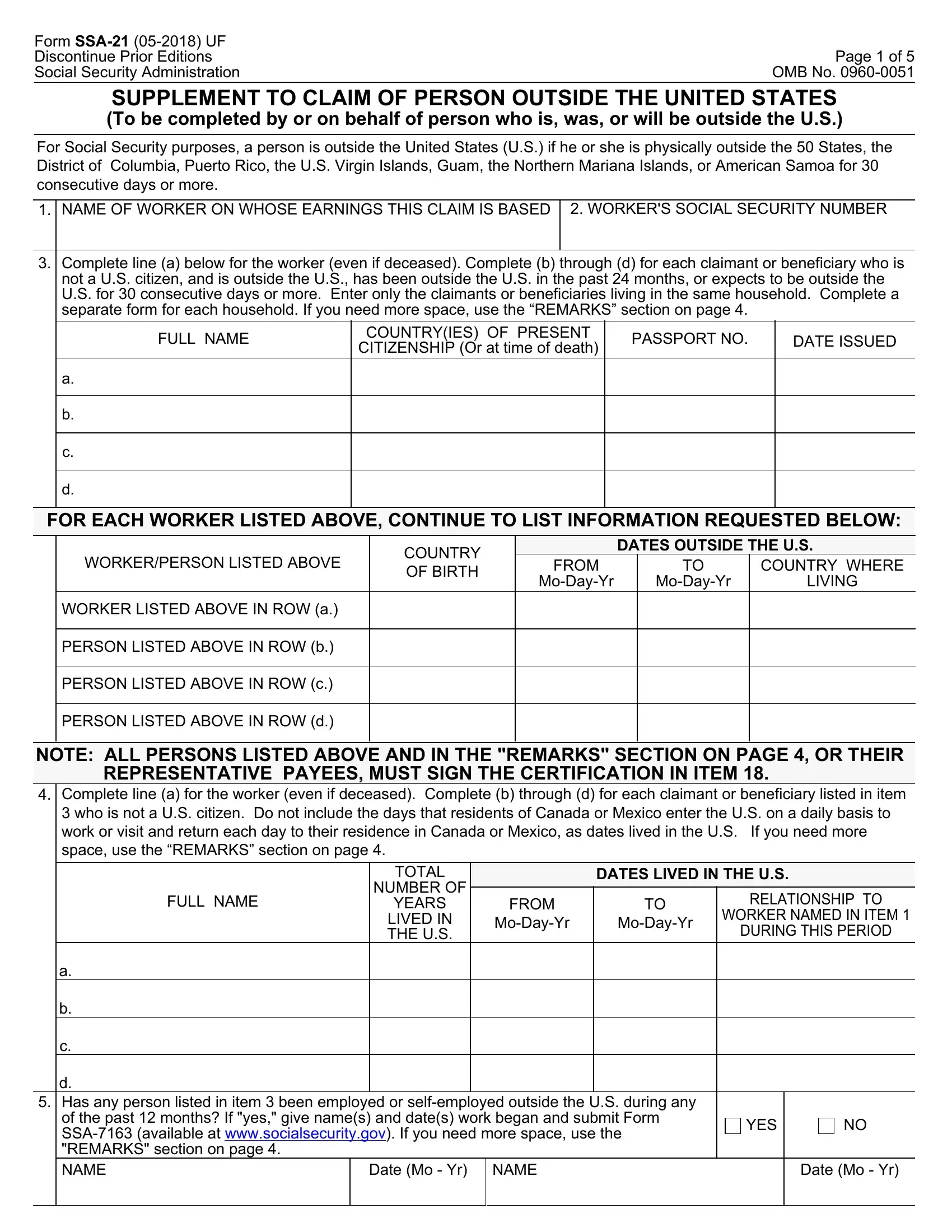

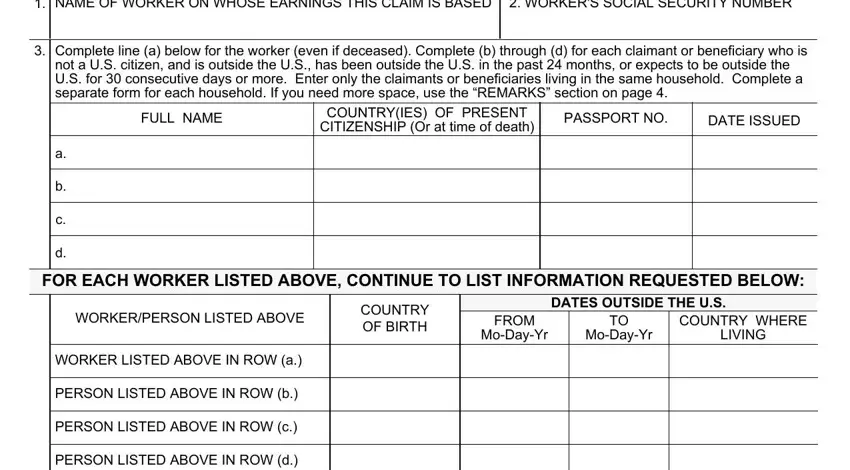

As for the blanks of this specific form, this is what you need to do:

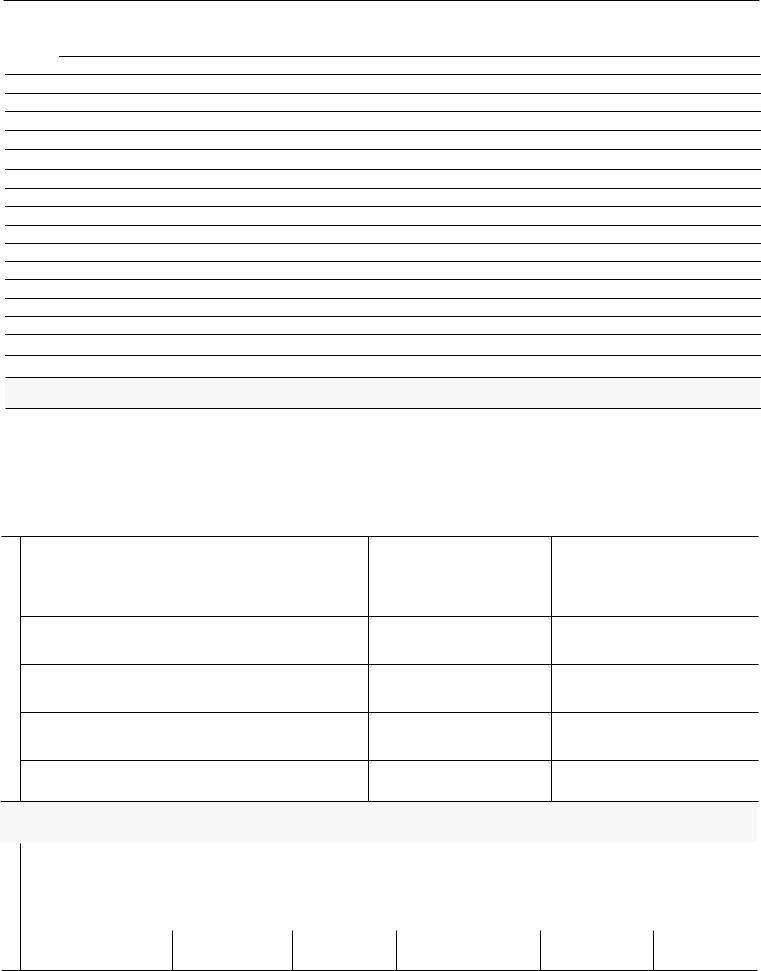

1. Whenever completing the form 21, ensure to include all needed fields in its associated area. This will help facilitate the process, making it possible for your information to be handled efficiently and accurately.

