There is nothing challenging related to working with the form appeal repayment when you launch our tool. Following these simple steps, you can obtain the prepared document within the least period possible.

Step 1: Press the "Get Form Now" button to begin the process.

Step 2: The instant you get into our form appeal repayment editing page, there'll be all of the options you can undertake with regards to your template in the upper menu.

These particular sections are going to make up your PDF document:

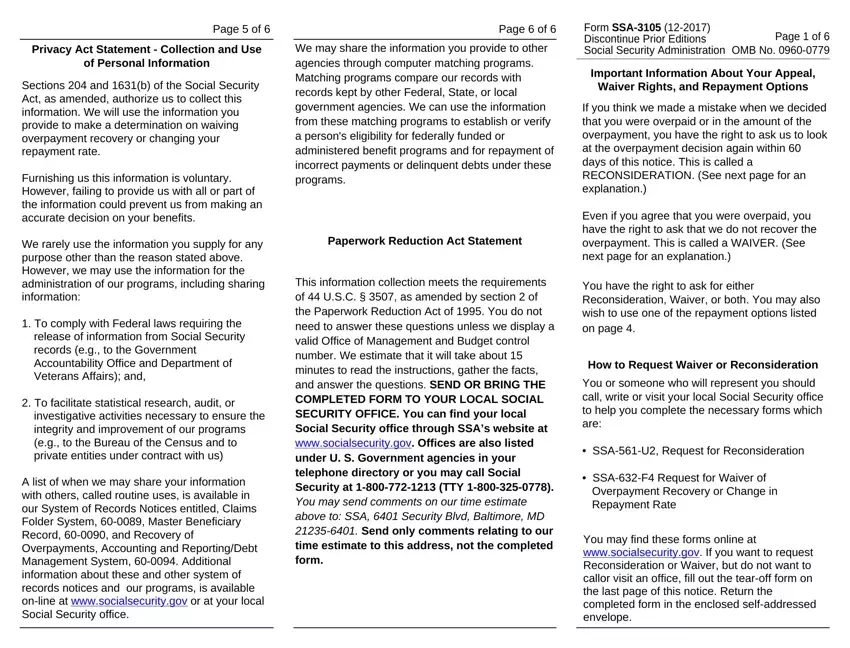

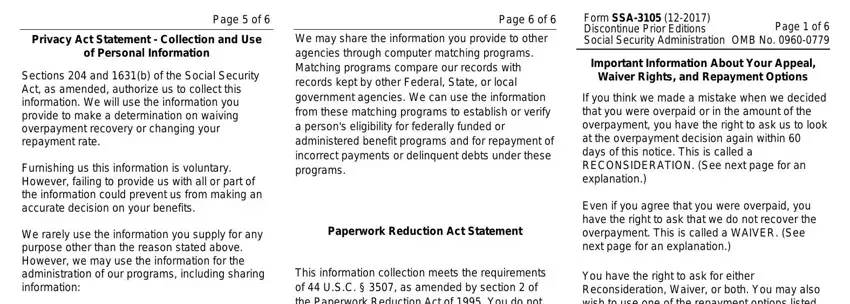

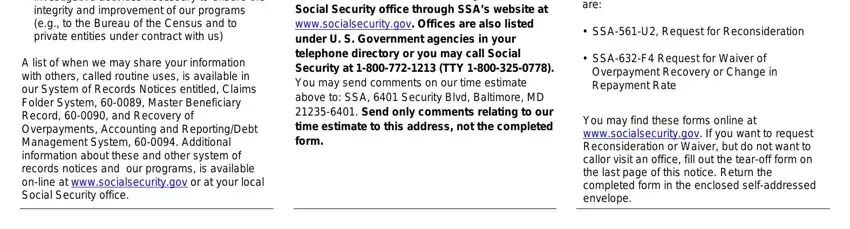

The application will demand you to prepare the investigative activities necessary, A list of when we may share your, This information collection meets, You or someone who will represent, SSAU Request for Reconsideration, SSAF Request for Waiver of, Overpayment Recovery or Change in, and You may find these forms online at part.

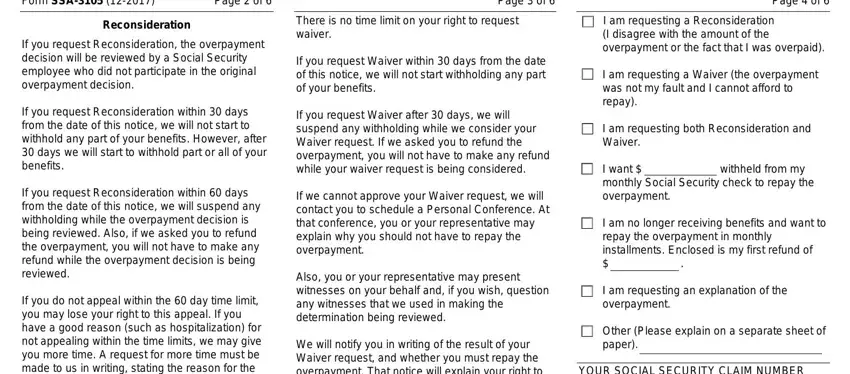

The application will demand you to give specific fundamental info to instantly fill in the field Form SSA, Page of, Page of, Page of, Reconsideration, If you request Reconsideration the, There is no time limit on your, If you request Waiver within days, If you request Reconsideration, If you request Waiver after days, If you request Reconsideration, If you do not appeal within the, If we cannot approve your Waiver, Also you or your representative, and We will notify you in writing of.

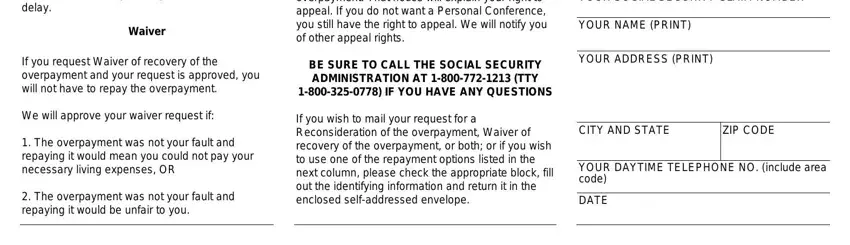

The If you do not appeal within the, Waiver, We will notify you in writing of, If you request Waiver of recovery, BE SURE TO CALL THE SOCIAL, YOUR SOCIAL SECURITY CLAIM NUMBER, YOUR NAME PRINT, YOUR ADDRESS PRINT, We will approve your waiver, The overpayment was not your, The overpayment was not your, If you wish to mail your request, CITY AND STATE, ZIP CODE, and YOUR DAYTIME TELEPHONE NO include area is the place to include the rights and obligations of each party.

Step 3: Select "Done". Now you may export the PDF form.

Step 4: You will need to create as many duplicates of the form as possible to remain away from future complications.