With the help of the online PDF editor by FormsPal, it is easy to fill in or change wisconsin withholding exemption certificate here. To maintain our tool on the leading edge of practicality, we strive to put into operation user-oriented capabilities and enhancements on a regular basis. We're always grateful for any suggestions - play a vital role in remolding how you work with PDF files. Here's what you would need to do to start:

Step 1: Hit the "Get Form" button above. It is going to open our pdf tool so that you could begin completing your form.

Step 2: With the help of this handy PDF tool, you can actually do more than merely fill out forms. Try all of the features and make your forms seem faultless with customized textual content added, or tweak the file's original input to perfection - all backed up by the capability to add your own images and sign the file off.

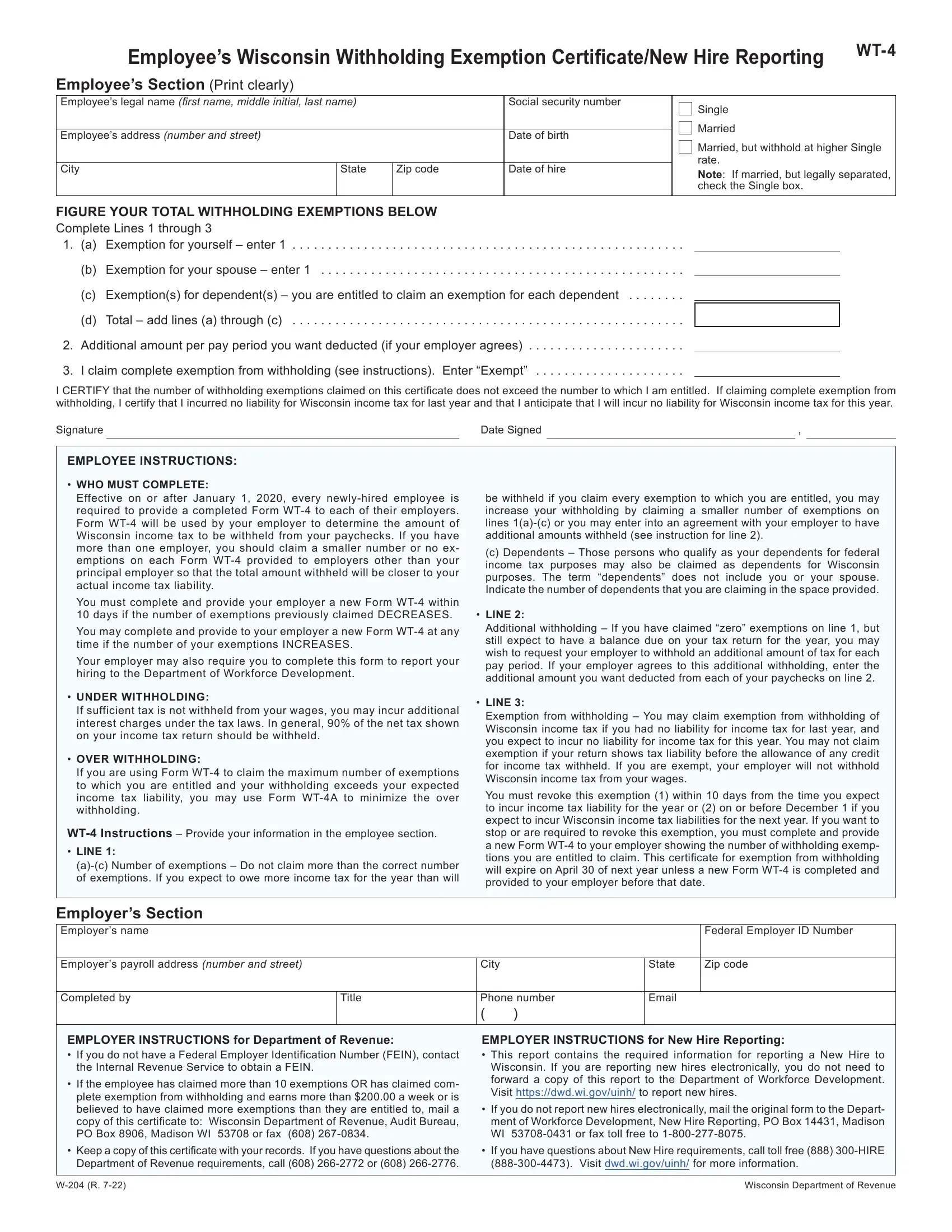

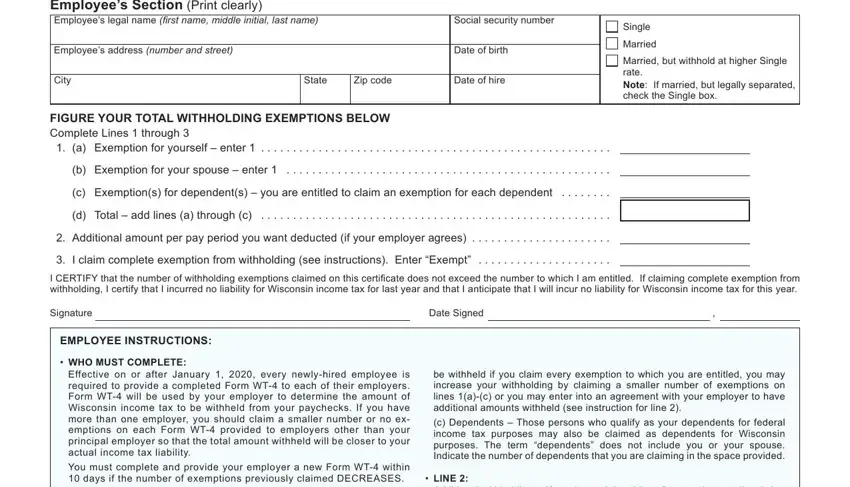

In order to finalize this document, ensure that you enter the required details in each field:

1. When submitting the wisconsin withholding exemption certificate, make sure to include all of the essential blank fields in their relevant part. It will help hasten the work, allowing your details to be processed promptly and appropriately.

