You may prepare hmrc c1 effectively using our online PDF editor. In order to make our editor better and simpler to use, we continuously design new features, taking into consideration suggestions from our users. All it requires is a couple of basic steps:

Step 1: Open the PDF file inside our editor by clicking the "Get Form Button" in the top part of this webpage.

Step 2: As you open the tool, you will notice the form all set to be completed. Apart from filling in different blank fields, you could also perform many other actions with the file, such as putting on custom words, changing the original textual content, adding images, affixing your signature to the document, and much more.

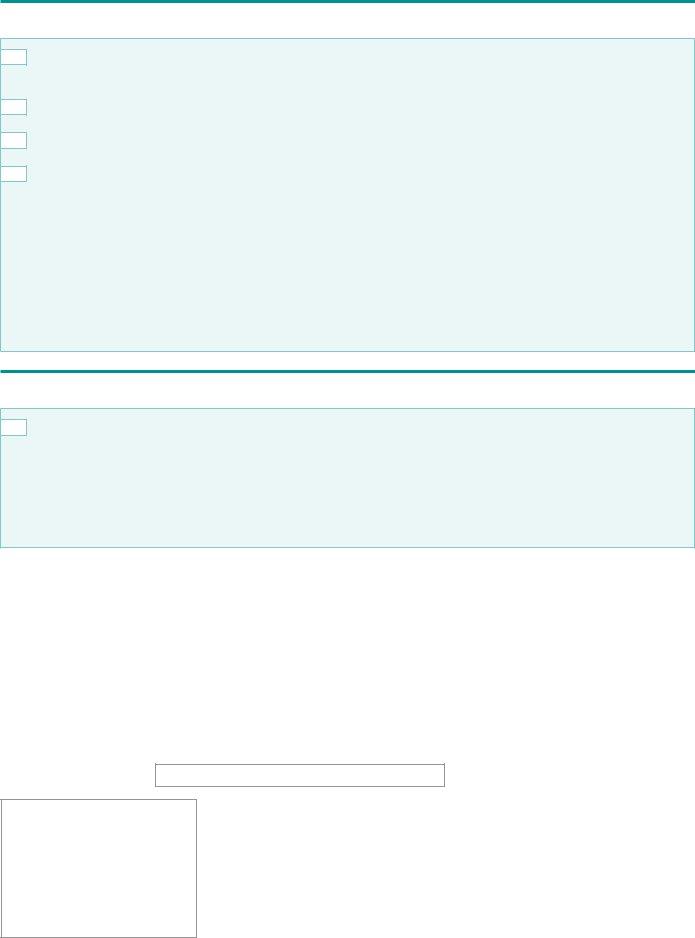

As for the blanks of this specific form, this is what you need to do:

