The WV/SPF-100 form is crucial for S Corporations and Partnerships operating within West Virginia, especially when addressing income and business franchise taxes for the year 2010. This comprehensive document, revised last in August 2010, simplifies the reporting process for these entities by providing a structured format to declare taxable income, apportion income, and calculate both income and franchise taxes due to the state. It incorporates detailed sections for different types of income, adjustments, and tax credits, ensuring that businesses accurately report their financial activities. S Corporations and Partnerships need to check specific boxes that pertain to their entity type and fill out schedules related to income/loss reporting, modifications to federal income, business franchise tax calculation, and tax payments. This form also gives room for declaring nonresident withholding requirements, a significant aspect for entities with nonresident members, and outlines the procedure for direct deposit refunds, making the tax return process smoother. Moreover, it mandates the attachment of the federal return and specifies conditions for amended returns, highlighting the state's compliance requirements. The form does more than just gather financial information; it serves as a tool for entities to reconcile their tax obligations with West Virginia’s specific tax laws, potentially impacting their tax planning and liabilities.

| Question | Answer |

|---|---|

| Form Name | Form Wv Spf 100 |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | spf100 form wvspf 100 for 2012 |

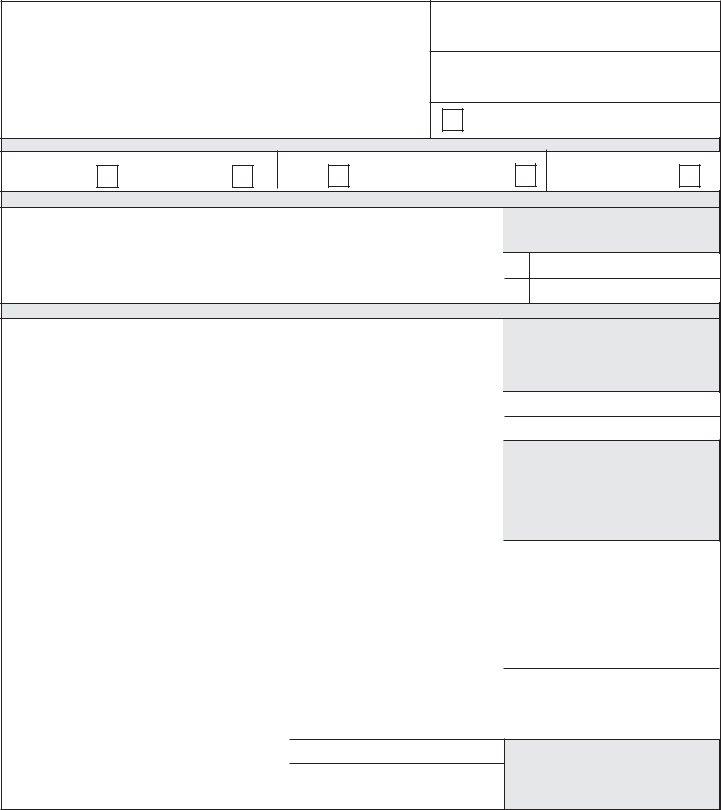

2010 |

|

WEST VIRGINIA INCOME/BUSINESS FRANCHISE TAX |

|

|

||||||||

|

|

|||||||||||

REV |

|

|

(PASSTHROUGH) |

|

|

|

FEIN |

|

||||

TAX YEAR |

|

|

|

ENDING |

|

|

EXTENDED |

|

|

|||

BEGINNING |

|

|

|

|

|

|

|

|

DUE DATE |

|

|

|

MM |

DD |

YYYY |

|

|

MM |

DD |

YYYY |

MM |

DD |

YYYY |

||

|

|

|

|

|||||||||

BUSINESS NAME AND ADDRESS

PRINCIPAL PLACE OF BUSINESS IN WV

TYPE OF ACTIVITY IN WV

52/53 WEEK FILER _______________________

day of week started

CHECK APPLICABLE BOXES

S CORPORATION

PARTNERSHIP

INITIAL

TYPE OF RETURN:

