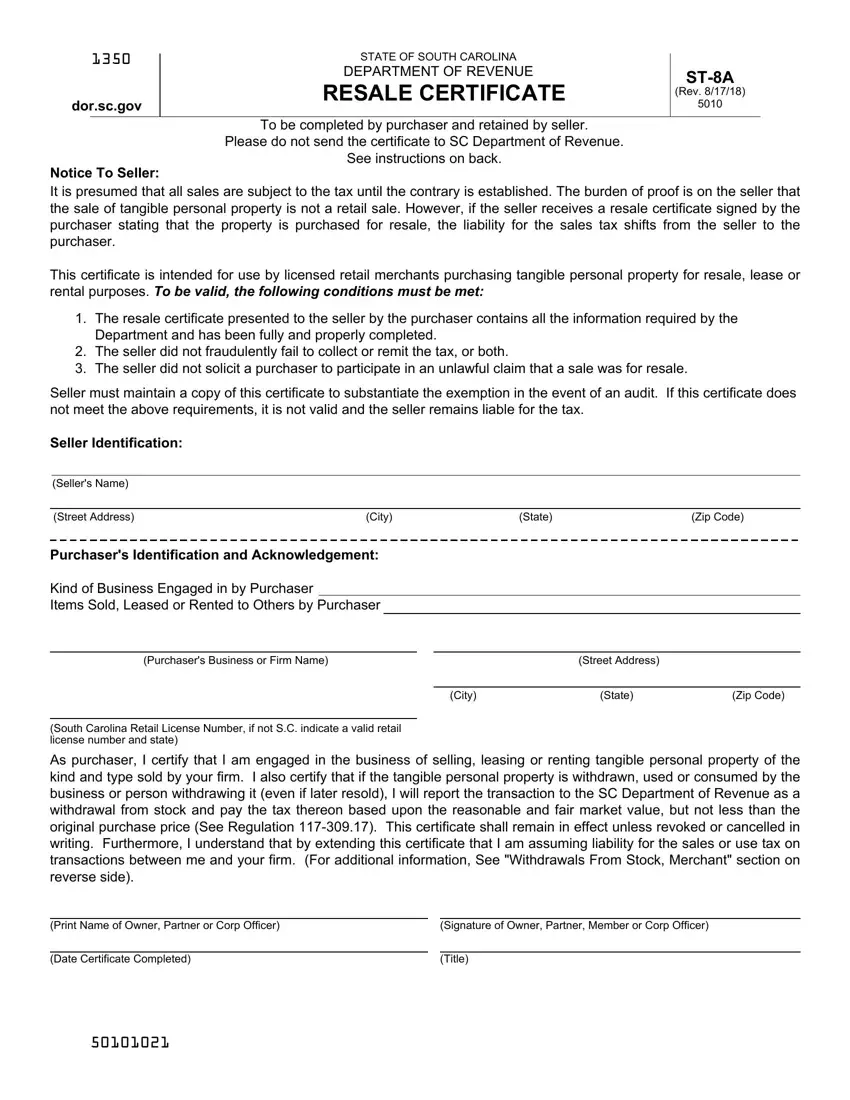

Notice to Purchaser: If a purchaser uses a resale certificate to purchase tangible personal property tax free which the purchaser knows is not excluded or exempt from the tax, then the purchaser is liable for the tax plus a penalty of 5% of the amount of the tax for each month, or fraction of a month, during which the failure to pay the tax continues, not exceeding 50% in the aggregate. This penalty is in addition to all other applicable penalties authorized under the law.

SALES TAX - A sales tax is imposed upon every person engaged or continuing within this state in the business of selling tangible personal property at retail.

USE TAX - A use tax is imposed on the storage, use, or other consumption in this state of tangible personal property purchased at retail for storage, use, or other consumption in this state.

TANGIBLE PERSONAL PROPERTY - "Tangible personal property" means personal property which may be seen, weighed, measured, felt, touched, or which is in any other manner perceptible to the senses. It also includes services and intangibles, including communication, laundry and related services, furnishing of accommodations and sales of electricity, and does not include stocks, notes, bonds, mortgages, or other evidences of debt.

WITHDRAWAL FROM STOCK, MERCHANTS - (Regulation 117-309.17): To be included in gross proceeds of sales is the money value of property purchased at wholesale for resale purposes and subsequently withdrawn from stock for use or consumption by the purchaser.

The value to be placed upon such goods is the price at which these goods are offered for sale by the person withdrawing them. All cash or other customary discounts which he would allow to his customers may be deducted; however, in no event can the amount used as gross proceeds of sales be less than the amount paid for the goods by the person making the withdrawal.

ADDITIONAL INFORMATION

(1)A valid SC retail license number contains the words "Retail License" in bold printed at the top of the license and is comprised of 9 to 10 digits.

(2)The following are examples of numbers which are not acceptable for resale purposes: Social Security Numbers, Federal Employer Identification numbers and use tax registration numbers. A South Carolina certificate of registration (use tax registration number) is simply for reporting use tax and not a retail license number. The words "Certificate of Registration" is printed at the top of the certificate.

(3)Another state's resale certificate and number is acceptable in this State. Indicate the other state's number on the front when using this form.

(4)A wholesaler's exemption number may be applicable in lieu of a retail license number. A South Carolina wholesaler's certificate will have the section 12-36-120(1) printed by the serial number.

Note: A copy of Form ST-8A Resale Certificate can be found on the Department's website at https://dor.sc.gov/forms/ find-a-form. It is not required that Form ST-8A be used, but the information requested on the form is required on any resale certificate accepted by the seller. For further information about the use of resale certificates, see SC Revenue Procedure #08-2, which can be found on the Department's website at https://dor.sc.gov/policy/advisory-opinions- sales.