social security direct deposit form can be filled in online in no time. Just make use of FormsPal PDF tool to do the job without delay. We are committed to making sure you have the absolute best experience with our tool by continuously releasing new capabilities and improvements. Our editor has become even more user-friendly with the most recent updates! Now, editing PDF documents is a lot easier and faster than ever before. In case you are seeking to begin, here is what it's going to take:

Step 1: First of all, access the editor by clicking the "Get Form Button" above on this page.

Step 2: When you access the editor, you will get the form made ready to be filled out. Aside from filling out various blank fields, you may as well perform some other actions with the file, that is writing custom textual content, editing the original text, inserting graphics, affixing your signature to the PDF, and a lot more.

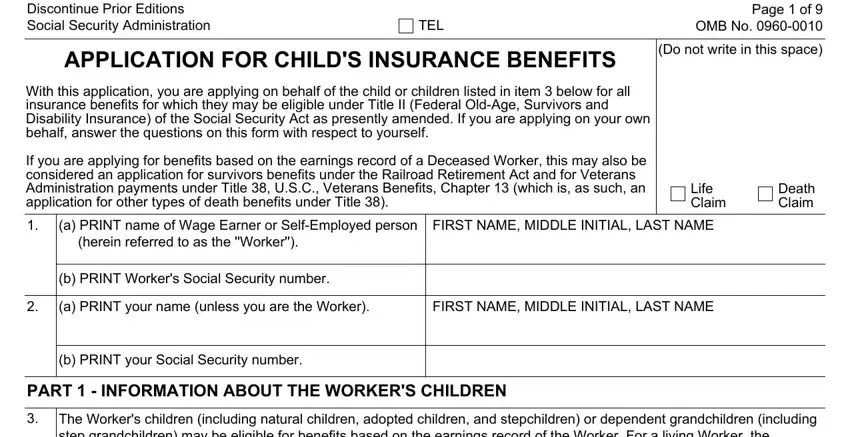

This PDF doc needs some specific information; in order to ensure accuracy and reliability, take the time to heed the following suggestions:

