Dealing with PDF forms online is definitely simple with our PDF tool. Anyone can fill out samoa dec itemized here effortlessly. Our tool is continually evolving to deliver the very best user experience achievable, and that is because of our dedication to continuous improvement and listening closely to comments from customers. Starting is simple! Everything you should do is follow the following easy steps below:

Step 1: Just click the "Get Form Button" above on this webpage to launch our pdf editing tool. This way, you'll find everything that is needed to work with your file.

Step 2: This tool enables you to work with your PDF file in various ways. Enhance it by writing customized text, adjust what is already in the file, and place in a signature - all possible within minutes!

Pay attention when filling in this document. Make sure that every blank is done properly.

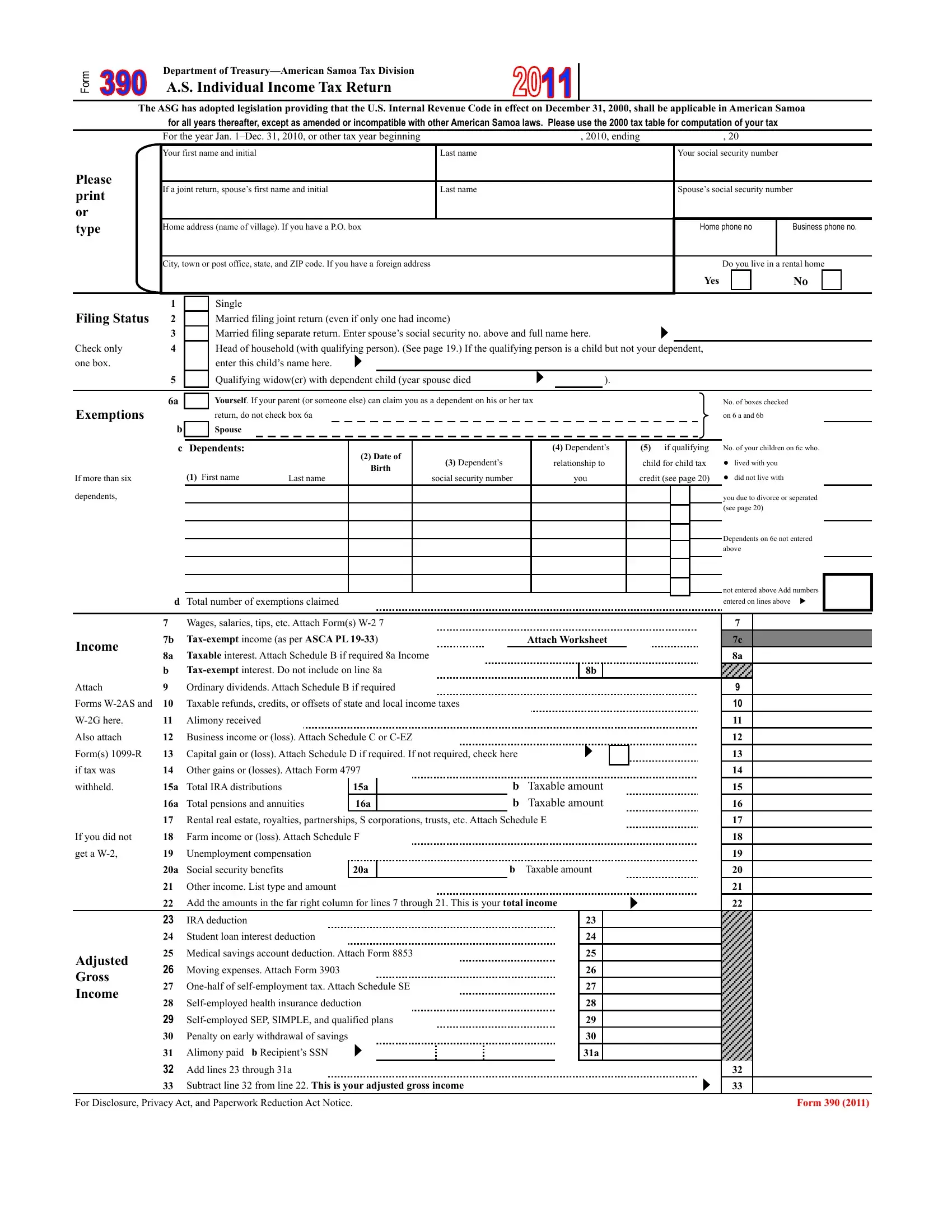

