Form St 390 is an important form that businesses must file in order to claim their state sales and use tax exemption. This form can be filed online or through the mail, and must be submitted annually. There are a few things business owners need to know about Form St 390 before filing, such as the exemption requirements and how to complete the form. By understanding these process and requirements, business owners can ensure they are compliant with state tax laws and receive their tax exemptions.

| Question | Answer |

|---|---|

| Form Name | Form St 390 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form 390, how to st390, south carolina st390, st 390 south carolina |

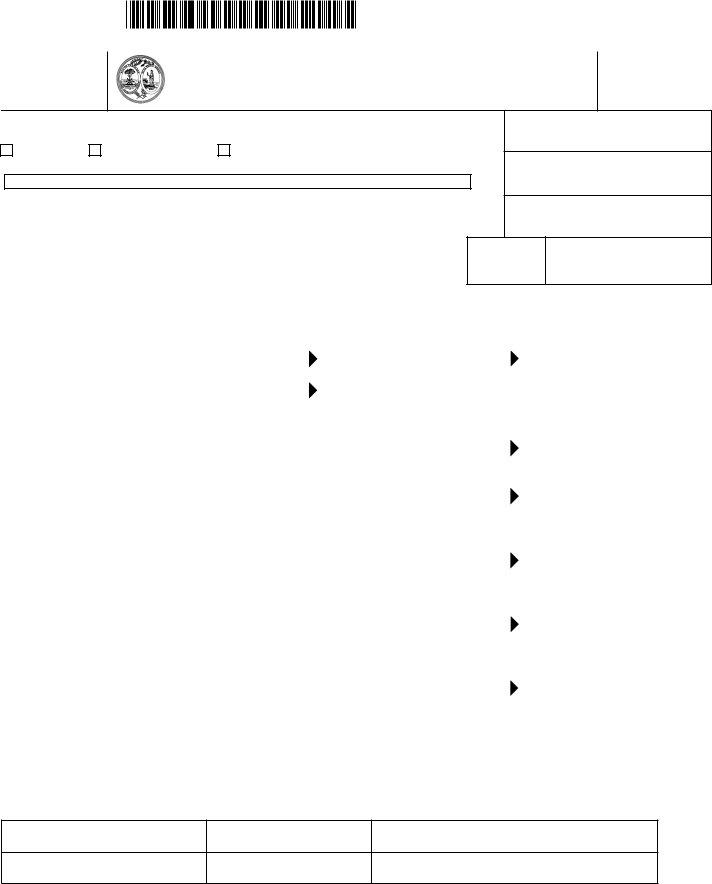

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SOLID WASTE EXCISE TAX RETURN

(Rev. 1/18/18)

5066

Place an X in all boxes that apply. |

|

|

|

||

AMENDED |

Change of Address |

Business Permanently Closed |

|||

(Make changes to |

Date |

|

|

||

Return |

|||||

address below) |

(Complete form |

||||

|

|||||

If the area below is blank, fill in name and address.

Retail License or Use Tax Registration

FEIN

SID Number

Period Ended |

File Return On or By |

TIRES (Tire credit cannot exceed number of tires sold and cannot be used for motor oil, batteries or white goods.)

1. |

Gross Number of Tires Sold |

1a. # of tires |

|

|

x 1.94 = |

1b. |

. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

2b. < |

|

> |

|

2. |

Tire Recycling Credits |

2a. # of tires |

|

|

x 1.00 = |

. |

|||||||||

|

(DHEC approved facility only) |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Name of the Tire Recycler |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3. |