FINAL |

|

AMENDED |

|

|

|

FEDERAL RETURN ATTACHED

1120S |

|

1065 |

|

|

|

NONRESIDENT WITHHOLDING - COMPLETE SCHEDULE SP BEFORE COMPLETING THIS SECTION

1 |

. Percent of nonresidents filing composite personal income tax |

1 |

|

• |

|

|||

|

|

returns (from Schedule SP, Column C, Line 11) |

|

|

|

|

||

|

|

|

|

|

|

|

||

2 |

. Percent of nonresidents filing nonresident personal income tax |

2 |

|

• |

|

|||

|

|

returns (from Schedule SP, Column D, Line 11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

. Income subject to withholding (from Schedule SP, Column G, Line 11) |

3 |

||||||

4 |

. West Virginia income tax withheld for nonresident shareholders/partners |

|

||||||

|

|

|||||||

|

|

(from Schedule SP, Column H, Line 11) |

|

|

|

|

|

4 |

BUSINESS FRANCHISE TAX/WITHHOLDING TAX |

|

|

|

|

|

|

||

5 |

. |

West Virginia taxable capital (Schedule B, Line 16) |

5 |

|

|

|

.00 |

|

6 |

. |

|

|

|

|

|

||

West Virginia business franchise tax (Line 5 x |

6 |

|

|

|

.00 |

|

||

|

|

0.0041 or $50.00, whichever is greater) |

|

|

|

|

||

|

|

|

|

|

|

|

||

7 |

. Tax credits (Schedule |

7 |

|

|

|

.00 |

|

|

.00

.00

..................................................................8 . Adjusted business franchise tax (Line 6 less Line 7) |

|

|

|

|

|

|

|

9 . Combined withholding/business franchise tax (add Line 4 and Line 8) |

|

|

|

||||

|

|

|

|

|

|

|

|

10 |

. Prior year carryforward credit |

1 0 |

|

.00 |

|

||

11 |

. Tax payments |

1 1 |

|

.00 |

|

||

12 |

. Withholding payments |

1 2 |

|

.00 |

|

||

13 |

. Amount paid with original return (Amended Return Only) |

1 3 |

|

.00 |

|

||

|

|

|

|

|

|

|

|

14 |

. Payments (add Lines 10 through 13) Must match total of Schedule of Tax Payments... |

|

|

|

|||

15 |

. Overpayment previously refunded or credited (Amended Return Only) |

|

|

|

|||

16 |

. Total Payments (Line 14 minus Line 15) |

|

|

|

|

|

|

17 |

. Tax Due- If Line 16 is smaller than Line 9, enter amount owed. |

|

|

|

|||

|

If Line 16 is larger than Line 9, enter |

|

|

|

|||

18 |

. Interest for late payment |

|

|

|

|

|

|

19 |

. Additions to tax for late filing and/or late payment |

|

|

|

|

|

|

20. Penalty for underpayment of business franchise estimated tax |

|

|

|

||||

|

|

|

|||||

|

Attach Form |

|

|

|

|||

.................................................................2 1 Total due with this return (add Lines 17 through 20) |

