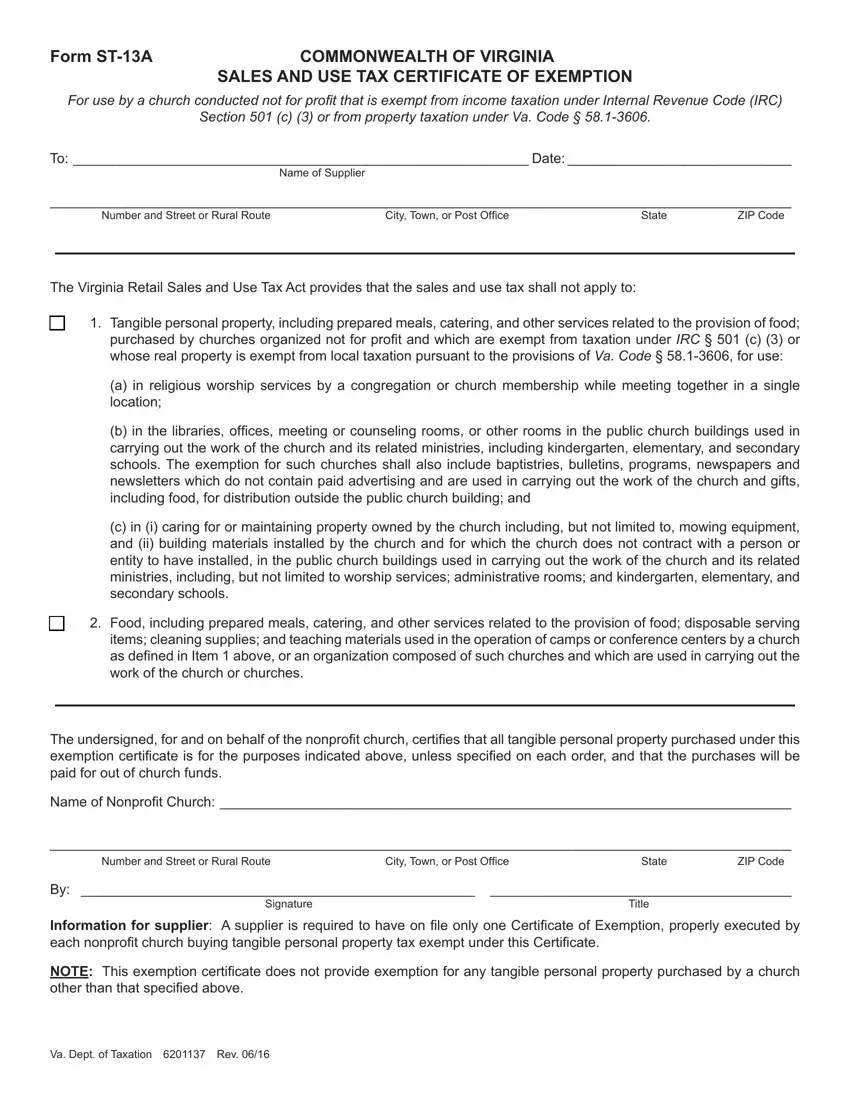

Form ST-13A |

COMMONWEALTH OF VIRGINIA |

|

SALES AND USE TAX CERTIFICATE OF EXEMPTION |

For use by a church conducted not for profit that is exempt from income taxation under Internal Revenue Code (IRC)

Section 501 (c) (3) or from property taxation under Va. Code § 58.1-3606.

