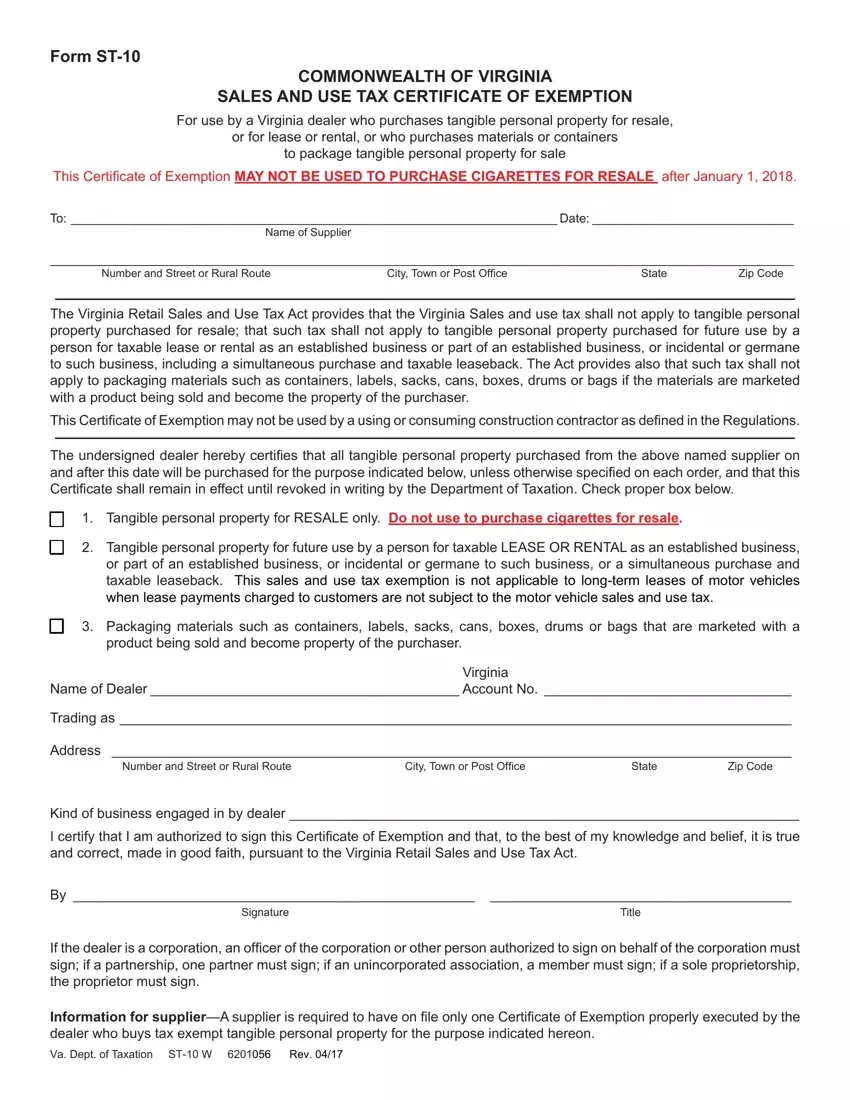

Form ST-10

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by a Virginia dealer who purchases tangible personal property for resale,

or for lease or rental, or who purchases materials or containers

to package tangible personal property for sale

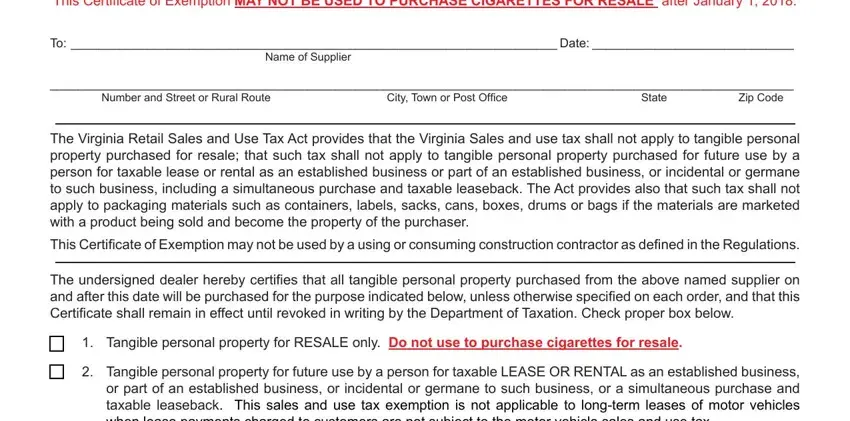

This Certiicate of Exemption MAY NOT BE USED TO PURCHASE CIGARETTES FOR RESALE after January 1, 2018.

