remit can be completed online effortlessly. Just make use of FormsPal PDF tool to finish the job in a timely fashion. In order to make our tool better and simpler to work with, we constantly come up with new features, bearing in mind feedback from our users. It just takes just a few simple steps:

Step 1: Press the "Get Form" button at the top of this webpage to get into our PDF tool.

Step 2: As soon as you open the editor, you will get the document all set to be filled in. Apart from filling out different blank fields, it's also possible to do various other actions with the form, namely writing custom text, editing the initial text, inserting graphics, placing your signature to the form, and much more.

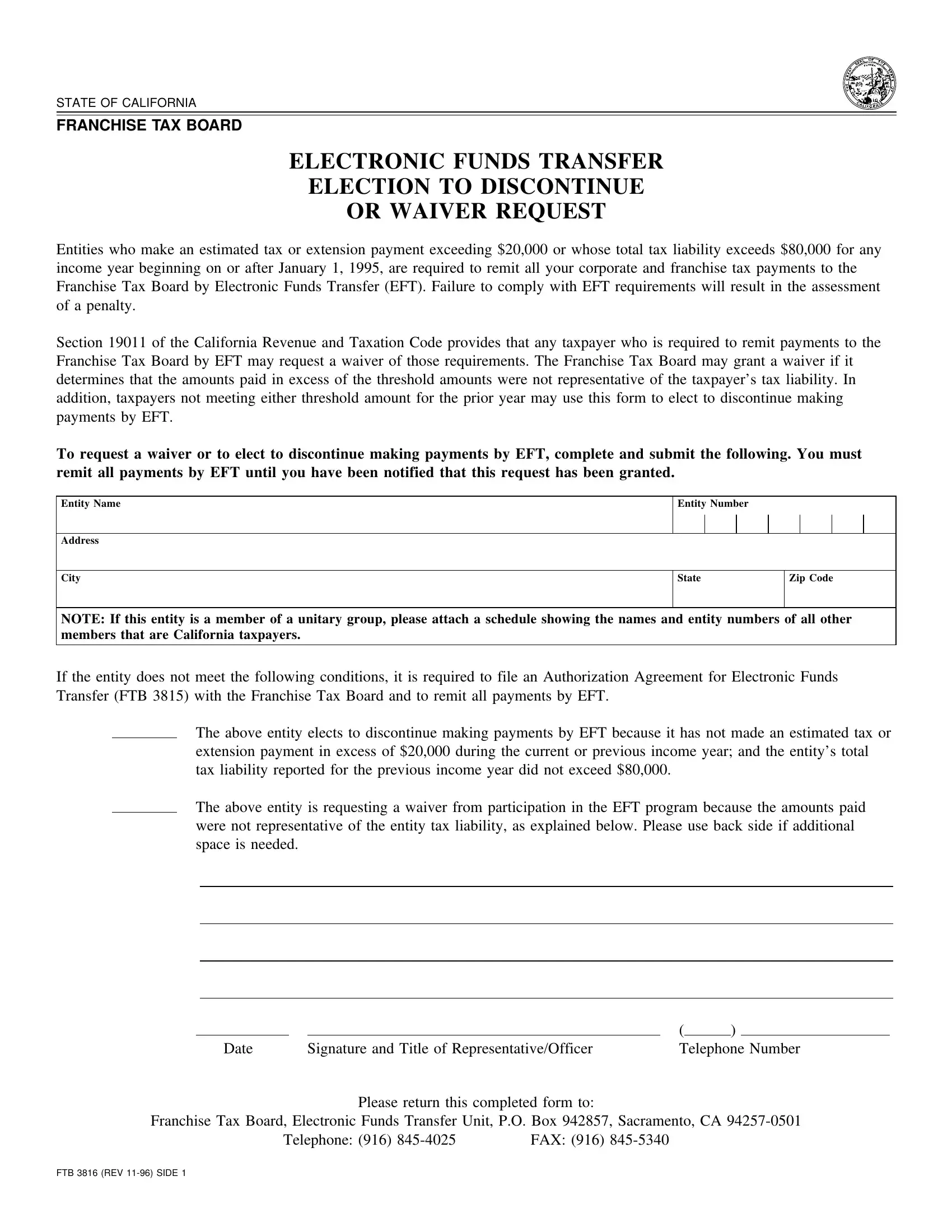

This document requires some specific details; to guarantee consistency, take the time to take into account the recommendations directly below:

1. Whenever filling out the remit, make certain to include all important blank fields in their corresponding section. This will help to facilitate the process, which allows your information to be handled efficiently and accurately.

