The uc 30h completing course of action is easy. Our editor lets you work with any PDF document.

Step 1: To begin the process, select the orange button "Get Form Now".

Step 2: At the moment, you can start modifying your uc 30h. The multifunctional toolbar is at your disposal - insert, erase, transform, highlight, and perform several other commands with the words and phrases in the document.

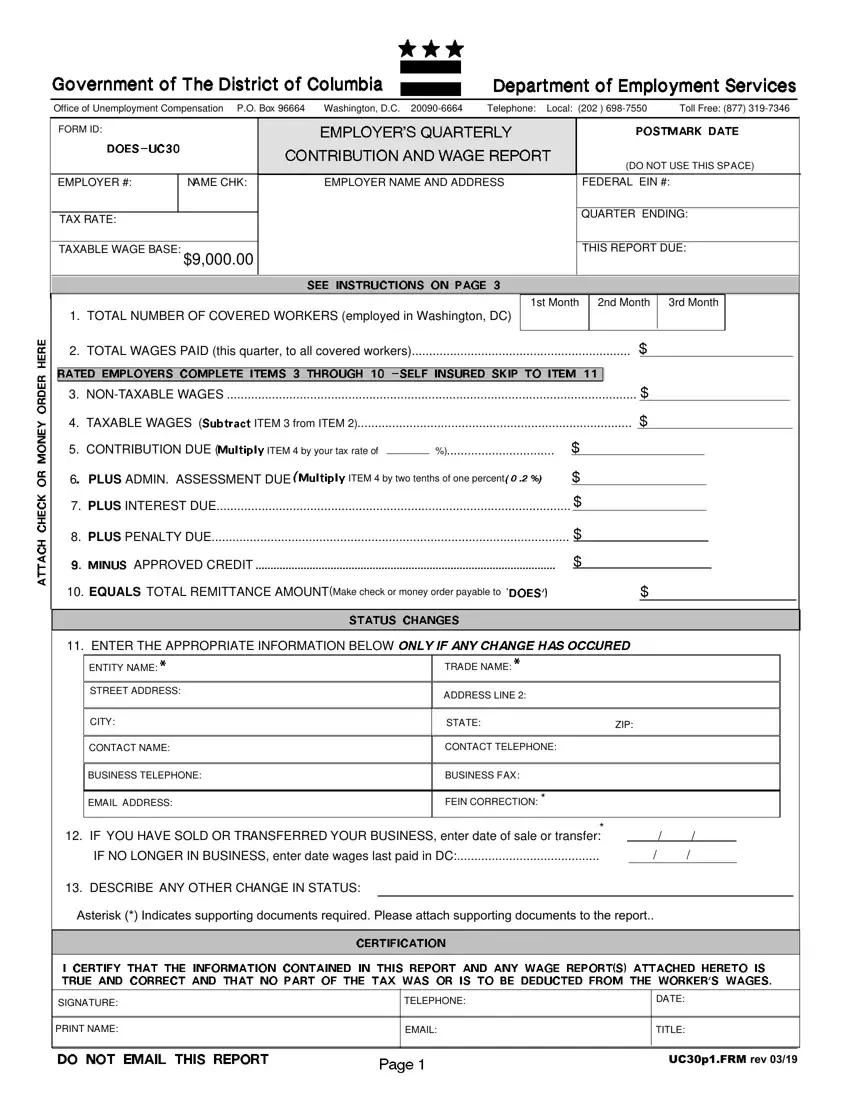

The next sections are contained in the PDF document you'll be completing.