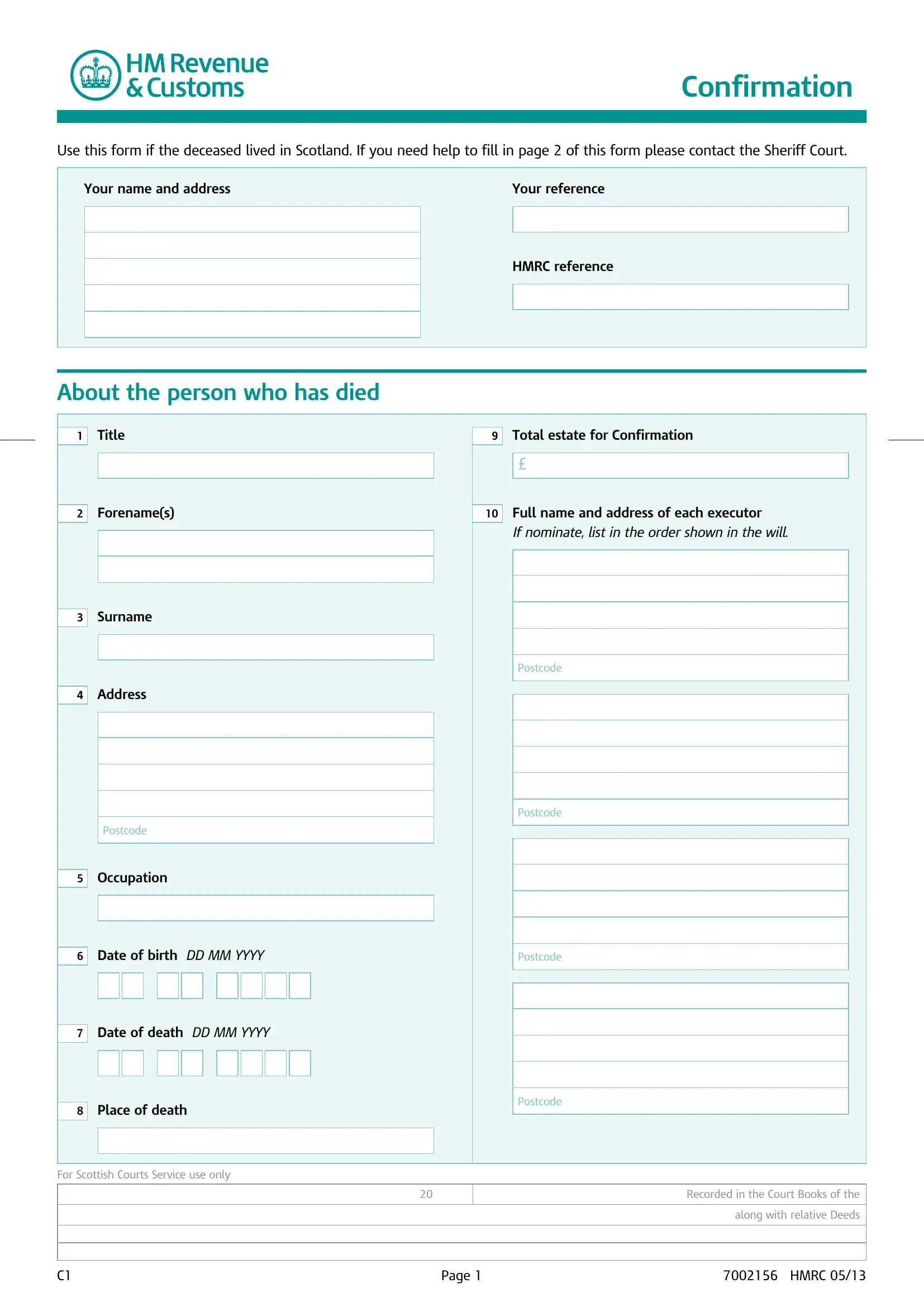

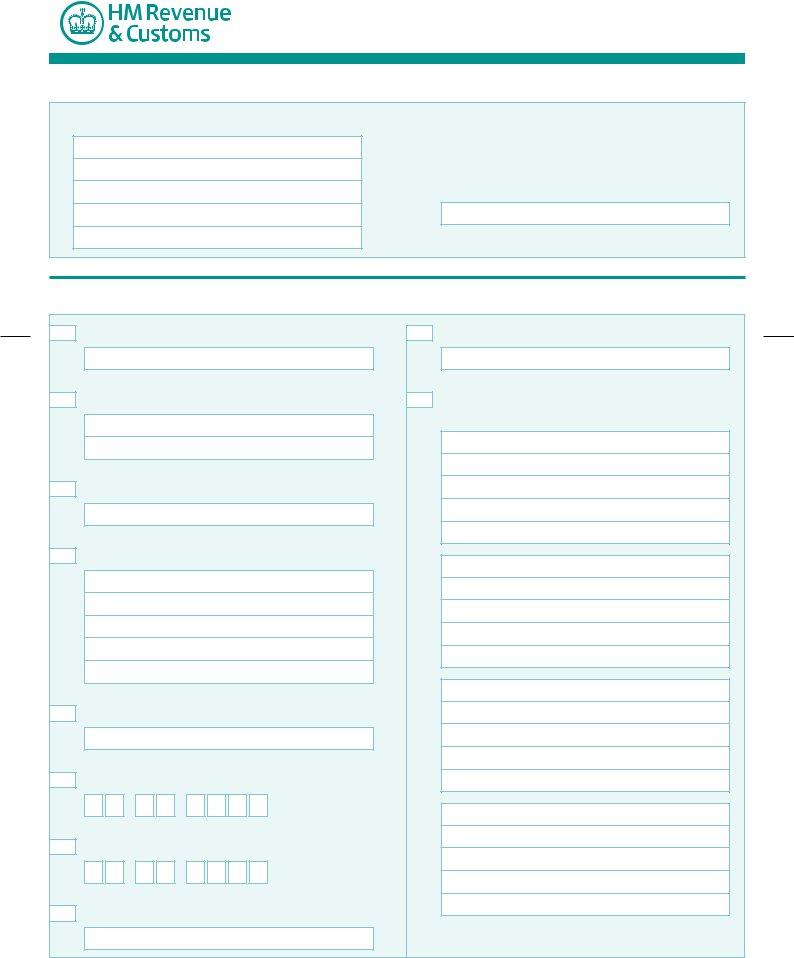

1. You should complete the hmrc c1 accurately, hence be careful when filling out the parts comprising all of these blanks:

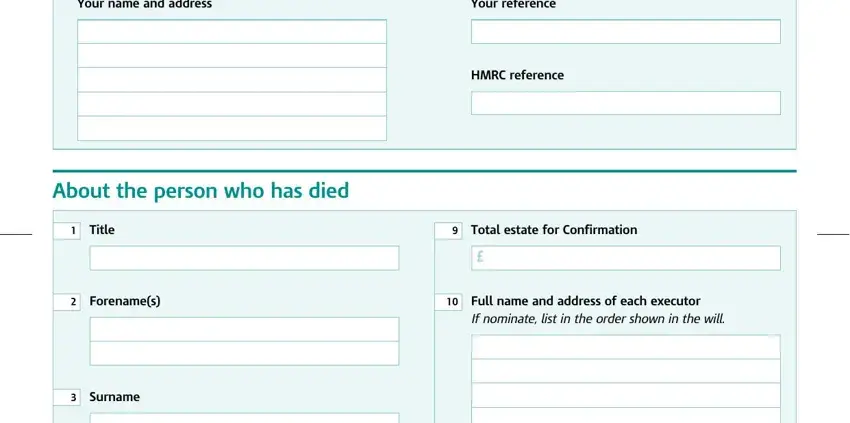

2. Once your current task is complete, take the next step – fill out all of these fields - Address, Postcode, Occupation, Postcode, Postcode, Date of birth DD MM YYYY, Postcode, and Date of death DD MM YYYY