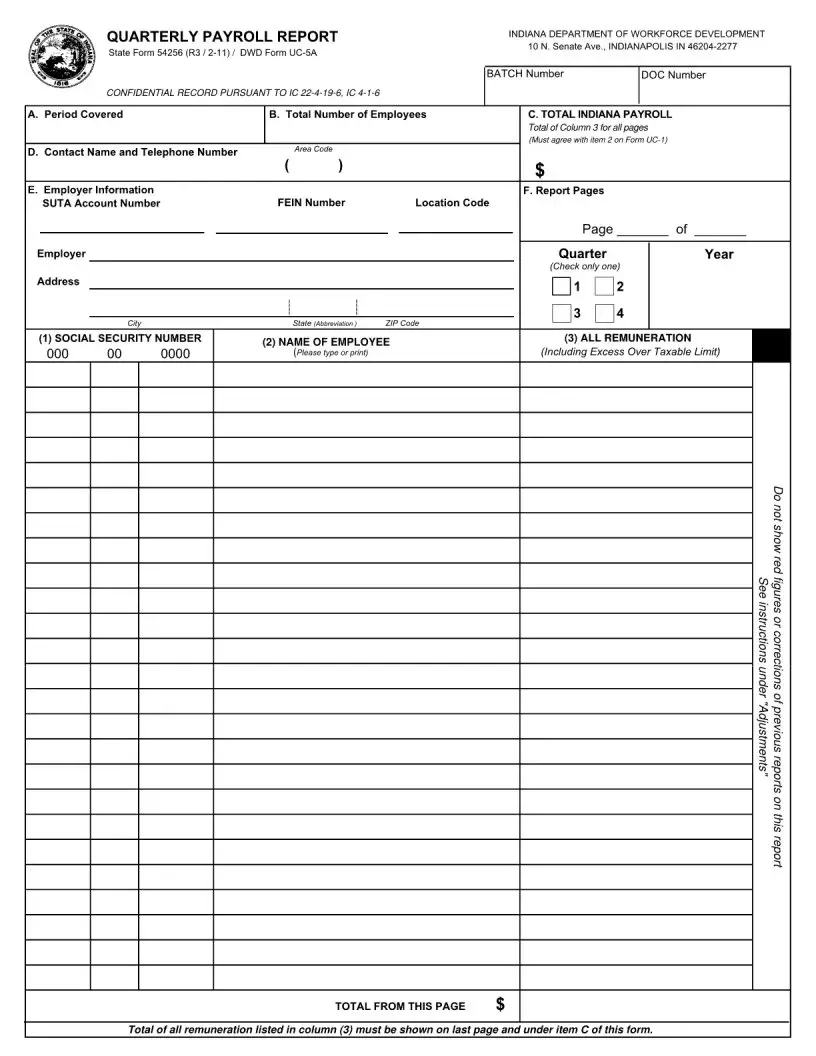

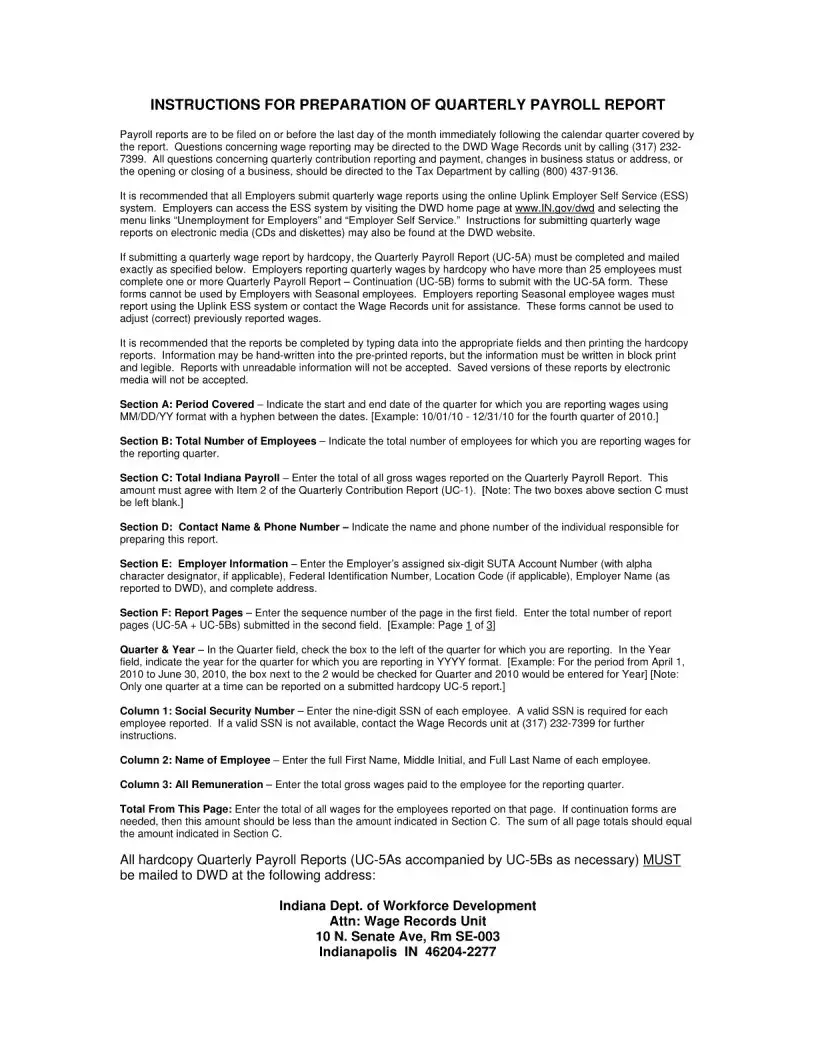

In the landscape of legal documentation, particularly within the realm of labor and employment, the UC-5A form stands as a crucial document for employers. This particular form is tasked with the responsibility of reporting an employee's quarterly wages, which plays a pivotal role in the accurate calculation of unemployment insurance contributions. The information reported through this form is not only essential for compliance with federal and state laws but also serves as a safeguard for the integrity of the unemployment insurance system. By ensuring that contributions are accurately reported, the form helps to maintain the financial health of the fund from which unemployment benefits are distributed. Moreover, it aids in preventing fraud and ensuring that benefits are only disbursed to those truly eligible. While on the surface, the UC-5A might appear as just another piece of bureaucratic paperwork, its implications for both employers and employees are significant, underscoring the importance of meticulousness and accuracy in its completion and submission.

| Question | Answer |

|---|---|

| Form Name | Form Uc 5A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | uc 5a form indiana, indiana quarterly payroll report state form 54256, development workforce indiana form, indiana uc5a |