Our leading computer programmers have worked together to implement the PDF editor that you may begin using. This application makes it easy to complete wt7 form forms immediately and effortlessly. This is certainly everything you should undertake.

Step 1: Select the button "Get Form Here" on the following website and click it.

Step 2: Once you've entered the editing page wt7 form, you should be able to find each of the options readily available for your document in the top menu.

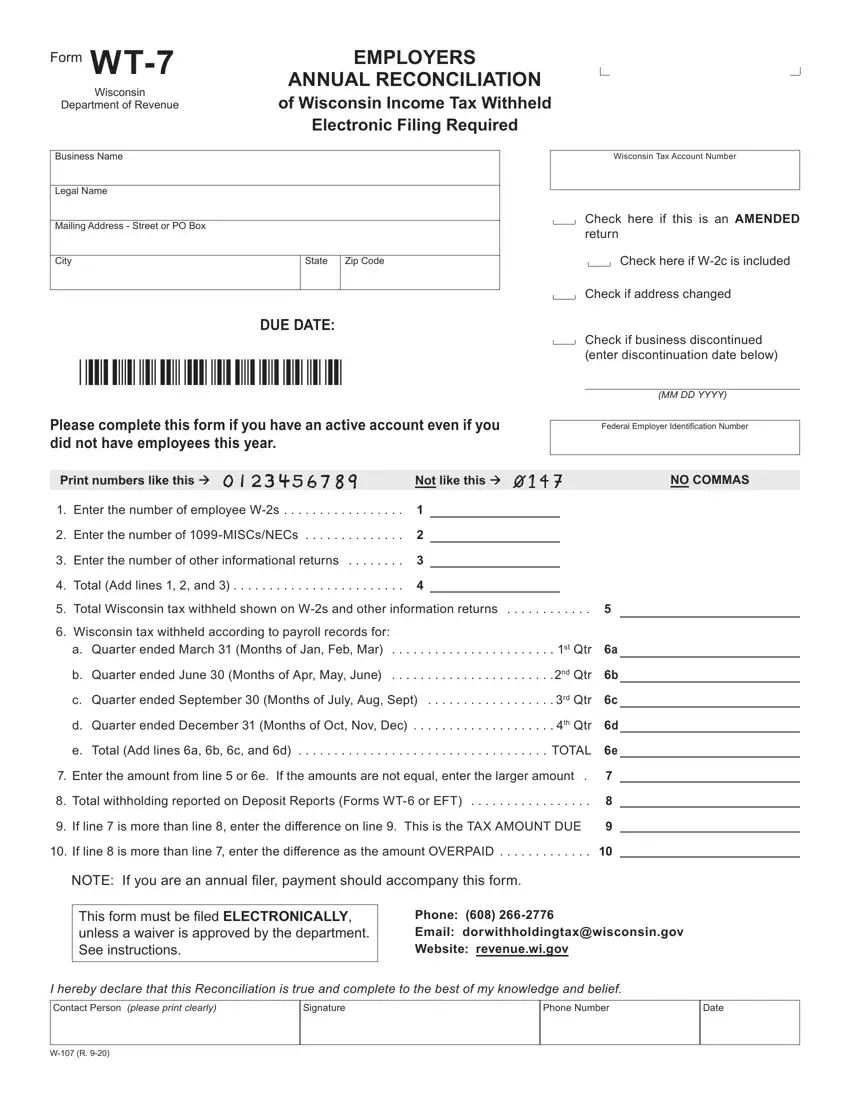

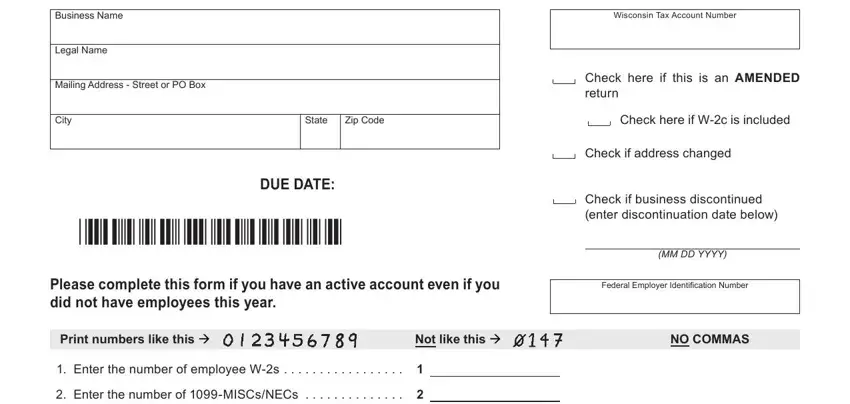

The next areas will create the PDF file that you'll be creating:

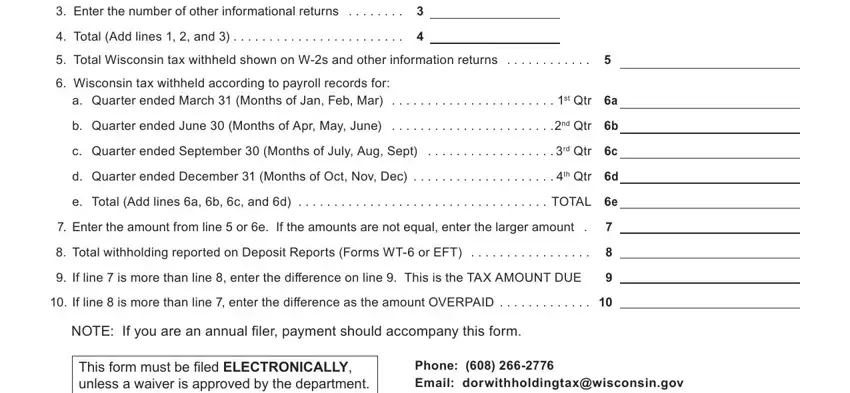

The system will demand you to fill out the Enter the number of other, Total Add lines and, Total Wisconsin tax withheld, Wisconsin tax withheld according, a Quarter ended March Months of, b Quarter ended June Months of, c Quarter ended September Months, d Quarter ended December Months, e Total Add lines a b c and d, Enter the amount from line or e, Total withholding reported on, If line is more than line enter, If line is more than line enter, NOTE If you are an annual filer, and This form must be filed section.

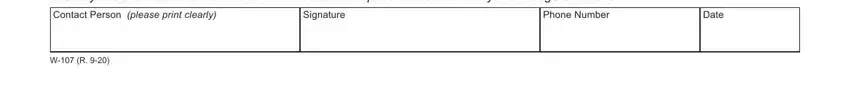

Describe the main details about the I hereby declare that this, Contact Person please print clearly, Signature, Phone Number, Date, and W R section.

Step 3: Hit the button "Done". Your PDF document may be exported. You can easily upload it to your device or send it by email.

Step 4: Make sure to remain away from forthcoming problems by creating minimally a pair of copies of the form.