|

|

|

|

|

|

|

|

Make check payable to West Virginia State Tax Department |

|

|

|

|||

...........................2 2 Overpayment (Line 16 less Line 9) |

|

2 2 |

|

.00 |

|

||

|

|

|

|

|

|||

2 3 Amount of Line 22 to be credited to next year’s tax |

|

2 3 |

|

.00 |

|

||

|

|

|

|

|

|||

.............................2 4 Amount of Line 22 to be refunded |

|

2 4 |

|

.00 |

|

||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

8 |

.00 |

9 |

.00 |

1 4 |

.00 |

1 5 |

.00 |

1 6 |

.00 |

1 7 |

.00 |

1 8 |

.00 |

1 9 |

.00 |

2 0 |

.00 |

2 1 |

.00 |

REV |

RETURN FOR S CORPORATION AND PARTNERSHIP |

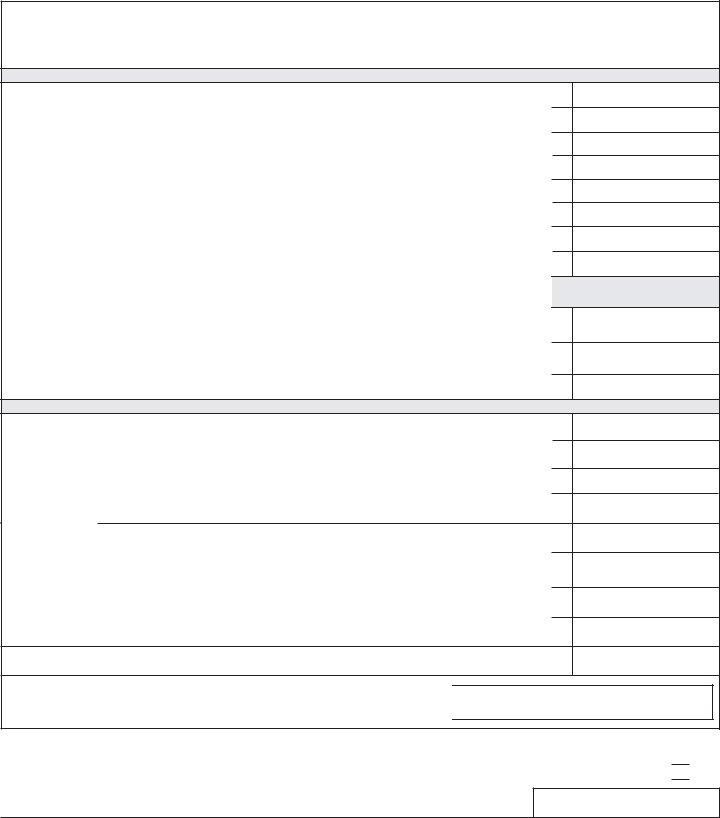

SCHEDULE A - INCOME/LOSS

1 |

............................... Income/Loss: S Corporation use Federal Form 1120S; Partnership use Federal Form 1065 |

1 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2 |

.Other income: S Corporation use Federal Form 1120S, Schedule K and |

2 |

|||||||||||||

|

Partnership use Federal Form 1065, Schedule K and |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||||

3 |

. Other expenses/deductions: S Corporation use Federal form 1120S, Schedule K; Partnership use Federal |

3 |

|||||||||||||

|

Form 1065, Schedule K |

|

|

|

|

|

|

|

|

|

|||||

4 |

. TOTAL FEDERAL INCOME: Add Lines 1 and 2 minus Line 3 - Attach federal return |

|

|

4 |

|||||||||||

5 |

. Net modifications to federal income (from Schedule |

5 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 |

. Modified federal income (sum of Lines 4 and 5). Wholly WV business go to Line 12; Multistate Corporation |

6 |

|||||||||||||

|

go to Line 7. Modified federal Partnership income (sum of Lines 4 and 5), go to Line 8 |

|

............................. |

||||||||||||

7 |

.Total nonbusiness income allocated everywhere: S CORPORATION ONLY use Form |

7 |

|||||||||||||

|

Schedule A1, Column 3, Line 8 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||||

8 |

. Income subject to apportionment (Line 6 less Line 7) |

|

|

|

|

|

|

8 |

|||||||

9 |

. West Virginia apportionment factor: (Round to 6 decimal places) from |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||||

|

|

9 |

|

• |

|

|

|||||||||

|

or Part 3, Column 3; Partnership use Schedule B, Line 8 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|||||||||

10 |

. West Virginia apportioned income (Line 8 multiplied by Line 9) If Line 10 shows a loss, omit Page 1, |

|

|||||||||||||

|

Lines 1 through 4. However you must complete Schedule SP. S Corporations complete Lines 11 and 12 |

1 0 |

|||||||||||||

11 |

. Nonbusiness income allocated to West Virginia; S CORPORATION ONLY. Use Form |

|

|||||||||||||

|

Schedule A2, Line 12 |

|

|

|

|

|

|

|

|

1 1 |

|||||

12 |

. West Virginia income (wholly WV |

|

|||||||||||||

|

If Line 12 shows a loss, omit Page 1, Lines 1 through 4. However, you must complete Schedule SP |

1 2 |

|||||||||||||

SCHEDULE |

|

|

|

|

|

|

|

||||||||

INCREASING |

|

|

|

|

|

|

|

|

|

|

1 3 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13 |

. Interest income from obligations or securities of any state, or political subdivision other than this state |

||||||||||||||

|

|||||||||||||||

14 |

. US Government obligation interest or dividends exempt from federal but not exempt from state tax, less |

