It is possible to prepare the social security ssa 8 file with our PDF editor. These actions will enable you to immediately prepare your document.

Step 1: Choose the "Get Form Here" button.

Step 2: Now, you can begin modifying the social security ssa 8. Our multifunctional toolbar is readily available - insert, delete, adjust, highlight, and conduct similar commands with the words and phrases in the document.

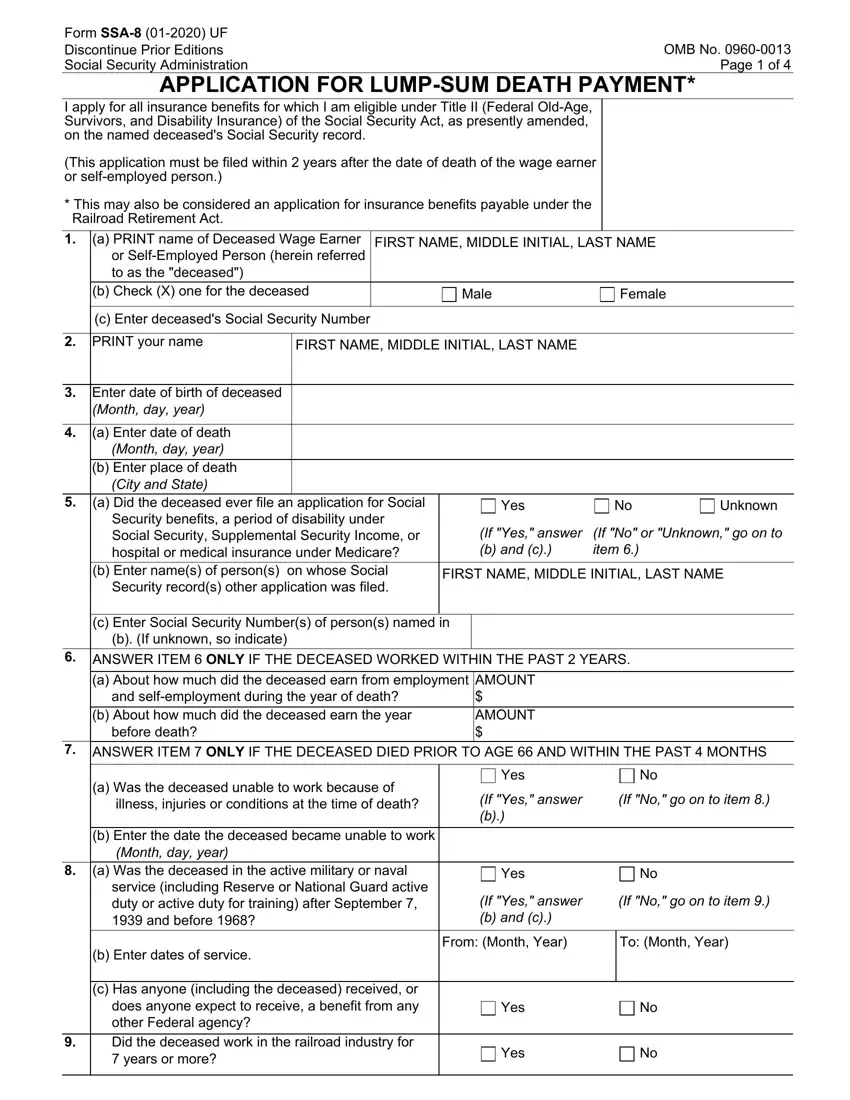

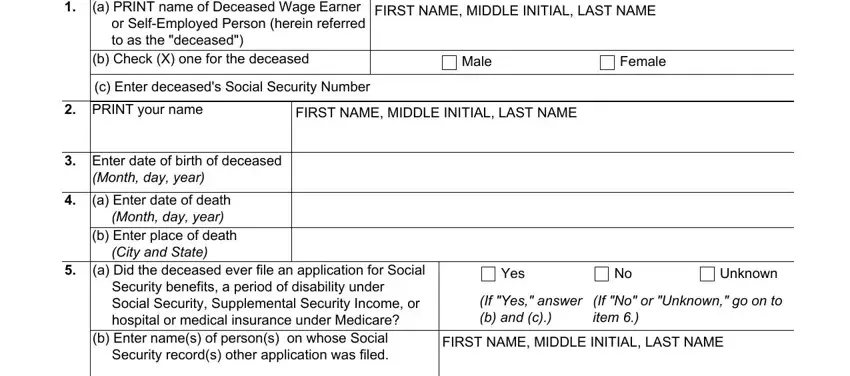

The PDF template you wish to fill in will contain the next areas:

