You can fill out Form W 8Exp effectively in our online PDF tool. FormsPal expert team is ceaselessly endeavoring to enhance the editor and help it become much easier for users with its cutting-edge features. Enjoy an ever-evolving experience now! For anyone who is looking to begin, here is what it's going to take:

Step 1: Access the PDF in our tool by hitting the "Get Form Button" above on this page.

Step 2: Once you access the tool, you will see the form made ready to be filled out. Other than filling out different blanks, you may as well do some other actions with the Document, such as putting on your own words, editing the initial text, adding graphics, placing your signature to the document, and more.

This PDF form requires some specific details; in order to ensure accuracy and reliability, you should heed the following guidelines:

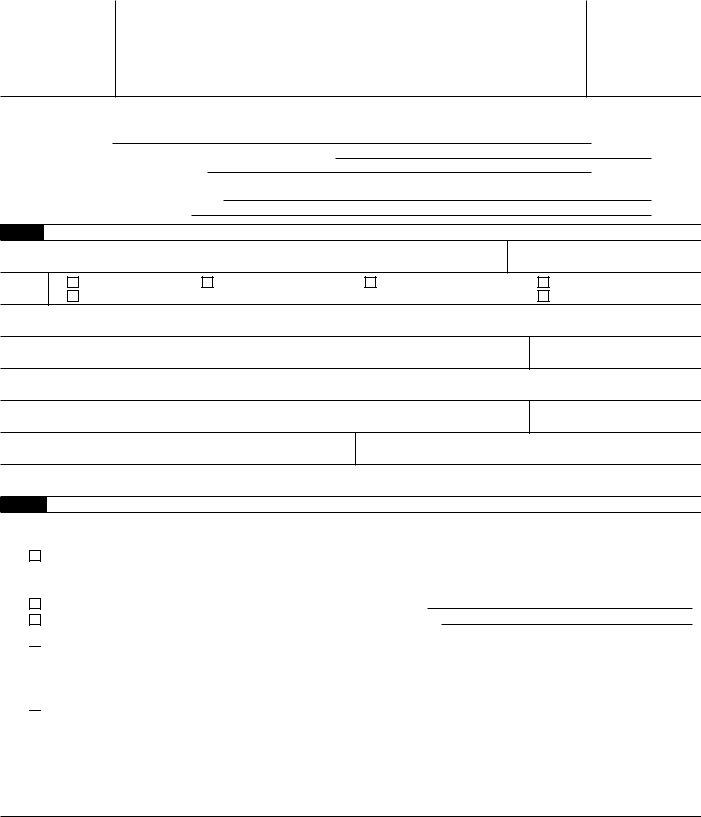

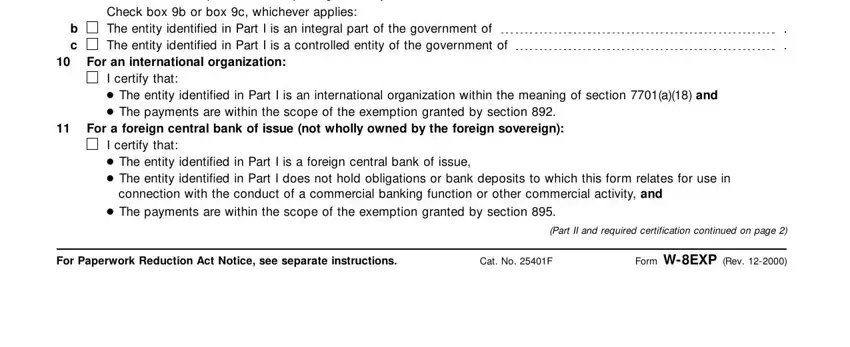

1. The Form W 8Exp will require certain information to be entered. Be sure that the next blank fields are finalized:

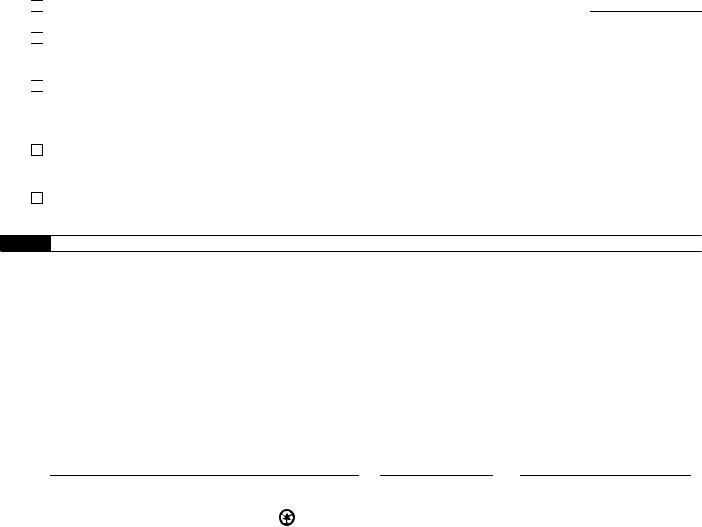

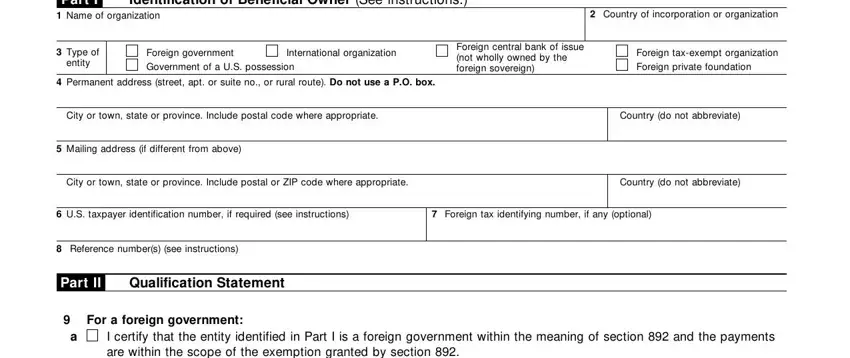