To: ______________________________________________________________________ Date: _____________________________

Name of Supplier

___________________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town or Post Ofice |

State |

Zip Code |

The Virginia Retail Sales and Use Tax Act provides that the Virginia Sales and use tax shall not apply to tangible personal property purchased for resale; that such tax shall not apply to tangible personal property purchased for future use by a person for taxable lease or rental as an established business or part of an established business, or incidental or germane to such business, including a simultaneous purchase and taxable leaseback. The Act provides also that such tax shall not apply to packaging materials such as containers, labels, sacks, cans, boxes, drums or bags if the materials are marketed

with a product being sold and become the property of the purchaser.

This Certiicate of Exemption may not be used by a using or consuming construction contractor as deined in the Regulations.

The undersigned dealer hereby certiies that all tangible personal property purchased from the above named supplier on and after this date will be purchased for the purpose indicated below, unless otherwise speciied on each order, and that this Certiicate shall remain in effect until revoked in writing by the Department of Taxation. Check proper box below.

1.Tangible personal property for RESALE only. Do not use to purchase cigarettes for resale.

2.Tangible personal property for future use by a person for taxable LEASE OR RENTAL as an established business,

or part of an established business, or incidental or germane to such business, or a simultaneous purchase and taxable leaseback. This sales and use tax exemption is not applicable to long-term leases of motor vehicles when lease payments charged to customers are not subject to the motor vehicle sales and use tax.

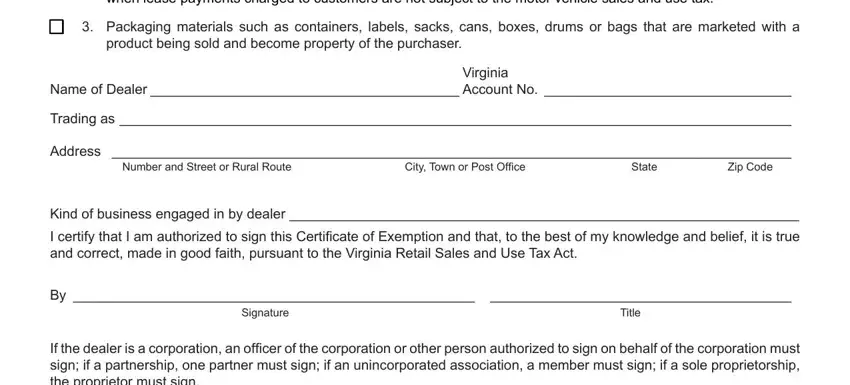

c3. Packaging materials such as containers, labels, sacks, cans, boxes, drums or bags that are marketed with a product being sold and become property of the purchaser.

Virginia

Name of Dealer ________________________________________ Account No. ________________________________

Trading as _______________________________________________________________________________________

Address ________________________________________________________________________________________

Number and Street or Rural RouteCity, Town or Post OficeStateZip Code

Kind of business engaged in by dealer __________________________________________________________________

I certify that I am authorized to sign this Certiicate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By ____________________________________________________ |

_______________________________________ |

Signature |

Title |

If the dealer is a corporation, an oficer of the corporation or other person authorized to sign on behalf of the corporation must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign; if a sole proprietorship, the proprietor must sign.

Information for supplier—A supplier is required to have on ile only one Certiicate of Exemption properly executed by the dealer who buys tax exempt tangible personal property for the purpose indicated hereon.

Va. Dept. of Taxation ST-10 W 6201056 Rev. 04/17