1 4 |

|||||||||||||

|

related expenses not deducted on federal return |

|

|

|

|

|

|

|

|||||||

15 |

. Interest expenses deducted on your federal return on indebtedness to purchase or carry |

securities |

1 5 |

||||||||||||

|

exempt from West Virginia income tax |

|

|

|

|

|

|

|

|||||||

16 |

. Total increasing modifications - Add Lines 13 through 15 |

|

|

|

|

|

|

1 6 |

|||||||

DECREASING |

|

|

|

|

|

|

|

|

|

|

|

||||

17 |

. Interest or dividends from US government obligations, included on your federal return |

|

|

1 7 |

|||||||||||

18 |

. US Government obligation interest or dividends subject to federal but exempt from state tax, less related |

1 8 |

|||||||||||||

|

expenses |

deducted on your federal return |

|

|

|

|

|

|

|||||||

19 |

. Refund or credit of income taxes or taxes based upon income, imposed by this state or any other jurisdiction, |

1 9 |

|||||||||||||

|

included |

on your federal |

return |

|

|

|

|

|

|

||||||

20 |

. Total decreasing modifications - Add Lines 17 through 19 |

|

|

|

|

|

|

2 0 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NET |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

21 |

. Net modifications to federal partnership income - Line 16 less Line 20. |

Enter here and on Schedule A, Line 5 |

2 1 |

||||||||||||

|

|

|

|

TYPE |

|

|

|

|

|

|

|

|

|

|

|

DIRECT |

|

|

CHECKING |

ROUTING |

|

|

ACCOUNT |

|

|

|

|

||||

DEPOSIT |

|

|

|

NUMBER |

|

|

|

|

|

|

|||||

|

|

|

|

|

NUMBER |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||

OF REFUND |

|

|

SAVINGS |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true and complete. All appropriate sections of the return must be completed. An incomplete return will not be accepted as timely filed. Checking this box indicates waiver of my/our rights of confidentiality for the purpose of contacting the preparer regarding this return.

Signature of Officer/Partner or Member |

Name of Officer/Partner or |

Title |

Date |

Business Phone Number |

|

|

|

|

|

|

|

|

|

|

Paid preparer's signature |

Firm's name and address |

MAIL TO:

WEST VIRGINIA STATE TAX DEPARTMENT

TAX ACCOUNT ADMINISTRATION DIVISION

PO BOX 11751

CHARLESTON, WV

Date |

Preparer phone number |

*b54201002W*

REV |

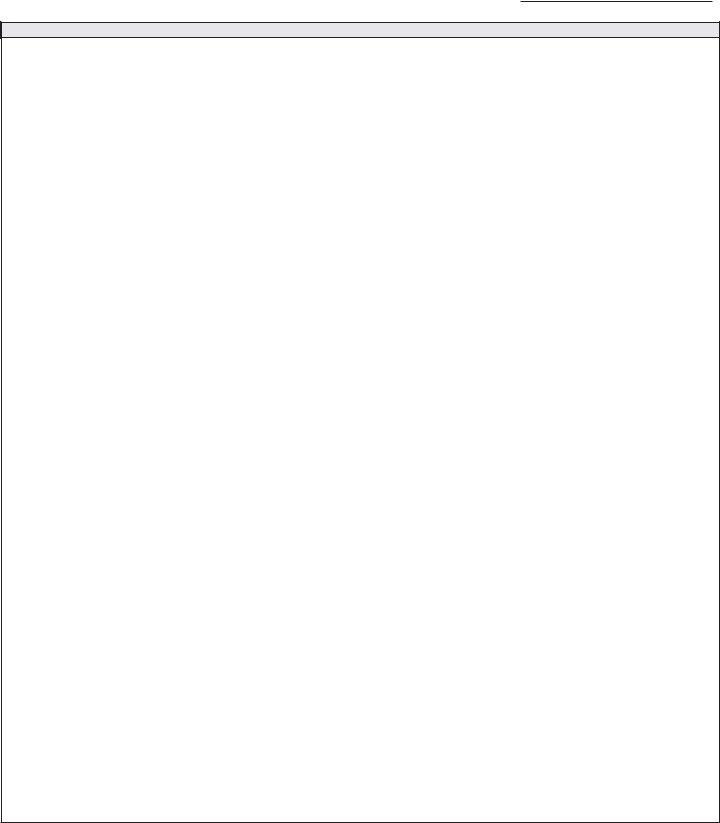

RETURN FOR S CORPORATION AND PARTNERSHIP |

|

SCHEDULE

FEIN

S CORPORATION INCOME TAX - CALCULATION OF WEST VIRGINIA TAXABLE INCOME

1.Interest or dividends from any state or local bonds or securities..............................................