Tax Due on Taxable Tires (line 1b minus 2b) |

|

|

|

|

3. |

|

||||||||

|

|

|

|

|

|

||||||||||

MOTOR OIL/LUBE |

|

|

|

|

|

|

|

|

|

|

. |

|

|||

4. |

Taxable Number of Gallons Motor Oil/Lube |

|

|

x .0776 = |

4. |

|

|||||||||

|

|

|

|

||||||||||||

BATTERIES |

|

|

|

|

|

|

|

|

|

|

. |

|

|||

5. |

Taxable Number of Batteries |

|

|

|

|

|

|

x 1.94 = |

5. |

|

|||||

|

|

|

|

|

|

|

|

||||||||

WHITE GOODS |

|

|

|

|

|

|

|

|

|

|

. |

|

|||

6. |

Taxable Number of White Goods |

|

|

|

|

|

|

x 1.94 = |

6. |

|

|||||

|

|

|

|

|

|

|

|

||||||||

7. |

Total Amount Tax Due (add lines 3, 4, 5 and 6) |

|

|

|

|

7. |

. |

|

|||||||

|

|

|

|

|

|

||||||||||

8. |

Penalty |

|

+ Interest |

|

|

= |

8. |

. |

|

||||||

|

|

||||||||||||||

9. |

Total Tax, Penalty and Interest (add lines 7 and 8) |

|

|

|

|

9. |

. |

|

|||||||

|

|

|

|

|

|

||||||||||

I hereby certify that the information contained in this report (including accompanying schedules and statements) has been examined by me and to the best of my knowledge is correct and complete.

Owner, Partner or Title

Printed Name

Taxpayer's Signature

Daytime Phone No.

Date

Mail To: SC Department of Revenue, P.O. Box 125, Columbia, SC

50661040

WHO MUST FILE:

The Solid Waste Excise Tax Return - Form

WHEN TO FILE:

The return is due at the same time as the sales tax return

Wholesalers who do not file a sales tax return must file Form

WHAT ITEMS ARE TAXED:

Sales of motor oil and similar lubricants, tires,

Tires - The continuous solid or pneumatic rubber covering encircling the wheel of a motor vehicle, trailer, or motorcycle as defined in S.C. Code Section

Motor oil and similar lubricants - The fraction of crude oil or synthetic oil that is classified for use in the crankcase, transmission, gearbox, or differential of an internal combustion engine, including automobiles, buses, trucks, lawn mowers and other household power equipment, industrial machinery, and other mechanical devices that derive their power from internal combustion engines. The terms include

White goods - Include refrigerators, ranges, water heaters, freezers, dishwashers, trash compactors, washers, dryers, air conditioners, and commercial large appliances.

HOW MUCH IS THE FEE:

The fee for each tire, battery or white good sold is $2.00 per item. The fee is 8 cents per gallon of motor oil or similar lubricants sold. (All sales of motor oil and lubricants should be totaled at the end of each reporting period. Any fraction of a gallon sold exceeding

The law allows that every taxpayer may retain three percent of the total fees collected as an administrative collection allowance. For your convenience, this allowance has been reflected in the preprinted form provided. Therefore, a $1.94 net fee on sales of tires, batteries and white goods and a 7.76 cent ($.0776) net fee on each gallon of motor oil or similar lubricant sold must be remitted to the Department.

HOW TO COMPUTE THE AMOUNT DUE ON FORM

Enter the gross number of tires sold in box 1a; the taxable number of gallons of motor oil/lube on line 4; the taxable number of batteries on line 5; and the taxable number of white goods on line 6. Multiply the numbers on lines 1a, 4, 5, and 6 by the rate given. If no sales of these items have been made, enter zero

Enter number of tires properly recycled at a DHEC approved facility on line 2a. Multiply number of tires on line 2a by $1.00 and enter the result on line 2b. REMINDER: If you take credit for recycled tires on line 2a, you cannot apply for a refund on the

WHERE TO FILE:

Mail the completed return and check or money order to:

South Carolina Department of Revenue

P.O. Box 125

Columbia, South Carolina

TELEPHONE NUMBER: (803)

INTEREST AND PENALTY FOR FAILURE TO FILE OR PAY TAX:

To calculate penalty and interest go to our website: MyDORWAY.dor.sc.gov

50662048