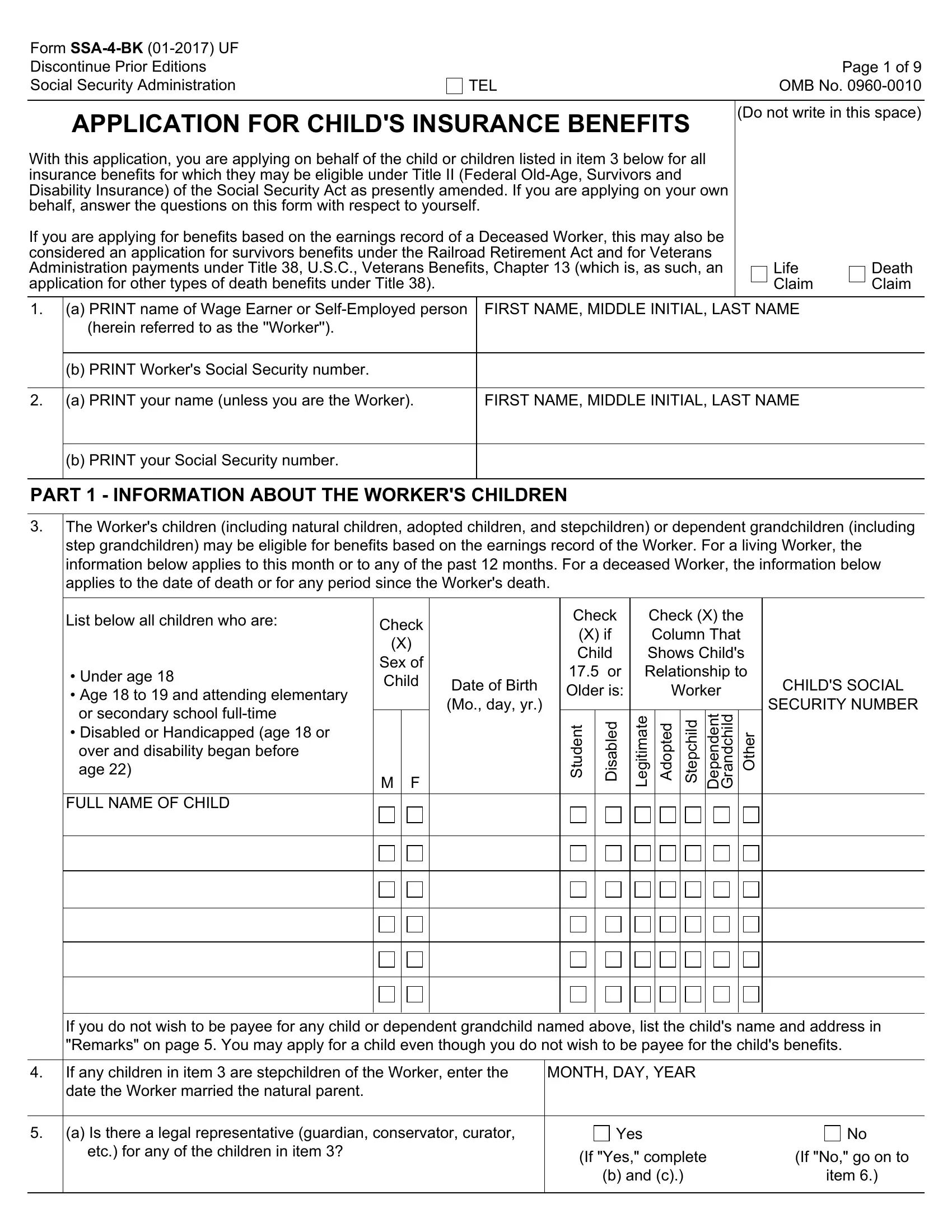

1. You will need to complete the social security direct deposit form accurately, hence take care while working with the parts comprising all of these blank fields:

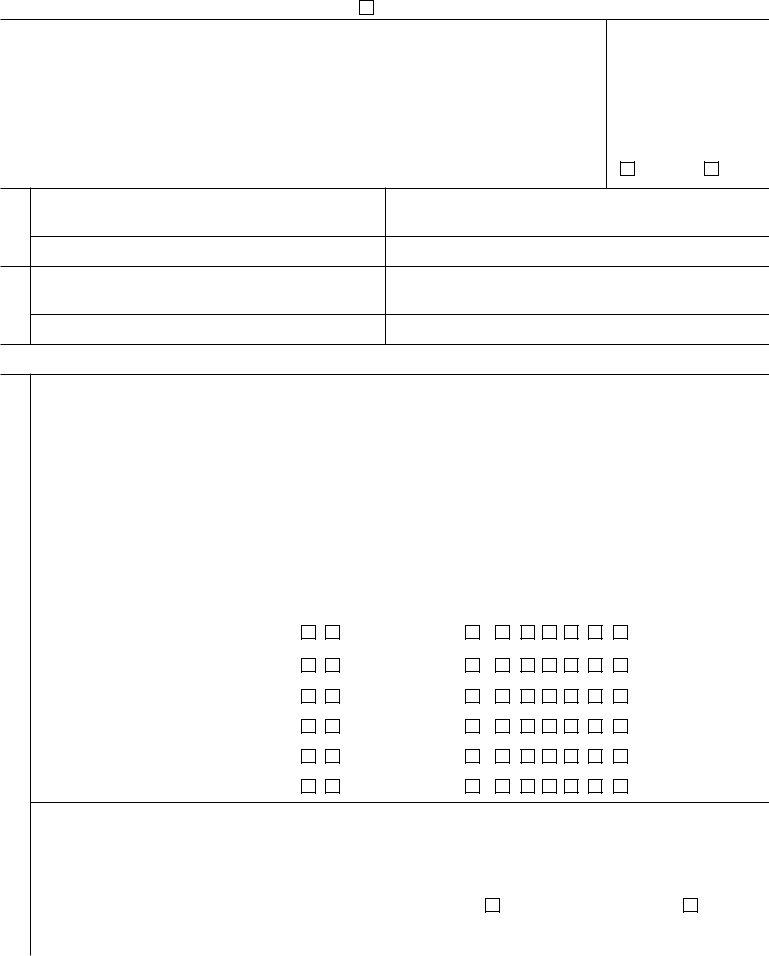

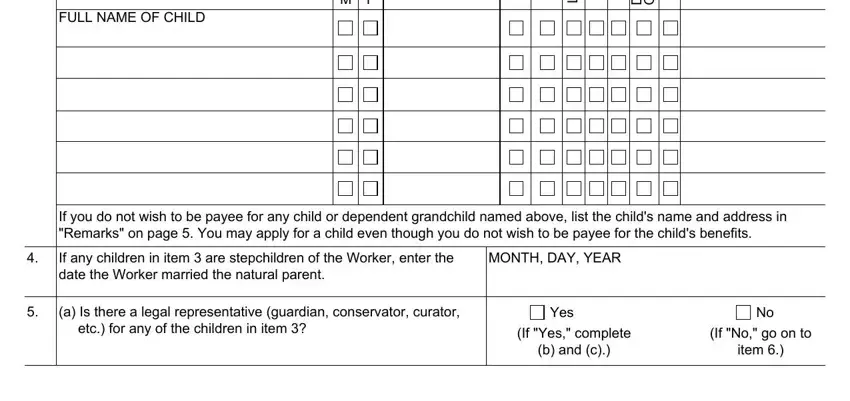

2. Once your current task is complete, take the next step – fill out all of these fields - FULL NAME OF CHILD, M F, g e L, h c p e S, n e d n e p e D, h c d n a r G, If you do not wish to be payee for, If any children in item are, MONTH DAY YEAR, a Is there a legal representative, Yes, If Yes complete, b and c, If No go on to, and item with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