with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be very mindful while filling in Address and Date of death DD MM YYYY, because this is the section in which most people make some mistakes.

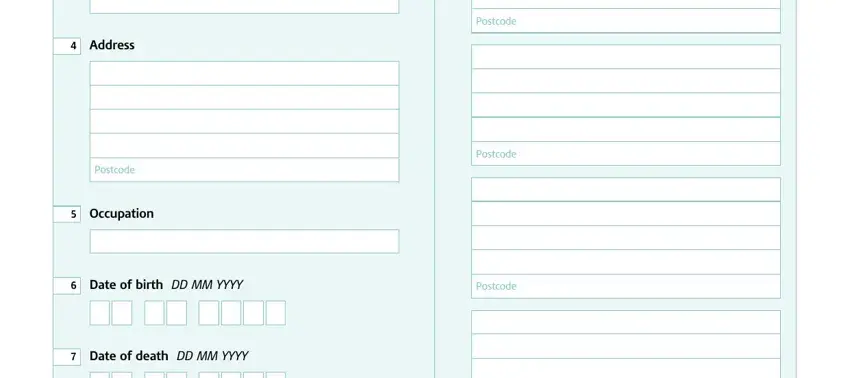

3. This 3rd segment should be relatively simple, Place of death, Postcode, For Scottish Courts Service use, Page, Recorded in the Court Books of the, along with relative Deeds, and HMRC - these blanks is required to be filled in here.

