Submitting documents together with our PDF editor is easier than nearly anything. To change miller trust the form, there is nothing you will do - just follow the actions down below:

Step 1: The initial step should be to select the orange "Get Form Now" button.

Step 2: You're now allowed to modify miller trust. You have a variety of options thanks to our multifunctional toolbar - you can add, erase, or modify the content, highlight its selected areas, as well as carry out many other commands.

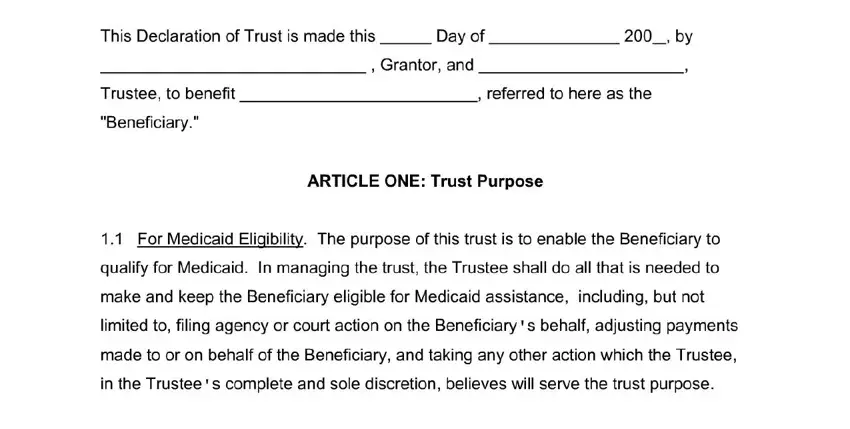

For you to obtain the document, type in the information the software will ask you to for each of the following sections:

The program will require you to complete the segment.

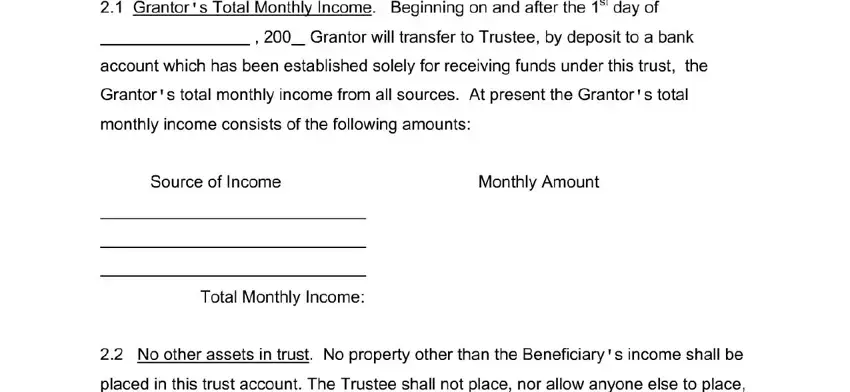

You'll be requested for some important details if you need to fill up the box.

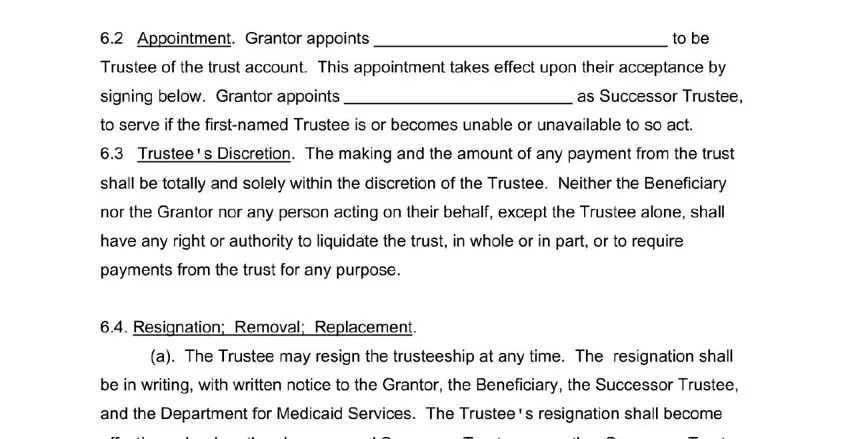

The area is going to be where you can indicate all parties' rights and obligations.

Look at the fields and thereafter fill them out.

Step 3: Hit the Done button to save your document. Now it is at your disposal for transfer to your device.

Step 4: Prepare copies of the file. This will protect you from upcoming misunderstandings. We don't look at or disclose your information, therefore feel comfortable knowing it will be protected.