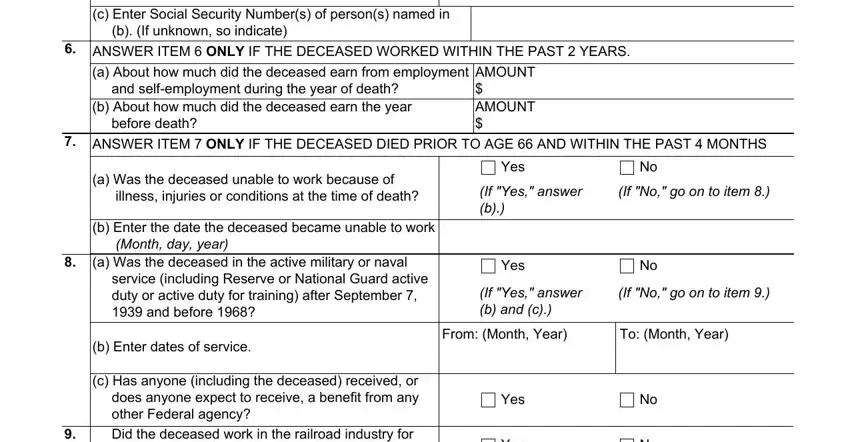

Remember to fill out the c Enter Social Security Numbers of, AMOUNT AMOUNT, a Was the deceased unable to work, b Enter the date the deceased, b Enter dates of service, Yes, If Yes answer b, If No go on to item, Yes, If Yes answer b and c, If No go on to item, From Month Year, To Month Year, c Has anyone including the, and Yes space with the required data.

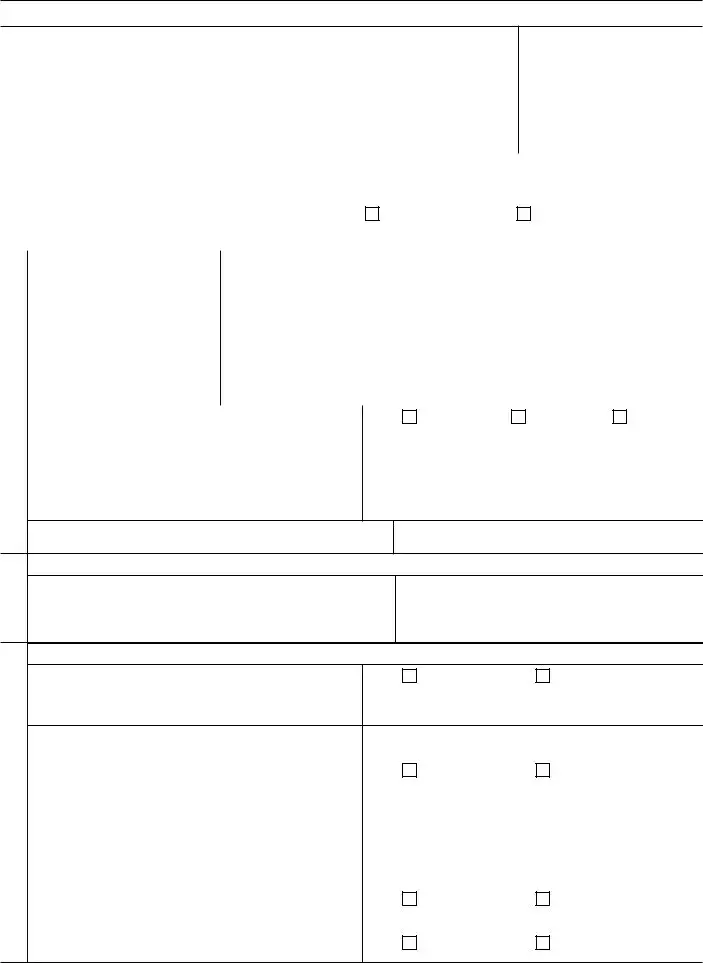

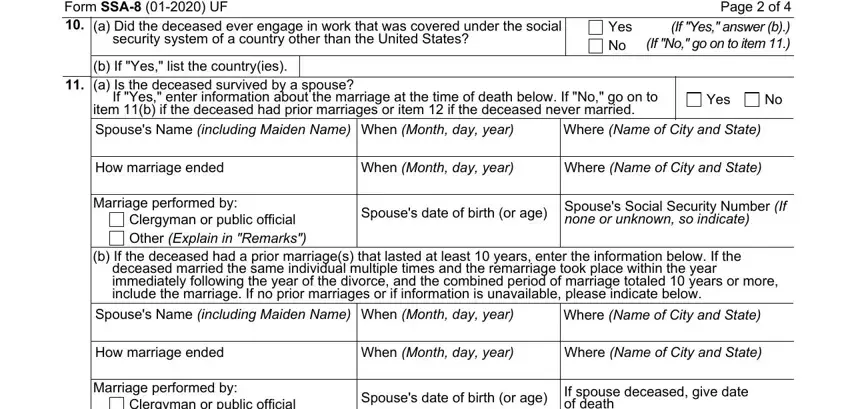

It is vital to put down some particulars inside the section Form SSA UF, a Did the deceased ever engage in, Page of If Yes answer b If No go, Yes No, b If Yes list the countryies a Is, Where Name of City and State, Yes, How marriage ended, When Month day year, Where Name of City and State, Marriage performed by, Clergyman or public official Other, Spouses date of birth or age, none or unknown so indicate, and b If the deceased had a prior.

