Form Tiaa Cref F11254 can be filled in online easily. Simply open FormsPal PDF editor to finish the job fast. We are dedicated to giving you the best possible experience with our editor by constantly introducing new features and improvements. Our tool is now much more helpful thanks to the most recent updates! At this point, editing PDF forms is a lot easier and faster than ever before. It merely requires just a few basic steps:

Step 1: Open the PDF form inside our editor by hitting the "Get Form Button" in the top part of this webpage.

Step 2: The tool offers you the ability to customize PDF files in a variety of ways. Modify it by including personalized text, adjust what's originally in the document, and place in a signature - all manageable in no time!

This document will need specific information to be typed in, thus you should take some time to type in what's asked:

1. It's very important to fill out the Form Tiaa Cref F11254 accurately, thus take care while filling out the parts including these blanks:

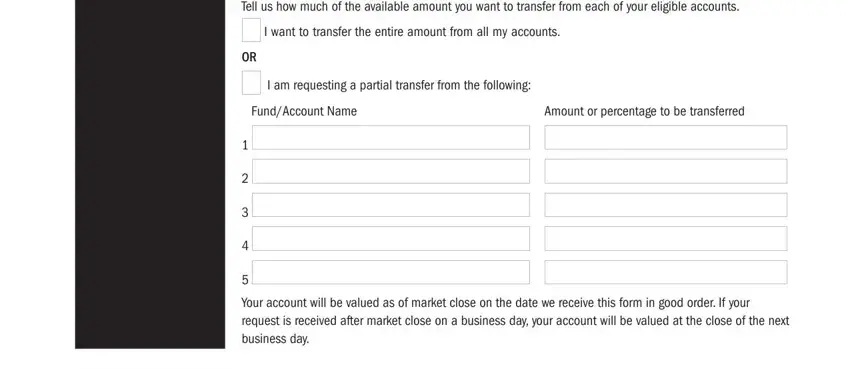

2. Soon after performing this step, head on to the next stage and fill out the necessary particulars in all these blank fields - Tell us how much of the available, I want to transfer the entire, I am requesting a partial transfer, FundAccount Name, Amount or percentage to be, Complete this part to request, and Your account will be valued as of.

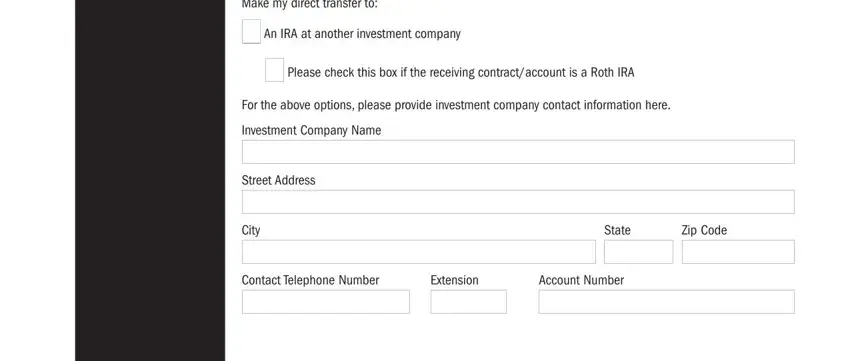

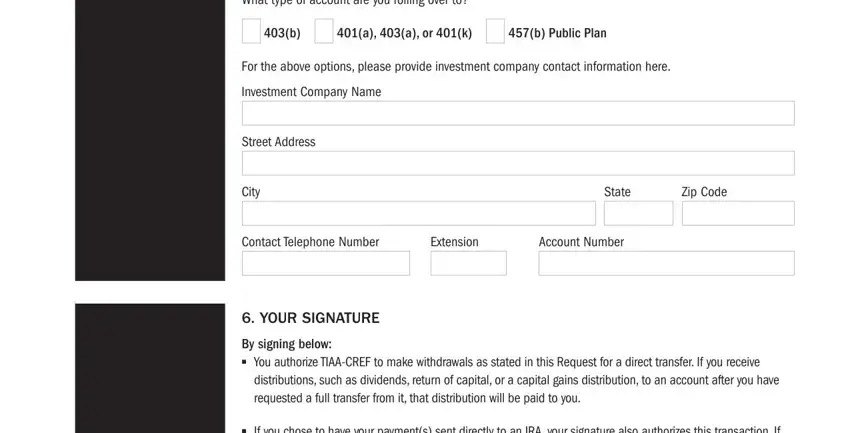

3. This subsequent section is normally pretty uncomplicated, The investment company receiving, Internal Revenue Service IRS rules, Make my direct transfer to, An IRA at another investment, Please check this box if the, For the above options please, Investment Company Name, Street Address, City, State, Zip Code, Contact Telephone Number, Extension, and Account Number - all of these blanks will have to be filled in here.

4. Filling out The investment company receiving, Internal Revenue Service IRS rules, What type of account are you, a a or k, b Public Plan, For the above options please, Investment Company Name, Street Address, City, State, Zip Code, Contact Telephone Number, Extension, Account Number, and YOUR SIGNATURE is paramount in this fourth part - you'll want to don't rush and fill out each and every field!

Be really attentive while filling in Internal Revenue Service IRS rules and Street Address, as this is where a lot of people make a few mistakes.

5. To conclude your document, this last part includes some extra fields. Filling out Your Signature, Todays Date mmddyyyy, and TAXTD F will certainly finalize everything and you will be done in a short time!

Step 3: Before addressing the next step, you should make sure that all form fields have been filled out the correct way. The moment you are satisfied with it, click on “Done." Find your Form Tiaa Cref F11254 once you subscribe to a 7-day free trial. Conveniently gain access to the document in your personal cabinet, together with any edits and adjustments all saved! FormsPal ensures your data privacy via a protected system that never saves or shares any sort of private information involved. Rest assured knowing your documents are kept confidential any time you use our tools!