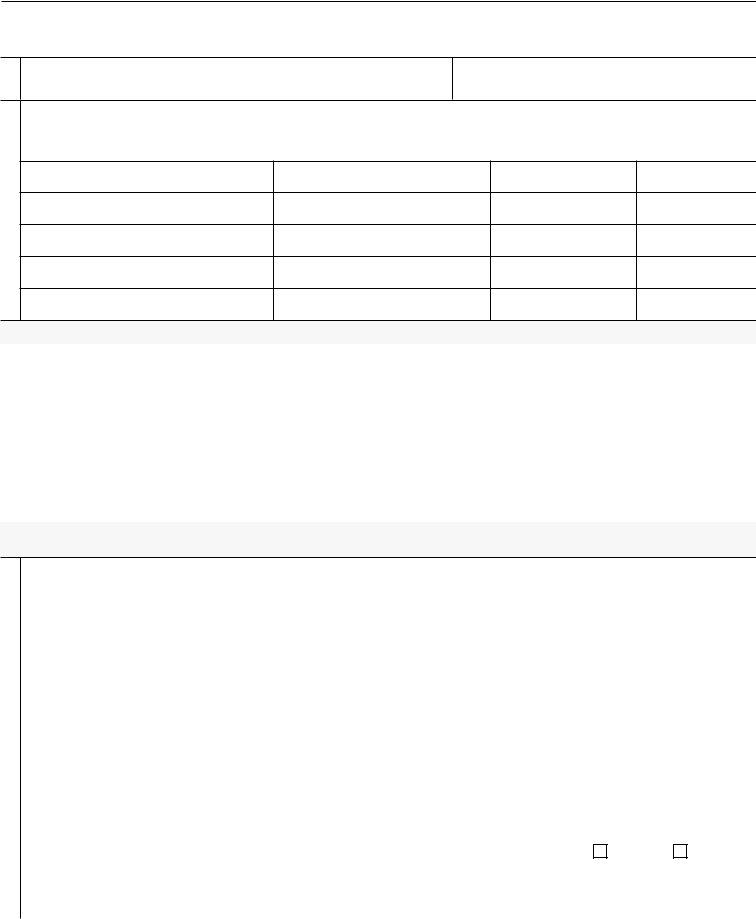

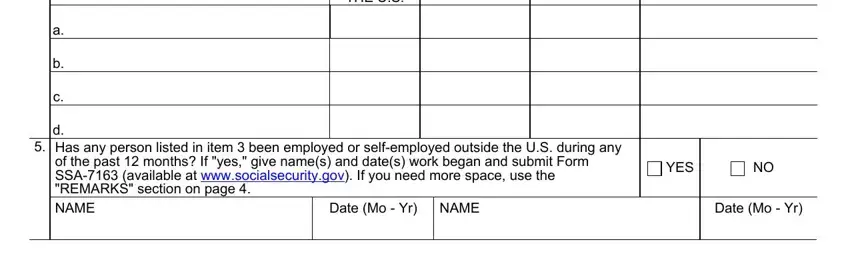

2. Once your current task is complete, take the next step – fill out all of these fields - YEARS LIVED IN THE US, DURING THIS PERIOD, d Has any person listed in item, Date Mo Yr, NAME, YES, and Date Mo Yr with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