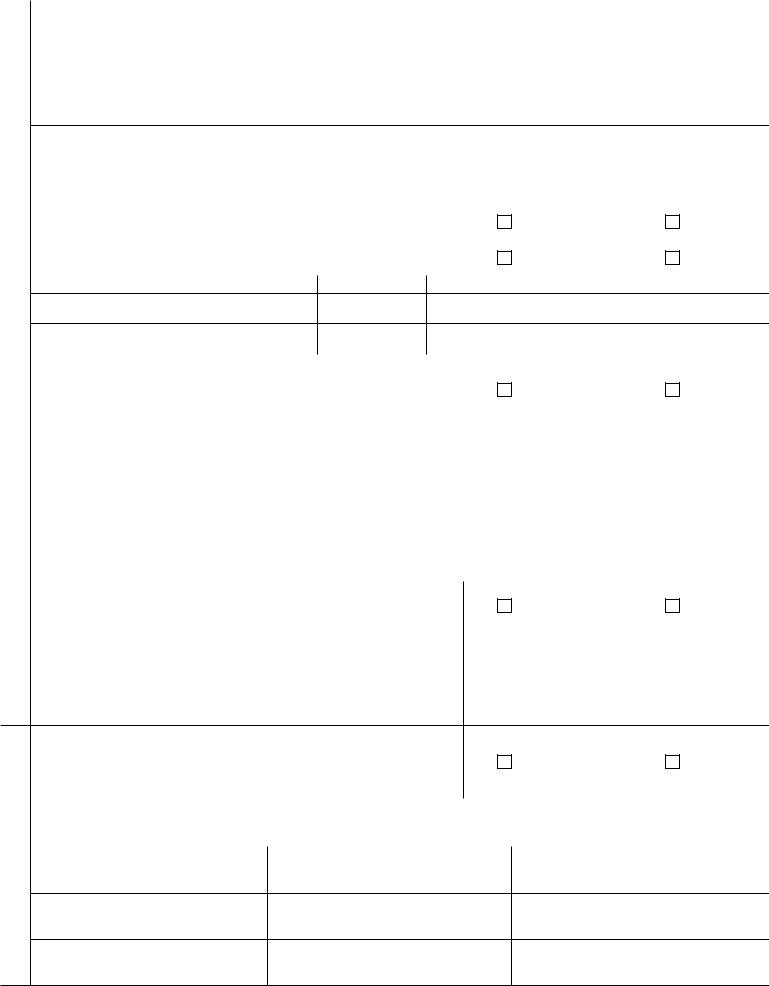

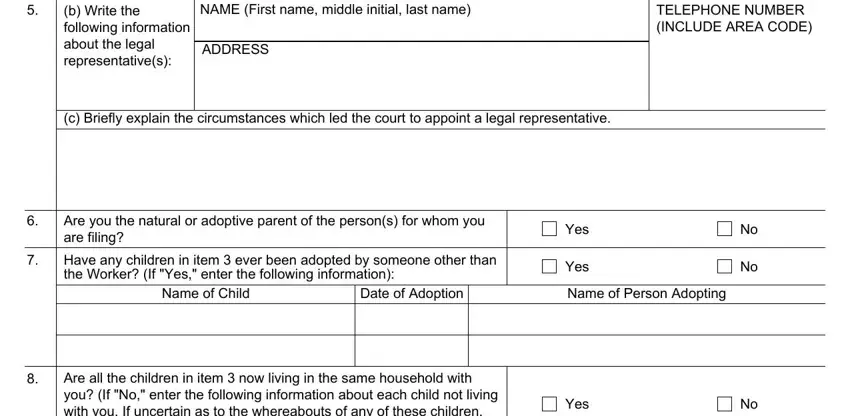

3. Your next stage is going to be easy - fill out every one of the blanks in b Write the following information, NAME First name middle initial, ADDRESS, TELEPHONE NUMBER INCLUDE AREA CODE, c Briefly explain the, Are you the natural or adoptive, Have any children in item ever, Yes, Yes, Name of Child, Date of Adoption, Name of Person Adopting, Are all the children in item now, and Yes to complete this part.