To:____________________________________________________________ Date:______________________________

Name of Supplier

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Office |

State |

ZIP Code |

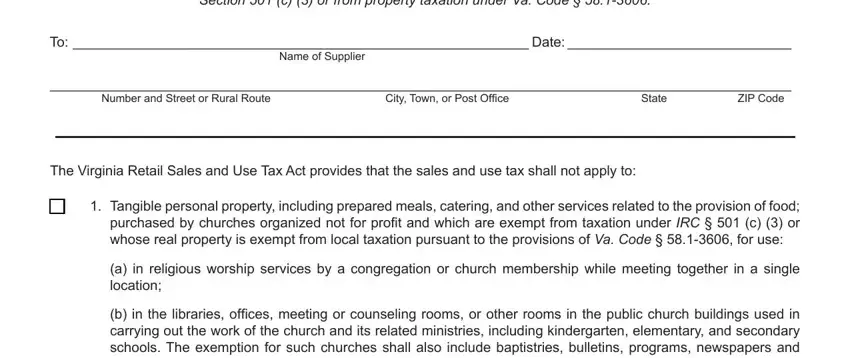

The Virginia Retail Sales and Use Tax Act provides that the sales and use tax shall not apply to:

c1. Tangible personal property, including prepared meals, catering, and other services related to the provision of food; purchased by churches organized not for profit and which are exempt from taxation under IRC § 501 (c) (3) or whose real property is exempt from local taxation pursuant to the provisions of Va. Code § 58.1-3606, for use:

(a)in religious worship services by a congregation or church membership while meeting together in a single location;

(b)in the libraries, offices, meeting or counseling rooms, or other rooms in the public church buildings used in carrying out the work of the church and its related ministries, including kindergarten, elementary, and secondary schools. The exemption for such churches shall also include baptistries, bulletins, programs, newspapers and newsletters which do not contain paid advertising and are used in carrying out the work of the church and gifts, including food, for distribution outside the public church building; and

(c)in (i) caring for or maintaining property owned by the church including, but not limited to, mowing equipment, and (ii) building materials installed by the church and for which the church does not contract with a person or entity to have installed, in the public church buildings used in carrying out the work of the church and its related ministries, including, but not limited to worship services; administrative rooms; and kindergarten, elementary, and secondary schools.

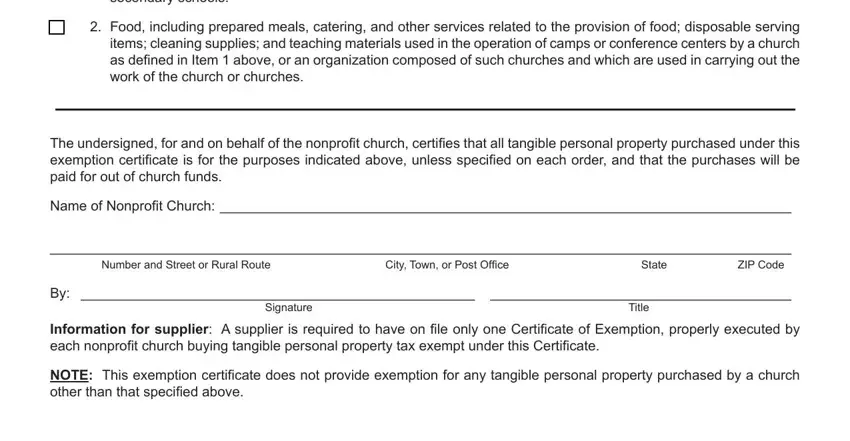

c2. Food, including prepared meals, catering, and other services related to the provision of food; disposable serving items; cleaning supplies; and teaching materials used in the operation of camps or conference centers by a church as defined in Item 1 above, or an organization composed of such churches and which are used in carrying out the work of the church or churches.

The undersigned, for and on behalf of the nonprofit church, certifies that all tangible personal property purchased under this exemption certificate is for the purposes indicated above, unless specified on each order, and that the purchases will be paid for out of church funds.

Name of Nonprofit Church: __________________________________________________________________________

________________________________________________________________________________________________

Number and Street or Rural RouteCity, Town, or Post OfficeStateZIP Code

By: ____________________________________________________ |

_______________________________________ |

Signature |

Title |

Information for supplier: A supplier is required to have on file only one Certificate of Exemption, properly executed by each nonprofit church buying tangible personal property tax exempt under this Certificate.

NOTE: This exemption certificate does not provide exemption for any tangible personal property purchased by a church other than that specified above.