2.U.S. Government obligation interest or dividends not exempt from state tax, less related expenses not deducted on federal return................................................................................

3.Income taxes or taxes based upon net income, imposed by this state or any other jurisdiction, deducted on your federal return...............................................................................................

4.Federal depreciation/amortization for WV water/air pollution control facilities -

wholly WV corporations only....................................................................................................

5. Unrelated business taxable income of a corporation exempt from federal tax (IRC 512)..........

6. Federal net operating loss deduction..........................................................................................

7. Federal deduction for charitable contributions to Neighborhood Investment Programs if

claiming the WV Neighborhood Investment Programs Tax credit.............................................

8. Net operating loss from sources outside the United States........................................................

9. Foreign taxes deducted on your federal return.........................................................................

10. Deduction taken under IRC 199 (WV Code

11. Add back for expenses related to certain REIT’s and Regulated Investment

Companies (WV Code

12. TOTAL INCREASING ADJUSTMENTS - add Lines 1 through 11.......................................

13. Refund or credit of income taxes or taxes based upon net income, imposed by this state or any

other jurisdiction, included in federal taxable income..................................................................

14. Interest expense on obligations or securities of any state or its political subdivisions,

disallowed in determining federal taxable income.....................................................................

15. Salary expense not allowed on federal return due to claiming the federal jobs credit............

16. Foreign dividend

17. Subpart F income (IRC Section 951)..........................................................................................

18. Taxable income from sources outside the United States...........................................................

19. Cost of West Virginia water/air pollution control facilities - wholly WV only.............................

20. Employer contributions to medical savings accounts (WV Code

taxable income less amounts withdrawn for

21. SUBTOTAL of decreasing adjustments - add Lines 13 through 20..........................................

22. Allowance for governmental obligations/obligations secured by residential property

(from Schedule

1 |

.00 |

|

|

2 |

.00 |

|

|

3 |

.00 |

|

|

4 |

.00 |

|

|

5 |

.00 |

6 |

.00 |

7 |

.00 |

8 |

.00 |

|

|

9 |

.00 |

|

|

10 |

.00 |

|

|

11 |

.00 |

12 |

.00 |

13 |

.00 |

14 |

.00 |

15 |

.00 |

16 |

.00 |

17 |

.00 |

18 |

.00 |

19 |

.00 |

20 |

.00 |

21 |

.00 |

22 |

.00 |

*b54201003W*

2010 |

|

|

||||||||

REV |

RETURN FOR S CORPORATION AND PARTNERSHIP |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

23. TOTAL DECREASING ADJUSTMENTS - add Lines 21 and 22 |

|

22 |

.00 |

|||||||

24. Net modifications to Federal S Corporation Income - Line 12 less Line 23. Enter here and |

|

|

|

.00 |

||||||

|

on Schedule A, Line 5 |

|

|

|

|

23 |

||||

|

|

|

|

|

|

|||||

SCHEDULE |

BY |

RESIDENTIAL PROPERTY |

||||||||

|

|

|

|

|

|

|

|

|

||

1. |

Federal obligations and securities |

|

|

|

|

1 |

|

.00 |

||

2. |

Obligations of WV and any political subdivision of WV |

|

|

............... |

|

2 |

|

.00 |

||

3. |

Investments or loans primarily secured by mortgages or deeds of trust on residential property |

|

|

|

|

|

||||

|

|

|

.00 |

|||||||

|

located in WV |

|

|

|

|

3 |

|

|||

4. |

Loans primarily secured by a lien or security agreement on a mobile home or |

|

|

|

|

|

||||

|

located in WV |

|

|

|

|

4 |

|

.00 |

||

5. |

......................................................................................................TOTAL - add Lines 1 through 4 |

|

|

|

|

5 |

|

.00 |

||

|

|

|

|

|

|

|

|

|||

6. |

........................................................Total assets as shown on Schedule L, Federal Form 1120S |

|

|

|

|

6 |

|

.00 |

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

COMPLETED SCHEDULE B |

|

7. |

Line 5 divided by Line 6 (round to six (6) decimal places) |

7 |

|

• |

|

|

|

MUST BE ATTACHED |

||

|

|

|

|

|

|

|

|

|

|

|

8. |

Adjusted income - Add Schedule A, Line 4 and Schedule |

|

|

|

|

|

||||

|

21 plus total from Form |

|

8 |

|

.00 |

|||||

9. |

ALLOWANCE - Line 7 x Line 8, disregard sign - enter here and on Schedule |

|

9 |

|

.00 |

|||||

SCHEDULE OF TAX PAYMENTS

|

Identification Number |

MM |

DD YEAR |

Indicate EFTif |

Type: withholding, |

|

year credit |

||||

Name of business |

West Virginia Account |

|

Date of Payment |

|

estimated,extension, |

|

|

other pmts or prior |

|||

|

|

|

|

|

|

TOTAL - This amount must agree with the amount on Line 14, on front of return........................................................