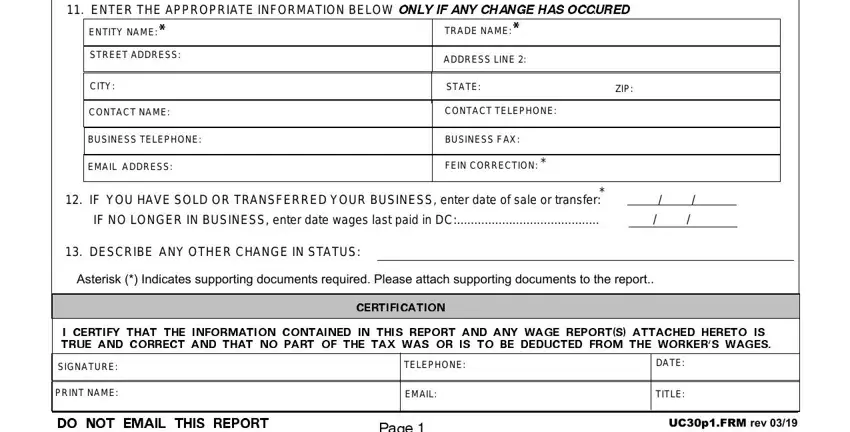

Provide the appropriate data in the ENTER THE APPROPRIATE INFORMATION, ENTIT, A NY, STREET ADDRESS, YCIT, CONT, CT N, BUSINESS TELEPHONE, AIL AEM, DDRESS, ATR, DE N, DDRESS LINE, TEAST, and ZIP area.

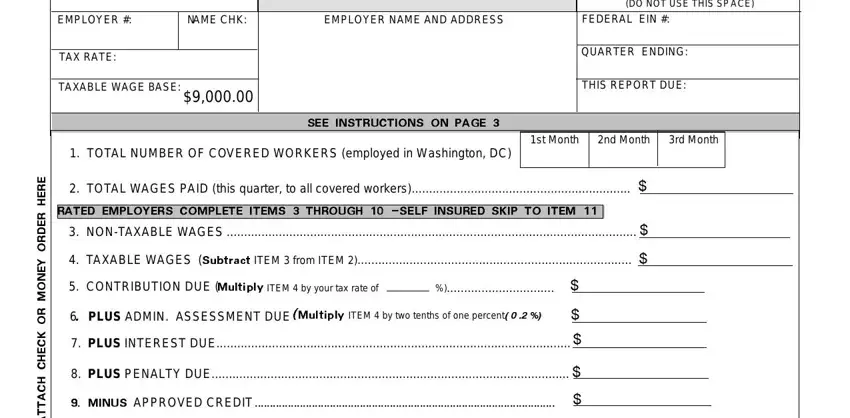

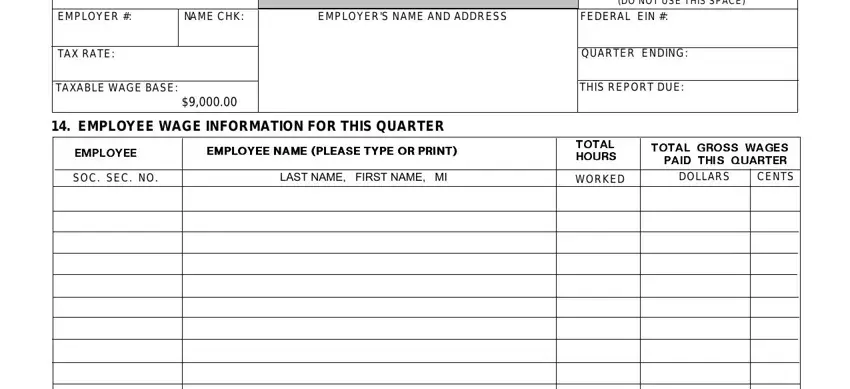

The application will request you to write some significant details to automatically fill in the segment EMPLO, N A, ME CHK, EMPLOYERS QUARTERLY CONTRIBUTION, DO NOT USE THIS SPACE A, L EIN, FEDER, TEAX RAT, AXAT, BLE W, GE B, AQU, RTER ENDING, THIS REPORT DUE, and EMPLO.

