Our finest web developers worked hard to build the PDF editor we are pleased to present to you. The application makes it possible to effortlessly complete uia and will save you precious time. You just need to keep up with this particular guide.

Step 1: The first task is to select the orange "Get Form Now" button.

Step 2: When you've accessed the uia editing page you may find all of the functions you can conduct concerning your document from the upper menu.

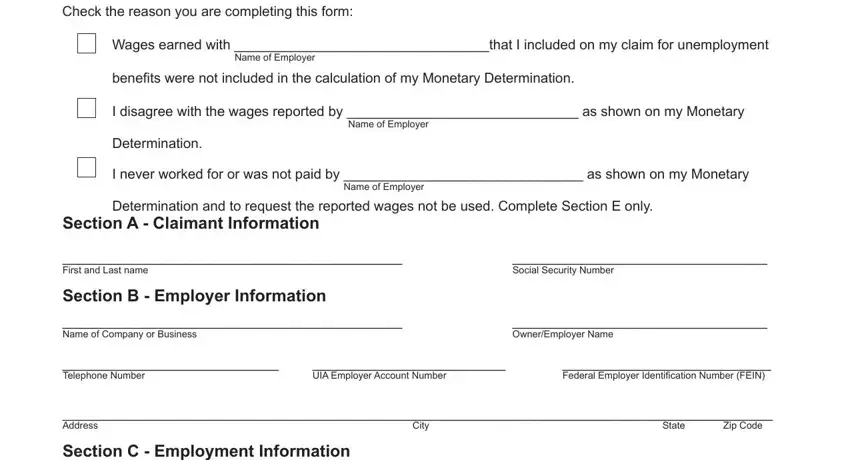

Get the uia PDF and type in the details for each and every part:

Type in the appropriate information in the field Check the reason you are, Wages earned with that I included, Name of Employer, benefits were not included in the, I disagree with the wages reported, Name of Employer, Determination, I never worked for or was not paid, Name of Employer, Determination and to request the, Section A Claimant Information, First and Last name, Social Security Number, Section B Employer Information, and Name of Company or Business.

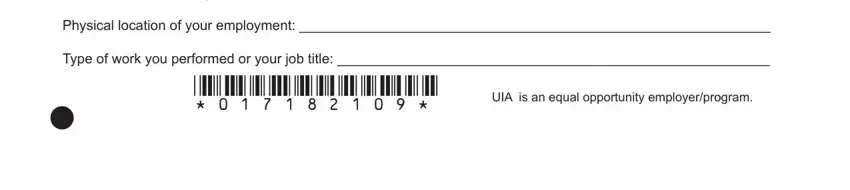

Write down the vital data in Section C Employment Information, Physical location of your, Type of work you performed or your, and UIA is an equal opportunity area.

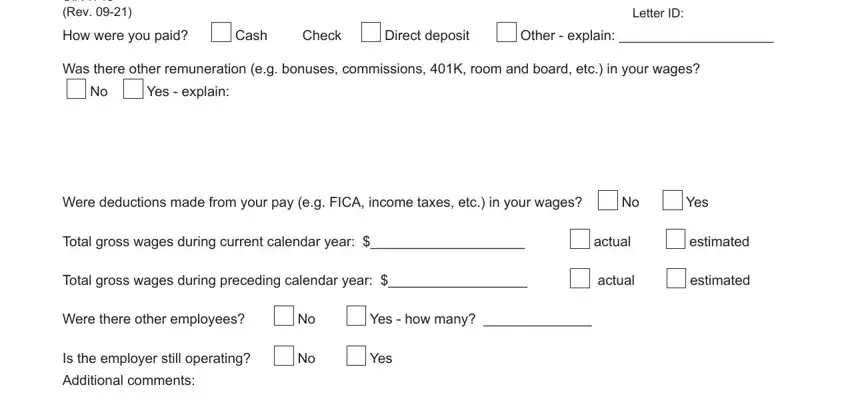

The area UIA Rev, Letter ID, How were you paid, Cash Check, Direct deposit, Other explain, Was there other remuneration eg, Yes explain, Were deductions made from your pay, Yes, Total gross wages during current, actual, estimated, Total gross wages during preceding, and actual is where you add all sides' rights and responsibilities.

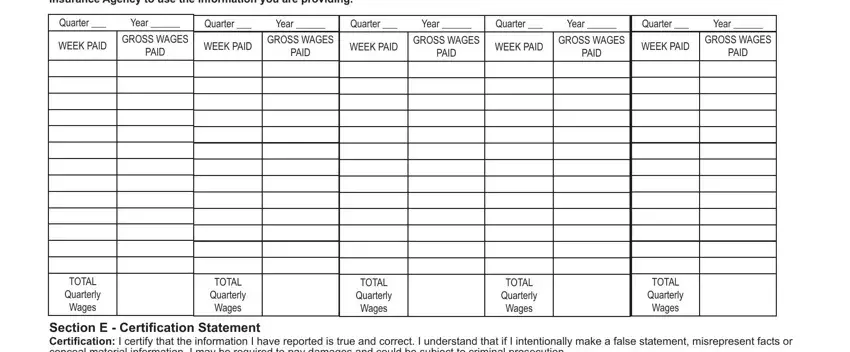

Finalize by reading these areas and writing the suitable particulars: You are required to send in clear, Quarter, Year, Quarter, Year, Quarter, Year, Quarter, Year, Quarter, Year, WEEK PAID, GROSS WAGES PAID, WEEK PAID, and GROSS WAGES PAID.

Step 3: When you are done, hit the "Done" button to transfer your PDF document.

Step 4: Try to generate as many duplicates of the document as you can to avoid future problems.