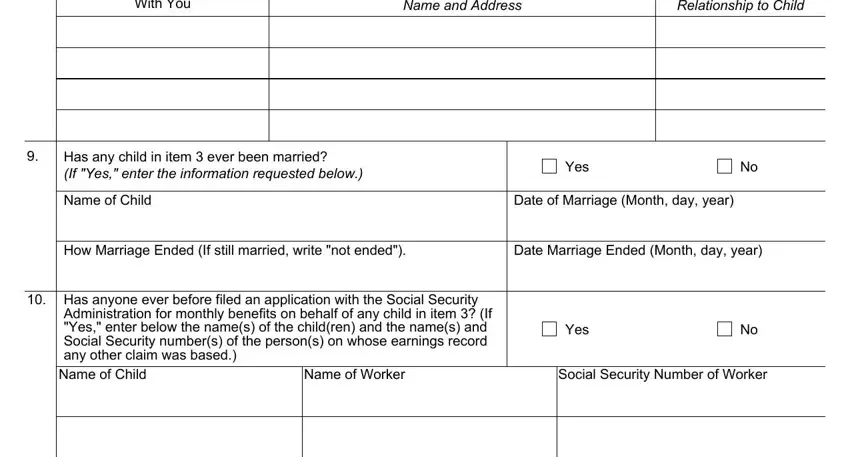

4. This next section requires some additional information. Ensure you complete all the necessary fields - With You, Name and Address, Relationship to Child, Has any child in item ever been, Yes, Name of Child, Date of Marriage Month day year, How Marriage Ended If still, Date Marriage Ended Month day year, Has anyone ever before filed an, Administration for monthly, Name of Worker, Yes, and Social Security Number of Worker - to proceed further in your process!

People who use this PDF frequently make mistakes while filling out Date Marriage Ended Month day year in this part. Ensure you reread everything you enter here.

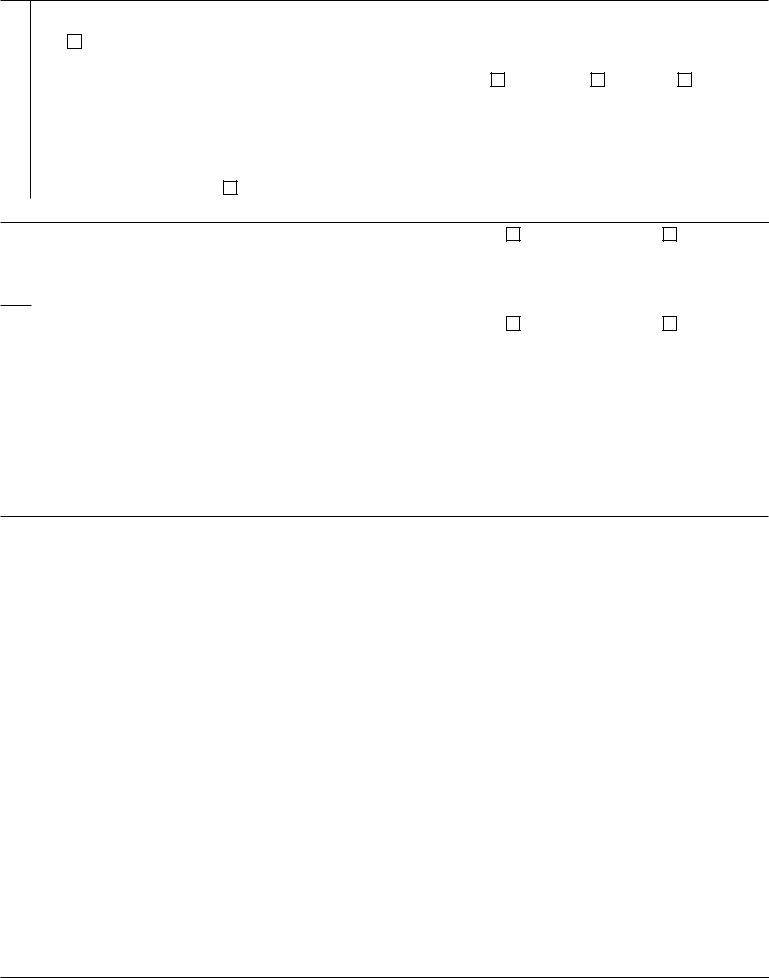

5. The pdf should be finished with this part. Below one can find a full set of blank fields that require accurate details for your form usage to be complete: .

Step 3: Right after looking through your fields you have filled in, press "Done" and you're good to go! Join FormsPal right now and immediately access social security direct deposit form, prepared for download. All modifications you make are preserved , letting you modify the form later on as needed. FormsPal is devoted to the confidentiality of our users; we make sure that all personal data coming through our tool stays confidential.