2. Once your current task is complete, take the next step – fill out all of these fields - with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Many people often make mistakes while filling out this field in this section. Ensure you revise whatever you type in right here.

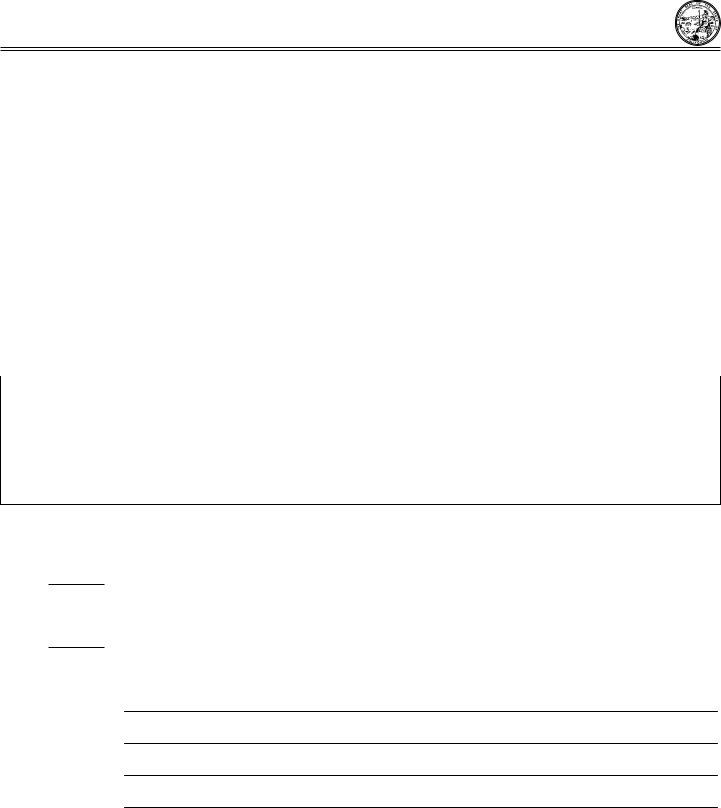

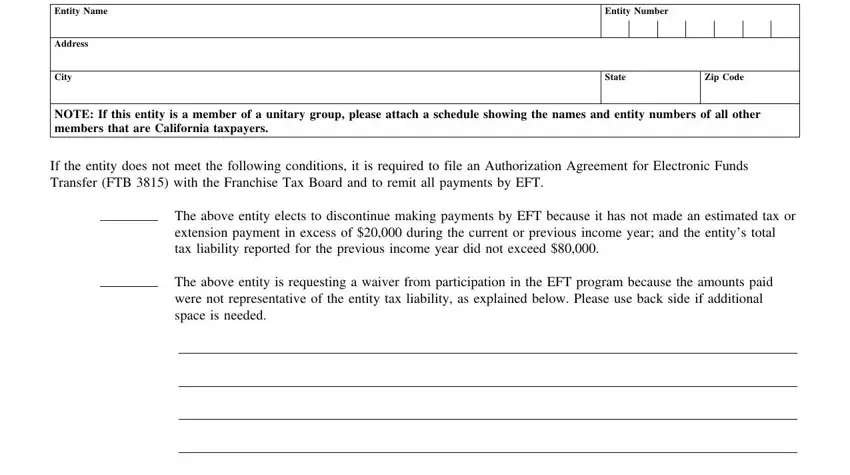

3. This next portion is related to - fill out every one of these blank fields.

4. All set to start working on the next portion! Here you have these FTB REV SIDE blanks to fill out.

Step 3: Make sure the details are accurate and click "Done" to progress further. Sign up with FormsPal right now and instantly get access to remit, available for download. Each and every edit made is conveniently saved , making it possible to edit the pdf at a later point as needed. At FormsPal, we aim to make sure that your details are stored private.