2. Just after performing the last part, go on to the subsequent step and fill in the essential details in these blank fields - b c, I certify that the entity, Check box b or box c whichever, For an international organization, I certify that The entity, For a foreign central bank of, I certify that The entity, connection with the conduct of a, The payments are within the scope, Part II and required certification, For Paperwork Reduction Act Notice, Cat No F, and Form WEXP Rev.

Regarding Part II and required certification and For a foreign central bank of, make certain you don't make any mistakes in this section. The two of these are the key fields in the document.

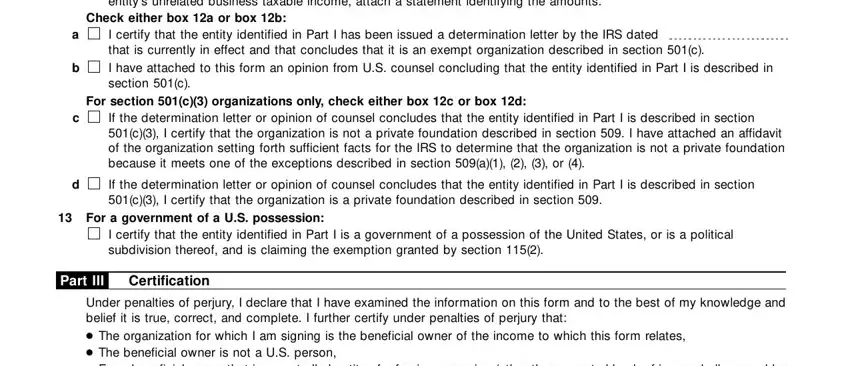

3. Within this part, review If any of the income to which this, Check either box a or box b, I certify that the entity, I have attached to this form an, For section c organizations only, If the determination letter or, If the determination letter or, For a government of a US, I certify that the entity, Part III, Certification, and Under penalties of perjury I. Every one of these are required to be completed with utmost accuracy.

Step 3: Look through everything you have typed into the form fields and hit the "Done" button. Go for a free trial option with us and gain direct access to Form W 8Exp - download or modify in your FormsPal account page. FormsPal is devoted to the privacy of all our users; we ensure that all personal data handled by our editor is kept secure.