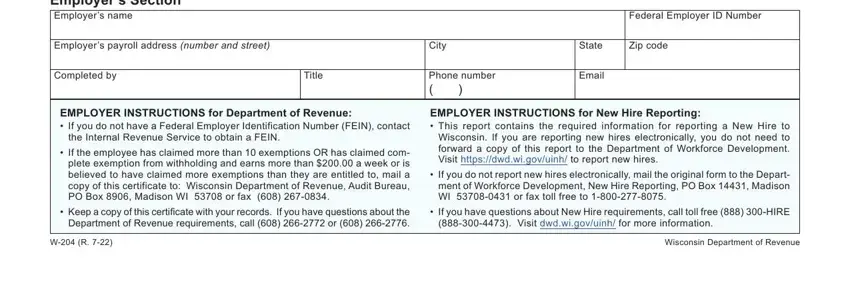

2. Once your current task is complete, take the next step – fill out all of these fields - Employers Section Employers name, Federal Employer ID Number, Employers payroll address number, City, State, Zip code, Completed by, Title, Phone number, Email, EMPLOYER INSTRUCTIONS for, the Internal Revenue Service to, If the employee has claimed more, EMPLOYER INSTRUCTIONS for New Hire, and If you do not report new hires with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make errors when filling in your Employers payroll address number, for that reason make sure you look again prior to when you send it in.

Step 3: Before obtaining the next step, it's a good idea to ensure that all form fields are filled out the proper way. As soon as you are satisfied with it, click on “Done." Try a free trial plan at FormsPal and obtain direct access to wisconsin withholding exemption certificate - with all transformations saved and accessible from your personal cabinet. FormsPal ensures your data confidentiality with a protected method that never records or distributes any type of sensitive information used. Feel safe knowing your docs are kept confidential any time you work with our tools!