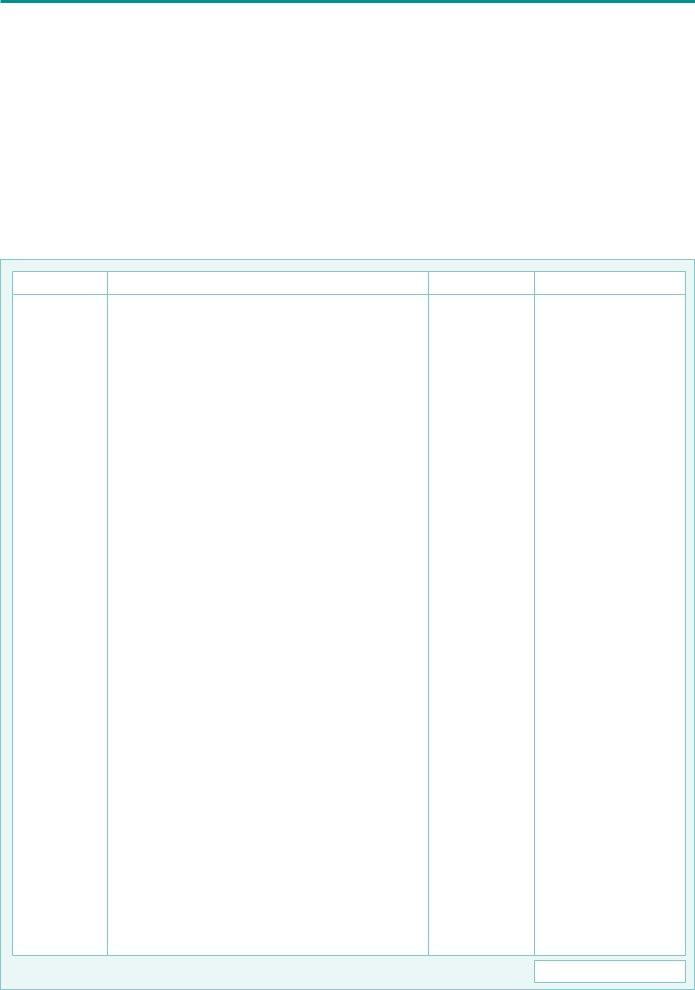

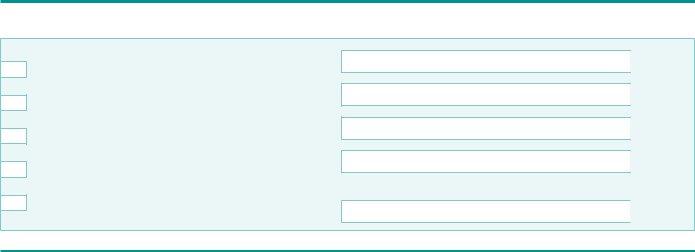

4. Your next part requires your involvement in the subsequent places: Declaration by, Who declares that the deceased, died on the date and at the place, domiciled in, and That I am. Make certain you enter all needed information to move onward.

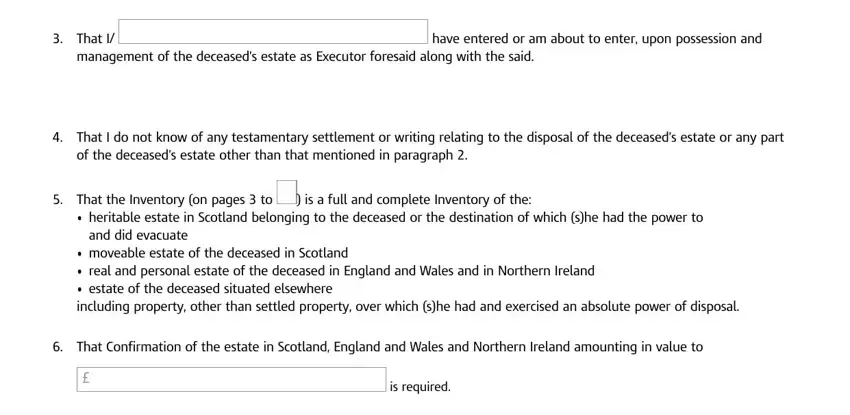

5. The final point to finalize this document is crucial. Ensure to fill out the mandatory fields, including That I, management of the deceaseds estate, have entered or am about to enter, That I do not know of any, of the deceaseds estate other than, That the Inventory on pages to, is a full and complete Inventory, and did evacuate, heritable estate in Scotland, moveable estate of the deceased, That Confirmation of the estate, and is required, before submitting. If not, it can produce an incomplete and potentially unacceptable document!

Step 3: Immediately after double-checking your entries, hit "Done" and you are good to go! Sign up with us right now and instantly gain access to hmrc c1, ready for download. All adjustments you make are kept , making it possible to edit the file further if required. FormsPal ensures your information confidentiality with a secure system that never saves or distributes any kind of private data used. Be assured knowing your files are kept safe each time you work with our tools!