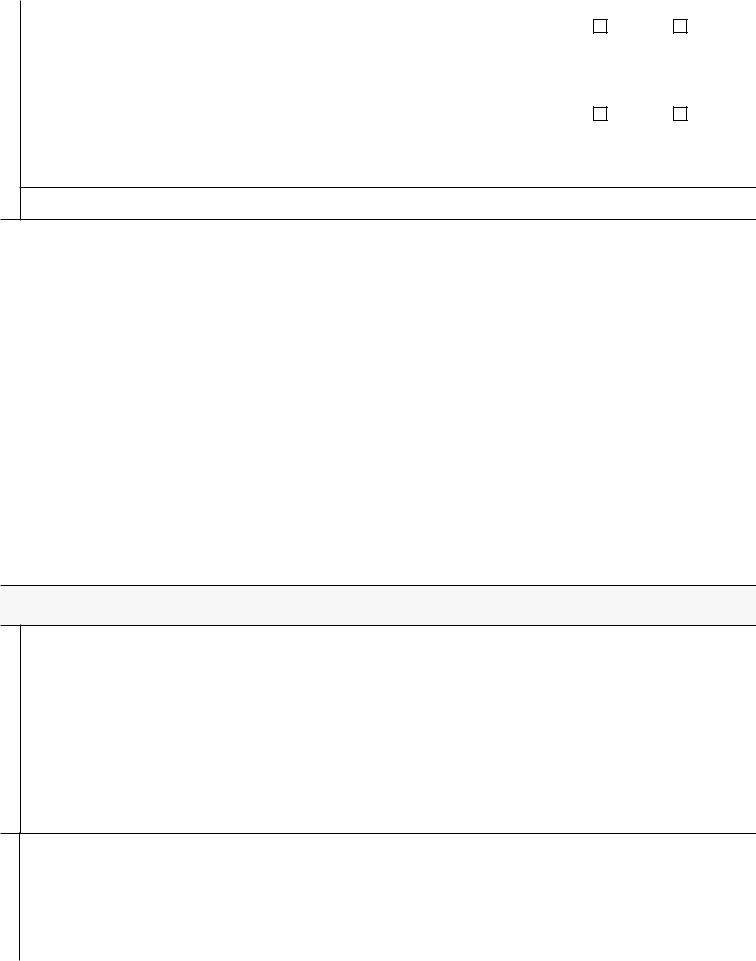

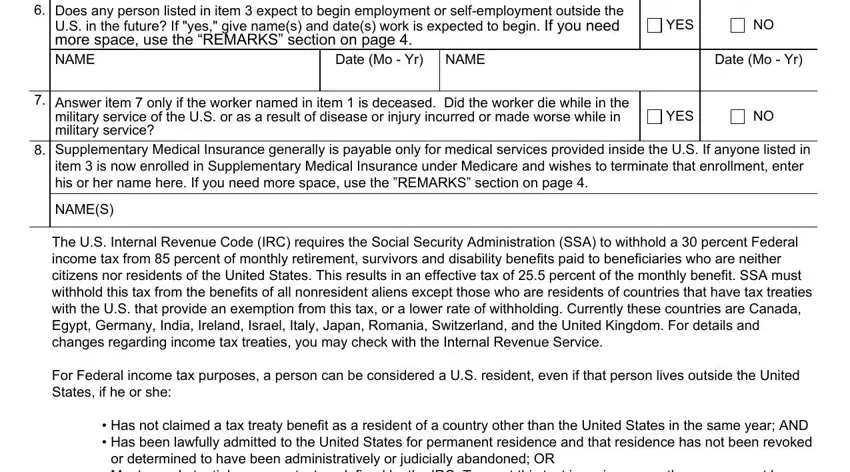

3. This next part is mostly about Does any person listed in item, Date Mo Yr, NAME, YES, Date Mo Yr, Answer item only if the worker, YES, Supplementary Medical Insurance, item is now enrolled in, NAMES, The US Internal Revenue Code IRC, Has not claimed a tax treaty, or determined to have been, and Meets a substantial presence test - type in each of these fields.

