Making use of the online editor for PDFs by FormsPal, you can complete or change uia michigan form here. Our tool is consistently developing to give the best user experience possible, and that is because of our resolve for continuous enhancement and listening closely to customer comments. Here's what you will need to do to get started:

Step 1: Just click on the "Get Form Button" in the top section of this site to start up our pdf editor. This way, you'll find everything that is required to fill out your document.

Step 2: As you access the online editor, you'll see the document prepared to be completed. In addition to filling out various blanks, you may as well perform many other actions with the file, namely adding custom words, modifying the initial textual content, inserting images, affixing your signature to the document, and a lot more.

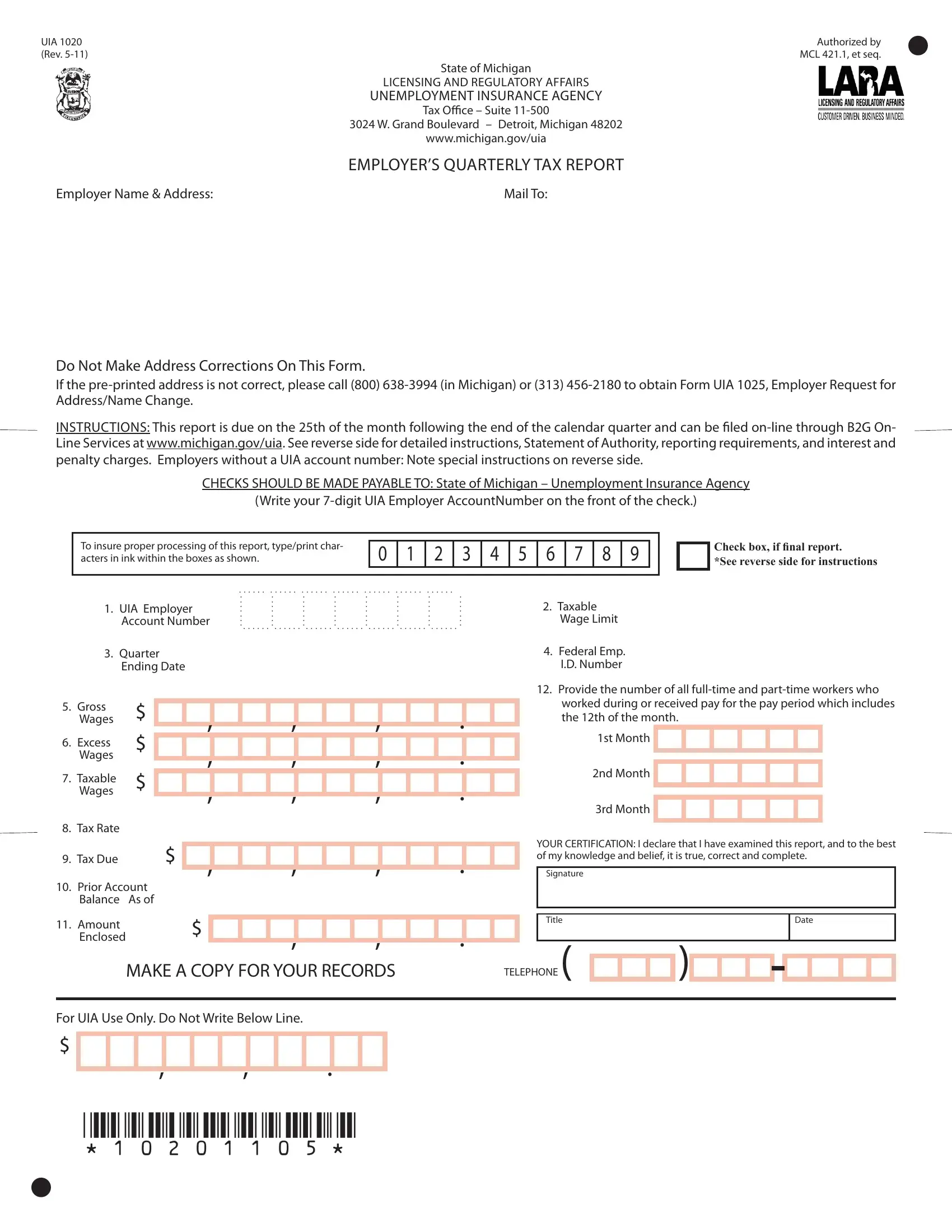

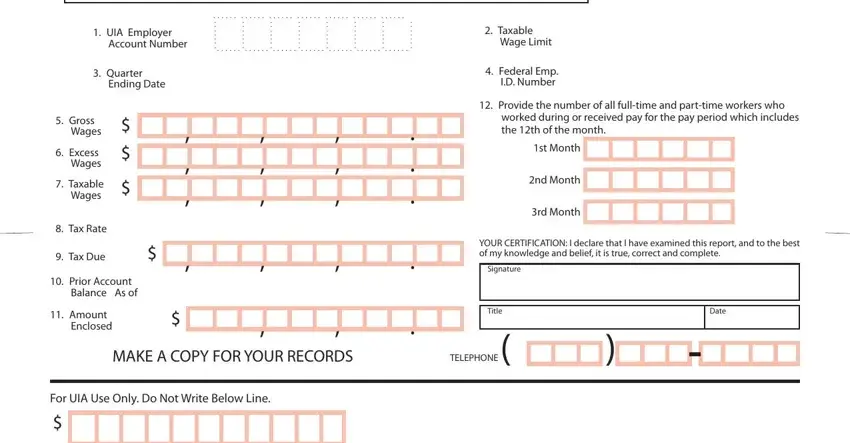

With regards to the blank fields of this particular document, here is what you need to know:

1. While completing the uia michigan form, ensure to incorporate all essential blanks in its corresponding section. It will help to expedite the work, allowing for your information to be processed efficiently and correctly.

2. Right after performing the last part, go to the next stage and fill in the essential particulars in these blanks - Taxable, Wage Limit, Federal Emp ID Number, Provide the number of all, worked during or received pay for, st Month, nd Month, rd Month, YOUR CERTIFICATION I declare that, Signature, Title, TELEPHONE, Date, UIA Employer, and Account Number.

Those who work with this PDF frequently make mistakes while completing Wage Limit in this section. You should re-examine everything you enter here.

Step 3: Revise all the details you have inserted in the blank fields and click the "Done" button. Try a 7-day free trial account at FormsPal and obtain immediate access to uia michigan form - download or edit from your FormsPal cabinet. FormsPal offers risk-free document editing without data record-keeping or distributing. Feel safe knowing that your information is safe with us!