MonFri can be completed online effortlessly. Simply use FormsPal PDF editing tool to finish the job quickly. We are devoted to providing you the best possible experience with our tool by continuously adding new features and upgrades. Our tool has become much more user-friendly thanks to the latest updates! So now, filling out PDF forms is easier and faster than before. All it requires is several simple steps:

Step 1: Press the "Get Form" button above. It will open up our editor so that you could start completing your form.

Step 2: With the help of our advanced PDF editor, you could do more than merely fill in forms. Edit away and make your docs seem perfect with custom textual content added in, or fine-tune the file's original input to perfection - all that accompanied by an ability to add almost any graphics and sign the PDF off.

As for the blanks of this particular PDF, this is what you should know:

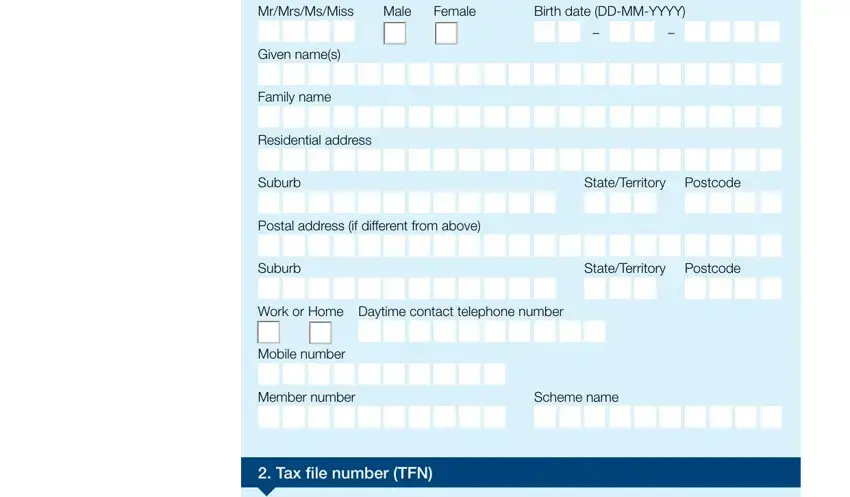

1. The MonFri necessitates particular details to be inserted. Ensure the next fields are finalized:

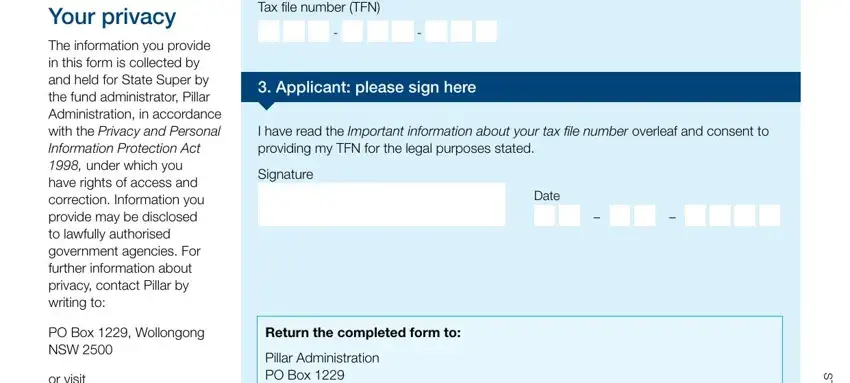

2. Once the last segment is completed, you're ready to insert the essential particulars in Tax file number TFN, Applicant please sign here, I have read the Important, Signature, Date, Return the completed form to, Pillar Administration PO Box, S T C, your privacy, The information you provide in, PO Box Wollongong NSW, and or visit wwwstatesupernswgovau allowing you to go to the third part.

Be extremely mindful when filling out Date and I have read the Important, because this is where most users make a few mistakes.

Step 3: After going through your fields and details, hit "Done" and you are good to go! Join us now and immediately obtain MonFri, prepared for download. All adjustments made by you are preserved , so that you can modify the pdf later when necessary. FormsPal ensures your data privacy with a secure method that never records or distributes any kind of personal information provided. Be assured knowing your files are kept safe any time you work with our tools!