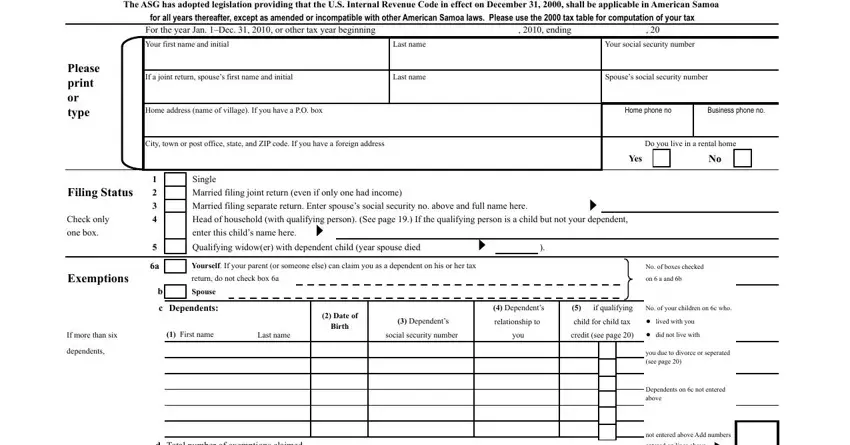

1. The samoa dec itemized will require certain details to be typed in. Ensure that the following blanks are completed:

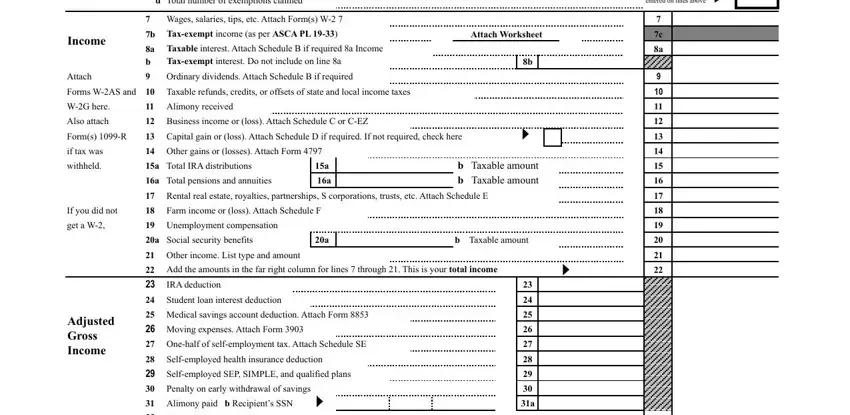

2. Soon after filling out this step, go to the next part and enter the necessary details in these blank fields - d Total number of exemptions, Wages salaries tips etc Attach, b Taxexempt income as per ASCA PL, a Taxable interest Attach Schedule, Taxexempt interest Do not include, Ordinary dividends Attach Schedule, Income, Attach, Attach Worksheet, Forms WAS and, Taxable refunds credits or offsets, WG here, Also attach, Alimony received, and Business income or loss Attach.

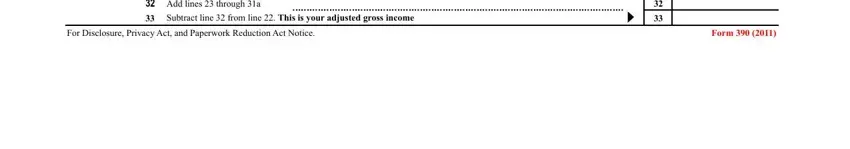

3. The third part is going to be easy - fill out all the fields in Add lines through a, Subtract line from line This is, For Disclosure Privacy Act and, and Form in order to complete this part.