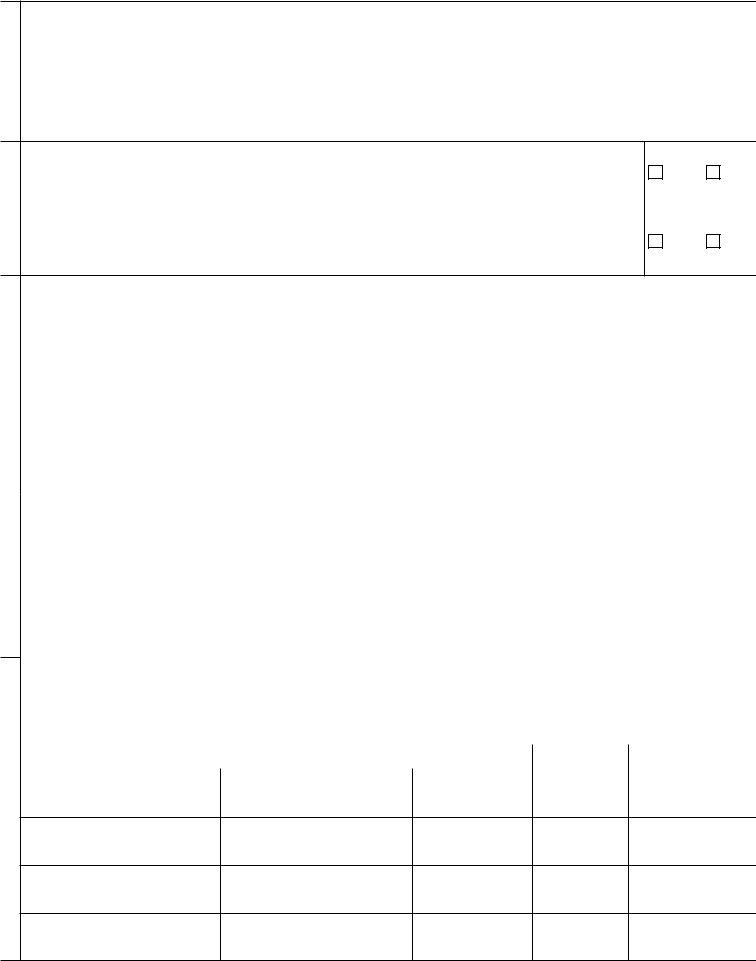

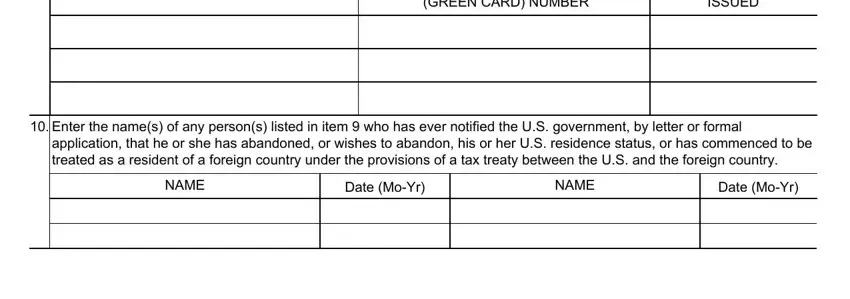

4. This specific subsection comes with the next few fields to type in your information in: NAME, GREEN CARD NUMBER, ISSUED, Enter the names of any persons, NAME, Date MoYr, NAME, and Date MoYr.

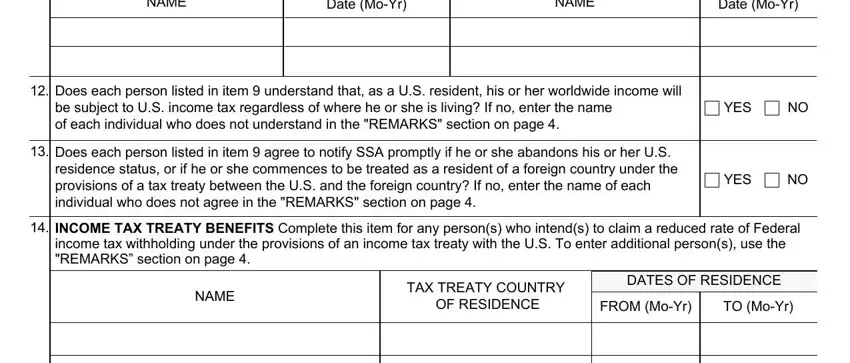

5. This very last section to finish this PDF form is critical. You'll want to fill in the required blanks, which includes NAME, Date MoYr, NAME, Date MoYr, Does each person listed in item, YES, Does each person listed in item, residence status or if he or she, YES, INCOME TAX TREATY BENEFITS, income tax withholding under the, NAME, TAX TREATY COUNTRY, OF RESIDENCE, and DATES OF RESIDENCE, before finalizing. In any other case, it could end up in a flawed and potentially incorrect form!

Always be very careful when filling out Date MoYr and INCOME TAX TREATY BENEFITS, as this is the section in which a lot of people make errors.

Step 3: Be certain that the details are correct and just click "Done" to finish the project. Try a 7-day free trial account at FormsPal and acquire immediate access to form 21 - readily available from your FormsPal account. At FormsPal.com, we strive to be sure that all of your information is maintained secure.