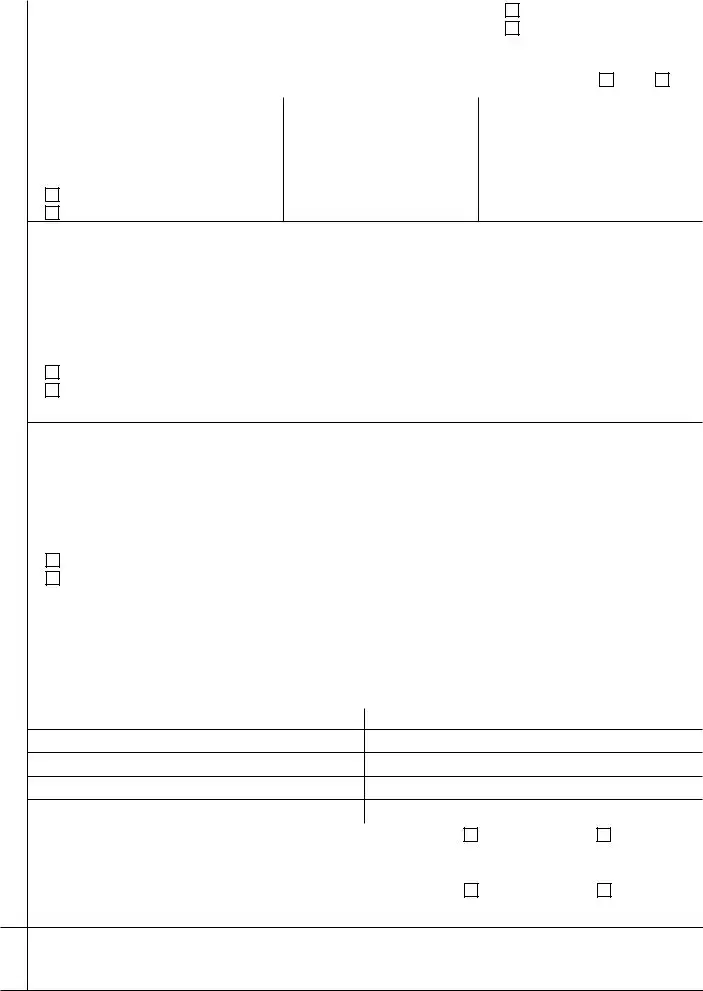

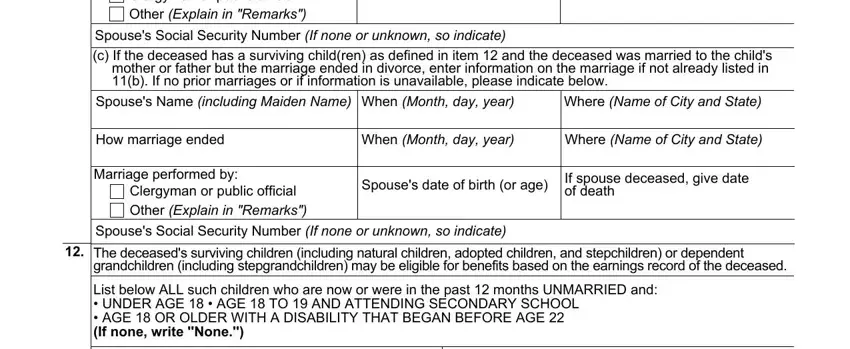

The Clergyman or public official Other, If spouse deceased give date of, Spouses Social Security Number If, Where Name of City and State, How marriage ended, When Month day year, Where Name of City and State, Marriage performed by, Clergyman or public official Other, Spouses date of birth or age, If spouse deceased give date of, Spouses Social Security Number If, The deceaseds surviving children, and List below ALL such children who field is the place to indicate the rights and obligations of each side.

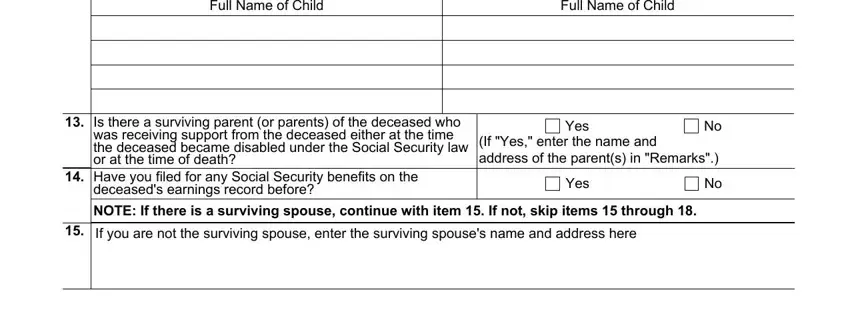

Finalize by reviewing the next fields and filling out the required data: Full Name of Child, Full Name of Child, Is there a surviving parent or, Yes If Yes enter the name and, Yes, NOTE If there is a surviving, and If you are not the surviving.

Step 3: Choose the "Done" button. Now, you may transfer the PDF document - upload it to your device or forward it via electronic mail.

Step 4: Create copies of the file. This should prevent possible misunderstandings. We do not look at or display your information, hence feel comfortable knowing it will be secure.