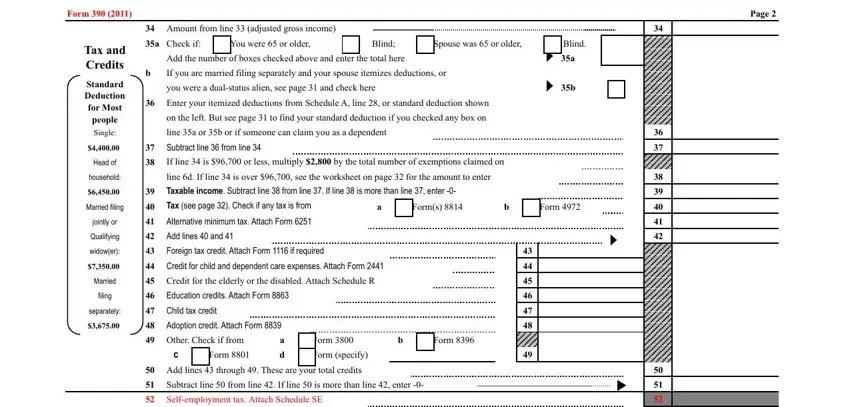

4. All set to begin working on this fourth portion! Here you'll get all of these Page, Form, Amount from line adjusted gross, You were or older, Blind, Spouse was or older, a Check if Tax and Credits, Standard Deduction for Most people, Add the number of boxes checked, If you are married filing, you were a dualstatus alien see, Enter your itemized deductions, on the left But see page to find, Blind, and line a or b or if someone can fields to complete.

You can easily get it wrong when filling out the Blind, therefore ensure that you go through it again before you finalize the form.

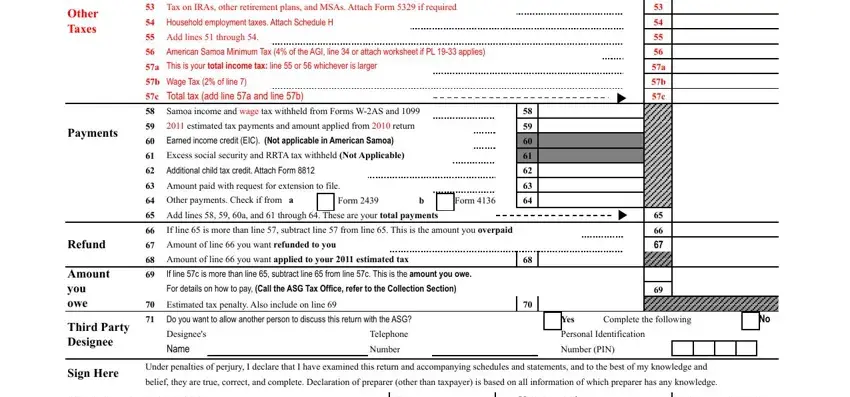

5. As you approach the final parts of the file, there are actually a couple extra requirements that should be met. Mainly, Other Taxes, Payments, Tax on IRAs other retirement plans, Household employment taxes Attach, Add lines through, American Samoa Minimum Tax of the, a This is your total income tax, b Wage Tax of line, c Total tax add line a and line b, Samoa income and wage tax withheld, estimated tax payments and amount, Earned income credit EIC Not, Excess social security and RRTA, Additional child tax credit Attach, and Amount paid with request for must all be filled in.

Step 3: Revise what you've entered into the form fields and hit the "Done" button. Right after setting up afree trial account here, it will be possible to download samoa dec itemized or send it through email at once. The PDF form will also be available from your personal cabinet with your each edit. FormsPal is committed to the confidentiality of our users; we always make sure that all personal data handled by our tool stays protected.