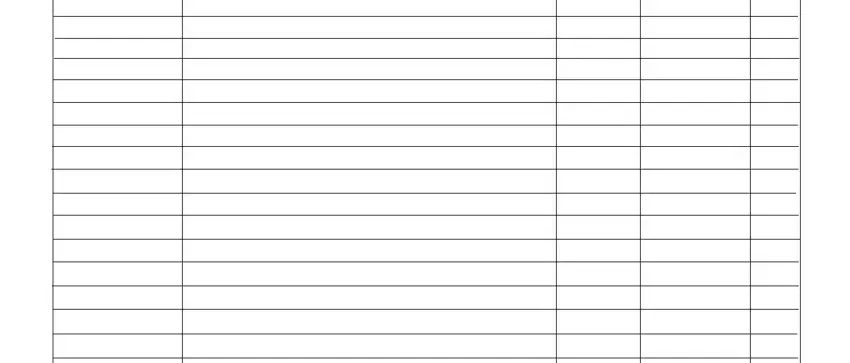

Inside the part , include the rights and responsibilities of the sides.

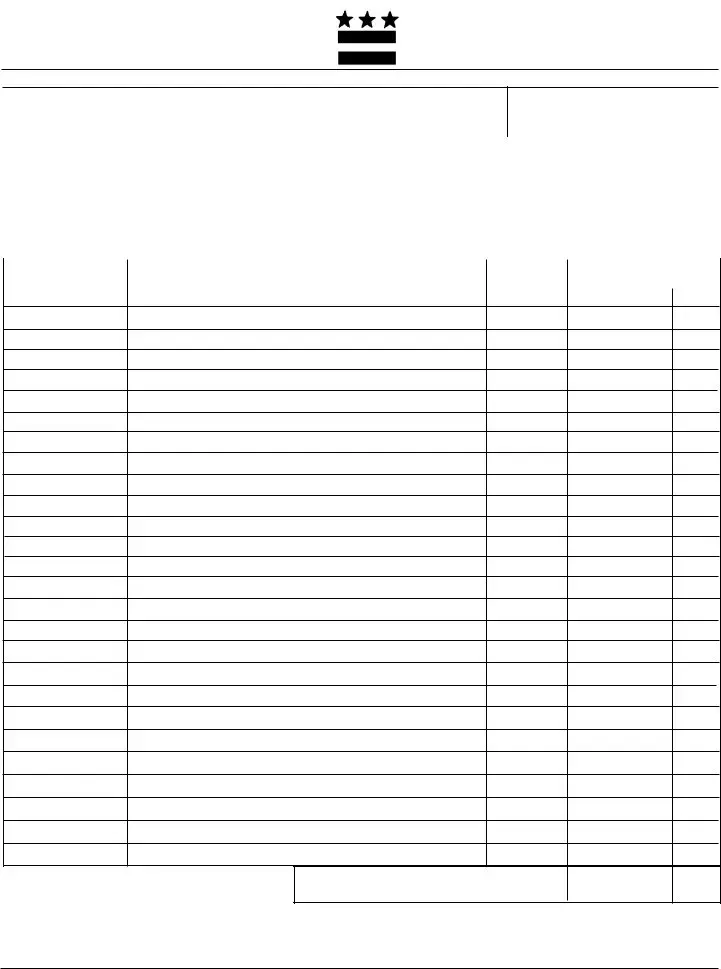

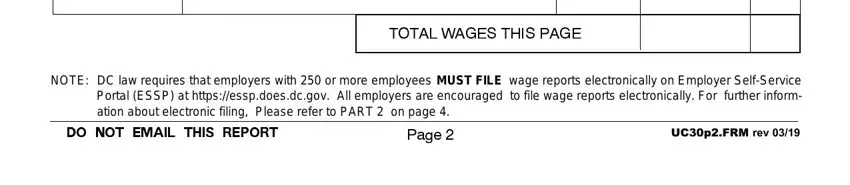

Review the sections TOT, AL WA, GES THIS P, GEA, NOTE, DC law requires that employers, UCpFRM rev, and DO NOT EMAIL THIS REPORT and thereafter complete them.

Step 3: At the time you click the Done button, your final file is easily exportable to every of your devices. Or, you will be able to deliver it through mail.

Step 4: Produce around a couple of copies of the document to avoid any sort of future challenges.