Amount of payment

.00

.00

.00

.00

.00

.00

.00

.00

*b54201004W*

|

|

RETURN FOR S CORPORATION AND PARTNERSHIP |

FEIN |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE B - BUSINESS FRANCHISE TAX - CALCULATION OF WEST VIRGINIA TAXABLE CAPITAL |

|

||||||||||

|

|

|

|

|

Column 1 |

|

|

|

Column 2 |

|

Column 3 - Average |

|

|

|

|

|

|

Beginning Balance |

|

|

|

Ending Balance |

|

(Col 1 + Col 2) divided by 2 |

|

|

1. Dollar amount of common stock & preferred stock |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

2. |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

3. Retained earnings appropriated & unappropriated |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

4. Adjustments to shareholders equity |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

5. Shareholders undistributed taxable income |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

6. Accumulated adjustments account |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

7. Other adjustments account |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

...................8. Add Lines 1 through 7 of Column 3 |

|

|

|

|

|

|

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Less: Cost of Treasury Stock |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

10. Dollar amount of partner’s capital accounts |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

11. Capital - Column 3, Line 8 less Column 3, Line 9 |

|

|

|

|

|

|

.00 |

|

|||

|

12. Multiplier for allowance for certain obligations/investments - |

|

• |

|

|

|

|

|||||

|

Schedule |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

.00 |

|

||||

|

13. Allowance - Line 10 or 11 multiplied by Line 12 |

|

|

|

|

|

|

|

||||

|

14. Adjusted capital - subtract Line 13 from Line 10, or 11. If taxable only in West Virginia check here |

|

.00 |

|

||||||||

|

and enter this amount on Line 16 |

|

|

|

|

|

|

|

||||

|

15. Apportionment factor - Form |

|

• |

|

|

COMPLETED FORM |

|

|||||

|

Part 3, Column 3 |

|

|

|

|

MUST BE ATTACHED |

|

|||||

|

16. TAXABLE CAPITAL - Line 14 multiplied by Line 15 - Enter on front of return, Line 5 |

.00 |

|

|||||||||

|

BUSINESS FRANCHISE TAX - SUBSIDIARY CREDIT |

|

|

|

|

|

|

|

||||

|

|

Column 1 |

|

Column 2 |

|

|

|

Column 3 |

Column 4 |

|||

|

|

Account number and name |

|

Recomputed Business |

|

Percentage |

Allowable Credit |

|||||

|

|

of Subsidiary or Partnership |

|

Franchise Tax Liability |

|

of Ownership |

(Column 2 x Column 3) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

.00 |

|

• |

|

.00 |

|

|||

|

FEIN |

|

|

|

|

.00 |

|

• |

|

.00 |

|

|

|

NAME |

|

|

|

|

|

||||||

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

.00 |

|

• |

|

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

17. TOTAL - (Enter here and on Schedule |

.00 |

|

|||||||||

BUSINESS FRANCHISE TAX - TAX CREDIT FOR PUBLIC UTILITIES AND ELECTRIC POWER GENERATORS

18.Gross income in West Virginia subject to the STATE Business and Occupation Tax...............................................

19.Total gross income of taxpayer from all activity in West Virginia..............................................................................

20. Line 18 divided by Line 19 (Round to 6 decimal places) |

• |

21.Business Franchise liability - From front of return, Line 6, reduced by any Subsidiary Credit..................................

22.Allowable credit - Line 21 multiplied by line 20 - Enter here and on Schedule

.00

.00

.00

.00

**IMPORTANT NOTE REGARDING LINE 15**

FORM

FAILURE TO ATTACH COMPLETED FORM

WILL RESULT IN 100% APPORTIONMENT TO WEST VIRGINIA

*b54201005W*