You can fill out Indiana easily using our online PDF tool. We at FormsPal are aimed at providing you with the ideal experience with our tool by regularly releasing new capabilities and upgrades. Our editor is now a lot more intuitive thanks to the newest updates! Currently, working with PDF files is a lot easier and faster than ever before. With some basic steps, you may start your PDF journey:

Step 1: Click the "Get Form" button in the top area of this page to get into our editor.

Step 2: This tool helps you modify PDF documents in a range of ways. Enhance it with your own text, correct what is already in the document, and place in a signature - all within a couple of clicks!

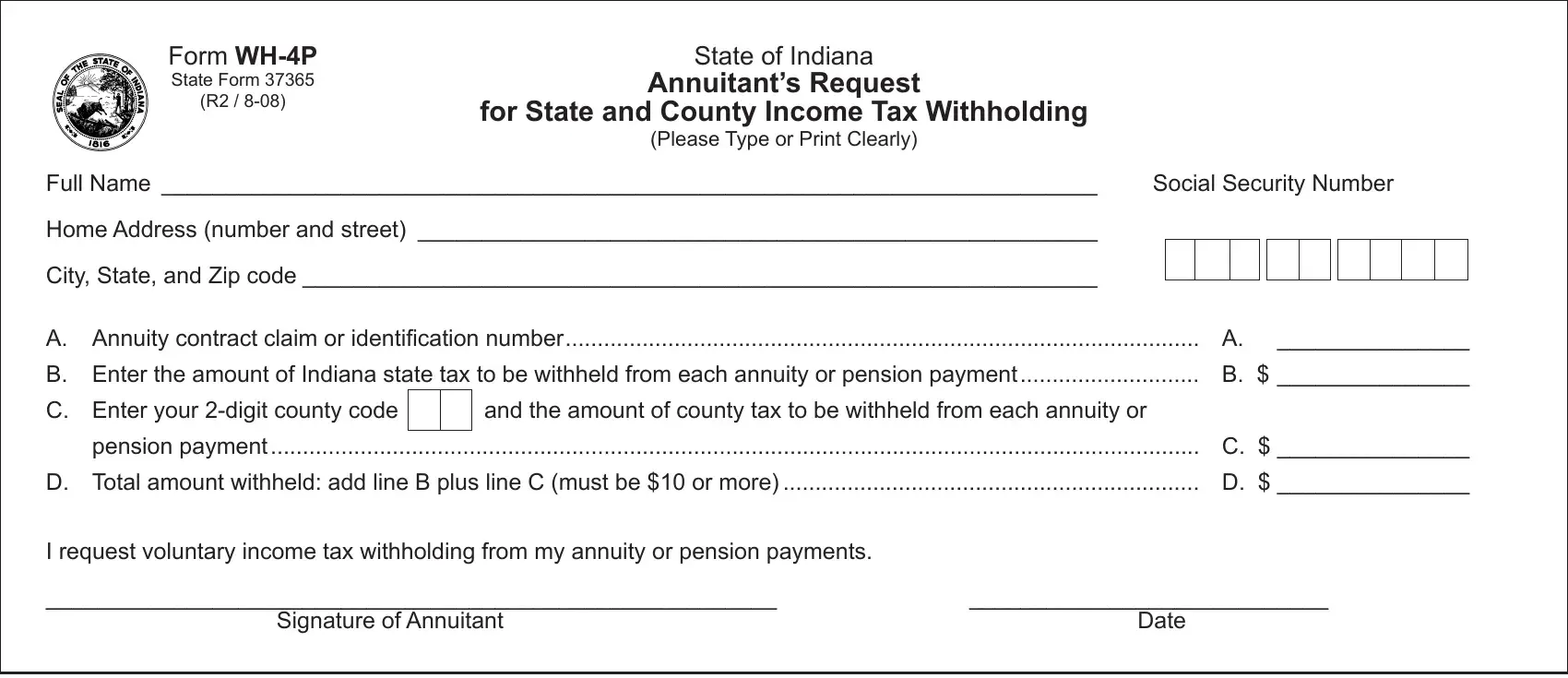

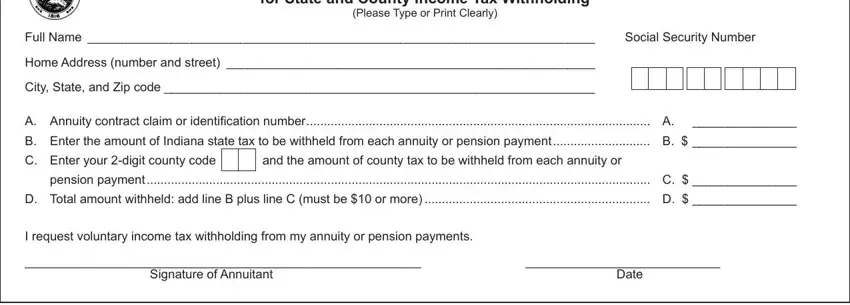

As a way to fill out this form, be certain to provide the necessary information in every blank field:

1. It's very important to complete the Indiana accurately, therefore be attentive when filling out the segments containing all of these blanks:

Step 3: Be certain that the details are right and then just click "Done" to continue further. Make a free trial account with us and acquire instant access to Indiana - download or modify in your FormsPal account. FormsPal guarantees safe form tools without data record-keeping or any type of sharing. Be assured that your details are safe with us!