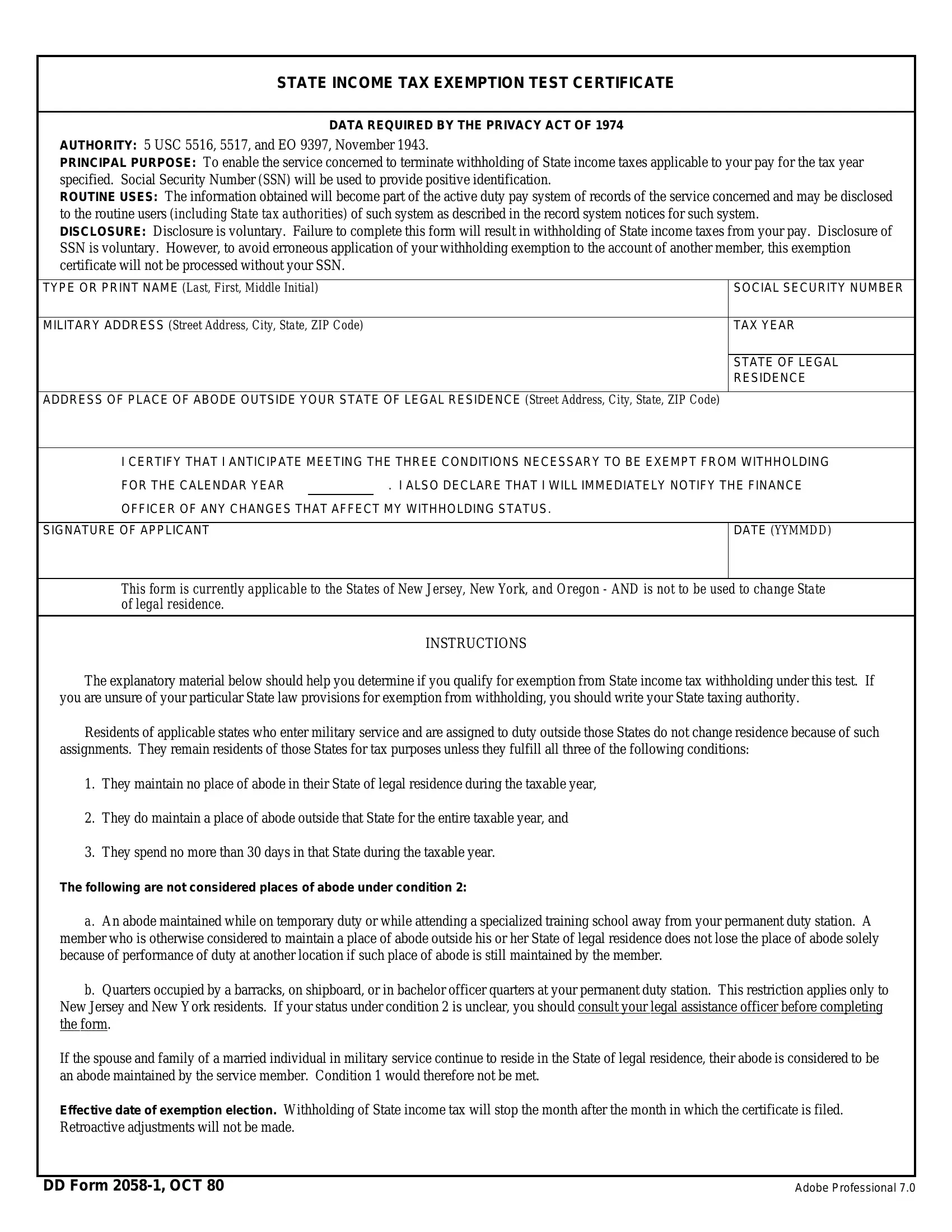

When using the online PDF tool by FormsPal, it is possible to fill in or modify exemption dd state right here and now. To retain our editor on the cutting edge of efficiency, we aim to integrate user-oriented features and enhancements regularly. We're routinely pleased to receive suggestions - assist us with revolutionizing PDF editing. If you're seeking to get going, this is what it requires:

Step 1: Simply press the "Get Form Button" at the top of this webpage to launch our pdf editor. This way, you will find everything that is required to work with your document.

Step 2: With this online PDF editing tool, you may do more than just fill out forms. Edit away and make your documents look sublime with customized textual content incorporated, or adjust the file's original input to perfection - all accompanied by the capability to insert almost any graphics and sign it off.

To be able to finalize this PDF form, ensure that you provide the right details in each area:

1. It is advisable to fill out the exemption dd state correctly, therefore be mindful while working with the areas containing all of these fields:

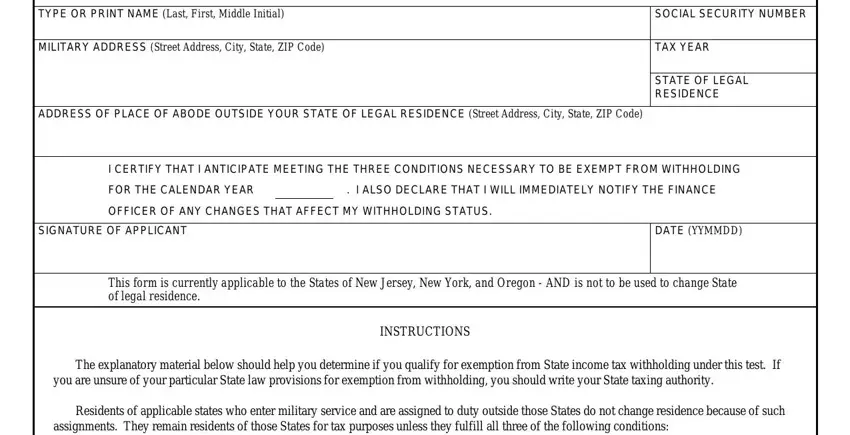

2. The subsequent stage is to complete all of the following blanks: DD Form OCT EG, and Designed using Perform Pro WHSDIOR.

Be very mindful when filling out DD Form OCT EG and Designed using Perform Pro WHSDIOR, because this is where most people make some mistakes.

Step 3: Right after going through the entries, press "Done" and you are all set! After creating a7-day free trial account here, you will be able to download exemption dd state or send it through email without delay. The PDF will also be readily available through your personal account with your each and every edit. FormsPal guarantees your information confidentiality by using a secure system that in no way records or distributes any kind of personal information provided. Feel safe knowing your files are kept protected each time you use our tools!