It is straightforward to complete the tsp 20 gaps. Our tool makes it nearly effortless to edit any kind of PDF file. Down below are the primary four steps you'll want to follow:

Step 1: To start out, choose the orange button "Get Form Now".

Step 2: So, it is possible to update your tsp 20. The multifunctional toolbar makes it easy to include, get rid of, adapt, highlight, and also perform other sorts of commands to the content and areas within the file.

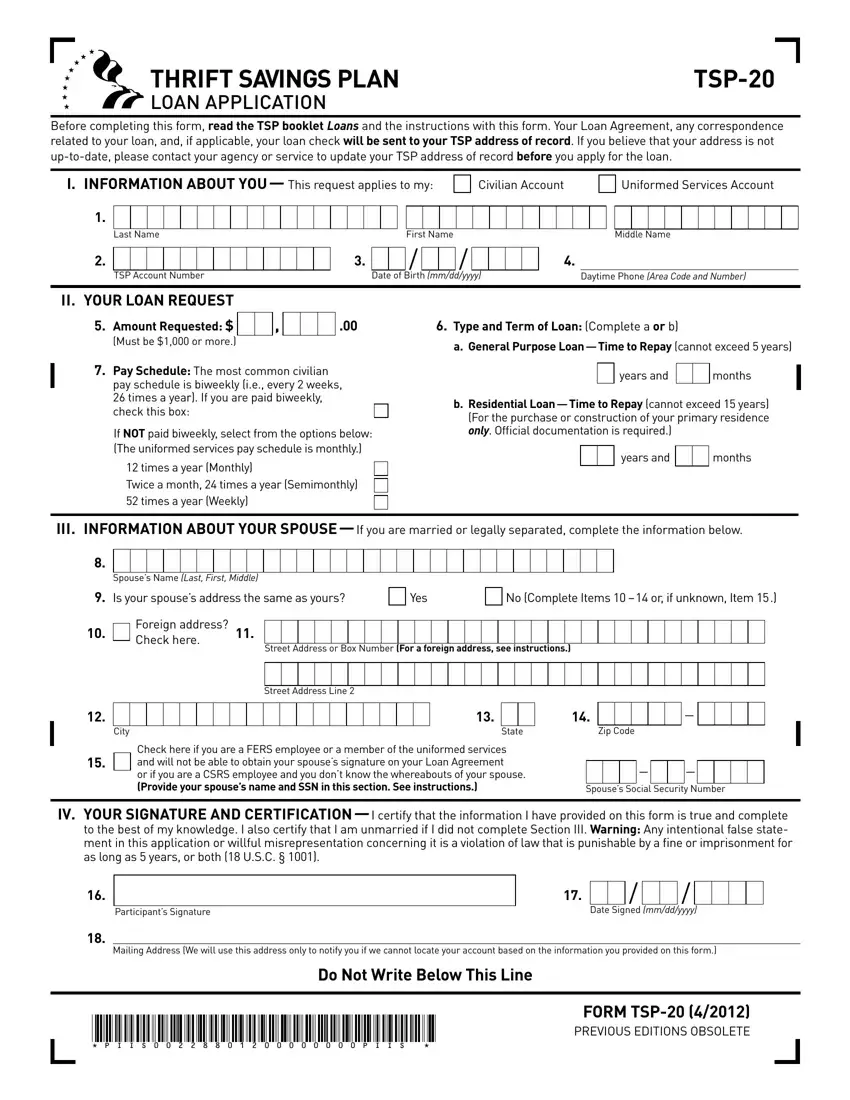

Prepare the particular parts to fill in the document:

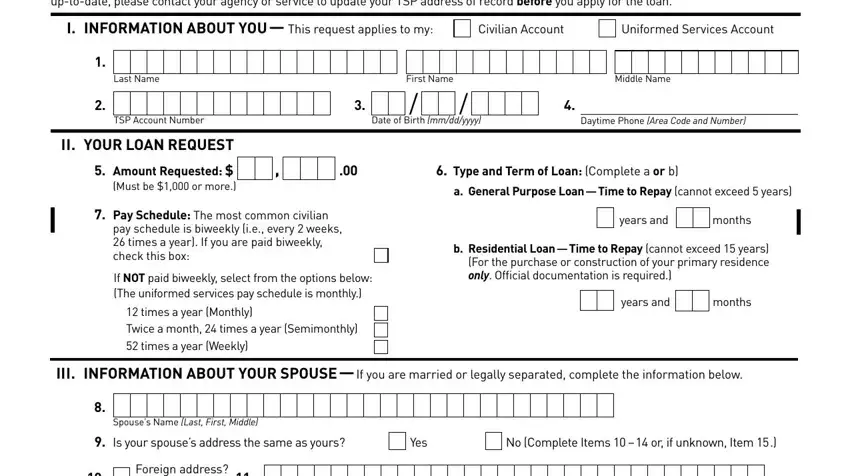

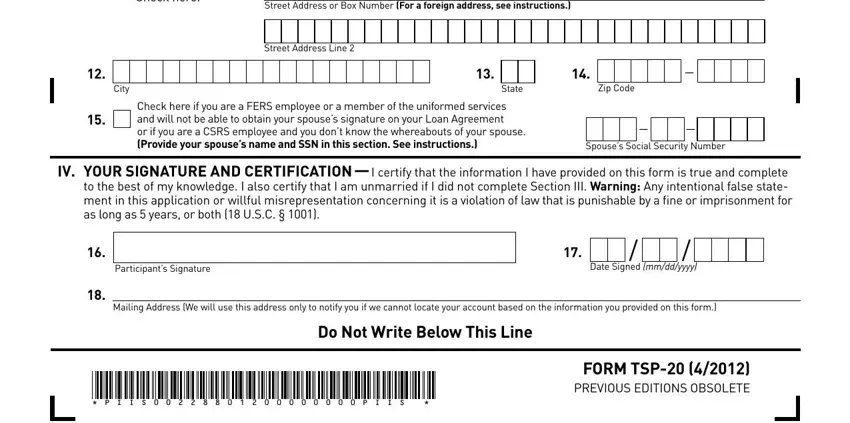

Type in the requested particulars in the Foreign address Check here, Street Address or Box Number For a, Street Address Line, State, Zip Code, City, Check here if you are a FERS, Spouses Social Security Number, IV YOUR SIGNATURe AND, Participants Signature, Date Signed mmddyyyy, Mailing Address We will use this, Do Not Write Below This Line, P I I S P I I S, and FORM TSP PREVIOUS EDITIONS box.

Step 3: Hit the "Done" button. Now, you can export your PDF file - upload it to your electronic device or deliver it through email.

Step 4: It can be safer to maintain copies of your file. You can rest assured that we won't display or see your information.

/

/